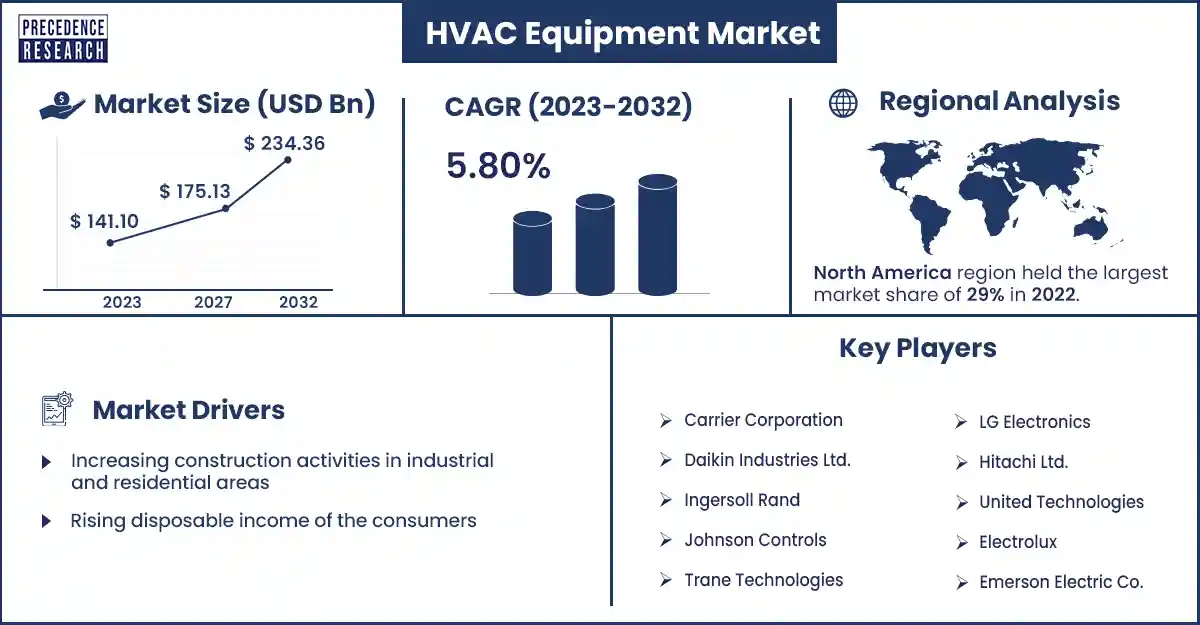

HVAC Equipment Market Size to Attain USD 234.36 Bn by 2032

The global HVAC equipment market size surpassed USD 141.10 billion in 2023 and is estimated to attain around USD 234.36 billion by 2032, growing at a CAGR of 5.80% from 2023 to 2032. The growth of the HVAC equipment market is due to the rapidly growing worldwide urbanization and industrialization.

Market Overview

The HVAC equipment market includes different attributes associated with regulating indoor environmental conditions in institutional, commercial, and residential buildings. These attributes are designing, manufacturing, distributing, installing, and servicing the HVAC systems. The growth market is attributed to sustainable buildings, cost-effectiveness, and increasing demand for energy efficiency. Buildings use cooling, heating, and climate control technologies to obtain satisfactory indoor air quality and thermal comfort. In modern times, the movement of people from rural areas to live in cities is one of the major population trends.

Increasing demand for the high seasonal coefficient of performance heating equipment, which can be efficient in both summer and winter, is anticipated to boost the product requirement. HVAC market players are introducing eco-friendly equipment by facing out hydrochlorofluorocarbons, chlorofluorocarbons, and other toxic and harmful refrigerant-based equipment. Integration of Internet of Things (IoT) systems such as mobile apps, remote controls, and sensors has enabled users to easily monitor and interact with HVAC equipment.

Increasing construction activities in industrial and residential areas

The construction sector is the significant driving force in the growth of the HVAC equipment market. The requirement for HVAC equipment has been increasing in both industrial and residential sectors, driven primarily by the increase in construction activities. The construction industry has led to major growth due to industrialization, population growth, and rapid urbanization. In the residential sector, the rising demand for housing segments has led to the construction of new apartments and homes boosting the demand for HVAC equipment.

In recent times, people spend a lot of time indoors, so it has become important to maintain the indoor air quality, this can be done by installing HVAC equipment. The HVAC equipment also provides cooling and heating solutions that increase the comfort levels of the residents. New equipments are often equipped with features that can help decrease energy consumption such as energy-efficient components and programmable thermostats. Hence, increasing construction activities in industrial and residential sectors are driving the growth of the HVAC equipment market.

However, variations in seasonal peaks can restrain the HVAC market growth or demand. People are considering air conditioning and heating when the temperature is unbearably high in the winter and summer. During this period, heating, ventilation, and air conditioning (HVAC) companies are continuously overburdened by the number of potential consumers, and that must be handled concurrently. However, when people do not need HVAC equipment, handling the company without financial loss can be difficult for the rest of the year. With the help of installing HVAC equipment, it has become more systematic than ever before. That's why the variation of seasonal peaks is the major restraint in the market.

HVAC Equipment Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 141.10 Billion |

| Projected Forecast Revenue by 2032 | USD 234.36 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 5.80% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

HVAC Equipment Market Key Companies

- Mitsubishi Co.

- Voltas

- Lennox International Inc.

- Sensata Technologies

- Honeywell International Inc.

- Emerson Electric Co.

- Electrolux

- United Technologies

- Hitachi Ltd.

- LG Electronics

- Trane Technologies

- Johnson Controls

- Ingersoll Rand

- Daikin Industries Ltd.

- Carrier Corporation

Recent Development

- In October 2023, Sensata Technologies introduced the Sensata Resonix RGD sensor in the UK. The UL-certified detection sensor in question is suitable for a range of A2L refrigerant gases found in HVAC (heating, ventilation, and air conditioning) systems. This sensor has helped manufacturers of HVAC equipment make the switch to refrigerants that have less of an impact on global warming.

Recent Development

- In September 2023, Johnson Controls, the company of Hitachi Air Conditioning, launched the Hitachi air365 Hybrid fuel system, which combines emissions-decreasing residential heating, ventilation, and air conditioning dual fuel heat pump and economical home comfort year-round.

Regional Insights

North America is estimated to grow fastest in the forecast period. The demand for air conditioning equipment in Canada and the United States has experienced heat waves every year, which is why the sale of cooling equipment is increasing rapidly in North America. Leading manufacturer’s focus on major trends such as urbanization and digitization, climate change, and increasing disposable incomes has led to technologically advanced solutions that serve different consumer segments. The major success factors in the region include use, ease of installation, building managers, cost knowledge support, product quality, and brand reputation. There are also inadequate certified professionals in advanced technologies increasing in the HVAC equipment market.

- In September 2023, in North America, Johnson Controls launched the next generation YORK YMAE Air-to-Water Inverter Scroll Modular heat pump. This modular heat pump is a future-ready solution for schools and offices, and it is sustainable.

Asia Pacific dominated the HVAC equipment market in 2023. In Asia Pacific, factors such as commercialization, rapid industrialization, and improving economic conditions. Several countries in this region, such as China and India, are experiencing population growth, industrialization, and rapid urbanization, enhancing the demand for heating and cooling solutions for both nonresidential and residential buildings

China has emerged as a global manufacturing country for HVAC equipment and plays an important role in supporting the growth of the HVAC equipment market. In the global supply chain integration, China has developed strong ties with the supply chain, enabling components for HVAC manufacturing and efficient sourcing of raw materials. Chinese companies have invested heavily in technological advancements in research and development.

In India, the heating, ventilation, and air-conditioning sector is witnessing extraordinary growth due to increased demand on the back of the government’s focus on infrastructure investment in the coming years. Apart from that, India has diverse temperatures compared to the northern and southern regions. Therefore, HVAC is needed throughout the year for different purposes.

- For instance, Finance Minister Nirmala Sitaraman has allocated Rs 11.11 lakh crore for HVAC equipment infrastructure in the annual budget for the 2024-25 financial year.

- In July 2023, in Bengaluru, the global leader for sustainable, healthy, and smart buildings, Johnson Controls launched the biggest state-of-the-art OpenBlue Innovation Centre. The new center showcases Johnson Controls OpenBlue with cloud, live environment, and AI in fully operable HVAC equipment.

Market Potential and Growth Opportunity

Smart thermostats

Smart thermostats are advanced technological devices that enable customers to automatically connect to their HVAC equipment to maintain the temperature of the buildings and connect to WIFI, even if they are far away from home. Smart thermostats are slowly creating their path into the mainstream with the increasing demand to maintain energy efficiency in buildings. Facility managers can make real-time adjustments that contribute to an overall sustainable future and energy savings with this advanced technology.

The future is sustainable with these technological developments in the market. These smart thermostat opportunities must drive the market growth.

The HVAC Equipment Market News

- In August 2023, Australian equipment solutions and hire industry Coates launched seamless and innovative temporary air, process, and climate change solutions to users. The launch of the new organization is in HVAC services across various sectors.

- In September 2023, the leading provider of enVerid systems launched the HLR 100C. This is the advanced addition to enVerid’s family of HVAC Load Deduction products.

Market Segmentation

By Product

- Heating

- Ventilation

- Cooling

By End-use

- Residential

- Commercial

- Industrial

Buy this Research Report@ https://www.precedenceresearch.com/checkout/1383

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308