What is the Data Center Automation Market Size?

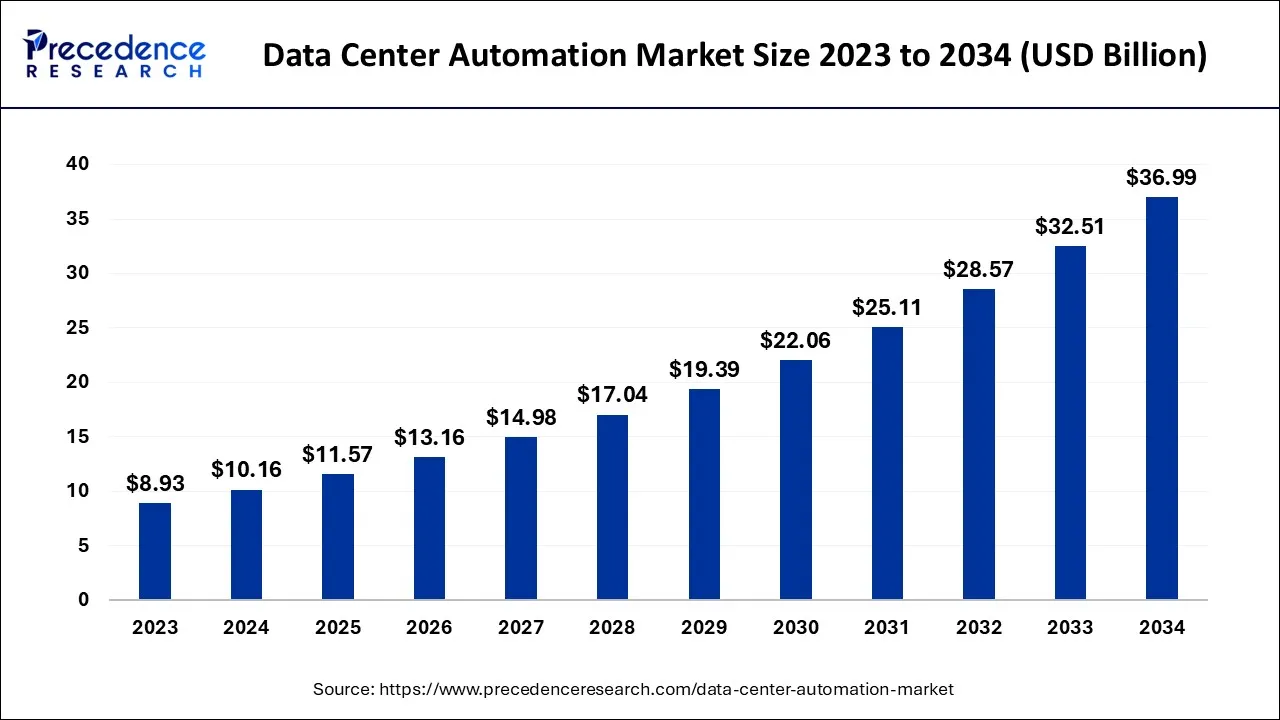

The global data center automation market size is accounted at USD 11.57 billion in 2025 and predicted to increase from USD 13.16 billion in 2026 to approximately USD 41.11 billion by 2035, representing a CAGR of 13.52% from 2026 to 2035.

Data Center Automation Market Key Takeaways

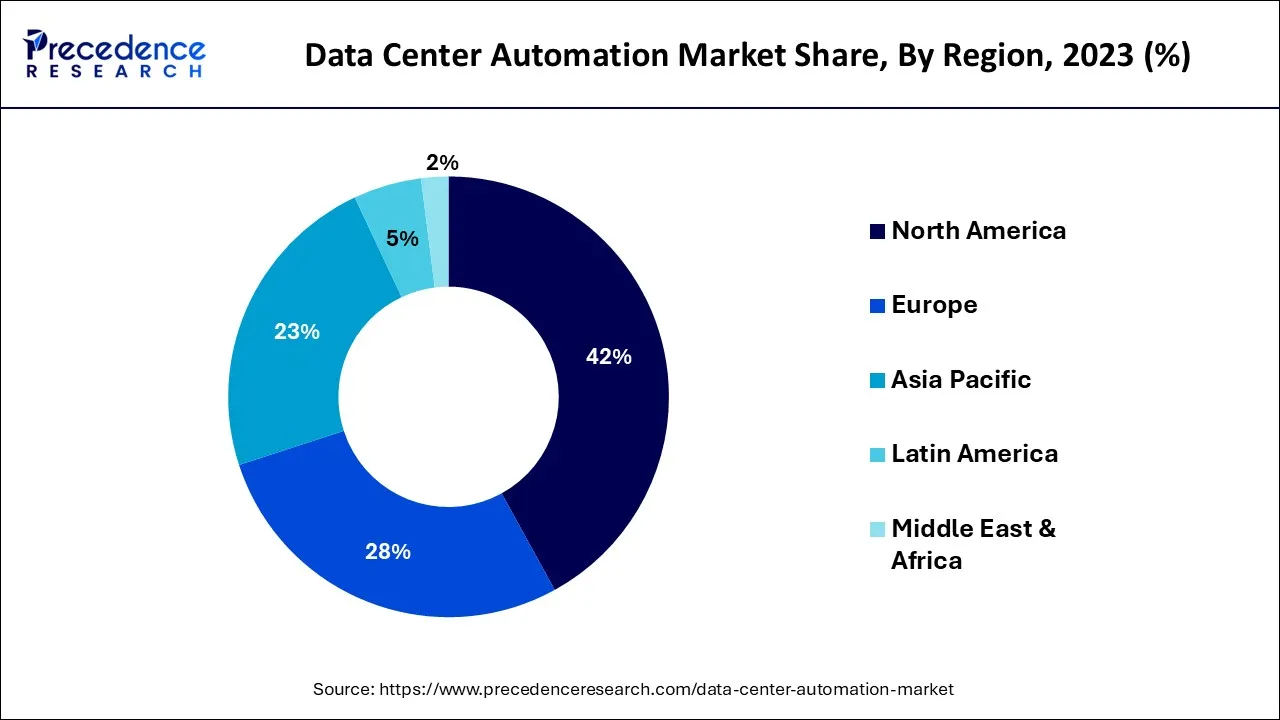

- North America generated more than 42% of the revenue share in 2025.

- By Solution, the server automation segment captured more than 52% of revenue share in 2025.

- By Service, the installation and support services segment contributed to the highest market share in 2025.

- By Deployment, the cloud segment generated more than 52% of revenue share in 2025.

- By Enterprise, the large-size enterprise segment captured more than 70% of revenue share in 2025.

- By Vertical, the Telecom& IT segment generated for the maximum market share in 2025.

Market Overview

Data center automation manages and executes routine workflows and techniques such as scheduling, monitoring, maintenance, application, and delivery without human intervention. Automation of data centers improves agility and operational efficiency. It reduces the time IT spends on routine tasks and enables them to provide services on demand in a repeatable, automated manner. End users can then quickly consume these services.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 11.57 Billion |

| Market Size in 2026 | USD 13.16 Billion |

| Market Size by 2035 | USD 41.11 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 13.52% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Solution, By Service, By Deployment, By Enterprise and By Vertical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

The growing global use of the internet and networking has significantly increased the demand for computing power, additional storage space and complex networking. This requirement has caused infrastructure development in current data centers, raising capital and operating expenditures for data centers and enterprises. This expansion has also enhanced the complication of networking, integration, and resource pooling in data centers. These factors are critical to the growth of the global data center automation market.

To address the concerns of the growing need for resource pooling, networking simplification, and overall data center management, innovators developed the complex conception of data center automation, also known as Software-Defined Data Centers (SDDCs). This enables conventional data center operators to level up their current infrastructure effortlessly, resulting in lower overheads. This additionally contributes to the integration of server storage and networking and the streamlined management of all resources. Data center automation assists enterprises and service providers in managing their active data centers and networks by overcoming the challenges of scalability, flexibility, manageability, and cost reduction.

Restraints

Lack of skilled professionals

Given the number of new technology innovations on the market, it is vital to have employees who are skilled in maintaining and programming advanced technologies. When addressing skill shortages, the data center skills difference is broadening. According to a study, more than half of data center workers need help recruiting staff as of April 2021. Moreover, the number of employees required to operate global data centers is expected to rise from 2 million in 2019 to approximately 2.3 million in 2025, implying that the number will increase even further.

According to the survey, 29% of respondents needed help recruiting cloud professionals, while 26% had difficulty recruiting data center facilities, engineering, and technicians. Furthermore, 25% of respondents reported needing help finding qualified candidates for network security, IT and data center management, and DevOps. Thus, the lack of skilled professionals restricts the market growth.

Opportunity

Rapid advancement in technology

The rapid advancement in technology transforming data centers, such as server virtualization, is expected to drive the market. Many manag

ed service providers (MSPs) and data centers are migrating to Software-Defined Data Centers to reduce infrastructure burdens (SDDCs). Virtualization technologies recreate computing power and storage in software form in an SDDC model. In contrast to the traditional, inefficient method of issuing one server to each user, server virtualization enables data centers and service providers to house multiple users on a single server by segmenting servers.

Since workloads are distributed across multiple servers, virtualization improves scalability. This model effectively functions as a cloud model, with the service provider allocating data storage and processing power on an 'as needed' basis. Virtualization also improves efficiency by ensuring that resources are used to their full potential.

Segment Insights

Solution Insights

Based on the solution segment, the data center automation market is segmented into network automation, server automation, and storage automation. In 2025, the server automation segment accounted for the largest market share of 52% and is expected to grow at a faster rate during the forecast period.

The growth of the segment is driven by the growing demand for efficient servers, which led to adequate network and storage facilities. Server automation benefits include clean architecture, secure and reliable, more accessible and reliable environment setup, instant feedback, software policies, range of interfaces and tools, testing and rollback of deployments. Server automation can help ease and accelerate the deployment process in various ways, beginning with the emergence of test environments.

Test environments that employ the same procedures as production enables developers to see how new features perform before releasing them to the final customer. Thus, server automation combines task and process automation to improve application deployment and administration across virtual and physical servers and provides end-to-end management via automated workflows, which reduce human errors.

Service Insights

The data center automation market is segmented based on services: consulting, installation, and support services. In 2023, the installation and support services segment accounted for the largest market share. All services provided to set up and integrate all data center management processes into one unified, simple, and highly efficient platform are referred to as installation and integration services.

Deployment Insights

Based on deployment, the data center automation market is segmented into on-premises and cloud. In 2025, the cloud segment accounted for the largest market share at about 52%. Businesses provide features and functions with greater efficiency and flexibility due to cloud deployment and growing cloud adoption reduces costs and maintenance requirements.

Organizations that use cloud-based solutions can gain access to a large number of data centers and cloud platforms for analysis and mapping.

Fastest Growing Segment: The on-premise segment is the fastest-growing segment as of this year. This rapid growth is driven by organizations that are prioritizing data security, control, and regulatory compliance. On-premise solutions help companies to maintain oversight over their infrastructure, which is vital for those who handle sensitive data, such as finance, healthcare, and government. This segment ensures that data is stored and protected in a controlled environment, thus mitigating potential risks.

Enterprise Insights

Based on the enterprise, the market is segmented into large-size enterprises and small-size enterprises. In 2023, the large size enterprise accounted for the largest market share of about 70% and is expected to grow faster during the forecast period. Companies must store massive volumes of daily data due to the rise of complex business tools such as data analytics and big data. Multinational corporations typically select data centers with superior data security, fueling segment growth.

Fastest Growing Segment: Small and medium enterprises (SMEs) are expected to grow at the fastest rate throughout the forecast period. The increasing adoption of digital technologies and the growing need for efficient data management solutions are driving the demand for this segment. This is because it helps to leverage advanced data management and automation capabilities without the need for any substantial investments in data center infrastructure.

Vertical Insights

Based on the vertical segment, the market is segmented into telecom and information technology (IT), media and entertainment, healthcare, banking, Financial Services and Insurance (BFSI), Public Sector, Manufacturing, Retail, and Others. In 2023, the Telecom& IT segment accounted for the largest market share. This is primarily due to the advancement of mobile technologies and the increasing demand for high-speed data services. The expansion of the IT and telecommunications industries benefited the economy by creating new jobs and business opportunities. Consumer prices have decreased due to increased competition among service providers.

Fastest Growing Segment: The BFSI (Banking, Financial Services, and Insurance) sector is set to witness the fastest growth throughout the forecast period. This rapid growth is fueled by the need for efficient data management, regulatory compliance, and the increasing adoption of digital banking services. Data center automation solutions help to manage vast amounts of data more effectively, thus ensuring regulatory compliance and enhancing overall operational efficiency.

Regional Insights

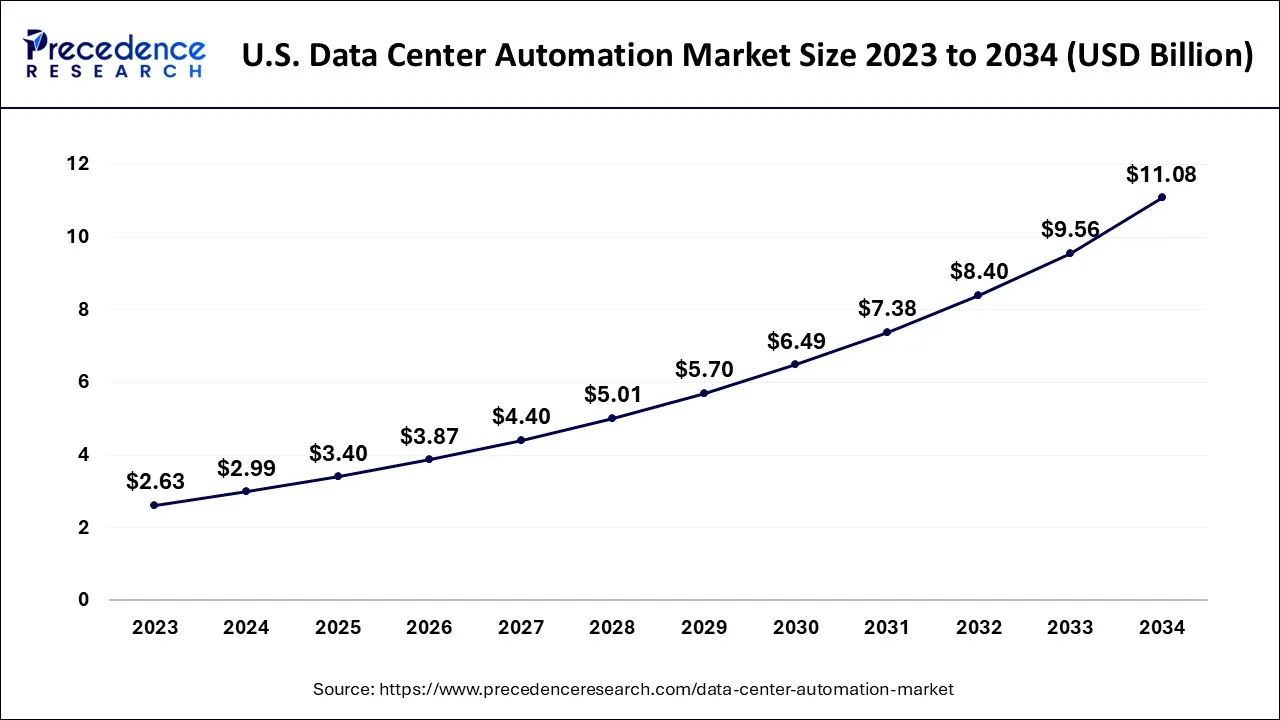

What is the U.S. Data Center Automation Market Size?

The U.S. data center automation market size is exhibited at USD 3.40 billion in 2025 and is projected to be worth around USD 12.60 billion by 2035, growing at a CAGR of 14.01% from 2026 to 2035.

In 2025, North America dominated the global data center automation market with the highest share of around 42%. The growth of this region is due to technological advancements and their adoption. It has a well-equipped infrastructure and the financial means to purchase data center automation software solutions. Furthermore, using data center automation tools improves efficiency and lowers costs for data center operations such as incident and event management. End-user industries can use it to monitor infrastructure, applications, performance, and security features.

In North America, data center automation solutions used in industries such as BFSI, IT & telecom, and media & entertainment are rapidly increasing. However, due to the large number of people who use social media and the presence of developing countries such as India, China, and South Korea, Asia-Pacific is the dominant region in the global data center automation market.

U.S. Data Center Automation Market Analysis

The market in the U.S. is rapidly growing, driven by AI and machine learning integration, expanding cloud and hybrid infrastructure, and increasing operational efficiency. Additionally, increasing integration of AI and machine learning, which enhances operational efficiency and reduces downtime, and the rising demand for automated management and monitoring solutions drive the market.

- In July 2025, the U.S. Department of Energy (DOE) announced the site selection for a new AI data center and energy infrastructure on federal lands.

Why is the Asia Pacific Considered a Significant Region in the Data Center Automation Market?

Asia Pacific is a significant region in the data center automation market due to rapid digital transformation, growing cloud adoption, and increasing investment in hyperscale and edge data centers. The region's expanding IT infrastructure and rising demand for efficient, AI-driven operations are driving widespread adoption of automation solutions. The surge in AI workloads, growing adoption of hyperscale cloud and hybrid cloud, mandates sustainability and energy efficiency, and government digitalization initiatives also support regional market growth.

India Data Center Automation Market Analysis

In India, the market is growing due to the rapid adoption of cloud computing, AI, and machine learning technologies across enterprises and service providers. Additionally, increasing investments in data center infrastructure and the rise of digital services are driving demand for automated management and operational efficiency solutions.

- In January 2025, Sify Technologies announced to invest $5 billion to expand data centers and AI operations in India.

How is the Opportunistic Rise of Europe in the Data Center Automation Market?

Europe is experiencing an opportunistic rise in the market due to increasing adoption of AI-driven management solutions, stringent energy efficiency regulations, and growing demand for cloud and hybrid infrastructure. Additionally, investments in smart data centers and sustainable IT operations are creating opportunities for automated monitoring, optimization, and predictive maintenance solutions across the region.

- In November 2025, Google announced the investment of €5.5 billion in AI infrastructure through 2029 in European countries like Germany.

What are the Advancements in the Data Center Automation Market in Europe?

Germany Data Center Automation Market Trends: The region's market landscape is propelled by its well-established industrial base and a strong focus towards Industry 4.0. The need to streamline data center operations and support IoT-based initiatives encourages automation. In addition, the region has strict regulations regarding data security, which helps to push companies toward advanced automation systems and tools.

What are the Major Factors Contributing to the Data Center Automation Market within Latin America?

The market in Latin America is driven by the rapid digitalization of businesses, increasing adoption of cloud and hybrid infrastructure, and the need for efficient IT operations. Growing investments in hyperscale and edge data centers are further fueling demand for automated management, monitoring, and predictive maintenance solutions. Additionally, government initiatives to enhance digital infrastructure and rising demand for energy-efficient and reliable data centers are supporting market growth across the region.

- Chile released the Guía para la Inversión en Data Centers in 2024 to guide companies through the complex process of setting up data centers, anticipating around $4 billion in upcoming projects. The guide is part of the national data centers plan (Pdata) and was developed by the Ministry of Science, Technology, and Innovation.

What Potentiates the Market in the Middle East & Africa (MEA)?

The data center automation market in the Middle East & Africa is potentiated by rapid digital transformation, increasing cloud adoption, and growing investments in hyperscale and edge data centers. Additionally, the demand for energy-efficient, AI-driven operations and government initiatives to enhance IT infrastructure is driving market growth in the region. Saudi Arabia is a major contributor to the market in the MEA due to rapid digitalization, significant investments in cloud and hyperscale data centers, and government initiatives like Vision 2030 that emphasize smart infrastructure and AI-driven operations.

Saudi Arabia Data Center Automation Market Trends: The region's market landscape is evolving rapidly, driven by the need for efficient IT infrastructure management, cost reduction through energy efficiency, and stringent compliance and security requirements. The expansion of 5G networks, artificial intelligence, and big data analytics is further increasing the need for scalable and software-defined data center operations.

Data Center Automation Market Companies

- Cisco Systems Inc.

- ABB Limited

- Oracle Corporation

- Microsoft Corporation

- BMC Software

- ServiceNow

- Citrix Systems, Inc

- Hewlett Packard Enterprise Development LP

- FUJITSU

- VMWare

Recent Developments

- In Oct 2022,Cisco invested in a dedicated India Webex infrastructure to accelerate Webex adoption, which included a new data center and the necessary regulatory licenses.

- In 2022,ABB collaborated with ATS Global, a provider of smartdigital transformationsolutions, to expand its reach in the data center automation market. Both companies will collaborate to combine resources, test the effectiveness and benefits of potential collaborations for ABB Ability data center customers, and grow their respective businesses.

- In 2022, Kyndryl,a provider of IT infrastructure services, Microsoft Corporation, and Dell Technologies have announced the launch of a hybrid cloud solution designed to support customers in mainframes, data centers, and remote environments.

- In October 2025, OMRON launched an automation center in Bengaluru to advance smart manufacturing in India.

- In September 2024, Nokia launched the most modern data center automation platform, specifically established for the AI era.

Segments Covered in the Report

By Solution

- Network automation

- Server automation

- Storage automation

By Service

- Consulting service

- Installation and support services

By Deployment

- On-Premises

- Cloud

By Enterprise

- Large Size Enterprises

- Small and Medium Sized Enterprises (SMEs)

By Vertical

- Telecom and Information Technology (IT)

- Media and Entertainment

- Healthcare

- Banking

- Financial Services and Insurance (BFSI)

- Public Sector

- Manufacturing

- Retail

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting