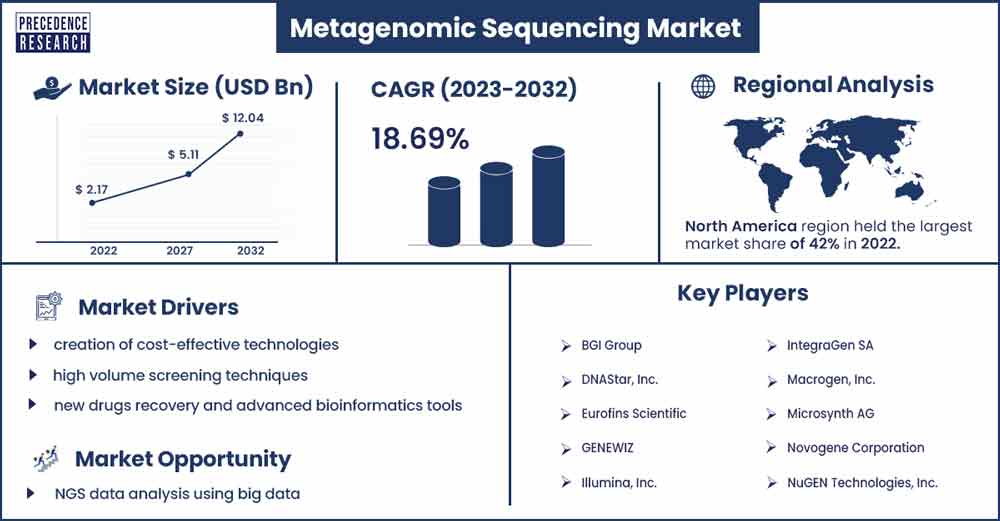

Metagenomic Sequencing Market Will Grow at CAGR of 18.69% By 2032

The global metagenomic sequencing market size is anticipated to reach around USD 12.04 billion by 2032 up from USD 2.17 billion in 2022 with a CAGR of 18.69% between 2023 and 2032.

The study of the entire microbe community's DNA is known as metagenomics. This process involves cloning and genetic research without using community-sourced animals as hosts. The metagenomics method has resulted in major improvements in microbial ecology, evolution, and diversity; this work is presently mostly done out in many study laboratories. Metagenomics that is sequenced and the analysis of the results is known as sequence-based metagenomics.

This has become well-established and extensively used over the past 20 years. This approach is more effective because it allows for scalability and independence from the availability of high-throughput screening systems and provides information about all potential activities of microorganisms represented by metagenomics rather than just a subset of those targeted by functional screening.

This method is reliant on known gene annotations, which restricts its ability to discover essentially new genes producing necessary activities, similar to genomic sequencing of grown microorganisms. Nevertheless, the use of sequencing-based metagenomics as the favored technique for finding functional activities of interest is encouraged by the accumulation of vast amounts of new data in genetic databases and the creation of more sophisticated bioinformatics algorithms.

Bioprospecting the genetic potential of microorganisms has been made possible by metagenomics, which has given researchers access to a vast array of previously unrecognized microbial variety from unusual environments. Old barriers to drug discovery have been removed by the advent of next-generation sequencing methods and advancements in computational tools. The issue of drug resistance may be solved thanks to developments in structural and functional metagenomics, which have cleared the way for the identification of new genes and metabolic pathways for the production of bioactive compounds with better properties.

But in order for these tactics to be effective, new technologies like metatranscriptomics and meta-phenomics must be created to enhance the current state of protein expression and the metabolic activity of innovative bioactive compounds. In the upcoming years, we will see the application of metagenomics or sequence-based technologies for personalized treatment influenced by the human genome.

Report Highlights

- The service sector of metagenomic sequencing encompasses sequencing services, research, and data interpretation options, with reagents and consumables expected to experience the highest growth rate during the study period.

- Due to the advantages of shotgun sequencing compared to other sequencing methods, the increasing number of metagenomic sequencing-based research projects and healthcare professionals, the segment of shotgun metagenomics sequencing is expected to grow at the fastest pace during the analyzed period.

- The drug discovery sector is projected to have the most rapid expansion during the study period, but the clinical diagnostics sector is anticipated to experience the greatest growth rate due to the development of advanced tools and software for metagenomics research.

- North America is currently the dominant market for global metagenomic sequencing and is expected to maintain its position throughout the forecast period.

Metagenomic Sequencing Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 2.58 Billion |

| Projected Forecast Revenue by 2032 | USD 12.04 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 18.69% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Regional Snapshots

The industry was controlled by North America. Due to the Region's dominance in deoxyribonucleic acid (DNA) sequencing technologies and its continued advancement, availability, and accessibility of DNA sequencing, the Region held the biggest portion of the worldwide metagenomic sequencing market.

Numerous foreign producers of DNA sequencing platforms, tools, and technologies are very busy in North America. Important companies try to enter the North American market with affordable DNA sequencing tools. This has helped the regional metagenomics industry grow and enabled scholars to learn more about the microbial ecology. Furthermore, the use of metagenomics products and technologies in biotechnology has advanced significantly in the North American market, which is anticipated to open up new channels and present a plethora of possibilities for market growth.

The greatest growth is predicted for the Asia-Pacific area. This study examines all of Asia-Pacific, including Japan, China, Australia, India, and the rest. Asia-Pacific has enormous potential for metagenomics development as a result of the shift in healthcare workers' attention toward drug discovery and expansion in the biotechnology sector. Furthermore, this region is anticipated to experience the greatest growth rate during the forecast period due to the greater access of novel advanced sequencing technologies across its nations.

Market Dynamics

Drivers

The metagenomic sequencing market outiook is emerging with better standards thanks to the growth drivers. The market's development rate is fueled by a variety of variables. The market is primarily being driven by the creation of cost-effective technologies, high volume screening techniques, new drugs recovery, and advanced bioinformatics tools. The development of new genes and metabolic pathways for the production of bioactive compounds with better properties has been made possible by advances in structural and functional metagenomics; this has helped to address the issue of drug resistance while concurrently driving demand in the market.

Restraints

Despite mNGS's promise, there are still a lot of challenges to overcome before this technology is widely used in laboratories. Interpreting results, such as separating contamination and colonization from actual microbes, choosing and verifying datasets for studies, and forecasting antimicrobial susceptibilities present significant challenges. Although mNGS is statistically more sensitive than conventional culturing techniques, the necessity of removing enormous quantities of human nucleic acid during sequencing preparation and the post-analytic process can occasionally reduce the sensitivity in contrast to targeted PCR approaches for many species.

Since the majority of the nucleic acids in clinical samples come from the host, the host genome predominates in sequence reads, which is a notable restriction of mNGS. As a consequence, pathogens present at a comparatively low burden may be harder to identify analytically. In the future, mNGS testing may very well play a significant part in the microbiological diagnostic pipeline as sequencing and bioinformatic computing capacity advance. However, this technology is extremely complicated and has questionable therapeutic utility in the present landscape of medical practice.

Opportunities

Metagenomic sequencing platforms have made substantial success in recent years thanks to technological breakthroughs. DNA sequencing is significantly more beneficial and favorable than conventional microarrays due to a number of factors, including the low input sample concentration requirements, the absence of experimental bias in microarrays, and others. The total number of sequence reads generated per run has soared since huge parallelization of sequencing processes was introduced. A platform that reduces the number of pre-sequencing steps, guarantees accurate sequences with long reads (MB to GB) generated with each run, operates on a DNA molecule without pre-amplification, and has excellent read accuracy is what scientists around the globe are searching for.

Therefore, researchers concentrate on creating cutting-edge sequencing tools. In 2021, each GenBank update contained 243 sequence data, and the total length of the whole genome shotgun sequence was 1,590,670,459. Advancements in this area are expected to support market expansion as DNA sequencing is mainly used in metagenomics research.

Challenge

End-user funding restrictions in some developing nations are one of the major difficulties metagenomic sequencing studies encounter. Additionally, market development is hampered by the fiscal and societal effects of genomic medicine and study in developing nations. The ARXIV group claims that only major research institutions with substantial financing, typically from developed countries, are able to carry out such projects, leaving developing nations behind because these nations cannot afford pricy next-generation sequencers. (NGS). This prevents the industry from growing.

Recent Developments

- Illumina purchased Pacific Biosciences, a well-known provider of sequencing tools, in November 2018. This supported Illumina's attempts to increase the variety of sequencing products it offers.

- In October 2018, Eurofins Scientific purchased TestAmerica, a famous environmental testing laboratory company in the United States. As a consequence, Eurofins was able to strengthen its standing in the US market.

Key Market Players

- BGI Group

- DNAStar, Inc.

- Eurofins Scientific

- GENEWIZ

- Illumina, Inc.

- IntegraGen SA

- Macrogen, Inc.

- Microsynth AG

- Novogene Corporation

- NuGEN Technologies, Inc.

- Oxford Nanopore Technologies Ltd.

- PerkinElmer

- QIAGEN N.V.

- Thermo Fisher Scientific, Inc.

- Zymo Research Corporation

Segments Covered in the Report:

By Product and Services

- Reagents and consumables

- Tools

- Services

By Technology

- Shotgun Metagenomics Sequencing

- 16S rRNA Sequencing

- Whole Genome Sequencing & De Novo Assembly

- Metatranscriptomics

By Application

- Ecological & Environmental Metagenomics

- Clinical Diagnostics

- Drug Discovery

- Biofuel

- Industrial Applications

Buy this Research Report@ https://www.precedenceresearch.com/checkout/2819

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 9197 992 333