Food Blenders and Mixers Market Revenue to Attain USD 18.07 Bn by 2033

Food Blenders and Mixers Market Revenue and Trends

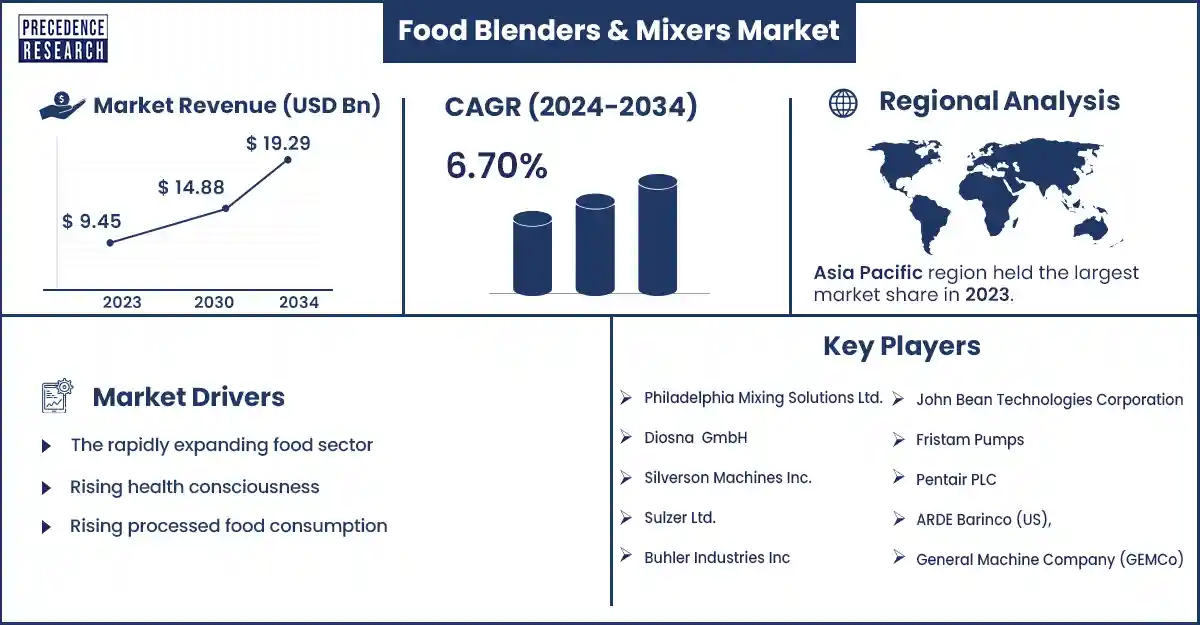

The global food blenders and mixers market revenue was valued at USD 10.08 billion in 2024 and is expected to reach around USD 18.07 billion by 2033, poised to expand at a compound annual growth rate (CAGR) of 6.70% from 2024 to 2033. The demand for food blenders and mixers is growing in the food and beverage industry. Due to technological improvements that have made food blenders and mixers user-friendly, quicker and more efficient tasks while improving hygiene are possible.

Market Overview

Turning raw components into food that is better equipped for human consumption is the main function of mixers and blenders. Equipment like food mixers and food blenders can be utilized for several different functions in domestic and professional settings. They aid in processing various food & beverage products from the bakery, dairy, confectionery, and other industries. Businesses in these sectors are willing to boost their production output by adopting automated machinery and systems to meet the overall increased demand for a variety of food and beverage items. Thus, market players are focusing on developing high-performance mixing and blending tools with improved processing capabilities, adaptability, and usability to meet the varying demands.

Report Highlights of the Food Blenders and Mixers Market

- Based on type, the high shear segment dominated the market in 2023. This is mainly due to the high demand for high-shear mixers across a range of food processing applications. They aid in the homogenization, emulsification, wetting out, and deagglomeration of powders.

- On the basis of technology, the batch mixing segment led the market in 2023. There are different formulations on similar manufacturing lines or similar types of applications, like bakery doughs and other preparations; the batch mixing equipment is a popular choice. Its cost-effectiveness further contributed to segment’s dominance.

- In terms of application, the bakery segment is projected to lead the market throughout the forecast period, owing to the rising demand for bakery goods such as cakes, cookies, biscuits, and breads in developed and emerging nations alike. However, proper mixing and blending are vital procedures in the bakery goods manufacturing process.

Food Blenders and Mixers Market Trends

Technological advancements: Innovative technologies applied by key market players have improved the technical quality of blenders and mixers. This has led to enhanced efficiency, functioning, consumer-friendly, precise, and hygienic processes, which are all necessary factors in the industry. It reduces human error and physical efforts while helping increase productivity.

Expansion of the food and beverage industry: The food and beverage industry is booming worldwide. The growing consumption of processed food contributes to the growth of the food blenders and mixers markets. Mixers and blenders are regularly used in restaurants, bakeries, food processing plants, and homes. Another aspect is the rise in population and spending capacities of people in developing countries, which is becoming an important factor to the growth of this market.

Efficient and lower production costs: The technological developments for food blenders and mixers have made them efficient, precise, and multipurpose for consumers. There is a need for blenders and mixers that cater to specific special ingredients or functions. The upcoming blenders and mixers are much more accurate and efficient and have an expanded range that can reduce production costs.

Regional Insights

Asia Pacific dominated the food blenders and mixers market in 2023 and is projected to continue its steady growth in the upcoming years. The growing population in the region significantly increases the demand for food and beverages. Thus, the need for healthy, wholesome food and drink items with new and improved flavors increases the demand for food blenders and mixers. Moreover, the rapid expansion of the food processing industry in countries like India and China contributed to regional dominance.

The market in North America is expected to grow rapidly during the forecast period due to the expansion of the food sector. Continuous technological breakthroughs in food processing equipment and technology and the high demand for bakery and dairy products further propel the food blenders and mixers market in this region.

Food Blenders and Mixers Market Market Coverage

| Report Attribute | Key Statistics |

| Market Revenue in 2024 | USD 10.08 Billion |

| Market Revenue by 2033 | USD 18.07 Billion |

| CAGR | 6.70% from 2024 to 2033 |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2023 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market News

- Sulzer AG introduced a new product line of mixers and blenders called the Salomix series. The Salomix equipment line includes side-mounted agitators used in various industrial applications where clean or lightly contaminated liquids, viscous liquids, and other slurries are stirred. Thanks to smooth hydraulics, these agitators also provide a long processing life at a low cost. The company has now been able to serve a bigger customer base and diversify its product offerings with this progress.

Segments covered in the report

By Type

- High shear mixer

- Shaft mixer

- Screw mixer & blender

- Double cone blender

- Ribbon blender

- Planetary mixer

- Others

By Technology

- Batch mixing

- Continuous mixing

By Mode of Operation

- Automatic

- Semi-automatic

By Application

- Beverages

- Non-alcoholic

- Alcoholic

- Dairy products

- Milk

- Ice cream & frozen desserts

- Yogurt

- Other dairy products

- Bakery products

- Meat, poultry, fish & seafood

- Confectionery

- Other applications

By End-User

- Household

- Commercial

By Distribution Channel

- B2B

- B2C

- Store-based Retail

- Hypermarkets/Supermarkets

- Specialty Stores

- Others

- Online Retail

- Store-based Retail

Get this report to explore global market size, share, CAGR and trends, featuring detailed segmental analysis and an insightful competitive landscape overview@ https://www.precedenceresearch.com/checkout/1899

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344