Functional Cosmetics Market To Attain Revenue USD 6.06 Bn By 2032

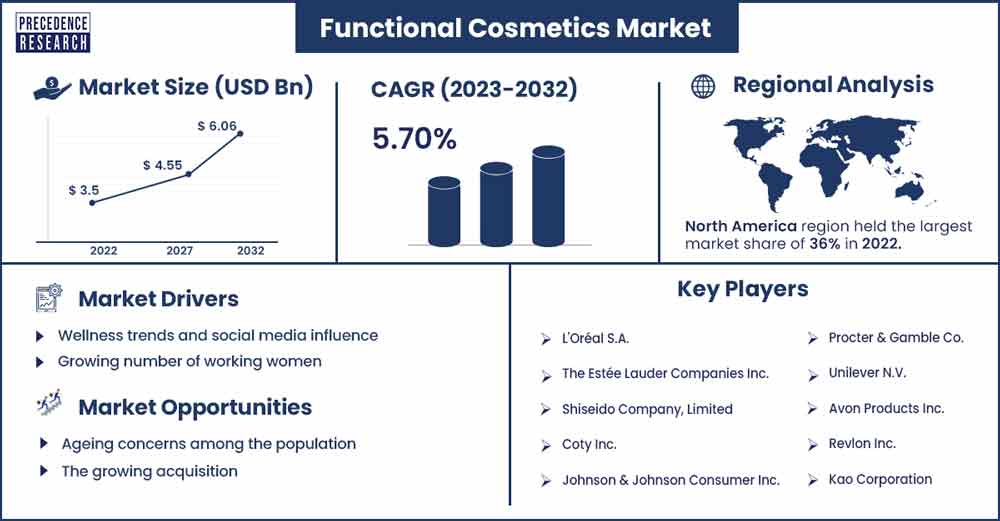

The global functional cosmetics market size reached USD 3.5 billion in 2022 and is projected to hit USD 6.06 billion by 2032, growing at a CAGR of 5.7% from 2023 to 2032.

Market Overview

Functional cosmetics refer to cosmetic products that go beyond the traditional purpose of enhancing appearance and aesthetics. These products are formulated with additional active ingredients that claim to provide specific functional benefits beyond basic beautification. The term “functional” in this context implies that these cosmetics offer some kind of physiological or therapeutic effect on the skin or hair.

Functional cosmetics may include ingredients known for their skincare or haircare benefits, such as antioxidants, vitamins, peptides, hyaluronic acid, retinoids, and other bioactive compounds. These ingredients are chosen for their potential to skin health, address specific skin concerns, or provide long-term benefits. The functional cosmetics include anti-ageing creams, sunscreen, hydrating foundations, acne-fighting creams and many others.

The functional cosmetics market is driven by several factors including growing consumer awareness, increasing demand for organic products, rising ageing populace, technological advancements, growing disposable income and rising wellness trends. Furthermore, the growing product launches and rising collaboration in the functional cosmetics industry are another important factor that propels the market growth.

According to MDALGORITHMS INC., acne is thought to impact 9.4% of people worldwide. It is very common in young people and teenagers, and beyond the age of thirty, it becomes less common. Even while acne is more common in teens, it nevertheless affects women more than men throughout their post-adolescent years. Acne affects over 50% of women in their 20s, 33% of women in their 30s, and 25% of women in their 40s.

Regional Insights

North America held a significant market share in 2022 and is expected to show its dominance during the forecast period. North America particularly the US hold the largest market share over the forecast period. The market growth is attributed to the increasing e-commerce industry. The rise of the e-commerce industry in the area has provided consumers with easy access to a wide range of cosmetic products, including functional cosmetics. Online platforms and beauty e-retailers play a significant role in the distribution and sales of these products.

For instance, the Department of Commerce's Census Bureau stated that the second quarter of 2023 saw a decrease of 2.3 percent (±0.4%) in U.S. retail e-commerce sales to $284.1 billion, which was adjusted for seasonal fluctuation but not pricing adjustments. There was a 1.5 percent (±0.2%) rise in total retail sales from the second quarter of 2023 to the predicted $1,825.3 billion during the third quarter.

While overall retail sales climbed by 2.3 percent (±0.4%) during the same time in 2022, the projection for e-commerce in the third quarter of 2023 increased by 7.6 percent (±1.2%). In 2023's third quarter, 15.6% of total revenues came from e-commerce. Additionally, the growing prevalence of skin diseases such as Acne is expected to propel the market growth. According to the American Academy of Dermatology, with up to 50 million cases every year, acne is the most prevalent skin ailment in the US. Many teenagers and young adults suffer from acne, which often starts around puberty. 85 percent of those in the 12 to 24 age range have at least mild acne.

Functional Cosmetics Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 3.68 Billion |

| Projected Forecast Revenue by 2032 | USD 6.06 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 5.7% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Wellness trends and social media influence

The overall wellness trend, encompassing both physical and mental well-being, has influenced consumer choices in various sectors, including cosmetics. Functional cosmetics that contribute to overall skin health align with the broader wellness movement. Furthermore, the influence of social media, beauty influencers, and online reviews has played a significant role in driving trends in the beauty and cosmetics industry. Consumers are often influenced by online content, leading to increased interest in new and innovative functional cosmetic products.

For instance, according to a survey conducted in 2022, approximately 69% of Gen Z respondents said they have purchased skincare and beauty items as a result of social media influence. Millennials came next, with 66% of those surveyed from this demographic stating that social media had an impact on their decision to buy cosmetics. Moreover, a recent StyleSeat poll found that 76% of social media users think influencer recommendations are false, but 57% of them had bought a cosmetic product after seeing it on social media. Thus, this is expected to drive the market growth during the forecast period.

Growing working women

The growing number of working women and rising consciousness regarding physical appearance among millennial women are the key factors driving the market growth during the forecast period. For instance, according to the Australian Institutes of Family Studies, women's employment involvement has increased significantly; in 2022, they made up 48% of all employed people, up from 36% in 1979. The rising employment of women can be attributed to several social and demographic developments.

Restraints

High cost

Compared to conventional cosmetics, functional cosmetics frequently need more promotion. This is because businesses must inform consumers about the advantages of functional cosmetics and persuade them to spend more money on these products. Although, to some degree, this could have a negative effect on the market owing to an increase in the product's price, marketing costs can also play a big role in market expansion.

Furthermore, the use of premium and cutting-edge components in functional cosmetics might raise production prices. This may result in higher product costs, which might prevent market penetration, particularly in consumer sectors where price is a determining factor.

Regulatory compliance and limited scientific evidence

It might be difficult to be certified for functional cosmetic goods and to comply with regulations. Product development and market entrance may face difficulties and delays in meeting the standards of various regulatory bodies. Furthermore, there might not be enough solid scientific proof to back up some functional cosmetics claims about their effectiveness. Customers are looking for items that have been shown to work, and certain functional cosmetics may not be accepted by the market if there isn't enough reliable scientific evidence.

Opportunities

Ageing concerns among the population

The ageing population and a growing desire to maintain youthful skin have fueled demand for functional cosmetics that claim anti-ageing properties. Ingredients like retinol, peptides, and antioxidants are often incorporated for these purposes. For instance, according to data from Euromonitor International, in the United States alone, the anti-aging market expanded from $3.9 billion in 2016 to $4.9 billion in 2021. In the same time frame, the worldwide anti-aging market grew from $25 billion to around $37 billion.

Growing acquisitions

The growing acquisition is expected to offer a lucrative opportunity for market growth during the forecast period. For instance, in November 2022, the premium leading TOM FORD brand was acquired by the Estée Lauder Companies Inc. The transformative agreement will make The Estée Lauder Companies ("ELC"), its longstanding partner, the exclusive owner of the TOM FORD brand and all of its intellectual property. As one of the leading international luxury brands of the twenty-first century, the TOM FORD brand will continue to grow and flourish under the direction of ELC due to the acquisition of the brand and the expansion of its current licensing partners.

Recent Developments

- In January 2023, to expedite the usage of sustainable packaging across all of LVMH's perfume and cosmetic goods, Dow and LVMH Beauty, a division of LVMH, the global leader in luxury and home to 75 renowned brands, partnered. Together, the two companies would be able to incorporate circular and bio-based plastics into various product applications for the cosmetics giant without sacrificing the packaging's quality or usefulness.

- In January 2022, in an exclusive move to improve skin health, L'Oréal, the global leader in beauty, and Verily, an Alphabet precision health subsidiary, established a strategic relationship. Two studies designed to better understand and characterize skin and hair ageing mechanisms as well as to enhance L'Oréal's precision beauty tech strategy and product development are anticipated to be part of this industry-first agreement.

Key Market Players

- L'Oréal S.A.

- The Estée Lauder Companies Inc.

- Shiseido Company, Limited

- Coty Inc.

- Johnson & Johnson Consumer Inc.

- Procter & Gamble Co.

- Unilever N.V.

- Avon Products Inc.

- Revlon Inc.

- Kao Corporation

- Amorepacific Corporation

- Mary Kay Inc.

- Beiersdorf AG

- Colgate-Palmolive Company

- The Clorox Company (owns Burt's Bees)

Market Segmentation

By Functionality

- Conditioning Agents

- UV Filters

- Anti-Aging Agents

- Skin Lightning Agents

By Application

- Skin Care

- Hair Care

Buy this Research Report@ https://www.precedenceresearch.com/checkout/3346

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308