How big is the Network Engineering Services Market?

Network Engineering Services Market Revenue, and Top Companies Analysis

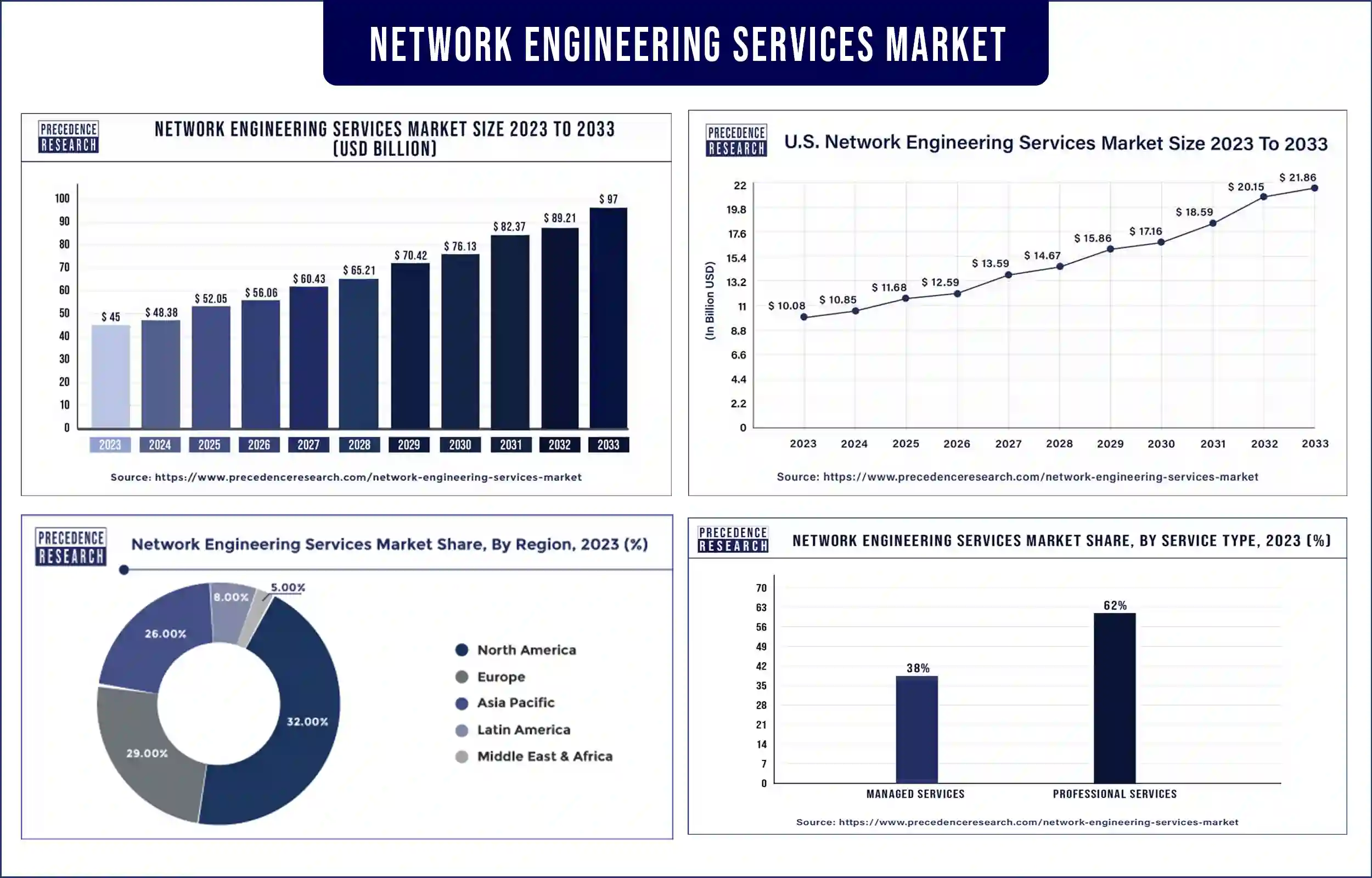

The global network engineering services market revenue was valued at USD 45 billion in 2023 and is poised to grow from USD 48.38 billion in 2024 to USD 97 billion by 2033, at a CAGR of 8% during the forecast period 2024 – 2033. The growing consumption of data-intensive applications is expected to drive the growth of the market.

Market Overview

The network engineering services market deals with a wide range of services aimed at optimizing, managing, implementing, and designing network infrastructures for businesses across several industries. The network engineering services include ongoing maintenance and support, performance, monitoring, optimization, configuration and installation of network equipment, and network planning and designing.

The increasing demand for network infrastructure, the growing emergence of 5G technology, and growing major concerns about cybersecurity and privacy are expected to drive the growth of the market. In addition, growing edge computing and Internet of Things (IoT) technologies, increasing flexibility and scalability transition of network engineering, the increasing demand for remote work, and digital transformation are further anticipated to drive the growth of the network engineering services market during the forecast period.

Network Engineering Services Market Trends

- The increasing complexity of network technologies contributed to propel the market growth.

- The growing business globalization and expansion and regulatory compliance requirements fuel the market growth.

- The Internet penetration and increasing need to digitize business operations are further estimated to accelerate the growth of network engineering services.

- Increasing digital transformation initiatives and cloud integration to fuel the market growth.

Various businesses are undergoing digital performance, necessitating scalable and agile networks to support new services, new applications, and digital platforms. These factors help to grow the market of digital transformation initiatives. In addition, the migration of data and applications to the cloud needs seamless integration with facilities-based networks. This further leads to a demand for skilled professionals in cloud-based network solutions. These are the major factors that are expected to drive the growth and demand for the network engineering services market during the forecast period.

However, rapid technological changes and security concerns about network engineering services restrain the growth of the market. The rapid evolution of technology means that network services instantly become outdated. Various organizations and businesses face many challenges in ensuring their networks remain compatible and keeping up with these changes with new protocols and technologies. In addition, while network engineering aims to increase security, the continuously increasing sophistication of cyber threats creates a constant challenge. Businesses need to invest in continuous privacy and security updates and measures to protect their networks, which are both costly and time-consuming. Therefore, these factors may restrain the growth of the network engineering services market.

Network Engineering Services Market Highlights

| Report Attribute | Key Statistics |

| Market Revenue in 2024 | USD 48.38 Billion |

| Market Revenue by 2033 | USD 97 Billion |

| Market CAGR | 8% from 2024 to 2033 |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Forecast Period | 2024 to 2033 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Network Engineering Services Market Top Companies

- Check Point Software Technologies Ltd.

- Fortniet, Inc.

- Palo Alto Networks, Inc.

- F5 Networks, Inc.

- IBM Corporation

- Broadcom Inc.

- Ericcsom Inc.

- Extreme Networks, Inc.

- Dell Technologies, Inc.

- Hewlett Packard Enterprise (HPE)

- Nokia Corporation

- Arista Networks, Inc.

- Huawei Technologies Co., Ltd.

- Juniper Networks, Inc.

- Cisco Systems, Inc.

Recent Innovation in Network Engineering Services by BESA

In April 2024, BESA, the Building Engineering Services Association, launched a dedicated group for newcomers and young engineers to the industry. The aim behind this launch was to support young engineers working for member companies who were seen to have bright future management potential. It also aimed to provide technical knowledge, networking opportunities, and career support.

Recent Innovation in Network Engineering Services by SmartCIC Global Services

In April 2024, a global managed service provider, SmartCIC Global Services, launched its Site Visit Reporting application to offer real-time information flow from network engineers in the field to global support centers. All 25,000 of SmartCIC’s certified network engineers have access to the mobile app with data from enterprise sites. The mobile application allows SmartCIC to deliver data to its consumers in real-time.

Regional Insights

Asia Pacific is expected to grow fastest during the forecast period. The growing surge in network infrastructure development to support 5G technologies, increasing investments in advanced technologies, and the region’s ongoing digital economy are attributed to accelerating the growth of the network engineering services market. In addition, a growing number of businesses and enterprises in the region are developing digital transformation, further enhancing the need for scalable and robust network solutions and further contributing to the growth of the market in Asia Pacific. China, India, Japan, and South Korea are the leading companies in this region.

China is the fastest-growing country in this market due to the growing technological advancements and increasing consumer demand. There are various leading network engineering companies in China, such as Cisco Systems, Accenture, Ericsson, Huawei, Fujitsu, Dell, Juniper Networks, IBM, and many more. The Chinese market for network engineering services is poised for continuous expansion and ongoing research and development activities aimed at enhancing product efficacy and quality. These are the major factors expected to drive the growth of the market in the Asia Pacific region.

- North America dominated the network engineering services market in 2023. The increasing widespread digitization in various industries, rising robust IT infrastructure, and rising advanced technological adoption in this market have contributed to the growth of the market in the region. The region’s proactive approach to incorporating technologies such as cloud services, IoT, and 5G enhances the demand for network engineering solutions.

- In addition, high awareness of strict data protection and cyber security further drives the demand for sophisticated network infrastructure. The U.S. and Canada are the major leading countries in the region and further drive the growth of the network engineering services market in North America.

- For instance, in June 2024, Vallum Software, Cummings Innovation Lab, Inc., and more Network Engineering companies were launched from the F6S community in the United States. Network engineering is part of the computer networking industry, which is the 45th most popular market group and industry.

Market Potential and Growth Opportunity

Increasing adoption of innovative technologies

The growing significance of innovative technologies such as software-defined networks, machine learning, network virtualization, the Internet of Things (IoT), artificial intelligence, and 5G is transforming the networking engineering landscape. Network engineering service offers are significantly integrating these technologies into their offerings to address the demand of business. Organizations or companies across industries are adopting innovative technologies to enhance customer experiences and modernize their operations.

This results in increasing demand for networking engineering services that are agile, scalable, and flexible. There is an increased focus on enhancing network reliability, quality of service, and performance with the growing importance of digital experiences. Thus, these factors play a vital role in growing the adoption of advanced technologies across network service providers and are expected to enhance the growth of the network engineering services market in the coming future.

Network Engineering Services Market News

- In May 2024, Arrow Electronics launched Arrow Edge AI engineering services to support customers searching to accelerate their embedded applications with machine learning and artificial intelligence. The resources include a curated selection of independent tools, ready-to-use software, design services, technical training, and engineering consultancy.

- In October 2023, Ericsson launched a new software toolkit to enable premium services and strengthen 5G Standalone network capabilities with differentiated connectivity. The aim behind this launch was to enhance the quality of the 5G experience and put greater demands on network performance and capacity.

Market Segmentation

By Service Type

- Professional Services

- Managed Services

By Connection Type

- Wired

- Wireless

By End-use

- Communication Service Providers (CSPs)

- Enterprises

Buy this Research Report@ https://www.precedenceresearch.com/checkout/3742

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308