High Speed Engine Market Revenue to Attain USD 48.26 Bn by 2033

High Speed Engine Market Revenue and Trends

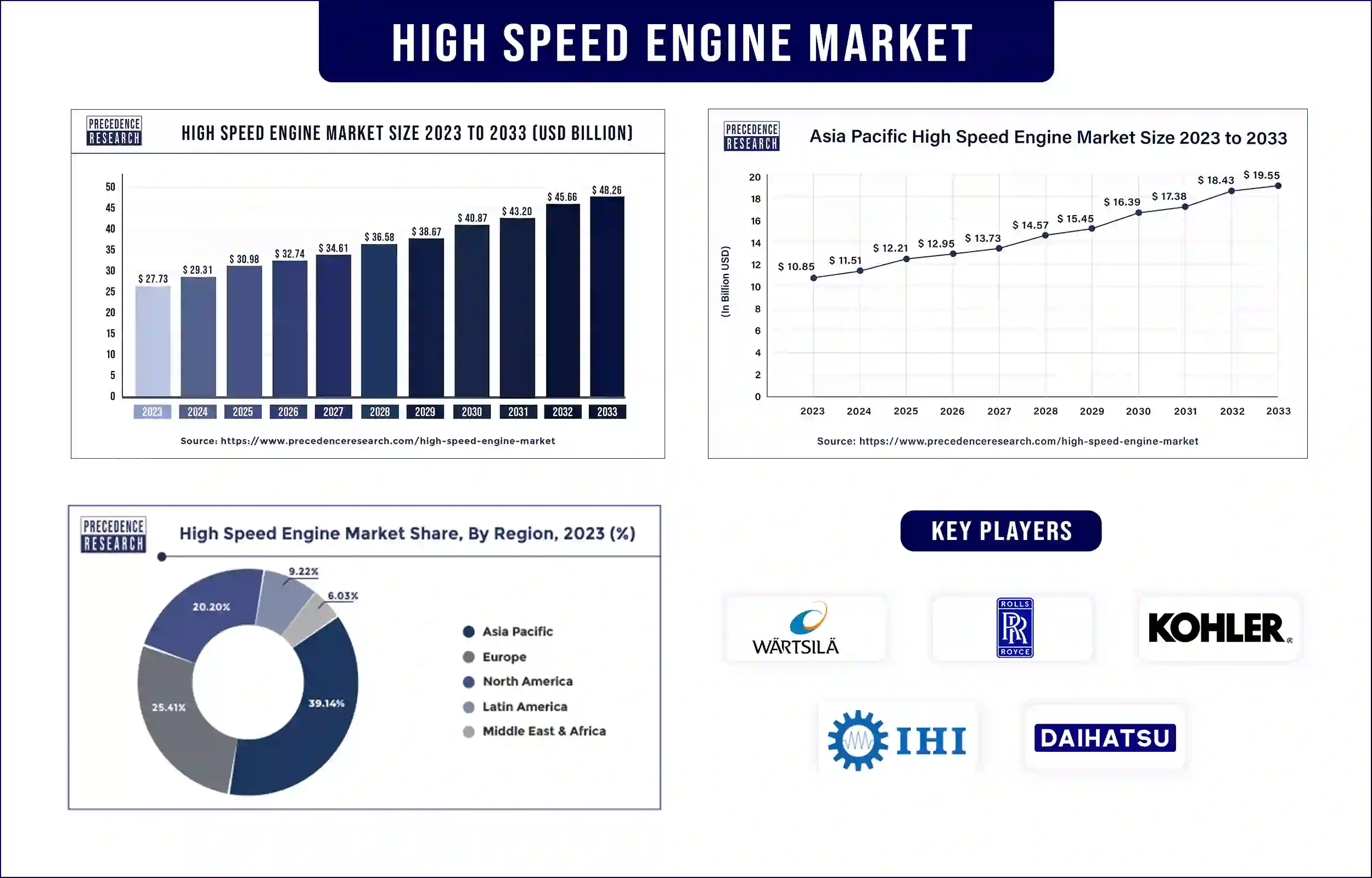

The global high speed engine market size was valued at USD 29.31 billion in 2024 and is pridicted to reach around USD 48.26 billion by 2033, expanding at a CAGR of 5.7% from 2024 to 2033. The demand for high speed engine is increasing because of necessity of reliable and continuous power and advancements in marine cargo travel globally.

Market Overview

High-speed engines are high-powered diesel motors that are used in different areas. There is a need for motors with high efficacy and performance. The rising need for reliable and continuous power in marine cargo travel is driving the high speed engine market. Moreover, the rising requirement for reinforcement power arrangements will probably fuel the market. With the rising industrialization worldwide, the demand for additional power sources is increasing, creating several opportunities in the market. Currently, high-speed engines are being utilized in different areas, such as power generation, marine, and railways.

Report Highlights of the High Speed Engine Market

- On the basis of power output, the 1-2 MW segment is expected to dominate the market in the coming years, as this power range is extensively used in commercial and industrial sectors.

- Based on speed, the 1500 to 1800 RPM segment led the market with the largest share in 2023. This range of motors is widely used in ships and boats due to their lower weight.

- By end-user, the power generation segment held the largest share of the market in 2023. This is due to the increasing demand for reliable power and the rapid expansion of the power generation facilities worldwide.

High Speed Engine Market Trends

Rising requirement for power: There is a need for reliable and continuous power due to the rising advancements in global marine cargo travel and soaring oceanic travel. A keen interest for reinforcement power arrangements is expected to be a major factor driving the growth of the high speed engine market during the forecast period. Power is a fundamental for each nation's advancement. As per the EIA's International Energy Outlook 2019, overall energy utilization is anticipated to ascend by 2.11 percent each year through 2040.

Extension of power networks: The extension of transmission and circulation networks that interface interest and supply will drive the improvement of high-velocity motors for power age. High-velocity motors improve productivity, giving them a benefit over other appropriated power age innovations for on-location age and reinforcement power requests. Accordingly, the ascent in the conveyed power age is probably going to create appealing possibilities for creators of high-velocity motors.

Power Structures: The coursed power generating structures have a limit of up to 100 MW and can be flexible or fixed. With the utilization of dispersed energy resources, the power systems and structures are becoming progressively decentralized. The issues of the quality of power, unexpected utility power outages, arranged blackouts, and inflating power costs are pushing interest away from conventional energy resources.

Regional Insights

Asia Pacific dominated the high speed engines market in 2023. There is a high demand for fast motors in this region. The demand for high-velocity and efficient motors is growing in countries like India and China due to growing industrialization, which is a key factor boosting the market. These countries are also investing heavily in expanding the production of high-velocity motors. Moreover, with the increasing energy demand, there is a high demand for high-speed engines.

North America is projected to be the fastest-growing market for high-speed engines. The region's electrical foundation is maturing, leading to the possibility of significant power outages and unexpected power disruptions. These outages and disturbances are creating a need for reinforcement of power structures.

High Speed Engine Market Coverage

| Report Attribute | Key Statistics |

| Market Revenue in 2024 | USD 29.31 Billion |

| Market Revenue by 2033 | USD 48.26 Billion |

| CAGR | 5.7% from 2024 to 2033 |

| 6.21% from 2024 to 2033 | Revenue in USD million/billion, Volume in units |

| Largest Market | 2023 |

| Base Year | North America |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Recent Developments in the High Speed Engine Market

- In January 2024, Yanmar Power Technology is working on a hydrogen compatible engine hybrid for electric propulsion vessel. They successfully created a hydrogen fueled 4-stroke-high-speed engine. This was developed for coastal vessels in Japan for the Nippon Foundation’s zero emission demonstrational experiment.

- In November 2023, MAN ES launched an entry date for their methanol-dual-fuel engines. This engine is supposed to be compatible with diesel-electric as well as diesel-mechanical propulsion systems that will help increase efficiency and the share of methanol is propulsion function.

Segments covered in the report.

By Power Output

- 0.5-1 MW

- 1-2 MW

- 2-4 MW

- Above 4 MW

By Speed

- 1,000 – 1,500 RPM

- 1,500 – 1,800 RPM

- Above 1,800 RPM

By End user

- Railway

- Marine

- Power Generation

- Oil & Gas

- Others

Get this report to explore global market size, share, CAGR and trends, featuring detailed segmental analysis and an insightful competitive landscape overview@ https://www.precedenceresearch.com/checkout/1883

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344