Next Generation Surgical Robotics Market Revenue to Attain USD 66.76 Bn by 2033

Next Generation Surgical Robotics Market Revenue and Trends

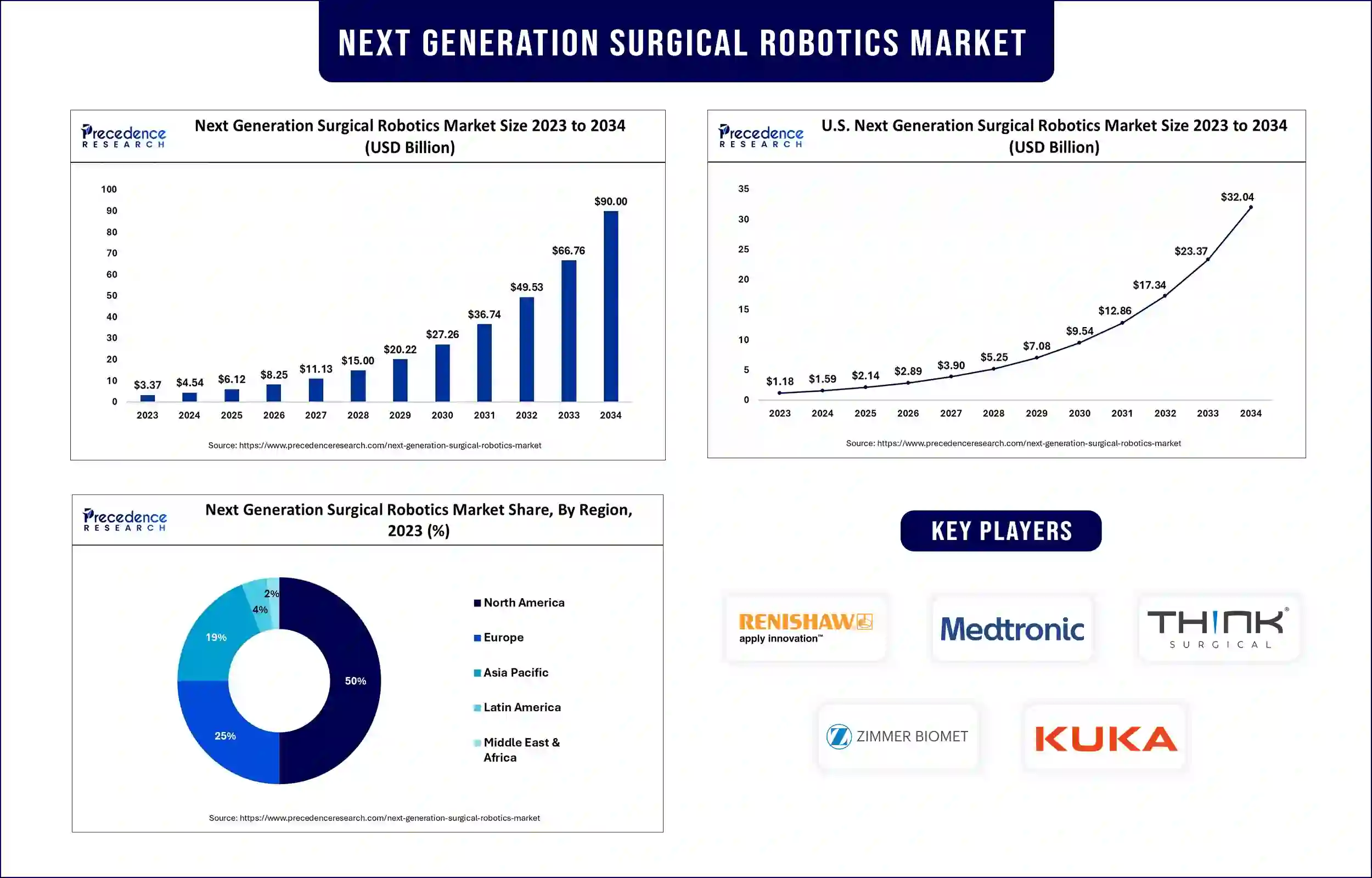

The global next generation surgical robotics market revenue was valued at USD 4.54 billion in 2024 and is expected to attain around USD 66.76 billion by 2033, growing at a CAGR of 34.81% during forecast period. The demand for next generation surgical robots is increasing worldwide due to the increasing number of surgeries. The rapid advancements in technology and the emergence of AIML have revolutionized the entire next-generation surgical robotics market. It has further led to the widespread adoption of surgical robots for different surgeries.

Market Overview

Next-generation surgical robotics enable surgeons to perform complex surgical procedures with higher precision. They are mainly used in orthopedic, general neurosurgeries, gynecological, urological, and other minor invasive procedures. The advantages of artificially assisted surgery mainly drive the market. Advancements in technology led to enhanced robot functionalities, which help in achieving better and more accurate results. The increase in funding for artificial intelligence further boosts the market in the upcoming years.

Highlights of the Next Generation Surgical Robotics Market

- Based on surgery type, the orthopedic surgery segment led the next generation surgical robotics market in 2023, owing to the rising frequency of road accidents worldwide. On the other hand, the neurosurgery segment is expected to grow at a rapid pace in the coming years due to the high demand for surgical robots in this field. Neurosurgery often requires greater precision and accuracy. The requirement for a high success rate for performing neuro surgeries has emerged as a major growth factor for this segment. The increasing number of high-velocity accidents that involve head injuries has also emerged as a major factor.

- On the basis of component, the accessories segment dominated the market in 2023 due to the extensive use of surgical accessories during surgical procedures.

- In terms of end-user, the hospitals segment led the market with the largest share in 2023. Hospitals are the primary setting a patient visits after a major accident or disease. The availability of multiple facilities in a hospital setup emerges as a major growth factor for the market.

Next Generation Surgical Robotics Market Trends

- Advancements in technology: Rapid technological advancements have revolutionized the medical industry. As a result, the adoption of surgical robots has increased to boost the efficiency of surgeries while minimizing the chances of errors. Also, surgical robots equipped with cutting-edge technologies have led to better surgery outcomes. This has not only reduced human efforts but also made the whole procedure super-fast and cost-effective.

- Rising use of surgical robots: Next-generation surgical robotics have found wide usage in the world of surgeries. They are not just limited to urology or gynecology anymore; rather, they have crossed the boundaries with neck surgeries, head surgeries, etc., which seems to boost the next-generation surgical market more in the upcoming years.

- Emergence of AIML: With the rise of artificial language and machine learning, it has now become very easy to predict the possible outcome of complications and tailor medical treatment according to the requirement based on the medical history and individual anatomy.

Regional Insight

North America dominated the next generation surgical robotics market in 2023 due to the extensive use of highly advanced technologies in the healthcare sector, which is supported by the schemes and policies of the government to provide maximum comfort and advanced facilities to the residents. In addition, the availability of high-tech healthcare solutions contributed to regional market growth. The huge investment that government makes into the healthcare sector has made it possible for the adoption of next-generation surgical robotics. The existence of the key market players in the region has also emerged as a major factor in the growth of the market in this region.

On the other hand, Asia Pacific is expected to witness rapid growth in the market during the forecast period. This is mainly due to the rising government initiatives to advanced healthcare infrastructure. Moreover, increasing instances of accidental injuries contributes to regional market growth.

Next Generation Surgical Robotics Market Coverage

| Report Attribute | Key Statistics |

| Market Revenue in 2024 | USD 4.54 billion |

| Market Revenue by 2033 | USD 66.76 Billion |

| CAGR | 34.81% from 2024 to 2033 |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2023 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market News

- In June 2024, SS Innovations International Inc., a leading Indian medical technology company, introduced a cutting-edge SSI Mantra 3 robotic surgery system to intensify surgical precision.

- In April 2024, Medtronic plc., an American-Irish medical device company, launched its latest artificial intelligence laparoscopic, robotic surgery technology

Segments Covered

By Component

- Systems

- Accessories

- Services

By Technology

- Miniaturized Surgical Robotics

- Autonomous Surgical Robotics

- Teleoperated Surgical Robotics

By Surgery Type

- Gynecology Surgery

- Urology Surgery

- Neurosurgery

- Orthopedic Surgery

- General Surgery

- Other Surgeries

By End User

- Hospitals

- Ambulatory Surgical Centers

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

Get this report to explore global market size, share, CAGR and trends, featuring detailed segmental analysis and an insightful competitive landscape overview@ https://www.precedenceresearch.com/checkout/2066

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344