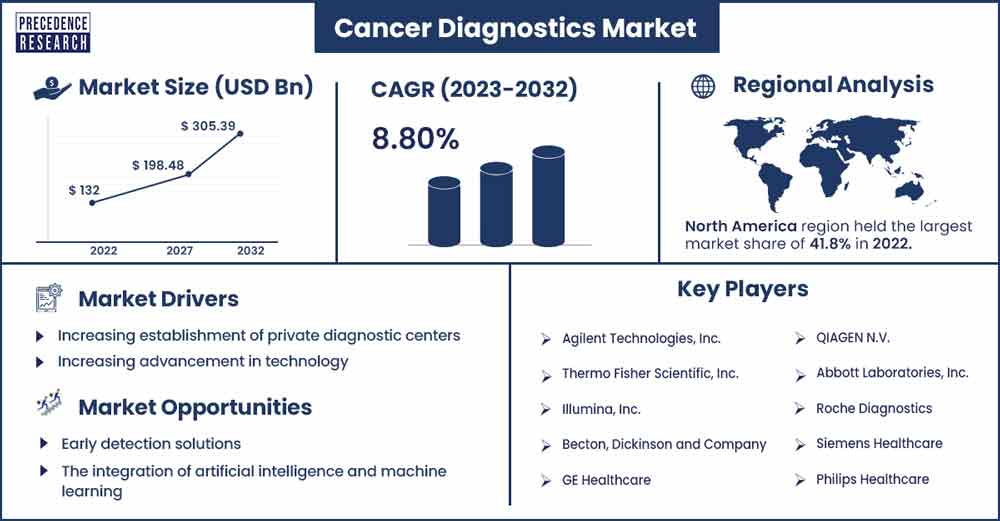

Cancer Diagnostics Market Size To Rise USD 305.39 Billion By 2032

The global cancer diagnostics market size is estimated at USD 132 billion in 2022 and is expected to reach USD 305.39 billion by 2032, growing at a CAGR of 8.8% during the forecast period.

The number of cancer patients is increasing significantly which is further becoming a top cause of mortality across the world. Healthcare experts are moving towards efficient treatment and diagnosis solutions in order to reduce the number of patients. The cancer diagnostic has witnessed remarkable growth owing to growing advancement in technology, and the surging burden of cancer.

Cancer diagnostics is the process of identifying and determining the presence of cancer in an individual. It involves various techniques and tools aimed at detecting cancer at an early stage, assessing the extent of the disease, and guiding treatment decisions. The goal of cancer diagnostics is to facilitate timely and accurate diagnosis, which is crucial for effective treatment and improved patient outcomes.

Regional Analysis

North America is anticipated to grow significantly during the upcoming years. The market's growth is driven by the increasing prevalence of cancer in the United States and Canada. Increasing penetration of medical device companies in order to develop new diagnostic devices. For instance, according to the American Cancer Society, the number of cancer patients is expected to increase from nearly 1,910,000 in 2022 to 1,958,310 in 2023 in the United States.

The cases of breast cancer are also increasing significantly. Additionally, colon cancer cases are predicted to increase from 80,690 in 2022 to 81, 860 in 2023. In order to lessen the burden of the illness, additional screening tests are required due to the high frequency of colorectal cancer. This propels the market under study's growth.

Furthermore, it is anticipated that the government's actions in this area would quicken market expansion. For example, in January 2022, President Biden announced the relaunch of the Cancer Moonshot, with new objectives aimed at enhancing the lives of cancer patients and survivors as well as halving the cancer mortality rate within 25 years. Additionally, the government funds cancer diagnostic campaigns, which are thought to aid in the expansion of the industry.

Cancer Diagnostics Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 142.96 Billion |

| Projected Forecast Revenue by 2032 | USD 305.39 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 8.8% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing establishment of private diagnostic centers

The number of private diagnostic centers is increasing significantly across the globe due to the rising diagnostic imaging operations and private hospitals. The limited availability of imaging modalities at the hospital is leading to an increase in diagnostic centers. Private diagnostic centers often invest in state-of-the-art technologies and equipment for cancer diagnosis. This includes advanced imaging modalities such as MRI, CT scans, PET scans, and molecular diagnostic techniques. Many private diagnostic centers collaborate with oncology clinics and hospitals to provide integrated cancer care services. This collaboration ensures a seamless flow of information and facilitates coordinated patient care.

Technological advancements

Diagnostic testing is experiencing increasing advancement in technology. Surging developments in diagnostic technologies, including next-generation sequencing (NGS), molecular imaging, and liquid biopsy assist in improving the efficiency and accuracy of cancer diagnostics.

The integration of AI and machine learning algorithms in cancer diagnostics has improved the speed and accuracy of image analysis, aiding in the interpretation of medical imaging data. Moreover, innovations in medical imaging, such as positron emission tomography (PET), computed tomography (CT), and magnetic resonance imaging (MRI), have enhanced the ability to detect and diagnose cancer at various stages.

Restraints

High cost

Many advanced cancer diagnostic tests and technologies can be expensive. This high cost can limit accessibility for patients, particularly in regions where advanced diagnostic technologies may not be readily available or accessible in all geographical areas. This limitation can hinder timely and accurate cancer diagnosis, especially in rural or underdeveloped regions.

Healthcare systems and professionals may be resistant to adopting new diagnostic technologies due to factors such as perceived reliability, training requirements, and the need for infrastructure upgrades. Moreover, many hospitals in underdeveloped and developing nations are unable to invest in diagnostic imaging equipment owing to high costs restraining the market growth.

Lack of skilled professionals

The field of cancer diagnostics is rapidly evolving with the introduction of new technologies such as advanced imaging techniques, molecular diagnostics, and artificial intelligence. Keeping up with these advancements requires continuous education and training, and there may be a lag in the availability of skilled professionals who are proficient in using these cutting-edge tools.

Cancer diagnostics often involves collaboration between various medical disciplines, including pathology, radiology, oncology, and molecular biology. Finding professionals with expertise in multiple domains and the ability to work seamlessly across disciplines can be challenging.

Opportunities

Early detection solutions

There is a growing emphasis on developing technologies that enable the early detection of cancer. Early diagnosis often leads to more effective treatment and improved patient outcomes. Advancements in imaging technologies, liquid biopsies, and molecular diagnostics contribute to early detection efforts. There is a growing interest in developing cancer diagnostic tools that can be used at the point of care, providing rapid and accessible results. This is particularly important for resource-limited settings and for facilitating quick decision-making in clinical settings.

Integration of AI technology

The integration of artificial intelligence and machine learning in analyzing medical imaging, pathology slides, and genomic data can enhance the accuracy and efficiency of cancer diagnosis. AI algorithms can help identify patterns and abnormalities that may be challenging for human interpretation. AI also assists oncologists in developing personalized treatment plans by analyzing a patient's medical history, genetic information, and treatment responses. This can help optimize the selection of therapies that are more likely to be effective for a particular individual.

Recent Developments

- In July 2023, NGeneBio Co., a medical diagnostic company in South Korea announced the establishment of an artificial intelligence precision diagnostic firm called NGeneBioAI in the US.

- In July 2023, Core Diagnostics, a key player in the health and diagnostic industry collaborated with PredOmix Technologies Pvt Ltd. to launch OncoVeryx-F, a multi-cancer detection test, particularly for asymptomatic women.

- In December 2022, PredOmix, an Indian firm, introduced OncoVeryx-F, a novel blood test for cancer detection that may identify early-stage malignancies in women with a 98% accuracy rate.

- In June 2022, Roche introduced the new BenchMark ULTRA PLUS cancer testing system, allowing for prompt, focused patient care.

- In September 2022, Radio pharm Theragnostic collaborated with the University of Texas MD Anderson Cancer Center for the launch of Radiopharm ventures.

Major Key Players

- Agilent Technologies, Inc.

- Thermo Fisher Scientific, Inc.

- Illumina, Inc.

- Becton, Dickinson and Company

- GE Healthcare

- QIAGEN N.V.

- Abbott Laboratories, Inc.

- Roche Diagnostics

- Siemens Healthcare

- Philips Healthcare

- R. Bard, Inc.

- bioMérieux SA

- NeoGenomics Laboratories, Inc.

- Volpara Solutions Limited

- Hologic Inc.

- Canon Medical Systems Corporation

- PenRad Technologies Inc.

- BioNTech Diagnostics GmbH

- BioGenex

Market Segmentation

By Product

- Consumables

- Antibodies

- Kits & Reagents

- Probes

- Other Consumables

- Instruments

- Pathology-based Instruments

- Slide Staining Systems

- Tissue Processing Systems

- Cell Processors

- PCR Instruments

- NGS Instruments

- Microarrays

- Other Pathology-based Instruments

- Imaging Instruments

- CT Systems

- Ultrasound Systems

- MRI Systems

- Mammography Systems

- Nuclear Imaging Systems

- Biopsy Instruments

By Technology

- IVD Testing

- Polymerase Chain Reaction (PCR)

- In Situ Hybridization (ISH)

- Immunohistochemistry (IHC)

- Next-generation Sequencing (NGS)

- Microarrays

- Flow Cytometry

- Immunoassays

- Other IVD Testing Technologies

- Imaging

- Magnetic Resonance Imaging (MRI)

- Computed Tomography (CT)

- Positron Emission Tomography (PET)

- Mammography

- Ultrasound

- Biopsy Technique

By Application

- Breast Cancer

- Colorectal Cancer

- Cervical Cancer

- Lung Cancer

- Prostate Cancer

- Skin Cancer

- Blood Cancer

- Kidney Cancer

- Liver Cancer

- Pancreatic Cancer

- Ovarian Cancer

- Others

By End Use

- Hospitals and Clinics

- Diagnostic Laboratories

- Diagnostic Imaging Centers

- Research Institutes

Buy this Research Report@ https://www.precedenceresearch.com/checkout/1194

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308