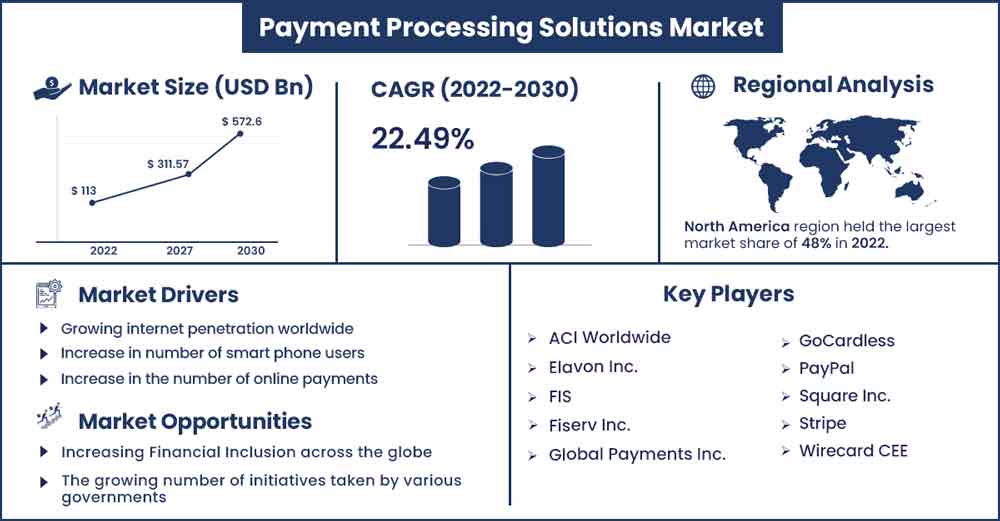

Payment Processing Solutions Market Poised to Exceed CAGR 22.49% By 2030

The global payment processing solutions market size was evaluated at USD 113 billion in 2022 and is expected to touch around USD 572.6 billion by 2030, growing at a noteworthy CAGR of 22.49% from 2022 to 2030.

The widespread use of payment processing solutions by banks, financial institutions and various end-user industries such as eCommerce & retail, healthcare, etc. in order to handle payments more efficiently is expected to drive the market growth. Additionally, growing need to improve the payment process & providing customers with integrated & value-added services is expected to spur the market growth during the forecast period. The increased availability of VoLTE along with increase in penetration of smart phone users is supporting the market growth. Further, increase in the use of mobile commerce is expected to fuel the market growth. Also, widespread penetration of EMV cards is expected to create lucrative opportunities for the market growth in the next few years.

Report Highlights:

- On the basis of payment mode, the debit card segment holds the largest market share in the global Payment Processing Solutions market. eWallet is expected to account for the majority of revenue in established nations over the predicted period. Due to the increasing digitalization across various end-user industries, payment processing solutions provider companies are facing a lot of competition, especially in emerging countries.

- On the basis of the end-user industry, the banking, financial services, and insurance (BFSI) segment holds the largest market share in the global Payment Processing Solutions market. Increasing cybercrimes and data breaches can slow down the demand for payment processing solutions across the BFSI segment.

Payment Processing Solutions Market Report Scope:

| Report Coverage | Details |

| Market Revenue in 2023 | USD 138.41 Billion |

| Projected Forecast Revenue in 2030 | USD 572.6 Billion |

| Growth Rate from 2022 to 2030 | CAGR of 22.49% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2022 To 2030 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Regional Snapshot:

North America region is the fastest growing region in the payment [rocessing solutions market. The U.S. hold the highest market share in the North America Payment Processing Solutions market. This can be attributed to the increase in near field communication (NFC) based payment processing solutions within the United States, since this mode offers quicker & safer payment experience. Similarly, widespread adoption of payment processing solutions in Canada are expected to support the regional market growth. In September 2020, PayMyTuition, a payment processing solution provider in Canada launched Payment Wheel for educational institutions across Canada to carry out their payments and financial activities in an efficient manner.

Asia-Pacific is the largest segment for Payment Processing Solutions market in terms of region. China is dominating the payment processing solutions market in the Asia-Pacific region. This is primarily due to the increase in the number of transactions done via mobile on a daily basis in the region. Besides, changing consumer preferences towards quick, seamless and secured modes of payment in the region is expected to support the market growth in the region. Also, flourishing retail and ecommerce industry in the region has made the payment processing solution providers to focus more on this region. Additionally, the availability of low cost and skilled workforce along with supportive policies by different governments in the region has made various global payment processing solution provider companies expand in the region, especially in countries like China and India.

Market Dynamics:

Drivers:

Growing e-Commerce Sales

Increasing penetration of ecommerce channels across the globe along with changing consumer preferences towards online mode of shopping is expected to increase the demand for payment processing solutions globally. Additionally, ecommerce channels offer wide range of products at an affordable cost with options of doorstep delivery make a lot of consumers shift towards them. Furthermore, availability of different mobile applications of different ecommerce channels coupled with increasing mobile phone users has led to an increase in the number of payments done, thereby positively influencing the market growth.

Restraints:

Threat of cyberattacks

The increasing incidence of cybercrime and cyberattacks is one of the major factor restraining the growth of global payment processing solutions market. Integration of payment processing solutions into businesses also lead to increasing concerns related to data privacy, theft of information, and compliance with regulatory norms. Additionally, mobile malwares break into the payment systems and get the cardholders information. Furthermore, fraudulent activities in new ways have increased significantly in the recent past, thereby hampering the growth of payment processing solutions.

Opportunities:

Increasing Financial Inclusion across the globe

The growing number of initiatives taken by various governments, financial organizations and non-profit organizations across the globe in order to provide financial access to wider pool of population worldwide is expected to support the market growth during the forecast period. Governments worldwide are taking initiatives to include this pool of population in the mainstream in terms of payment processing solutions. Furthermore, Online payments and online banking help in increasing the number of people holding bank accounts.

Challenges:

Lack of standard for cross border transactions

There is no set global regulations, norms or standards for making cross border transactions. The lack of a global payment system reduces opportunities of capitalization by various payment vendors and governments worldwide.

Recent Developments:

- In January 2022, PayPal and Salesforce collaborated in order to provide merchants with direct access to PayPal Commerce Platform while using Salesforce payments.

- In February 2020, Central Bank of Brazil, launched a QR-Code based instant payment platform. This platform is known as PIX. This will help the Brazilian population to make hassle free transaction 24/7.

Major Key Players:

- ACI Worldwide

- Elavon Inc.

- FIS

- Fiserv Inc.

- Global Payments Inc.

- GoCardless

- PayPal

- Square Inc.

- Stripe

- Wirecard CEE

Market Segmentation:

By Payment Mode

- E-Wallet

- Credit Card

- Debit Card

- Automatic Clearing House

- Others

By Deployment Mode

- On-Premises

- Cloud-Based

By End-User Industry

- Banking, Financial Services and Insurance (BFSI)

- IT & Telecommunication

- Healthcare

- E-Commerce & Retail

- Government & Utilities

- Others

Buy this Research Report@ https://www.precedenceresearch.com/checkout/2258

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 9197 992 333