Electric Motor Market Size to Expand USD 322.56 Billion By 2030

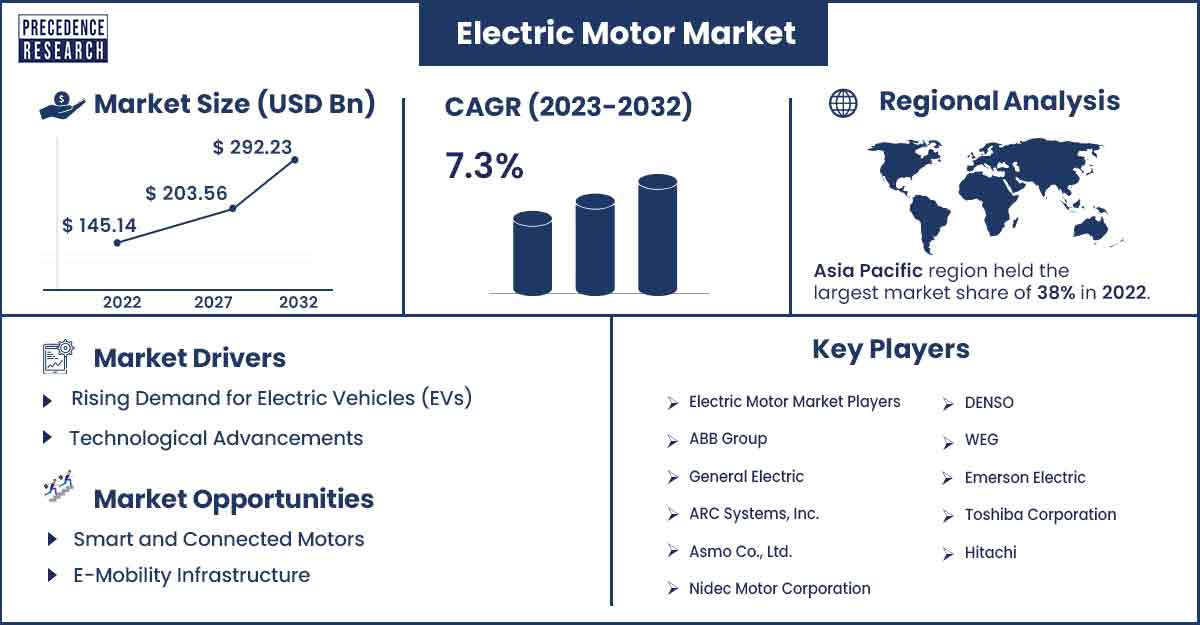

The global electric motor market size is expected to expand around USD 292.23 billion by 2032 from USD 145.14 billion in 2022, growing at a CAGR of 7.3% during the forecast period from 2023 to 2032.

Market Overview

An electric motor is a device that turns electrical current into a rotor's spinning or linear movement. In simpler terms, it generates rotational force and makes things move. The motor works based on the interaction between magnetic and electric fields. There are two main types: A.C. motors, which use alternating current, and D.C. motors, which use direct current. A.C. motors transform alternating current into mechanical power, including induction, synchronous, and linear motors. D.C. motors, on the other hand, convert electric energy into mechanical power.

The market is growing because people use more electricity and rely on electrical equipment in different industries worldwide. Industries, in particular, are using more electricity, and new technologies like combined heat and power are being introduced. This expansion in technology has increased the use of electrical machinery in industries. Moreover, major companies in the electric motor market are actively working on creating innovative products, which is becoming a prominent trend.

The world's growing population has significantly contributed to expanding various industries, including automotive. Despite economic uncertainties in 2023, many consumers resumed delayed purchases due to the COVID-19 pandemic, boosting car sales. Electric motors play a vital role in the automotive industry, with an average car containing about 40. Additionally, the surge in fuel prices and increasing environmental concerns have fueled the demand for electric vehicles.

Many governments are encouraging the adoption of EVs by offering subsidies and incentives. Some countries, including China, India, France, and the United Kingdom, have even set goals to completely phase out traditional petrol and diesel vehicles by 2040.

Also, the construction of new homes and businesses, the expansion of water supply networks, the growth of wastewater treatment plants, the establishment of public agricultural irrigation systems, and other infrastructure projects in developing economies contribute to an increasing demand for electric motors, especially for pumping purposes. Additionally, the growing number of industrial facilities worldwide, spanning sectors like food and beverages, chemicals, petrochemicals, pharmaceuticals, and others, is also playing a positive role in driving the growth of the electric motor market.

The number of newly registered electric cars in Germany has notably risen, as the Federal Motor Transport Authority reported. In 2022, 470,559 new electric vehicles were registered, showing a substantial growth of 32.19% compared to the previous year's numbers.

- In April 2023, Nippon Steel Corporation (NSC) revealed its intention to establish the world's largest steel plant in Odisha, India, with an investment of around INR 1.02 lakh crore.

- In the first half of 2023, Chinese auto sales increased by 9.8%. India also experienced a 27% rise in passenger vehicle sales and a 16% increase in commercial vehicle sales.

- In October 2022, the European Union announced a plan to ban the sale of new internal combustion engine (ICE) vehicles by 2035 in its member states.

Regional Snapshots

Asia Pacific is expected to lead the market in the coming years. This is due to the growing demand for household electronics and the rapid industrialization happening in the region. The presence of several car manufacturers also contributes to the market. Additionally, with governments in the region focusing on initiatives to boost electric vehicle sales, there is an anticipated increase in the demand for electric motors. The demand for electronics has seen significant growth in this region.

China plays a crucial role in the global manufacturing sector, leading in steel, chemicals, power, and cement industries and being a significant player in petrochemicals and refining. The country continues to add new projects to its industrial portfolio.

- In January 2023, the government of Odisha approved a joint venture of Nippon Steel and Arcelor Mittal for a USD 4.68 billion steel plant by AMNS India.

- In January 2022, an Aramco-led joint venture decided to build a significant integrated refinery and petrochemical complex in Northeast China, which is expected to be operational by 2024.

- In June 2023, Nidec Corporation and Renesas Electronics Corporation decided to develop semiconductor solutions for a cutting-edge E-Axle. This system combines an electric vehicle (E.V.) drive motor and power electronics, aiming to enhance the performance of electric cars.

- In September 2023, Toshiba Corporation, a leading technology company, revealed the opening of its Regenerative Innovation Centre in Düsseldorf, Germany. This move is part of Toshiba's strategic commitment to achieving carbon neutrality and fostering a circular economy.

Electric Motor Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 155 Billion |

| Projected Forecast Revenue by 2032 | USD 292.23 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 7.3% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Report Highlights

- The AC motor segment is expected to grow well during the forecast. As these motors are used in the appliances used in agriculture it is also used in the appliances used in big buildings and shopping malls, and AC motors are also used in many household appliances. The demand for the AC motor is expected to grow as they are used in a lot of industries due to its properties of being lightweight and cost effective.

- Depending upon the power output the fractional horsepower output segment is expected to grow well during the forecast period. In the industries where heavy equipments are used the fractional horsepower Motors are used. These motors happen to be efficient when it comes to the consumption of Energy.

- On the basis of application electric motors are used maximum in the manufacturing of the motor vehicles. The motor vehicle segment will dominate the market in the coming years. Electric motors of different powers are used in the manufacturing of the commercial cars and about 40 of these motors are used on an average. Increase the prices of the fuel have created more demand for the other alternatives like that of the electric vehicles.

Market Dynamics

Drivers

Urbanization trends

The growing industrialization and urbanization have led to a higher demand for air conditioning, ventilation, and heating in large indoor spaces. The modern increase in shopping malls and office buildings has intensified the need for ventilation and air conditioning. D.C. motors, known for their efficiency in improving airflow systems, are widely used due to their powerful performance and durability. Countries like India and China are experiencing a rise in the demand for D.C. motors, particularly the brushless type, driven by the increasing number of offices and indoor spaces. The automotive industry, especially in electric vehicles, contributes to the growing demand for brushless motors, emphasizing the impact of technological advancements on market growth.

Widespread adoption of electric vehicles (EV)

The global electric motor market is expected to grow due to the increasing adoption of electric vehicles worldwide. The transportation sector is shifting towards clean energy, leading to a rise in electric vehicle usage. Governments globally are implementing supportive policies to encourage the adoption of electric vehicles. Additionally, ongoing technological advancements contribute to the increasing popularity of electric cars. This surge in electric vehicle demand is fueling the growth of the global electric motor market.

Restraint

Supply chain issues

The global electric motor market might need help growing due to higher product costs and components and supply chain issues. These problems are expected to affect electric motors in manufacturing or have already been contracted. Industry experts anticipate a slowdown in delivery and construction due to increased inflation, economic downturns, and fluctuations in energy prices.

Opportunities

Environment-friendly automotive policies

Companies are increasingly participating in government-led energy management programs. By joining these initiatives, businesses contribute to national energy and carbon savings and enjoy lower costs, reduced vulnerability to energy price fluctuations, and increased competitiveness. Introducing standards and promoting the development of energy-efficient electric motors presents an opportunity for growth for key players constantly innovating their products.

- In July 2023, strict regulations were implemented for using IE4 motors in industrial applications.

- In September 2023, the U.S. amended and implemented the Energy Policy and Conservation Act. This act sets energy conservation standards for various consumer products and specific commercial and industrial equipment, including electric motors.

Research and development initiatives

Ongoing research and development efforts have enhanced electric vehicle technology, with developed nations implementing policies to reduce carbon emissions. The electric motor market is poised for growth as electric vehicles heavily rely on these motors. Advanced technologies and research have resulted in cost-effective batteries with improved charging capabilities, while government incentives further promote electric vehicle adoption. Collectively, these factors present significant market expansion opportunities in the coming years.

Recent Developments

- In November 2023, the British sports car manufacturer Lotus debuted in the Indian market.

- In November 2023, TVS Motor Company, a prominent manufacturer of two- and three-wheelers, entered the European market. The company signed an import and distribution agreement with Emil Frey, a well-established enterprise with a century-long history and a notable presence in automotive distribution.

Key Players:

- ABB Group

- General Electric

- ARC Systems, Inc.

- Asmo Co., Ltd.

- Nidec Motor Corporation

- DENSO

- WEG

- Emerson Electric

- Toshiba Corporation

- Hitachi

- Bosch

- Maxon Motors AG

- Regal Beloit Corporation

- Rockwell Automation, Inc.

- Siemens AG

- AMETEK.Inc.

- Johnson Electric Holdings Limited

Segments Covered in the Report

By Type

- Alternate Current (AC)

- Direct Current (DC)

By Output Power

- <1 HP

- >1 HP

By Rotor Type

- Outer Rotor

- Inner Rotor

By End-User

- Industrial

- Residential

- Commercial

- Agriculture

- Transportation

Full Report is Ready | Buy this Research Report @ https://www.precedenceresearch.com/checkout/1293

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 9197 992 333