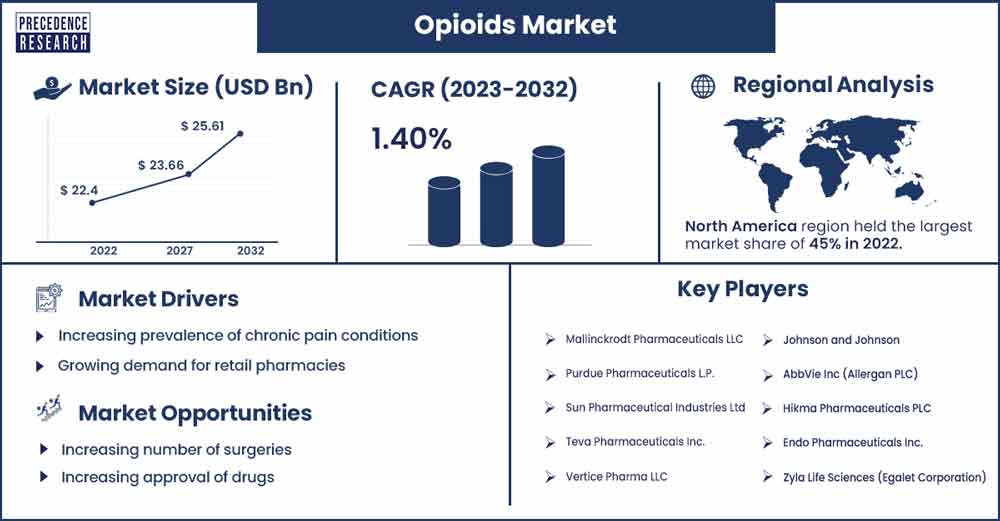

Opioids Market To Rake USD 25.61 Billion By 2032

The global opioids market size surpassed USD 22.4 billion in 2022 and is expected to rake around USD 25.61 billion by 2032, poised to grow at a CAGR of 1.40% from 2023 to 2032.

Market Overview

Opioids are effective drugs and powerful pain relievers that are bought using a prescription. Some commonly used opioid-based medications include oxycontin, codeine, methadone, morphine, fentanyl, and others. Opioids are considered addictive drugs, which are either artificial or naturally derived from the opium poppy plant. These compounds activate opioid receptors present on the nerve cells in the brain and body. Prescription opioids are pain-reducing drugs that have both benefits and potential risks. The opioid class of drugs also includes the illegal compound heroin. Many people have been adversely impacted due to the serious harms associated with these medications. Regular use and misuse of these drugs can lead to addiction, and sometimes overdose may result in harmful incidents and possibly, death.

Growth Factors

The global opioids market is driven by several factors, including the rapid growth of the pharmaceutical sector, increasing investment in the healthcare sector, rising demand for pain-relieving drugs, the growing burden of medical ailments, the expanding elderly demographic, and frequent drug approval and new launches of opioid drugs. Additionally, the increasing prevalence of diseases that cause chronic pain, such as cancer, arthritis, lower back pain, postsurgical pain, orthopedic, and other chronic illnesses related to pain, potentiate the growth of the market. Furthermore, the rising manufacturing of opioid drugs towards favoring health concerns is expected to fuel the market’s expansion.

Regional Insights

North America is projected to retain the largest share of the market over the forecast period. This is mainly due to an increasing number of pharmaceutical companies, the presence of sophisticated healthcare infrastructure, a rising aging population, emerging applications of chemicals, and the presence of prominent market players such as Pfizer Inc., Actavis Plc, Egalet, Mallinckrodt Pharmaceuticals LLC, Purdue Pharma, Johnson and Johnson, AcelRx Pharmaceuticals Inc among others.

Among all countries in the region, the United States is the most significant contributor to the market. This is mainly attributed to several factors, such as the rising significance of the healthcare sector, increasing investment in the development of new pharmaceutical drugs, growing awareness of pain management options, rise in the number of surgeries, growth in pharmaceutical research and development, increasing approval of opioid-based medicines, and increasing prevalence of chronic pain conditions such as cancer, lung infection, arthritis, and post-surgical pain.

As per CDC data, 6 in 10 adults in the U.S. have a chronic disease, and 4 in 10 adults have two or more chronic illnesses. Furthermore, the major market players are adopting marketing strategies such as new product launches, collaboration, and mergers and acquisitions for expansion and to gain a competitive edge.

- In August 2022, Adalvo announced the acquisition of its first branded product, Onsolis. This opioid drug is for the management of persistent breakthrough pain in cancer patients who have already received and are tolerant to opioid therapy for their underlying cancer pain.

- In May 2023, the FDA approved Nalmefene nasal spray for emergency opioid overdose treatment in patients 12 years and older. This is the first FDA approval of Nalmefene hydrochloride nasal spray for health care and community use.

Opioids Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 22.60 Billion |

| Projected Forecast Revenue by 2032 | USD 25.61 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 1.4% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing prevalence of chronic pain conditions

The increasing prevalence of chronic pain conditions is expected to drive the growth of the opioid market during the forecast period. Doctors prescribe opioid drugs for several chronic health conditions such as cancer, HIV, cough suppression, diarrhea, arthritis, lower back pain, and post-surgical pain. People use these drugs to alleviate severe pain and help patients in recovering from surgery. As opioid drugs are considered the most effective drugs for the management of pain, they often are prescribed to children who have encountered physical trauma for the treatment of their injuries. Therefore, with increasing cases of chronic pain, the demand for opioid medications increases for treatment and is anticipated to fuel the growth of the market in the coming years.

Growing demand for retail pharmacies

The rise in the number of retail pharmacies in highly developed countries is expected to fuel the market’s growth in the coming years. Patients highly prefer retail pharmacies for purchasing opioid drugs to treat chronic pain, as these are easily accessible.

Restraints

Increasing cases of Opioid use disorders

Opioid use disorder (OUD) is a mental health condition characterized by cravings for opioids. Many people may take opioids in an unhealthy way to achieve euphoria. Even in the short term, the use of opioids can lead to addiction. People who consume opioids are at higher risk of OUDs, often called opioid addiction. In recent years, there has been a surge in cases of overdose deaths among the adolescent population, likely driven by illicit counterfeit drugs comprising fentanyl. According to the American Society of Anesthesiologists report 2023, more than 90 Americans die by opioid overdose every day.

As per a new NIH-funded study published in June 2023, a significant need to expand access to evidence-based treatment among the young population was observed. Only one in every four addiction treatment facilities in the United States for individuals under the age of 18 years offer buprenorphine, a medication used to treat OUD. Only one in eight prescribe buprenorphine for ongoing treatment. This severely restrains the opioid market growth during the forecast period.

Stringent government regulations and growing awareness

Implementation of stringent government regulations is projected to hamper the growth of the opioid market. Several governments of various regions impose different rules regarding the production and use of opioids. Moreover, the opioid market's expansion is anticipated to be constrained by factors such as the legalization of cannabis as an alternative to opioids.

- In August 2023, the CDC awarded USD 279 million to 49 states. The District of Columbia and 40 local health departments to help stop overdoses within their communities. The resources come from two new Overdose Data to Action funding opportunities. The announcement of this award was made on International Overdose Awareness Day, and funding will assist in ending overdose by spreading awareness about drug overdose prevention.

Opportunities

Increasing number of surgeries

The rising number of surgeries is projected to create significant market growth opportunities during the forecast period. According to the NLM or the National Institutes of Health, over 300 million major surgeries are performed every year globally, about 45 million in the United States and 20 million in Europe. The most commonly utilized narcotics are morphine, fentanyl, hydromorphone, meperidine, and oxycodone. Many opioids are taken in tablet form, lozenges, through a vein, by injection, or through an IV, and others. Thereby driving the market’s growth.

Increasing approval of drugs

The rise in the approval of drug strategies, in addition to the presence of sophisticated healthcare infrastructure and robust growth research and development activities, is projected to impact the market’s growth positively in the coming years.

- In May 2023, Trevena, Inc, a biopharmaceutical company, announced that its partner in China, Jiangsu Nhwa, received formal approval from the National Medical Products Administration (NMPA) for OLINVYK (oliceridine) injection. It has been approved for use in adults for the management of pain severe enough to require an intravenous opioid analgesic and for whom alternative treatments are inadequate. The company is also due to receive a USD 3 million milestone payment from Jiangsu Nhwa associated with the approval.

Recent Developments

- In March 2023, The U.S. Food and Drug Administration (FDA) approved the first over-the-counter naloxone nasal spray for use without a prescription. Naloxone is a medication that reverses the effects of opioid overdose and is the standard treatment for opioid overdose.

Key Market Players

- Mallinckrodt Pharmaceuticals LLC

- Purdue Pharmaceuticals L.P.

- Sun Pharmaceutical Industries Ltd

- Teva Pharmaceuticals Inc.

- Vertice Pharma LLC

- Johnson and Johnson

- AbbVie Inc (Allergan PLC)

- Hikma Pharmaceuticals PLC

- Endo Pharmaceuticals Inc.

- Zyla Life Sciences (Egalet Corporation)

- Amneal Pharmaceuticals Inc.

- Pfizer Inc.

- AcelRx Pharmaceuticals Inc

- Alcaliber SA

Market Segmentation

By Product

- IR/Short-Acting Opioids

- ER/Long-Acting Opioids

By Application

- Pain Relief

- Anesthesia

- Cough Suppression

- Diarrhea Suppression

- De-addiction

By Route of Administration

- Oral

- Injectable

- Others

By Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Others

Buy this Research Report@ https://www.precedenceresearch.com/checkout/3411

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308