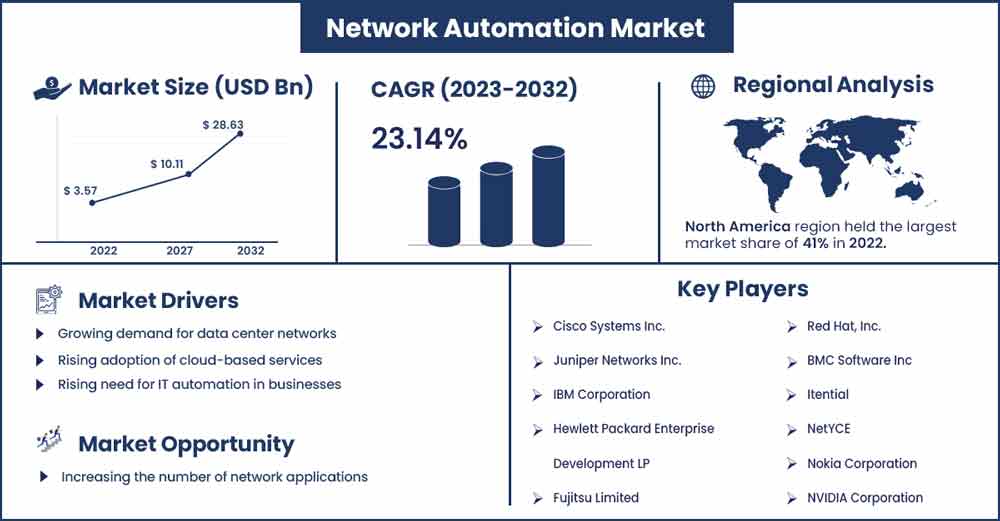

Network Automation Market Will Grow at CAGR of 23.14% By 2032

The global network automation market size is anticipated to reach around USD 28.63 billion by 2032 up from USD 4.4 billion in 2022 with a CAGR of 23.14% between 2023 and 2032.

Factors such as a surge in the adoption of smart-connected devices, escalation in error rates by manual systems, rising adoption of cloud-based services, and rising need for IT Automation in businesses are driving the network automation market. However, the lack of skilled professionals and open-source automation tools obstruct the market.

Regional Landscape:

Asia Pacific is expected to grow at a significant CAGR during the forecast period. The increase is due to the growing penetration of network automation solutions and services and the emergence of network automation start-ups in the region. India and China have a large and diverse customer base, which drives demand and opens new regional opportunities.

Furthermore, Europe is estimated to be the fastest-growing region during the forecast period owing to the rapid growth of the area and the presence of market players such as Nokia Communications, Ericsson, and Entuity Network Management. Several large enterprises in Europe are using WAN and LAN services.

The adoption of software-defined networking (SDN) and network function virtualization (NFV) technologies is rising in Europe. These factors rapidly change how large enterprises build their broad area networks to meet these growing network requirements. Adopting multiple technologies in organisations increases the complexity of their IT infrastructure, increasing demand for network automation solutions.

Network Automation Market Report Scope:

| Report Coverage | Details |

| Market Revenue in 2023 | USD 4.4 Billion |

| Projected Forecast Revenue by 2032 | USD 28.63 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 23.14% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics:

Driver:

Rising adoption of intent networking in healthcare

Intent-based networking technology is gaining traction in the healthcare industry to meet ever-increasing customer demands, such as broadening network infrastructure at screening centers, providing efficient wireless infrastructure for designing advanced hospitals, and improving hospital IT infrastructure reliability and efficiency. Intent-based networking is a type of networking software that aids in the planning, design, and implementation/operation of networks to improve network availability and agility. IBN streamlines the process of modifying or upgrading the network by ensuring that the result matches the original intent of the action.

Since common tasks can be automated to connect business objectives, simplifying will relieve IT staff. IBN has been adopted by the most prominent organizations even if software-defined networking (SDN) is deployed. Virtualization is used in SDN to remove intelligent management software from network hardware, and SDN accomplishes this by establishing a centralised, more intellectual, and easier-to-manage network architecture. SDN enables network administrators to regulate networks through abstraction, providing a simpler platform for operating apps and programs.

The difference between IBN and SDN is that IBN assists organizations in network planning, design, and implementation, whereas SDN is network architecture. IBN operates a network that can be SDN-based or not.

Restraint:

Lack of skilled professionals

It is critical to have networking professionals who understand cloud networking constructs. Also included are cloud teams who know how it incorporates and operates within the network. As a result, the global network automation market is expected to be hampered by a need for more skilled networking professionals.

Opportunity:

Rising investments in R & D

Networking companies invest heavily in networking solution research and development, emphasizing long-term value creation. Despite variations in limited-time performance and financial results, renowned networking companies have not lowered their investment in network automation solution innovation and testing. Intent-based Networking Solutions, for instance, have been developed by networking companies such as Forward Networks. Intent-based Networking takes as input business policy, converts it to a network configuration, and creates network designs.

COVID -19 Impact:

During the pandemic, SMEs experienced a loss in 2020; hence they reduced their expenses. This halted expenditure on new automation initiatives. Furthermore, the interruption in the 5G rollout directly impacts decisions regarding the acceptance of network planning software and professional services expenditure. However, once the economies started to recover, and 5G spending resumes, communication service providers and companies aimed to increase their prices on network automation to support new capacities such as 5G core and network slicing.

Components Landscape:

The services segment is estimated to grow faster during the forecast period. The growth of this segment is due to its dynamic role in training employees and deploying and integrating networking solutions for businesses. The services segment is further segmented into professional services, which include advisory and consulting, training and support and deployment and integration. These services enable effective functioning and improved network operational efficiencies throughout the process.

Deployment Mode Landscape:

The on-premises segment is expected to grow faster during the forecast period. It offers an annual service agreement, a one-time license fee, and a vast prospect of customised network automation depending on business demands owing to the deployment of apparatus within the organization. Large enterprises adopted on-premises deployment of network equipment owing to its pros, such as lower network bandwidth costs, greater security and privacy and more control over server hardware.

Network Type Landscape:

The hybrid network type is expected to grow faster during the forecast period. An IT infrastructure environment is comprised of a hybrid network. It is a hybrid of public and private clouds and data centers that allows for monitoring and managing entire system services. It aids in administering and assessing physical and cloud-based infrastructure, allowing for performance optimisation. IT operations automation, IT service support automation, and provisioning and release automation are all included in hybrid infrastructure service automation.

Organization Size Landscape:

The large enterprise segment is expected to grow faster during the forecast period. The growth of this segment is driven by the growing adoption of network automation, virtualization solutions and services in large enterprises. Large enterprises require robust network infrastructure to manage their resources efficiently and increase productivity, which contributes significantly to on-premises deployment. Furthermore, the rapid adoption of advanced technologies, such as automation by large enterprises, is fueling the growth of this segment.

Vertical Landscape:

The manufacturing segment is expected to grow faster during the forecast period. The growth of this segment is driven by Industry 4.0, smart manufacturing, and industrial automation. These require secure and robust networking manufacturing environments for the acceptance of companies and clients to access the data.

Recent Developments:

- In July 2020, Micro Focus added Al support to its Unified Functional Testing (UFT) solutions, designed to reduce the overall complexity of automating functional testing processes.

- In 2020, Juniper Networks and Anuta Networks collaborated to provide advanced network automation. Juniper's existing network automation portfolio, which includes Junos Telemetry, Juniper HealthBot, and Juniper NorthStar products, will be integrated with the Anuta ATOM platform.

Major Key Players:

Market players attempt to increase their market share through investments, partnerships, acquisitions, and mergers. Businesses are also investing in the development of new products. Furthermore, they are concentrating on maintaining competitive pricing. Some of the prominent market players include:

- Cisco Systems Inc.

- Juniper Networks Inc.

- IBM Corporation

- Hewlett Packard Enterprise Development LP

- Fujitsu Limited

- Red Hat, Inc.

- BMC Software, Inc

- Itential

- NetYCE

- Nokia Corporation

- NVIDIA Corporation

Market Segmentation:

By Components

- Solutions

- Network Automation Tools

- Intent-based Networking

- Services

- Professional Services

- Advisory and Consulting

- Training and Support

- Deployment and Integration

By Network Type

- Physical Network

- Virtual Network

- Hybrid Network

By Deployment Mode

- On-premises

- Cloud

By End-User

- Enterprise Vertical

- Service Providers

By Organization Size

- Small and Medium Sized Enterprises (SMEs)

- Large Enterprises

By Vertical

- Information Technology

- Banking, Financial Services, and Insurance (BFSI)

- Manufacturing

- Healthcare

- Energy and Utilities

- Education

- Others

Buy this Research Report@

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 9197 992 333