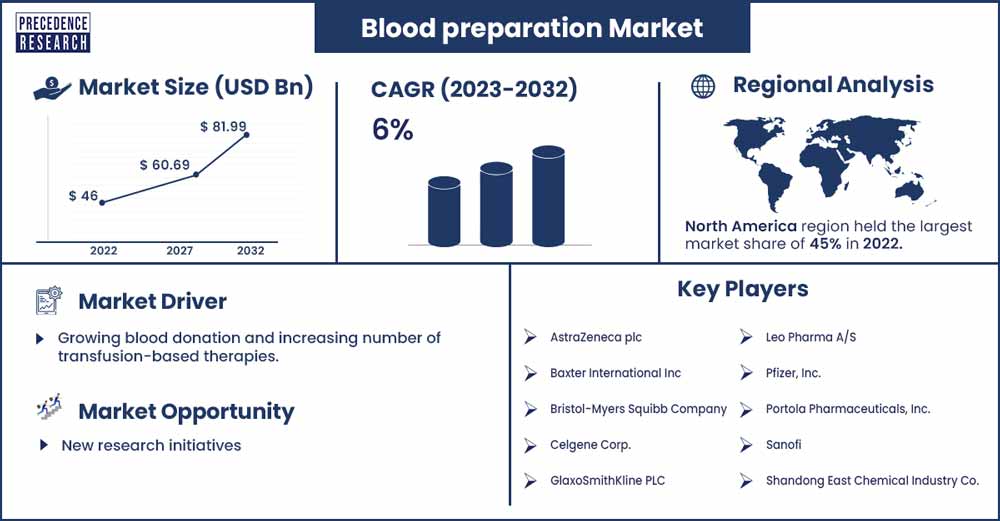

Blood Preparation Market To Attain Revenue USD 81.99 Bn By 2032

The global blood preparation market size was valued at USD 46 billion in 2022 and is expected to be worth around USD 81.99 billion by 2032, growing at a CAGR of 6% from 2023 to 2032.

Market Overview

Blood is composed of several elements, such as plasma, platelets, blood cells, etc. These constituents and their derived are called blood components and are derivative from the blood by procedures like phlebotomy or hemapheresis. Laboratories and blood centers use differential centrifugation to extract the required components from the whole blood that are then sent to patients through transfusions. The increasing demand for blood and blood components in surgeries and growing private sector and government initiatives are supporting the blood preparation market growth notably.

The blood preparation market is driven by several other factors, including rising knowledge of transfusion procedures in advancing countries, growing enthusiasm and stated initiative for blood donation, increasing incidences of conditions requiring transfusion or plasma therapies, etc. The requirement for plasma is growing rapidly in various parts of the world. This is supported by the data generated by Friends2support. According to their reports, around 30 million blood components are transfused every year, and over 38,000 blood donations are needed in India every day. Increasing blood donation is strengthening the blood preparation market from the supply side, while upcoming research on products like immunoglobulins, coagulation factor products, human thrombin, and dried plasma is predicted to generate newer opportunities for the future.

- In June 2023, the Pan American Health Organization (PAHO) highlighted the significance of voluntary, regular blood and plasma donation. The encouraging initiatives are supporting the donation of blood and blood components.

Regional Snapshot

Asia Pacific is expected to dominate the blood preparation market in terms of growth rate during the forecast period. The high donation of blood and blood components is supporting the European blood preparation market from the supply side. Spain reported over 1.1 million individuals donating blood and blood components in 2022 alone. This donor solidarity enabled over 1.7 million transfusions in the country. According to the Association of Voluntary Blood Donors (AVIS), in Italy, Lombardy, Emilia-Romagna, and Veneto lead the county in terms of blood donation counts in 2022 with 466,346, 259,295, and 193,660 donations, respectively. Piedmont, Sicily, and Tuscany followed close behind with 167,675, 127,425, and 105,799 donations. As per the Singapore Red Cross Society, 15 units of blood are used every hour of the day in Singapore. Singapore requires around 120,000 units of blood to meet the transfusion requirements of patients each year. This is equivalent to over 400 units of blood per day. Thus, higher demand for blood is expected to drive the growth of the blood preparation market in the Asia Pacific region during the forecast period.

Blood Preparation Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 48.53 Billion |

| Projected Forecast Revenue by 2032 | USD 81.99 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 6% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

High rate of transfusions

Each year in the U.S., around 21 million blood components like platelets, red blood cells, and plasma are transfused. These transfusions help in improving the lives of more than 4 million Americans. As per an article shared by springer nature, 1.13 million blood transfusions are performed in Japan each year. Thus, the high requirement for transfusions is majorly driving the blood preparation market growth worldwide.

Restraint

High price of blood products

The storage of blood and its components is expensive, resulting in an increased retail price of their products. Developing economies are generally unable to afford the costs associated with blood products-based treatment. As per the World Bank’s latest data, the poorest nations in Africa by Gross National Income (GNI) per capita in 2023 are Burundi, Somalia, and Central African Republic, with $220, $430, and $480 estimates, respectively. The high price of plasma tends to hinder its adoption to a considerable extent. Thus, unaffordability in poor countries is restraining the blood preparation market growth to a certain extent.

Opportunity

Increasing awareness about donation

Countries across the world celebrate World Blood Donor Day (WBDD) every year, according to the World Health Organization (WHO). This day aims to increase understanding of the necessity for blood and blood products and encourage voluntary unpaid blood donation. In August 2022, the U.S. Department of Health and Human Services (HHS) launched a new campaign, ‘Giving = Living’. This new campaign was initiated in order to increase awareness of the significance of blood and plasma donation and encourage Americans to create new, regular donation habits. The increase in the donation of blood components supports the blood preparation process. Thus, the rising awareness of donating blood products is creating promising growth opportunities for the blood preparation market.

Challenge

After-effects of transfusion

Some of the after-effects of transfusion include chest pain and nausea. These symptoms can be experienced immediately or within the next 24 hours. Non-infectious complications of transfusion are classified as acute (<24 hours) and delayed (>24 hours) reactions. Immune-mediated acute reactions include febrile nonhemolytic transfusion reactions, acute hemolytic transfusion reactions, anaphylactic reactions, and transfusion-related acute lung injury. Immune-mediated delayed reactions include delayed hemolytic transfusion reaction, transfusion-related immunomodulation, transfusion-associated graft versus host disease, and post-transfusion purpura. As per the National Library of Medicine, the incidence of hemolytic transfusion reaction is 2.0 per 100,000 RBC transfusions, and alloimmunization is 2 to 8% in chronic RBC transfusion recipients. The after-effects of transfusion are proving to be a major challenge for the growth of the blood preparation market.

Recent Developments

- In July 2022, an initiative called 'In the Joy of Others Blood Donation Campaign' was launched by BAPS Charities in Canada. The event was organized in partnership with the Canadian Blood Services. The blood donation campaign was launched with a goal to collect over 1,000 units of plasma, blood, and stem cells.

- In September 2022, the Akhil Bhartiya Terapanth Yuvak Parishad, abbreviated as ABTYP, launched a mega blood donation drive. With 350 branches and a workforce constituting over 45000 members, the drive hopes to organize around 2000 camps and donate nearly 100000 units of blood across the globe.

- In June 2022, ZKTeco West Africa partnered with the Lagos State Government for the blood donation campaign titled 'Give Blood and Keep the World Beating' in Lagos State in Nigeria.

- In August 2022, the United States Department of Health and Human Services, also called HHS, announced a new campaign to increase the awareness and paternities for blood and plasma donation in the United States. The campaign aimed to generate a public understanding of the significance of donating blood and plasma and encourage Americans to create new, regular donation habits.

- In September 2022, Grifols signed a long-term contract with Canada's national blood authority, Canadian Blood Services. The pioneering venture will significantly increase the country's self-sufficiency in immunoglobulin medicines, essential plasma-protein therapies for various immunodeficiencies and other medical conditions.

Blood Preparation Market Players

- AstraZeneca plc

- Baxter International Inc

- Bristol-Myers Squibb Company

- Celgene Corp.

- GlaxoSmithKline PLC

- Leo Pharma A/S

- Pfizer, Inc.

- Portola Pharmaceuticals, Inc.

- Sanofi

- Shandong East Chemical Industry Co.

- Xiamen Hisunny Chemical Co., LTD

Segments Covered in the Report

By Product

- Whole blood

- Granulocytes

- Red blood cells

- Plasma

- Platelets

- Blood components

- Leukocyte reduced red blood cells

- Packed red blood cells

- Frozen plasma

- Platelet concentrates

- Cryoprecipitate

- Blood derivatives

By Antithrombotic and Anticoagulants Type

- Platelet aggregation inhibitors

- Glycoprotein inhibitors

- ADP antagonists

- COX inhibitors

- Others

- Fibrinolytics

- Streptokinase

- Tissue plasminogen activator (tPA)

- Urokinase

- Anticoagulants

- Heparins

- Low molecular weight heparin (LMWH)

- Unfractionated heparin

- Ultra-low molecular weight heparin

- Direct thrombin inhibitors

- Vitamin K antagonists

- Direct factor Xa inhibitors

- Heparins

By Application

- Thrombocytosis

- Renal impairment

- Pulmonary embolism

- Angina blood vessel complications

- Others

By End User

- Clinics

- Hospitals

- Diagnostic centers

- Research labs

- Blood banks

Buy this Research Report@ https://www.precedenceresearch.com/checkout/3551

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 9197 992 333