Closed System Transfer Devices Market Will Grow at CAGR of 16.1% By 2032

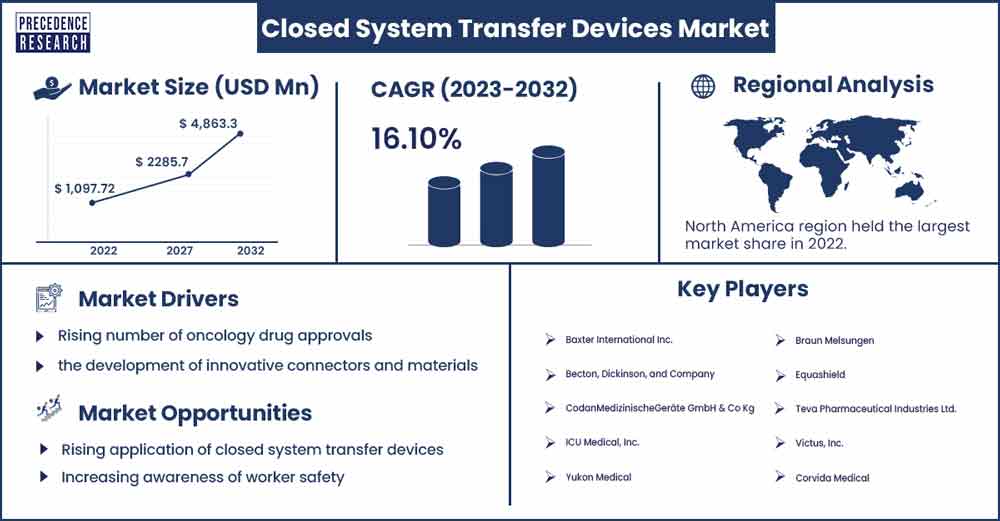

The global closed system transfer devices market size accounted for USD 1,097.72 million in 2022 and is projected to reach around USD 4,863.3 million by 2032, growing at a CAGR of 16.1% from 2023 to 2032.

Market Overview

Closed system transfer devices are specialized equipment designed to safely transfer hazardous drugs from one container to another in a closed and contained manner. These devices are used in healthcare settings, particularly in pharmacies and oncology units where healthcare workers handle and administer potent and potentially harmful medications. These devices are particularly used to alleviate the risk of exposure to hazardous drugs for healthcare workers, patients, and the environment. Exposure to these drugs can occur through skin contact, inhalation, or ingestion, and some of these drugs have been associated with adverse health effects, including reproductive issues and an increased risk of cancer.

According to the National Library of Medicine, the number of cancer patients in India in 2022 reached to nearly 14,60,000. Nearly 1 in 9 people are expected to develop cancer once in their lifetime.

According to National Cancer Institute, the number of cancer survivors are expected to increase by more than 20% to nearly 22 million by 2032.

Regional Insight

North America is anticipated to have a sizeable market share in the global closed system transfer devices market. The rise in growth is ascribed to patient safety measures implemented by the U.S. Food and Medication Administration and other regulatory agencies in North America, as well as the growing number of cancer medication approvals in the area. The growth of the region is attributed to the increasing cancer research and surging prevalence of cancer in developed and developing countries. These devices are widely used to combat the hazardous drugs by various organization which is further expected to proliferate the market growth.

Surging number of chronic disease patients across the region is expected to add to the growth of the market. According to various researches cancer is the leading cause of death in the United States. Ease in the accessibility of advanced options along with rising awareness about the benefits associated with closed system transfer devices among healthcare workers, oncologists, nurses, and pharmacist is expected to propel the growth of the industry. Moreover, various manufacturers across the region are also focusing on the product innovation. For instance, according to cancer society, in 2022, the number of cancer patients reached nearly 1.9 million and the death due to the cancer reached to 609,360 in United States.

Closed System Transfer Devices Market Scope

| Report Highlights | Details |

| Market Size in 2023 | USD 1,268.97 Million |

| Market Size by 2032 | USD 4,863.3 Million |

| Growth Rate from 2023 to 2032 | CAGR of 16.1% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers:

Rising number of oncology drug approvals

Pharmaceutical companies are increasingly putting efforts for the development of oncology drugs. growing understanding of cancer therapeutic and biology strategies are supporting the drug development. According to various researches the number of cancer patients are expected to surge significantly during the upcoming years which is further driving the demand for various drugs. Moreover, increasing advancement of technology is expected to propel the treatment options and safety issues associated with the medicines. Various clinical researches are also being conducted in order to develop the effective drugs owing to rising molecular understanding of cancer is expected to support the growth of the market. These factors are further expected to drive the need for closed system transfer devices demand.

Technological advancements

Continuous advancements in closed system transfer device technologies, such as the development of innovative connectors and materials, have also played a role in driving market growth. Moreover, the primary driver for CSTD adoption is the growing emphasis on ensuring the safety of healthcare workers and patients during the handling and administration of hazardous drugs. Closed systems help minimize the risk of exposure to harmful substances. Growing advent of technology is leading to surge in the clinical trials of various diseases.

Restraints

Hight cost

Adoption of closed system transfer device is adding to the cost in the healthcare facilities. Factors such as manufacturers, and components used can be expensive. Moreover, the adoption of new technologies, including closed system transfer devices, may face resistance from traditional practices and established workflows. Healthcare professionals and organizations may be reluctant to change their existing processes, especially if they have been in place for a long time. These factors further add to the cost.

Regulatory challenges

Meeting and maintaining compliance with evolving regulatory standards and guidelines can be challenging for manufacturers of closed system transfer devices. Changes in regulations can require costly updates to existing devices, and staying ahead of these changes requires continuous investment in research and development. Moreover, implementing closed system transfer devices can be complex, especially in existing facilities that were not originally designed to accommodate such systems. Retrofitting or modifying facilities to integrate closed system technology may require downtime and can be disruptive to operations.

Opportunity

Rising application of closed system transfer devices

Closed system transfer devices are widely used in order to protect healthcare workers from the harmful effects of antineoplastic dugs in chemotherapy. The application of these devices is increasing owing to the rising usage in the treatment of various cancerous and non-cancerous disease such as arthritis, psoriasis, and systematic lupus erythematosus. Non-cytotoxic drugs that are used in the treatment of various illnesses are also hazardous, hence requires closed system transfer devices.

Increasing awareness of worker safety

As awareness of the potential health risks associated with the handling of hazardous drugs grows, there is an increasing focus on worker safety. Healthcare facilities and pharmaceutical companies are likely to invest in technologies that minimize the risk of exposure to hazardous drugs, creating opportunities for CSTDs. The prevalence of cancer and other chronic diseases is on the rise globally. Many of the drugs used in the treatment of these conditions are hazardous. As the demand for these drugs increases, so does the need for safe and effective drug transfer systems, driving the demand for CSTDs.

Recent Developments

- In May 2022, the disposable series of needle-free cattle vaccination tools was introduced by Pulse Needle Free Systems. The device provides the advantages of needle-free technology at a price that is equivalent to traditional syringes and needles, all with plug-and-play operating simplicity.

- In February 2022, The Indian government started receiving Zydus Cadila's needle-free anti-Covid vaccination, ZyCoV-D.

- In November 2023, Kaleido, one of the smallest and lightest insulin patches across the globe launched cutting-edge hybrid closed loop system with Diabeloop and Dexom for diabetic people.

Closed System Transfer Devices Market Players

- Baxter International Inc.

- Becton, Dickinson, and Company

- CodanMedizinischeGeräte GmbH & Co Kg

- ICU Medical, Inc.

- Yukon Medical

- Braun Melsungen

- Equashield

- Teva Pharmaceutical Industries Ltd.

- Victus, Inc.

- Corvida Medical

Major Market Segments Covered

By Type

- Needleless Systems

- Membrane-to-Membrane Systems

By Closing Mechanism

- Color-To-Color Alignment Systems

- Push-To-Turn Systems

- Click-To-Lock Systems

- Luer-Lock Systems

By Component

- Syringe Safety Devices

- Vial Access Devices

- Accessories

- Bag/Line Access Devices

By End User

- Clinics & Oncology Centers

- Hospitals

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Buy this Research Report@ https://www.precedenceresearch.com/checkout/1180

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308