What is Network Automation Market Size?

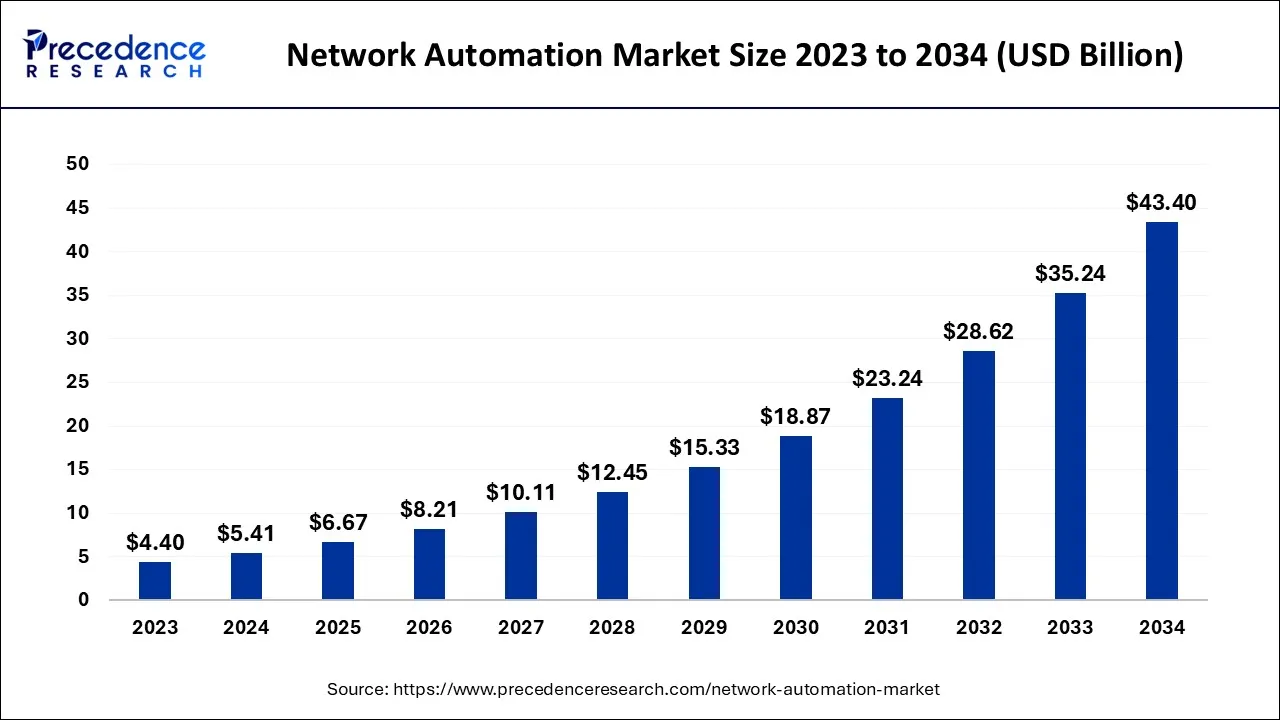

The global network automation market size is expected to be valued at USD 6.67 billion in 2025 and is anticipated to reach around USD 50.5 billion by 2035, expanding at a CAGR of 22.44% over the forecast period from 2026 to 2035

Market Highlights

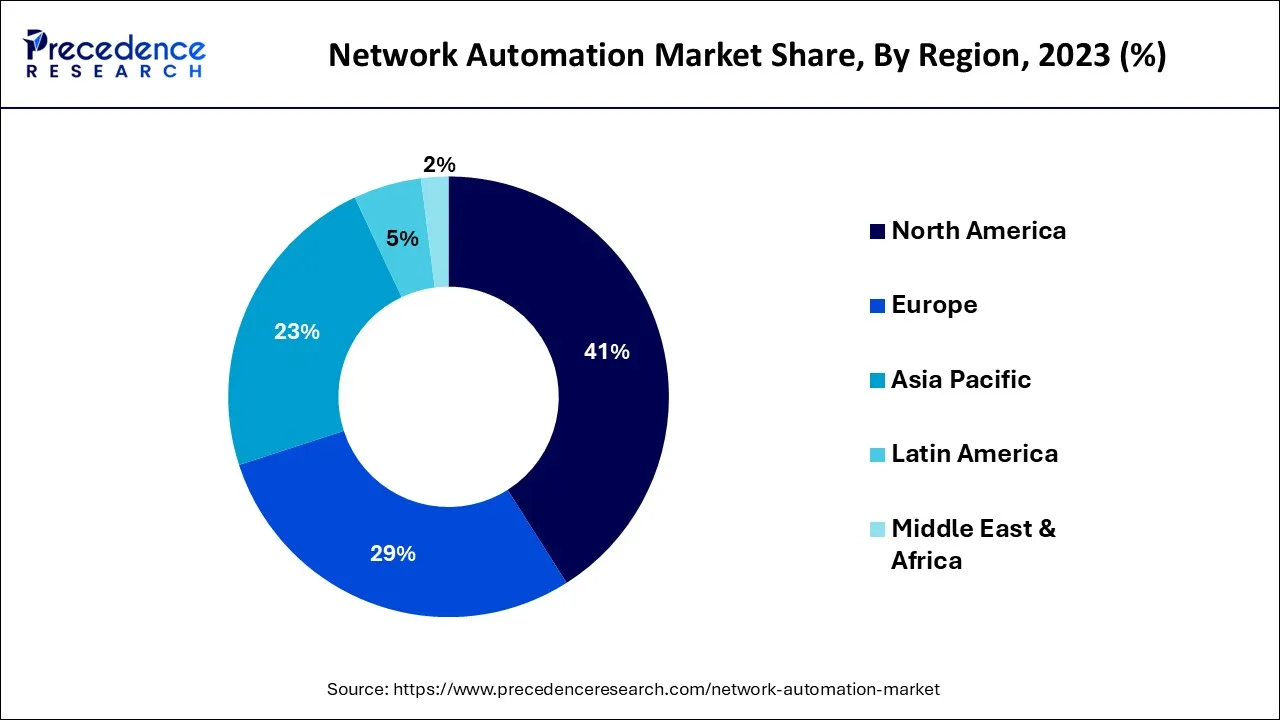

- North America generated for a significant market share of around 41% and is expected to expand at the fastest CAGR between 2026 and 2035.

- By Components, the solutions segment contributed to the maximum market share 70% in 2025.

- By Deployment Mode, the On-premise segment recorded the largest market share 56% in 2025.

- By Organization Size, the large segment generated the maximum revenue share of 64% in 2025.

- By Vertical, the information technology segment captured 25% of revenue share in 2025.

Network Automation: Powering Smarter, Faster, and More Efficient Digital Infrastructure.

The process of using software to automate network and security provisioning and management to maximize network efficiency and functionality constantly is known as network automation. Network automation is frequently used in conjunction with network virtualization. It offers improved operational efficiency, reduced probability of errors, and lower operating expenses. Moreover, surging investments in automation solutions and growing implementation of virtual solutions-defined infrastructure are the factors opening opportunities for market growth.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 6.67 Billion |

| Market Size in 2026 | USD 8.21 Billion |

| Market Size by 2035 | USD 50.5 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 22.44% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Components, By Network Type, By Deployment Mode, By End-User, By Organization Size, and By Vertical, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Growing demand for data center networks

The growing popularity of cloud computing and advanced applications such as telehealth, ultra-HD streaming video, virtual reality (VR) streaming, rising stock trading, and connected vehicle safety applications are resulting in a significant shift in data center infrastructure and traffic. According to this sequence, hardware manufacturers emphasize network hardware and release equipment that meets these specifications.

This exponential growth in the data center market necessitates improved operations, processing speeds, and security through data center automation software and hardware. Data centers increasingly use artificial intelligence to improve every aspect of their operations, along with network efficiency, dependability, efficiency, and security. This will propel the network automation market forward during the forecast period.

Restraint

Security threats

One of the primary reasons impeding market growth is some companies' insecurity that automated systems will overlook security threats or enforce too many constraints on the network. Furthermore, implementing automated solutions or procedures in the organization necessitates hiring professionals or training existing network teams, both of which increase the company's expenses. In addition, no new automation regulations or standards have been established.

Without clearly defined standards, all networking vendors may develop different configuration commands, making infrastructure management even more complicated for the networking team. It may occasionally result in configuration errors, resulting in an instant network breakdown. For example, in June 2019, a software bug caused a significant outage in Google due to a runaway automation process.

Opportunity

Technological advances

As a result of technological advancement, numerous industries have undergone digital transformation, increasing the number of network applications. This has significantly increased network and system complexity, requiring the installation of automation for potential performance and fueling network automation market growth. At present, intent-based networking skills help businesses keep up with digital and cloud-based change demands even though comprehensive automated solutions for network management tools and technologies will be available in the future.

Furthermore, the adoption of software-defined networks, such as software-defined wide-area networks (SD-WANSs), has allowed network automation tools to progress from operationally focused point products that address change management and setup to policy and orchestration tools. Data centers are currently under pressure to reduce operating costs while supporting many devices, so they emphasize efficiency, ease, and automation in configuration management and employ automated solutions. Network vendors are expanding their assistance for open-source platforms and systems operators use for routine tasks such as configuration monitoring and data refresh. As a result, such advancements in network automation create profitable opportunities for market players.

Segment Insights

Components Insights

In 2025, the solutions segment accounted for the largest market share and it is expected to reach at a CAGR of 21.5%. SD-WAN and network cloud computing solutions, intent-based networking solutions/platforms, configuration management tools, and other network automation tools comprise the solution segment.

The adoption of network automation solutions by communication service providers (CSPs) to accelerate the delivery of this software and applications can be attributed to the growth of the solution segment. An efficient network automation solution must be multi-level, allowing everything from virtual machines to system management to network discovery as needed by an enterprise. Network automation is a critical step in implementing a networking solution that becomes smarter, more flexible, and repeatedly adopts and protects the network. Solutions for network automation include network automation tools and intent-based networking.

Furthermore, key market players are incorporating advanced solutions to meet the needs of end users. The growing adoption of connected devices and the increasing demand for network bandwidth drive the growth of this market. These solutions prevent service-level agreement (SLA) violations, increase network uptime, and decrease mean time to repair (MTTR). The benefits of network automation mentioned above encourage CSPs to invest in R&D to enable low-cost and effective solutions, which are expected to provide lucrative opportunities for the market.The services segment is poised to hit at a CAGR of 25.3% over the forecast period 2026 to 2035

Deployment Mode Insights

In2025, the cloud segment accounted for the highest market share andit is expected to reach at a CAGR of 21.2% over the forecast period. By leveraging cloud computing capabilities, cloud network automation enables quick and secure network configuration. Furthermore, the cloud deployment model scales the capacity of a solution to handle massive network application traffic. Small businesses can collect and analyze data with the help of these solutions, which improves customer service.

The cloud deployment segment is poised to grow at a CAGR of 24.7% over the forecast period 2026 to 2035. Due to the numerous benefits the cloud deployment model provides, the demand for cloud-based network automation solutions is currently outpacing that of on-premises counterparts. Cloud computing is becoming more popular among small and medium-sized businesses. Several businesses are gradually shifting to cloud infrastructure, which is expected to expand in the coming years. The advantages of cloud infrastructure, such as ease of adoption, low reliance on in-house infrastructure, scalability, and simple installation of network automation solutions, contribute to the segment's rapid growth.

Organization Size Insights

Based on organization size, the global market is segmented into small and medium-sized enterprises (SMEs) and large enterprises. In2023, the small and medium-sized enterprises (SMEs) segment accounted for the largest market share. The increasing use of cloud technology has accelerated the adoption of SDN technology among SMEs. Due to financial constraints, SMEs tend to prefer the market's cloud-based solutions. These organizations have gradually begun to adopt technologically advanced products that improve business functionality while using limited resources. Network automation can help SMEs save money on network infrastructure while also reducing the time spent resolving network issues by determining the state of the network at any point in time.

Vertical Insights

Based on vertical, the global network automation market is segmented into information technology, banking, financial services, insurance (BFSI), manufacturing, healthcare, energy and utilities, education, and others. The information technology (IT) segment is poised to hit at a CAGR of 23.3% over the forecast period. There are numerous computing, storage, and network devices in data centers. As a result, data centers must deal with difficulties in configuring and managing these multi-vendor devices. Network scaling has also enhanced the OPEX for establishing IT departments and rising to respond to changing business needs. These factors have prompted IT departments to make significant investments in network infrastructure maintenance, fueling the growth of the network automation market.

The manufacturing segment is poised to hit at a CAGR of 24.7% over the forecast period 2026 to 2035

Regional Insights

U.S. Network Automation Market Size and Growth 2026 to 2035

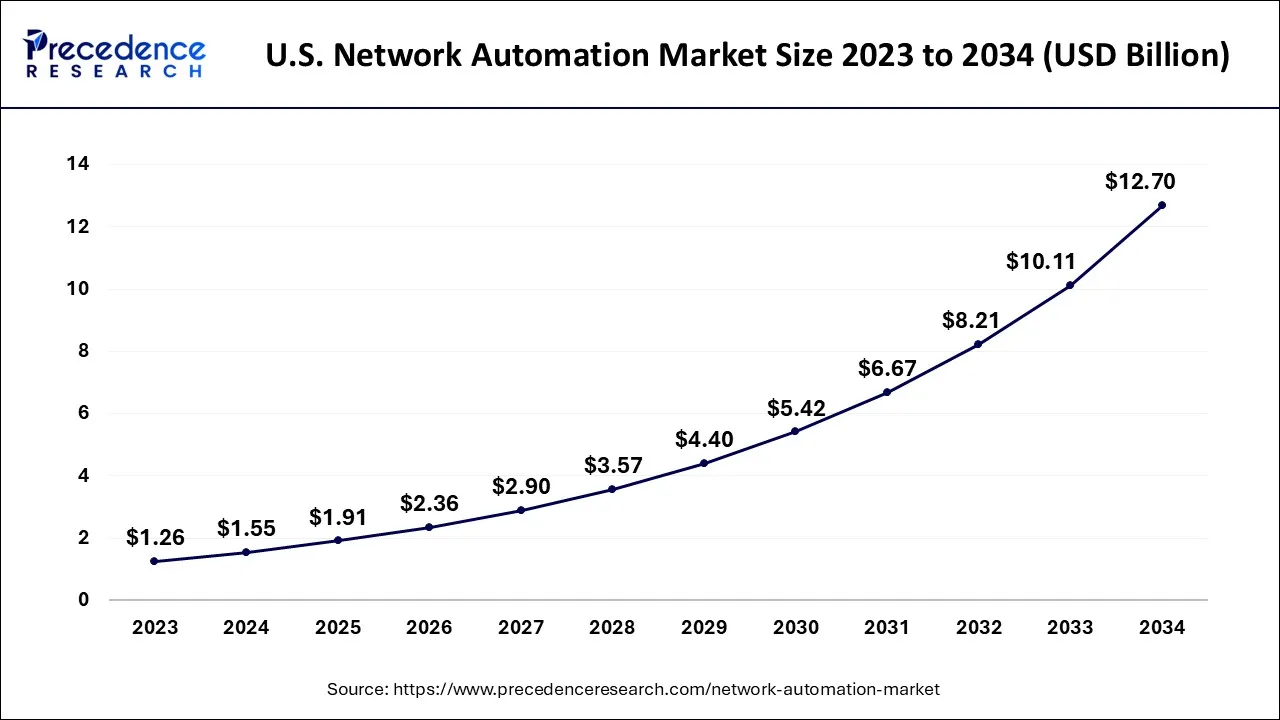

The U.S. network automation market size is exhibited at USD 1.91 billion in 2025 and is projected to be worth around USD 14.83 billion by 2035, growing at a CAGR of 22.75% from 2026 to 2035

U.S. Network Automation Market Analysis

The U.S. market is driven by the major growth drivers like 5G, edge computing, cloud-native, hybrid IT, AI, and ML. According to the National Institute of Standards and Technology (NIST), the Open Radio Access Network (Open RAN) is a prominent technology that supports next-generation communications cases. Additionally, organizations are prioritizing reduced operational costs, improved service reliability, and enhanced cybersecurity through automated processes and predictive maintenance.

• In August 2025, the National Science Foundation (NSF) planned to invest in a new national network of AI-programmable cloud laboratories. The investment is expected to support a network of “programmable clod laboratories”.

How did the North America Region dominate the Network Automation Market in 2025?

North America holds a significant market share of around 41% and is expected to grow faster during the forecast period.Some factors driving market growth in the region include an increase in the number of data centers, a rapid shift of SMEs toward digitalization, and increased investment in 5G projects.

Why is Asia Pacific the Fastest-Growing Region in the Network Automation Market?

Asia Pacific market is expected to reach at a CAGR of 24.1% over the forecast period. Several businesses in the United States intend to deploy highly efficient wireless communication solutions to increase network capacity. This would assist in boosting the efficiency of employees who use digital data and cutting-edge software.

India Network Automation Market Analysis

The network automation industry in India is expanding due to cloud integration and the expansion of IoT. India is transforming with AI through the investment of over ₹10,300 crore and 38,000 GPUs that are powering innovation. According to the 2025 report of the Press Information Bureau (PIB), India, about 6 million people are employed in the AI and tech ecosystem.

How is the Notable Growth of Europe in the Network Automation Market?

Europe is expected to grow at a notable rate in the market during the studied period due to the smart city and IoT trend, EU regulatory mandates, and AI and ML integration. The rapid expansion of 5G networks, growing cloud adoption, and the proliferation of IoT devices are further accelerating demand for automated network management solutions that can handle high traffic volumes and dynamic workloads.

Additionally, companies are focusing on reducing operational costs, minimizing downtime, improving service quality, and strengthening cybersecurity through automated processes and predictive maintenance.

- In November 2025, the Organisation for Economic Co-operation and Development (OECD) reported progress in implementing the European Union coordinated plan on AI in Germany. The report is a part of a larger OECD analysis of all EU member states.

UK Network Automation Market Analysis

In the UK, the market is growing due to rising focus on improving operational efficiency, reducing manual errors, and cost savings, alongside increasing cybersecurity concerns and the integration of AI/ML for smarter network management. Expansion of cloud, 5G, and hybrid networks, and strong digital infrastructure investment also boost adoption across industries seeking agility and reliability.

What are the Major Factors Contributing to the Network Automation Market within South America?

South America is expected to experience significant growth during the forecast period due to digital transformation funding initiatives of the government, tax reduction, and incentive programs. The national data centers and education plans in countries like Chile maintain regional leadership in the network automation market.

What Opportunities Exist in the Middle East and Africa in the Network Automation Market?

MEA is expected to grow at a significant rate in the market in the coming years, driven by industrial automation and the expansion of cloud and data centers. Adoption of advanced technologies such as software-defined networking (SDN), network function virtualization (NFV), and AI-driven network analytics is enabling operators and enterprises to automate monitoring, configuration, and optimization of complex networks. The rollout of 5G networks, growth in cloud services, and increasing IoT deployments are further fueling the need for intelligent automation to handle higher traffic volumes and dynamic workloads.

- In October 2025, Gulf Bridge International (GBI) selected Nokia to establish a new Middle East network of cloud, connectivity, and content. The plan is designed to enhance network diversity and resilience.

Top Companies Operating in the Market & Their Offerings

- Cisco Systems Inc. – Cisco delivers broad network automation solutions such as Cisco DNA Center, NSO, and Crosswork Network Automation Suite for intent-based provisioning, policy automation, closed-loop assurance, and AI-driven analytics across enterprise, SD-WAN, and service provider networks.

- Juniper Networks Inc. – Juniper offers AI-enabled automation through its Paragon Automation portfolio, including Pathfinder, Planner, Active Assurance, and Insights to automate provisioning, traffic engineering, analytics, and multi-vendor network operations.

- IBM Corporation – IBM's network automation portfolio includes Rapid Network Automation (from Pliant acquisition), integrated with hybrid cloud tooling to automate configuration, observability, provisioning, and orchestration across distributed network and IT environments.

- Hewlett Packard Enterprise (HPE) – HPE provides cloud-native automation with Aruba Networking Central and Paragon Automation for zero-touch provisioning, performance monitoring, and AI-assisted assurance across wired, wireless, SD-WAN, and telco networks.

- Fujitsu Limited – Fujitsu's Virtuora network automation and orchestration solutions deliver multidomain AI-driven automation for programmable networks, service management, and optimization across RAN, transport, and optical layers.

- Red Hat, Inc. – Red Hat supports network automation via its Ansible Automation Platform and OpenShift hybrid cloud, enabling playbook-driven device configuration, zero-touch deployment, orchestration, and automated workflows in cloud-native and multivendor environments.

- BMC Software, Inc. – BMC's automation portfolio—including TrueSight Automation for Networks and related ITSM/AIOps tools—uses AI and ML to automate network configuration, monitoring, event correlation, and remediation across hybrid and cloud infrastructures.

Network Automation Market Companies

- Cisco Systems Inc.

- Juniper Networks Inc.

- IBM Corporation

- Hewlett Packard Enterprise Development LP

- Fujitsu Limited

- Red Hat, Inc.

- BMC Software, Inc

- Itential

- NetYCE

- Nokia Corporation

- NVIDIA Corporation

Recent Developments

- In November 2025, Telcos reported that AI-driven network automation is the top priority of the company in the next 12 months to drive research and innovation.

- In June 2025, Telefónica reported strong progress in network autonomy through its new approaches, including advanced AI, generative AI, and digital twins. The report includes AI-enabled innovations, measurable KPIs, and a clarion call for industry-wide transparency.

- In 2021, Juniper Networks Inc. merged Apstra's network automation solution, which is built on an open, multi-vendor architecture, with its data-center networking portfolio centered on Juniper's JUNOS operating system. The combined platform would assist public and private cloud partners in optimising their operations as they progress toward AI-driven autonomous networks.

- In 2020, Fluidmesh Networks, a leader in resilient wireless backhaul solutions, was acquired by Cisco. Cisco's strengths, combined with Fluidmesh's solution-based offerings and relationships with systems integrators, would help to accelerate Cisco's industrial loT business and enable wireless deployments in industrial settings.

- In 2020,IBM has announced a new Al designed to assist Chief Information Officers (CIOs) in automating IT operations for greater resiliency and lower costs. IBM Watson AlOps is a new offering from IBM that uses Al to automate how enterprises detect, diagnose, and respond to IT anomalies in real-time.

- In June 2025, Meter, supported by Sam Altman, secured USD 170 million in funding to advance and scale its AI-driven network automation solutions.

(Source: https://www.nytimes.com) - In March 2025, ServiceNow announced a USD 2.85 billion acquisition of Moveworks to strengthen AI-driven automation capabilities across its workflow platform.

(Source: https://techcrunch.com)

Segments Covered in the Report

By Components

- Solutions

- Network Automation Tools

- Intent-based Networking

- Services

- Professional Services

- Advisory and Consulting

- Training and Support

- Deployment and Integration

By Network Type

- Physical Network

- Virtual Network

- Hybrid Network

By Deployment Mode

- On-premises

- Cloud

By End-User

- Enterprise Vertical

- Service Providers

By Organization Size

- Small and Medium Sized Enterprises (SMEs)

- Large Enterprises

By Vertical

- Information Technology

- Banking, Financial Services, and Insurance (BFSI)

- Manufacturing

- Healthcare

- Energy and Utilities

- Education

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content