What is the Payment Processing Solutions Market Size?

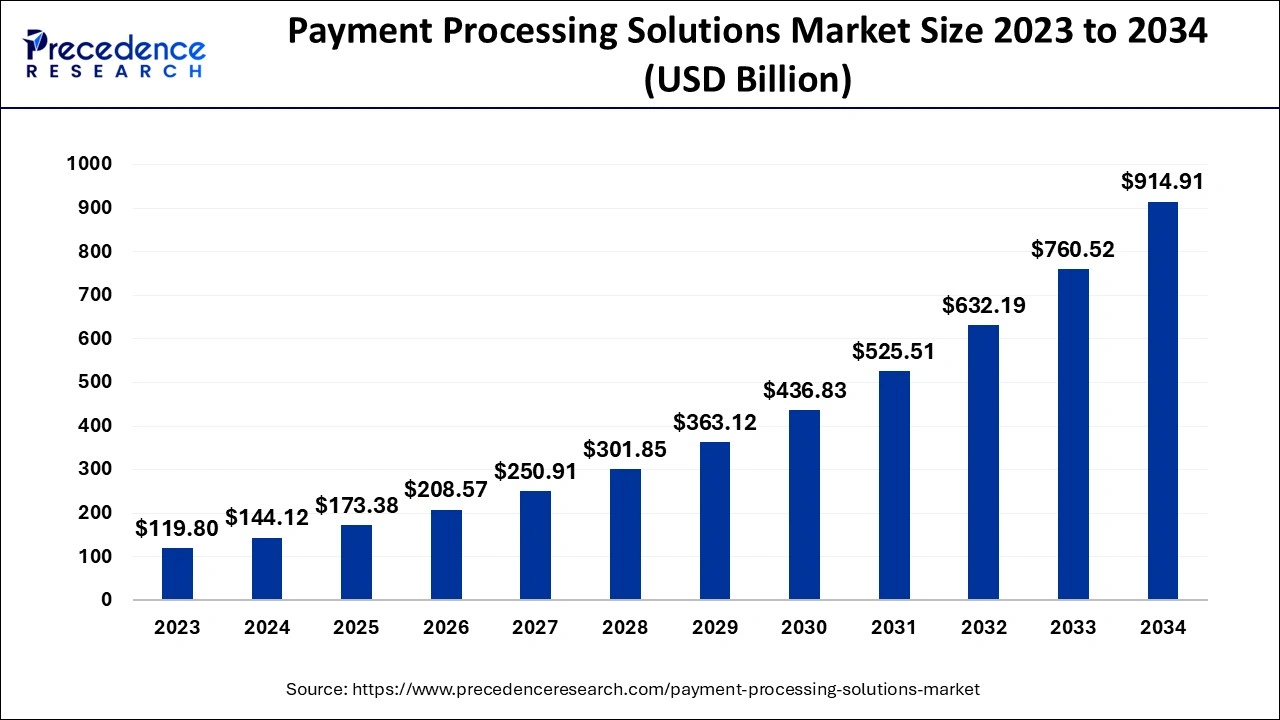

The global payment processing solutions market size was estimated at USD 173.38 billion in 2025, and is projected to be worth USD 208.57 billion by 2026, and is anticipated to reach around USD 1051.93 billion by 2035, expanding at a CAGR of 19.76% from 2026 to 2035.

Payment Processing Solutions Market Key Takeaways

- In terms of revenue, the market is valued at $173.38 billion in 2025.

- It is projected to reach $1051.93 billion by 2035.

- The market is expected to grow at a CAGR of 19.76% from 2026 to 2035.

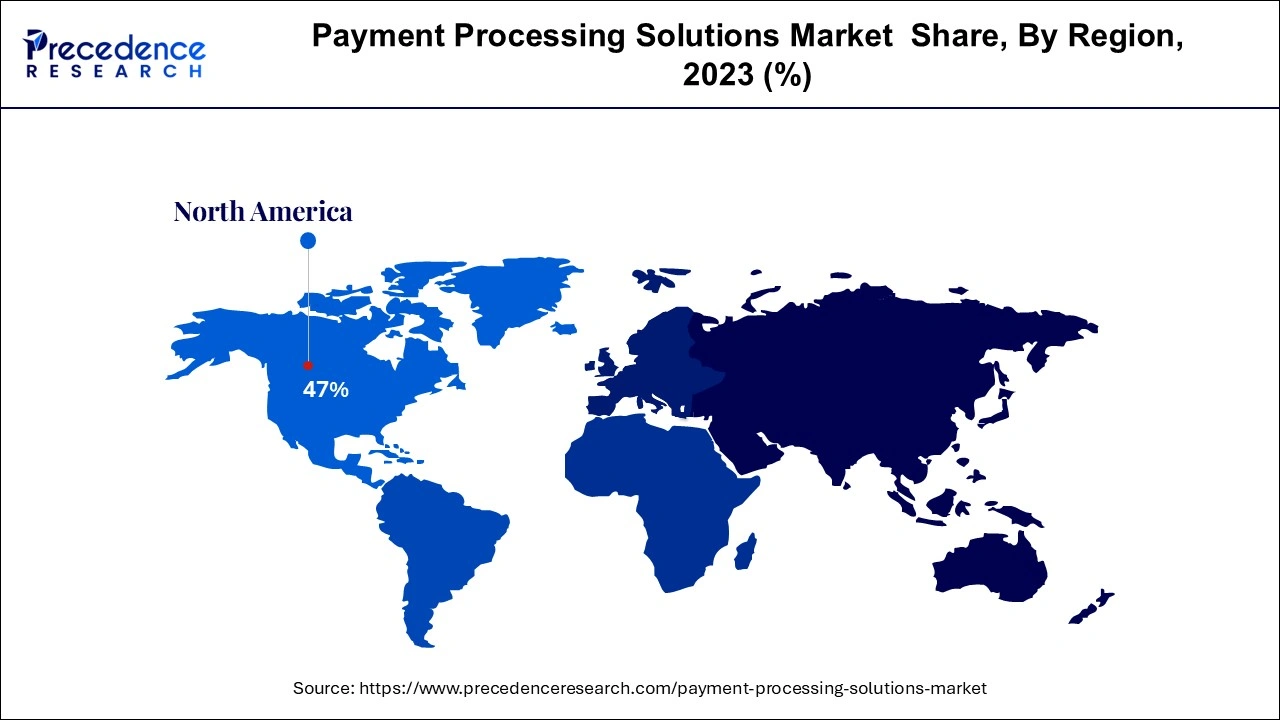

- North America dominated the global market with the largest market share of 47% in 2025.

- The eWallet segment is growing at a CAGR of 24% from 2026 to 2035.

- The cloud-based category has contributed a revenue share of over 61% in 2025.

- The BFSI category has captured the largest market share of around 26% in 2025.

- The retail and e-commerce segment is growing at a CAGR of 25% from 2026 to 2035.

Payment Processing Solutions Market Growth Factors

The global Payment Processing Solutions market is driven by the growing internet penetration worldwide coupled with the increase in number of smart phone users. This in turn has led to an increase in the number of online payments, thereby supporting market growth. As of April 2022, the number of internet users globally reached around 5 billion which is about 63% of the total world population.

One of the major factors driving the growth of the global payment processing solutions market is the widespread adoption of mobile payment solutions which has made businesses shift towards alternative modes of payments such as debit cards, credit cards, different types of e-wallets, automated clearing house (ACH), among others.

Another factor supporting the growth of the global payment processing solutions market is change in consumer behavior patterns and shift towards online mode shopping. Besides, widespread penetration of different e-commerce platforms which provides the users with multiple modes of payments is further expected to support the market growth. Furthermore, benefits such as reduced risks of fraudulent activities and improved customer experience are expected to support market growth.

The global Payment Processing Solutions market is expected to benefit significantly from the sudden outbreak and spread of pandemic COVID-19. The pandemic crisis has made several banking & financial and non-banking & financial to adopt and invest in different digital payment solutions.

Additionally, the increase in near-field communication or contactless payments worldwide is further expected to create opportunities for the growth of global payment processing solutions. Debit cards are being offered through which either by a tap or via Wi-Fi the payments can be processed. This in turn has increased the demand for contactless cards. In 2021, around 229.87 million contactless cards were shipped to the United States. Additionally, the increasing adoption of NFC-enabled payment modes such as Google Pay, Apple Pay, etc. is creating opportunities for the growth of the market.

The growth of global Payment Processing Solutions market is also being driven by the technological advancements and supportive government activities and initiatives. For instance, machine learning and artificial intelligence are widely used in handling different payment processing solutions in order to detect fraudulent activities. As a result, all of these aforementioned factors are boosting the growth of global Payment Processing Solutions market.

The surge in the number of online payments, along with the increasing internet penetration, is expected to accelerate the market's growth during the forecast period. For instance, as of 2024, India is home to over 900 million internet users and over 500 million smartphone users. India continues to see significant growth in digital payments, with over 130 billion transactions projected by the end of 2025. RBI reported a 32% year-on-year growth in digital payments in the first quarter of 2025. According to Worldline, the country's instant payment system, UPI, accounted for over 75% of payment transaction volumes in 2024, processing over 13 billion transactions monthly. In value terms, digital payments exceeded USD 1.6 trillion during the second half of 2024 alone.

Major Trends in Payment Processing Solutions Market:

- The surge in the number of online payments, along with the increasing internet penetration, is expected to accelerate the market's growth during the forecast period. For instance, as of 2024, India is home to over 900 million internet users and over 500 million smartphone users. India continues to see significant growth in digital payments, with over 130 billion transactions projected by the end of 2025.

- RBI reported a 32% year-on-year growth in digital payments in the first quarter of 2025. According to Worldline, the country's instant payment system, UPI, accounted for over 75% of payment transaction volumes in 2024, processing over 13 billion transactions monthly. In value terms, digital payments exceeded USD 1.6 trillion during the second half of 2024 alone.

Market Outlook

- Industry Growth Overview: The growing shift from legacy systems to contactless, real-time, and AI-powered payment solutions is driving the payment processing solutions industry growth.

- Major Investors: The large institutional investors and specialized private equity firms are the major investors in the market. BlackRock, Advent International, Berkshire Hathaway, and Warburg Pincus are some of the major investors.

- Startup Ecosystem: The startup ecosystem is focusing on the development of account-to-account (A2A) payment solutions, embedded finance, and AI-native fraud orchestration. The startups like Zilo, Keeta, and Gr4vy are actively participating in the market.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 1051.93 Billion |

| Market Size in 2025 | USD 173.38 Billion |

| Market Size in 2026 | USD 208.91 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 19.76% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Payment Mode, Deployment Mode, End User Industry, and Geography |

| Region Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Segment Insights

Payment Mode Insights

The debit card segment dominated the market in 2024. This can be ascribed to the growing adoption and use of debit cards to carry out daily transactions not only in developed regions such as North America and Europe but also in emerging countries such as India, China, the United Kingdom, Germany, etc. The total number of debit cards in China reached around 8.19 billion in 2020. Additionally, the increasing number of banked consumers worldwide is further expected to support segmental growth.

The eWallet segment is expected to register the fastest growth during the forecast period, on account of growing digitalization worldwide. Additionally, increasing internet and smartphone users is further expected to support the segmental growth. Also, supportive initiatives by the governments of different countries across the globe to promote digital payments and the use of wallets is expected to bolster segmental growth in the coming years.

End-User Industry Insights

The banking, financial services and insurance (BFSI) end-user industry dominated the Payment Processing Solutions market in 2024. This growth can be attributed to the widespread adoption of advanced payment processing solutions by different banking, financial services and insurance organizations.

The eCommerce & retail segment is expected to register the fastest growth during the forecast period on account of an increasing number of retail vendors offering personalized solutions for making payments. Additionally, growing number of online buyers and availability of different modes of payment on online channels support segmental growth.

Regional Insights

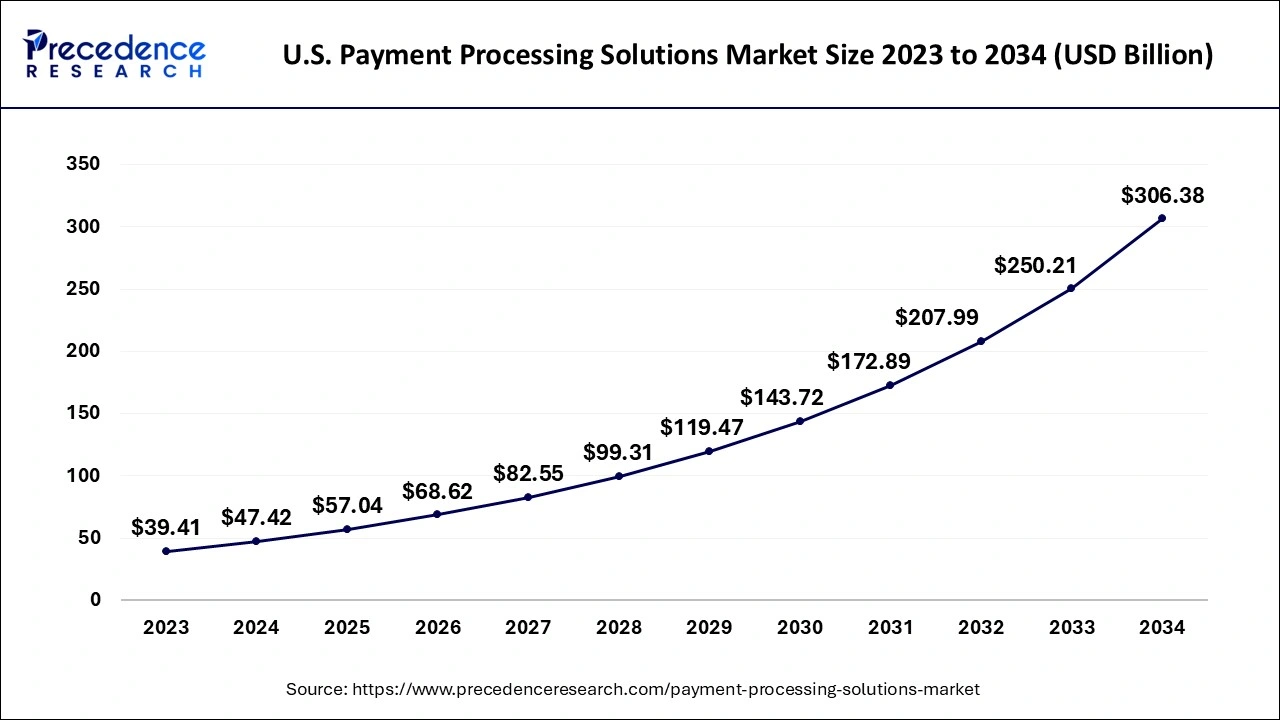

What is the U.S. Payment Processing Solutions Market Size?

The U.S. payment processing solutions market size was evaluated at USD 57.04 billion in 2025 and is predicted to be worth around USD 353.25 billion by 2035, rising at a CAGR of 20.00% from 2026 to 2035.

Growing Online Payment Adoption Promotes North America

North America dominated the payment processing solutions market in 2024. This can be attributed to the wider acceptance and adoption of online payments in the region. Additionally, the increase in POS systems and mobile wallet-based payments across shopping centers, coffee shops, grocery stores, among others across Canada is expected to support the regional market growth.

The adoption of online payment in the United States is expected to continue to grow, with a rising percentage of businesses and consumers using digital wallets and various other online payment methods. For instance, according to the secondary data published in February 2024, Digital payments are the most used payment method in the United States. In 2023, 69 percent of U.S. online adults said that they had used a digital payment method over the past three months to make a purchase. PayPal is still the most used digital payment method in the U.S. In 2023, 40% of US online adults used PayPal over the past three months to make a purchase.

The adoption of online payment in the United States is expected to continue to grow, with a rising percentage of businesses and consumers using digital wallets and various other online payment methods. For instance, according to the secondary data published in February 2024, Digital payments are the most used payment method in the United States. In 2023, 69 percent of U.S. online adults said that they had used a digital payment method over the past three months to make a purchase. PayPal is still the most used digital payment method in the U.S. In 2023, 40% of US online adults used PayPal over the past three months to make a purchase.

Blooming Industries Fuel Asia Pacific Payment Processing Solutions Industry

Asia-Pacific, on the other hand, is expected to develop at the fastest rate during the forecast period. China dominates the Payment Processing Solutions market in Asia-Pacific region. The Asia-Pacific Payment Processing Solutions market's expansion is being fueled by flourishing consumer goods & retail industry in the region especially in countries like China, India and Australia. Additionally, increasing population of bank account holders across the region is expected to create lucrative opportunities for market growth during the forecast period. This, together with rising internet, communications and telecommunications spending, is likely to drive Asia-Pacific Payment Processing Solutions market forward. The favorable regulatory rules for adoption of digital payment options especially in countries like India is expected to improve demand for payment processing solutions, thereby fueling the overall growth of the market.

China Payment Processing Solutions Market Trends

China consists of a well-developed digital payment ecosystem where the growing smartphone penetration is also increasing the use of various payment processing solutions. At the same time, the growing online transaction platforms and government policies are increasing the adoption of digital solutions and promoting innovations.

Advanced Infrastructure Stimulates European Payment Processing Solutions Market

On the other hand, the Europe region is expected to grow at a notable rate. The growth of the region is attributed to the presence of established digital infrastructure, supportive government policies, an increase in the number of online payments, growing internet & smartphone penetration, and increasing popularity of contactless payment such as NFC, QR codes, and others. Moreover, the strategic initiatives adopted by the key market players to expand their presence in the region, such as partnerships or collaborations, are anticipated to drive the region's market growth.

The UK Payment Processing Solutions Market Trends

The growth in digitalization is driving the use of payment processing solutions in the UK. This, in turn, is driving the adoption of card and online payment modes, where the growing smartphone use is also increasing the acceptance rates of digital online payment modes. Furthermore, the growing e-commerce services are also increasing their use.

For instance, in April 2025, Deluxe proudly announced a strategic partnership with TowneBank, a prominent financial institution dedicated to exceptional service and community banking. This collaboration aims to provide TowneBank business members with seamless, secure, and scalable merchant services, empowering them with the tools they need to optimize payment processing and grow their businesses.

Under this partnership, TowneBank members will gain access to merchant processing solutions from Deluxe that are reliable, convenient, and easy to use, including advanced features like advanced fraud protection, contactless payment capabilities, and real-time transaction management.

Growing Digital Payments Propels MEA Payment Processing Solutions Industry

MEA is expected to grow significantly in the payment processing solutions market during the forecast period, due to growing digital payment solutions. At the same time, the growing online banking solutions and card payments are also increasing their use. Moreover, the growing use of smartphones is also increasing their use, where the increasing government initiatives are also encouraging cashless payments, promoting the market growth.

Saudi Arabia Payment Processing Solutions Market Trends

The growing government initiatives are promoting the use of payment processing solutions across Saudi Arabia. The growing internet and mobile penetration are also increasing the use of various online payment solutions. Additionally, the growing innovations and online services are also promoting their use.

Payment Processing Solutions Market Top Companies

- ACI Worldwide: The company provides Real-Time Payments (RTP) software and UP Payments Framework.

- Elavon Inc.: Integrated Omnicommerce payment solutions are provided by the company.

- FIS, Fiserv, Inc.: The company offers the Worldpay global platform, B2B payment automation, and fraud detection solutions.

- GoCardless: Various bank payment solutions are provided by the company.

- PayPal: The company provides the PayPal complete payment and the Braintree platforms.

- Global Payments Inc.: The TSYS Issuer solutions and unified commerce platform are offered by the company.

- Square, Inc.: The company offers an all-in-one integrated ecosystem.

- Stripe: Various payment solutions with AI-driven smart retries are provided by the company.

- Wirecard CEE: The company delivers regional omnichannel payment gateways and terminal management services.

Recent Developments

- In February 2025, Mastercard launched a new One Credential checkout solution. Mastercard has unveiled its new One Credential solution, designed to enable consumers to leverage multiple payment methods at the point of purchase through one consolidated account. The solution is designed to offer consumers a way of completing purchases without needing to toggle between different cards and payment methods, bringing together debit cards, prepaid cards, credit, and instalment options.

- In June 2025, PNC Bank announced the launch of PNC Mobile Accept, a fully integrated payment solution that provides its micro business clients with the ability to accept in-person credit and debit card payments directly within the PNC Mobile app. Designed for businesses processing less than $300,000 in credit and debit card transactions annually, PNC Mobile Accept enables business owners fast, secure access to accept funds directly from their phone or tablet with no monthly fee.

- In March 2024, PayPal launched its most advanced solution for small and mid-sized enterprises in the UK, Canada, and across more than 20 European markets. The solution enables small businesses in the UK to accept a range of payments, including PayPal, buy now pay later solutions, Apple Pay, Google Pay, credit and debit cards, and alternative payment methods from across the globe.

- In June 2023, Adyen, a Global fintech platform, announced the launch of Payout Services, a solution that allows businesses to send global payouts in real-time. With the release of this service, Adyen leverages its direct connection to RTP banking and card schemes as well as its branch and banking licenses to allow its customers to transfer funds within a single infrastructure. As a result, any payments can be processed up to three days faster than the industry's customary time.

- In May 2025, Elavon announced the launch of its new payment gateway on the Polish market. The ''Elavon Payment Gateway'' service enables entrepreneurs to accept payments in shops, using POS terminals, and online, through an integrated payment gateway.

- The global Payment Processing Solutions industry is dominated by different banking, financial services, and insurance organizations. The global Payment Processing Solutions market is expected to become more competitive on account of an increase in the number of banking services and financial organizations worldwide.

- Fiserv launched Clover Online Ordering with Delivery in November 2021. This will provide flexible food delivery services with direct menu management, order and payment processing, and reporting via the Clover platform.

- Earthwise High Content Card, a sustainable card made up of 98% upcycled plastic was launched by Visa and CPI Card Group in June, 2020.

- In April 2020, Fiserv, Inc. collaborated with Deluxe Corporation and the companies launched merchant solutions for Deluxe small business customers. Deluxe customers can carry out online transactions efficiently through Clover platform.

Segments Covered in the Report

By Payment Mode

- eWallet

- Credit Card

- Debit Card

- Automatic Clearing House

- Others

By Deployment Mode

- On-Premises

- Cloud-Based

By End-User Industry

- Banking, Financial Services and Insurance (BFSI)

- IT & Telecommunication

- Healthcare

- eCommerce & Retail

- Government & Utilities

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting