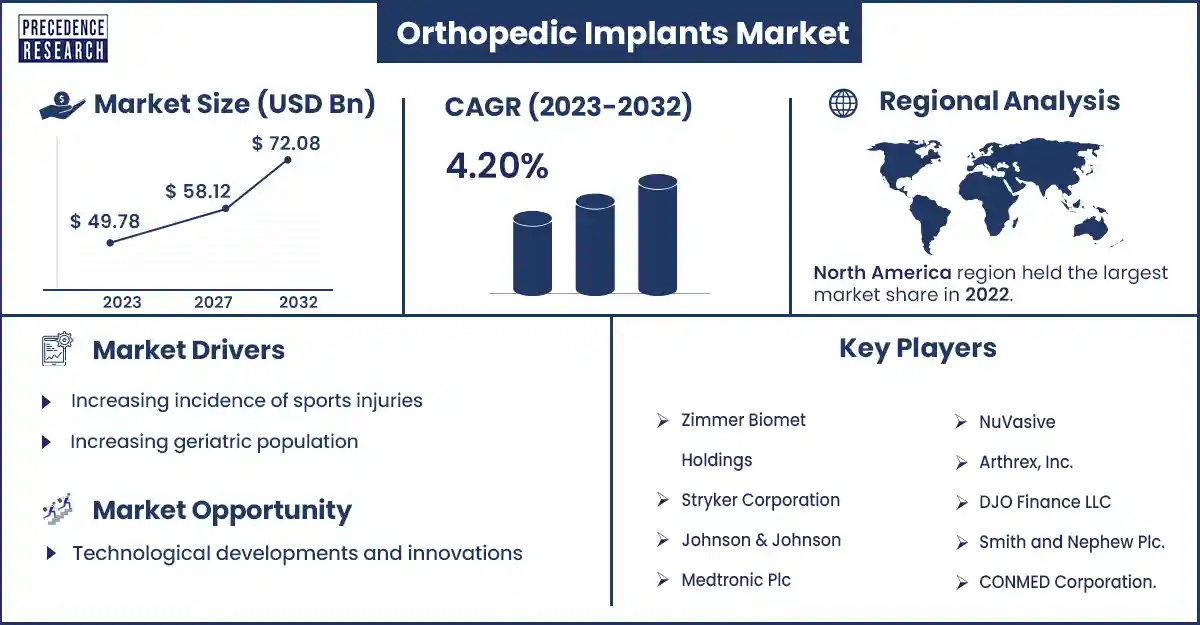

Orthopedic Implants Market Size to Rise USD 72.08 Bn By 2032

The global orthopedic implants market size surpassed USD 49.78 billion in 2023 and is expected to rise around USD 72.08 billion by 2032, expanding at a CAGR of 4.20% during the forecast period from 2023 to 2032.

Market Overview

The orthopedic implants market deals with the development, manufacturing, and distribution of medical devices that are needed for different disorders associated with musculoskeletal. An orthopedic implant is a device used to support or replace damaged bone, joint, and cartilage. These are specially designed for metallic alloys such as polymers, cobalt-based, titanium, and stainless steel. The increasing commonness of orthopedic diseases and the rising number of orthopedic processes are expected to surge the demand for these devices. In addition, the increasing geriatric populations inclined to an increased risk of bone or joint conditions and osteoporosis are expected to increase the patient group for subsequent and diagnosis surgical processes for these implants.

Moreover, the technological innovations and advancements assisted the operative equipment, the rising use of orthopedic implants and the assumption of medical devices that are used for execution and the other various advanced techniques to deal with bone injuries have helped to drive the market during the forecast.

Regional Snapshot

North America dominated the orthopedic implants market in 2023. North America is anticipated to increase the need for orthopedic procedures due to the increasing incidence of orthopedic diseases such as osteoporosis and other bone-related diseases and the rising geriatric population at a higher risk of bone fractures. The rising demand for orthopedic procedures combined with an increase in implantations is expected to enhance the market growth.

In addition, the significance of market players on inorganic growth policies, such as collaborations and partnerships, to introduce innovative implants to serve the increasing demand for patient-oriented customization is an important factor responsible for enhancing market growth in North America. In addition, the region's policy existence of major market players, such as Stryker, Biomet, and others, and the increasing adoption of orthopedic implants are considered to support the market growth.

- For instance, in March 2022, LimaCorporate S.P.A. introduced a partnership with OrthoCarolina Center in New York City, with victorious implantations of ProMade, a particular 3D printed implant. The advancements illustrate the advantages of onsite development of implants connected with surgeons' experts, like patient-specific customization and decreasing the duration of the process of implants.

Asia Pacific is estimated to grow fastest in the forecast period. Asia Pacific region also has significant growth in joint replacement surgery. The rising sitting lifestyle of many people, especially geriatrics, has led to numerous born and joined diseases. A rise in the number of patients suffering orthopedic treatments is due to developments in bone scan diagnostics for regulating bone density among diagnostic laboratories, better refunds by private and governmental organizations, and the development of healthcare structures. This, coupled with favorable regulation by governments to support orthopedic processes, is expected to drive the orthopedic implant market growth in Asian regions.

Orthopedic Implants Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 49.78 Billion |

| Projected Forecast Revenue by 2032 | USD 72.08 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 4.20% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing incidence of sports injuries

The growth of participation in sports and physical activities has shown a higher incidence of sports-related injuries. Orthopedic implants are continuously required to treat conditions like joint instability, fractures, and torn ligaments. Young athletes and fitness-conscious people are increasingly searching for orthopedic solutions to return to their active and sporty lifestyles. This trend is not limited to professional athletes but also expands to fitness freaks and recreational sports.

As a result, the need for orthopedic implants, such as shoulder implants and anterior cruciate ligament construction devices, is increasing. As more people engage in outdoor activities and sports, the demand for effective orthopedic interference continues to grow, making sports-related injuries an important driver of orthopedic implants market growth.

Increasing geriatric population

With the rapidly increasing geriatric population in the world, diabetic patients are also growing rapidly. As more patients live longer, it is possible that a growing number of geriatric patients will need surgery. Medical complications and perioperative risks of geriatric patients become rapidly complex with time as patients live longer and become unhealthy patients. Hip and knee fractures in geriatric patients often have a significant outcome in strength and independence. Different surgical inspirational factors are known to improve the outcome of orthopedic implants. These opportunities will drive the growth of the orthopedic implants market in the coming years.

Restraint

Complications and risks related to the orthopedic surgical process

Total knee and hip orthopedic-related surgeries are the two most common surgeries. Sometimes hip and knee arthroplasty surgeries create significant risks and complications such as implant failures, deep vein thrombosis, and surgical site infections owing to the failure of the material to hold the hip implants in place. Artificial leg fractures are other complications that can result in knee and hip replacement operations. All these risks and complications are likely to restrain the growth of the orthopedic implants market.

Opportunity

Technological developments and innovations

Developments in technology play an important role in advancing the orthopedic implants market. These revolutions include surgical techniques, implant designs, and materials. Biocompatible materials like ceramics and titanium are rapidly used to develop implants that combine flawlessly with the human body. In addition, the use of developed products like wear-resistant polyethylene expands the lifetime of joint replacements. This modern technology not only improves implant performance but also improves patient satisfaction, making it an important opportunity in the market.

Recent Developments

- In January 2024, Sawbones and Numalogics announced the release of a web tool that enables orthopedic implant manufacturers to thoroughly test their devices in a virtual environment using a standard Sawbones bone surrogate. Engineers may quickly and easily identify orthopedic screw designs using sophisticated simulation techniques with the new web tool called ENDPOINT. Results can be obtained in a matter of days. The organization can save time and money by reducing the number of devices represented during testing with this innovative technique.

- In July 2023, the Orthopaedic Implant company introduced the commercial launch of its creative Threaded Metacarpal Nail system. This leading to metacarpal fixation marks an important development in hand fracture care, supplying orthopedic surgeons with superior solutions that merge stability, ease of use, and efficiency.

- In May 2023, Zimmer Biomet introduced a new cementless knee or joint material, the Persona Osseo Ti KEEL Tibia. This implant permits orthopedic surgeons to decide, during the surgery, if the process requires connection based on the patient's bone quality.

Market Key Players

- Zimmer Biomet Holdings

- Stryker Corporation

- Johnson & Johnson

- Medtronic Plc

- NuVasive

- Arthrex, Inc.

- DJO Finance LLC

- Smith and Nephew Plc.

- CONMED Corporation.

Market Segmentation

By Product

- Reconstructive Joint Replacements

- Knee Replacement Implants

- Hip Replacement Implants

- Extremities

- Upper Extremity Reconstruction

- Elbow

- Shoulder

- Hand Wrist

- Lower Extremity Reconstruction

- Upper

- Lower

- Upper Extremity Reconstruction

- Spinal Implants

- Spinal Fusion Implants

- Thoracolumbar Devices

- Cervical Fixation Devices

- Interbody Fusion Devices

- Vertebral Compression Fracture (VCF) Devices

- Balloon Kyphoplasty Devices

- Vertebroplasty Devices

- Motion Preservation Devices/Non-Fusion Devices

- Dynamic Stabilization Devices

- Artificial Disc Replacement Devices

- Annulus Repair Devices

- Nuclear Disc Prostheses

- Spinal Fusion Implants

- Dental Implants

- Root Form Dental Implants

- Plate Form Dental Implants

- Trauma

- Orthobiologics

- Demineralized Bone Matrix (DBM)

- Allograft

- Bone Morphogenetic Protein (BMP)

- Viscosupplementation Products

- Synthetic Bone Substitutes

- Others

- Others

By Type

- Wrist & Shoulder

- Dental

- Knee

- Hip

- Spine

- Ankle

By Biomaterial

- Metallic Biomaterials

- Stainless Steel

- Titanium Alloy

- Cobalt Alloy

- Others

- Ceramic Biomaterials

- Polymers Biomaterials

- Others

By Procedure

- Open Surgery

- Minimally Invasive Surgery (MIS)

- Others

By End User

- Hospitals

- Orthopedic Clinics

- Home Cares

- Others

Buy this Research Report@ https://www.precedenceresearch.com/checkout/1884

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308