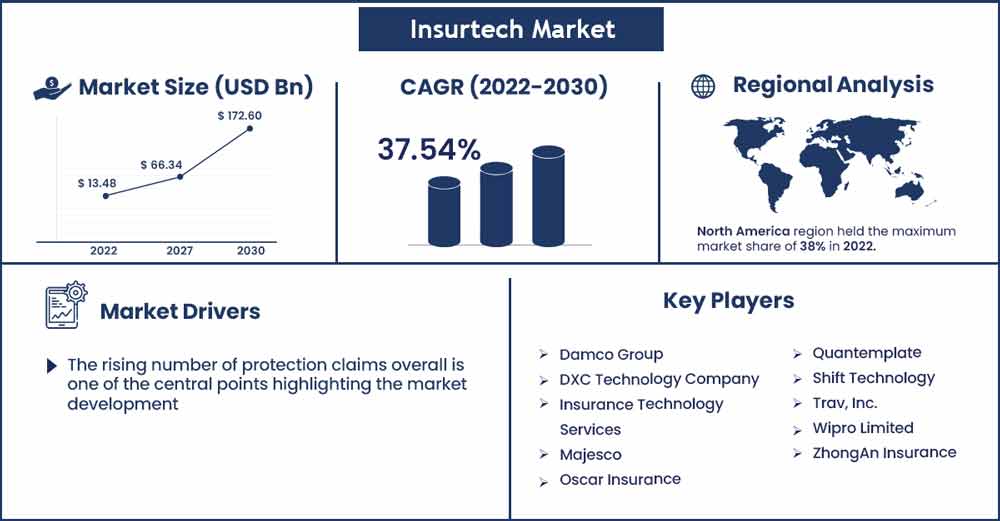

Insurtech Market is Expected to Increase at a 37.54% of CAGR by 2030

The global insurtech market size surpassed USD 13.48 billion in 2022 and is projected to rise to USD 172.6 billion by 2030, anticipated to grow at a strong CAGR of 37.54 percent during the projection period from 2022 to 2030.

Mechanized progressions are used to appreciate client needs and to overhaul their commitments considering the changing client needs. According to a survey coordinated by EIS Group, an item association, 59% of the protection organization outlined extended their advantage in the modernized establishment in 2022. Benefits introduced by blockchain development, similar to discount save reserves, faster portions, and blackmail mitigation, are driving its advantage among protection offices all over the planet. Blockchain advancement is used in protection organizations for applications like Know Your Customer (KYC), Anti-tax avoidance (AML) frameworks, ensure management, and make appropriate models.

A couple of Insurtech associations are going into a relationship with protection organizations to offer blockchain development-based plans. For instance, in December 2020, Amodo, an Insurtech association, revealed its relationship with Galileo Platforms Limited, a development association. Through this association, the associations would use blockchain advancements to assist protection organizations with offering new security courses of action and changing their client experience. Protection organizations are continuously enduring computerized revenue-based portions. For instance, in December 20an to allow policy21, Metromile, a mishap assurance association, detailed its game plholders to pay costs and assurance portions using advanced cash. This drive should help the association with building up its market position.

Report Highlights:

- The health portion ruled the market in 2022 and represented over 24.0% portion of the worldwide income. The rising interest in advanced stages, which associate trades, dealers, suppliers, and transporters in health care coverage, is expected to fuel the interest for the well-being fragment.

- The managed services fragment held the main income portion of over 44% in 2022. Overseen administrations suppliers can give safety net providers a deliberate passage to change by integrating mastery and ability with new innovations.

- The cloud computing portion drove the market with an income portion of more than 24.0% in 2020. Cloud computing has changed the protection business with its creativity, simplicity of arrangement, and adaptability. Boundless acknowledgment of Bring Your Own Device (BYOD) approaches, combined with the developing measure of information insurance agencies gather, is supposed to drive the development.

- The BFSI fragment ruled the market and represented over 20.0% portion of the worldwide income in 2020. BFSI organizations are broadly taking on Insurtech answers for further developing business effectiveness. The expansion in the quantity of associated gadgets in the BFSI area is prompting the age of a gigantic measure of information. Also, insurance agency has understood that they can utilize such information to convey better administrations, upgrade costs, gain bits of knowledge, and lift incomes.

Insurtech Market Report Scope:

| Report Coverage | Details |

| Market Revenue in 2023 | USD 18.54 Billion |

| Projected Forecast Revenue in 2030 | USD 172.6 Billion |

| Growth Rate from 2022 to 2030 | CAGR of 37.54% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2022 To 2030 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Regional Snapshot:

North America overwhelmed the market for Insurtech in 2022 and represented in excess of a 38% portion of the worldwide income. The area is seeing an expanded reception of Insurtech arrangements inferable from the rising expenditure of clients for protection-related items. Also, these arrangements offer adjustable and adaptable designs for property and healthcare coverage. The developing number of Insurtech new companies across the locale is additionally driving the market development in the area.

Asia Pacific is expected to arise as the quickest-developing territorial market over the estimated period. The district is supposed to observe huge development because of the presence of various arising economies and monetary centers in Singapore, India, and Hong Kong. Insurance specialist co-ops in the district are meaning to offer reasonable protection payment plans.

Market Dynamics:

Drivers:

The rising number of protection claims overall is one of the central points highlighting the market development. Auto, life, and home are the most widely recognized protection claims got by individuals around the world. As per a recent report by the Insurance Barometer, 36% of American respondents wanted to buy disaster protection in 2022. Insurance agency are progressively putting resources into computerized advances to lessen functional expenses and to work on functional effectiveness and the whole client experience.

Restraints:

Different regulations lay out shifted standards and guidelines across nations, with monetary focuses adopting a more joined strategy to guidelines. This turns into a basic issue for Insurtech organizations to create Insurtech arrangements across a few guidelines like MiFID II, GDPR, and others, which causes between guideline struggle. Accordingly, this variable smothers the Insurtech market's development.

Opportunities:

The interest for Insurtech arrangements is ascending as it sets better expectations of purchaser expectations, increments buying amounts, upgrades direction, and protection arranging using AI, man-made consciousness, and distributed computing.

The deals of Insurtech arrangements are becoming because of the help of different hearty innovations like AI, AI, blockchain, and distributed computing that offer continuous reconnaissance and checking of safeguarded action for some organizations.

Challenges:

The COVID-19 pandemic is expected to decidedly affect market development in 2022. Various insurance agency is reexamining their drawn-out methodologies and momentary requirements as COVID-19 and its effects have sped up the execution of online stages and new portable applications to address buyer issues. A few insurances agency are going into organizations with computerized arrangement suppliers to upgrade their contributions. For example, in December 2021, Duck Creek Technologies, a center framework supplier for Property and Casualty (P&C) safety net providers, reported that SECURA Insurance, a P&C insurance transporter, chose Duck Creek Rating, Claims, Contract, and Insights to smooth out its P&C business.

Recent Developments:

- Amodo, an Insurtech firm, shaped a relationship with Galileo Platforms Limited, an innovation firm, in December 2020. The organizations will use blockchain innovations to empower insurance agencies to convey new protection items and change their client experience because of their relationship.

- Amazon Web Services Inc. reported in November 2021 that it has been picked as a favored public cloud supplier by American International Group, Inc., an insurance agency. The American International Group desires to further develop client assistance through this work.

- Metromile, a collision protection business, expressed in December 2021 that supporters would have the option to pay charges and guarantee payouts utilizing Bitcoin. This drive ought to help the association to advance its market position.

- General Fire and Liability Insurance Company, which has practical experience in giving conventional property and setback insurance to little undertakings, started tolerating digital currencies for payment installments in June 2021.

Major Key Players:

- Damco Group

- DXC Technology Company

- Insurance Technology Services

- Majesco

- Oscar Insurance

- Quantemplate

- Shift Technology

- TrÅÂv, Inc.

- Wipro Limited

- ZhongAn Insurance

Market Segmentation:

By Services

- Consulting

- Support & Maintenance

- Managed Services

By Deployment Model

- On-premise

- Cloud

By Type

- Auto

- Business

- Health

- Home

- Specialty

- Travel

- Others

By Technology

- Blockchain

- Cloud Computing

- IoT

- Machine Learning

- Robo Advisory

- Others

By Application

- Product Development & Underwriting

- Sales & Marketing

- Policy Admin Collection & Disbursement

- Claims Management

By End User

- Automotive

- BFSI

- Government

- Healthcare

- Manufacturing

- Retail

- Transportation

- Others

Buy this Research Report@ https://www.precedenceresearch.com/checkout/2124

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 9197 992 333