Image-guided Therapy Systems Market Revenue to Attain USD 10.08 Bn by 2033

Image-guided Therapy Systems Market Revenue and Trends

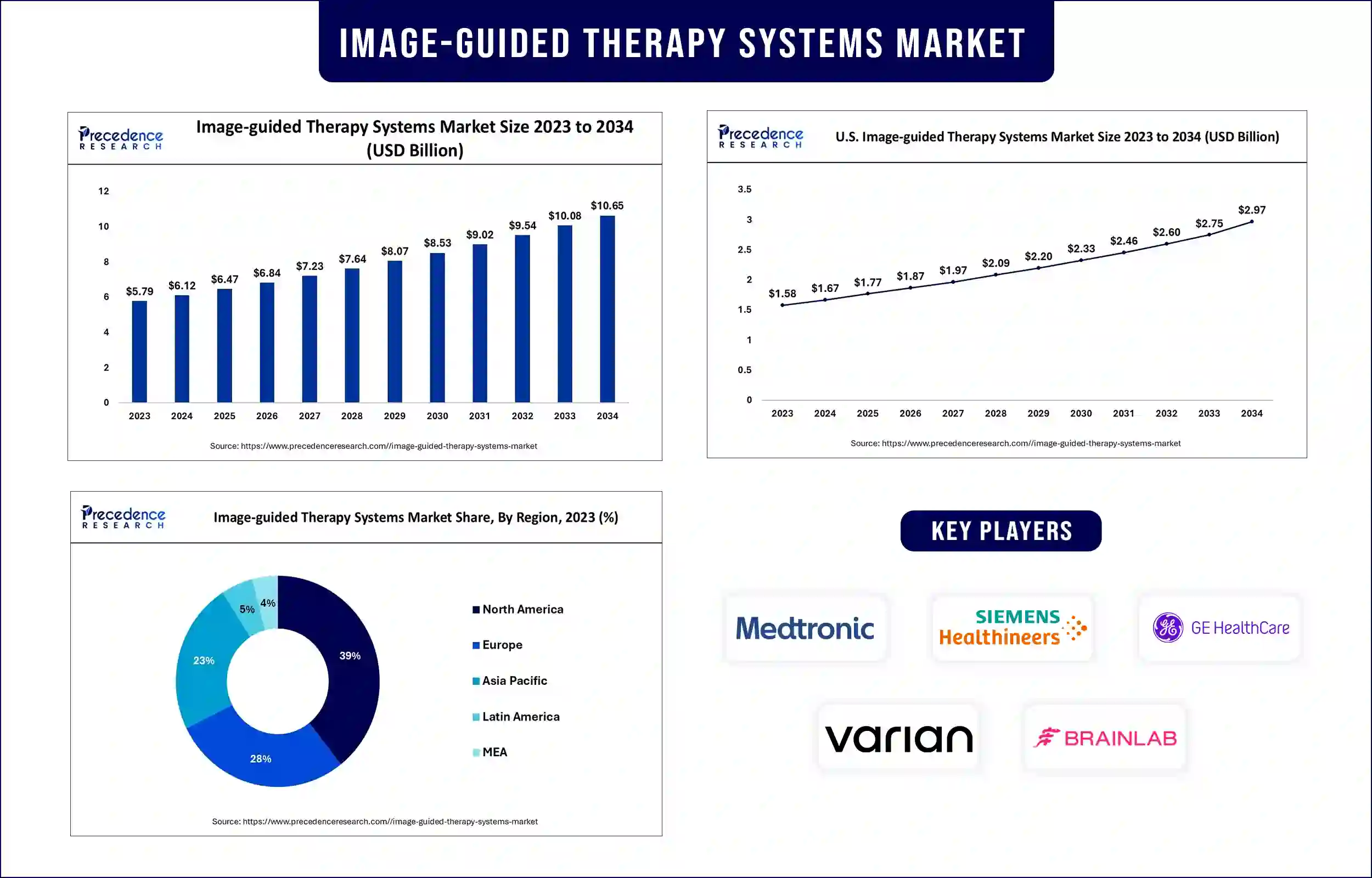

The global image-guided therapy systems market revenue was USD 6.12 billion in 2024 and is projected to reach about USD 10.08 billion by 2033, expanding at a remarkable CAGR of 5.70% between 2023 and 2034. The demand for image-guided therapy system is increasing in medical procedures. With the rising number of surgical procedures, the focus on improved accuracy and patient outcomes is increasing. The market is experiencing substantial growth due to advancements in imaging technology, increasing demand for minimally invasive procedures, and growing focus on precision medicine.

Image-guided Therapy Systems Market Overview

Image-guided therapy or image-guided interventions support medical professionals by examining the devices inside the group of patients and delivering a three-layered image of the targeted region, making the medical treatment more secure and unobtrusive. Today, experts in a range of fields, such as urology, muscular health, spine and nervous system, cardiovascular, vascular, and endovascular disease, pain and damage, can anticipate medical treatments and make minute alterations to care for patients. The quality of healthcare has increased, and mortality rates have decreased because of technology. Treatment of complicated diseases, particularly cancer, has benefited from the use of computational tools in conjunction with improvements in imaging techniques. Some of the most widely used image-driven therapeutic systems today include ultrasound, computed tomography scans, and magnetic resonance imaging.

Highlights of the Image-guided Therapy Systems Market Report

By product, the endoscopes segment held the largest share of the market in 2023. This is due to the increasing adoption of robot-assisted endoscopic medical procedures. Its extension has also been made possible by the significant number of endoscope-guided medical operations performed for various interventions. The segment is being driven by the growing incidences of gastrointestinal infections and malignant development, both of which have increased interest in interventional endoscopic devices. Due to mechanical advancements in endoscopy and subsequent product launches, this segment is also projected to expand at a rapid pace throughout the forecast period.

On the basis of end-user, the medical clinic segment dominated the market in 2023 due to the increasing number of medical procedures and the widespread use of image-guided therapy systems in clinics. Clinics are adopting these technologies because of the growing demand for clinical work processes that are more cost-effective.

Based on application, the cardiovascular medical procedure segment led the market with the largest share in 2023. The increasing prevalence of cardiovascular diseases (CVDs) worldwide is the major factor contributed to segment’s dominance.

Image-guided Therapy Systems Market Trends

Increasing demand for effective therapeutic methods: With the rising cancer incidences worldwide, the demand for effective therapeutic methods is rising. Image-guided therapy systems are widely employed in diagnosing and treating complex disorders. Key players operating in the image-guided therapy systems market are producing more efficient products to guarantee precision in the therapeutic process, thus boosting the market.

Increasing financing for developing cost-effective image-guided therapeutic systems: The demand for minimally invasive procedures has increased in recent years. Developing nations have also witnessed improvements in surgical techniques. These factors lead to the development of cost-effective therapeutic approaches. In addition, the availability of numerous government programs and financing considerably accelerated the development of innovative and economically viable image-guided systems, thus fueling the market growth.

Regional Insights

North America dominated the image-guided therapy systems market in 2023. The availability of advanced medical care systems and rapid adoption of cutting-edge radiation therapy in the region are major factors that contributed to regional dominance. In addition, rising technological advancements in healthcare technology, including diagnostic systems, further contribute to regional market growth. On the other hand, the market in Asia Pacific is expected to expand at the fastest CAGR in the near future. This is mainly due to the aging population, rising rare disease cases, and increasing government initiatives in advancing healthcare infrastructure.

Image-guided Therapy Systems Market Coverage

| Report Attribute | Key Statistics |

| Market Revenue in 2024 | USD 6.12 Billion |

| Market Revenue by 2033 | USD 10.08 Billion |

| CAGR | 5.70% from 2024 to 2033 |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2023 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market News

- In February 2024, Canon Medical Systems announced an expansion of its AI-powered image analysis capabilities for interventional treatments. These new services are aimed at boosting workflow efficiency and decision assistance during image-guided treatments.

- In July 2023, U.S. Food and Drug Administration approved Boston Scientific’s Vercise Neural Navigator 5 Software. This software program used to set and adjust stimulation parameters for the Vercise Deep Brain Stimulation (DBS) Systems, a previously approved therapeutic approach for patients suffering from Parkinson's disease (PD) and essential tremor.

- In May 2023, Koninklijke Philips N.V. announced the extension of Mobile C-arm portfolio with Zenition 10. Philips Image Guided Therapy now has a new cost-effective addition. The mobile C-arm platform brings flat panel imaging and user-friendliness to routine surgery.

Segments Covered in the Report

By Product

- Ultrasound Systems

- Computed Tomography (CT) Scanners

- Positron Emission Tomography (PET)

- Endoscopes

- Magnetic Resonance Imaging (MRI)

- X-ray Fluoroscopy

- Single Photon Emission Computed Tomography (SPECT)

By Application

- Cardiac Surgery

- Neurosurgery

- Orthopedic Surgery

- Urology

- Oncology Surgery

- Gastroenterology

- Others

By End-use

- Hospitals

- Specialty Clinics

- Ambulatory Surgical Centers

- Research & Academic Institutions

- Others

Get this report to explore global market size, share, CAGR and trends, featuring detailed segmental analysis and an insightful competitive landscape overview@ https://www.precedenceresearch.com/checkout/2005

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344