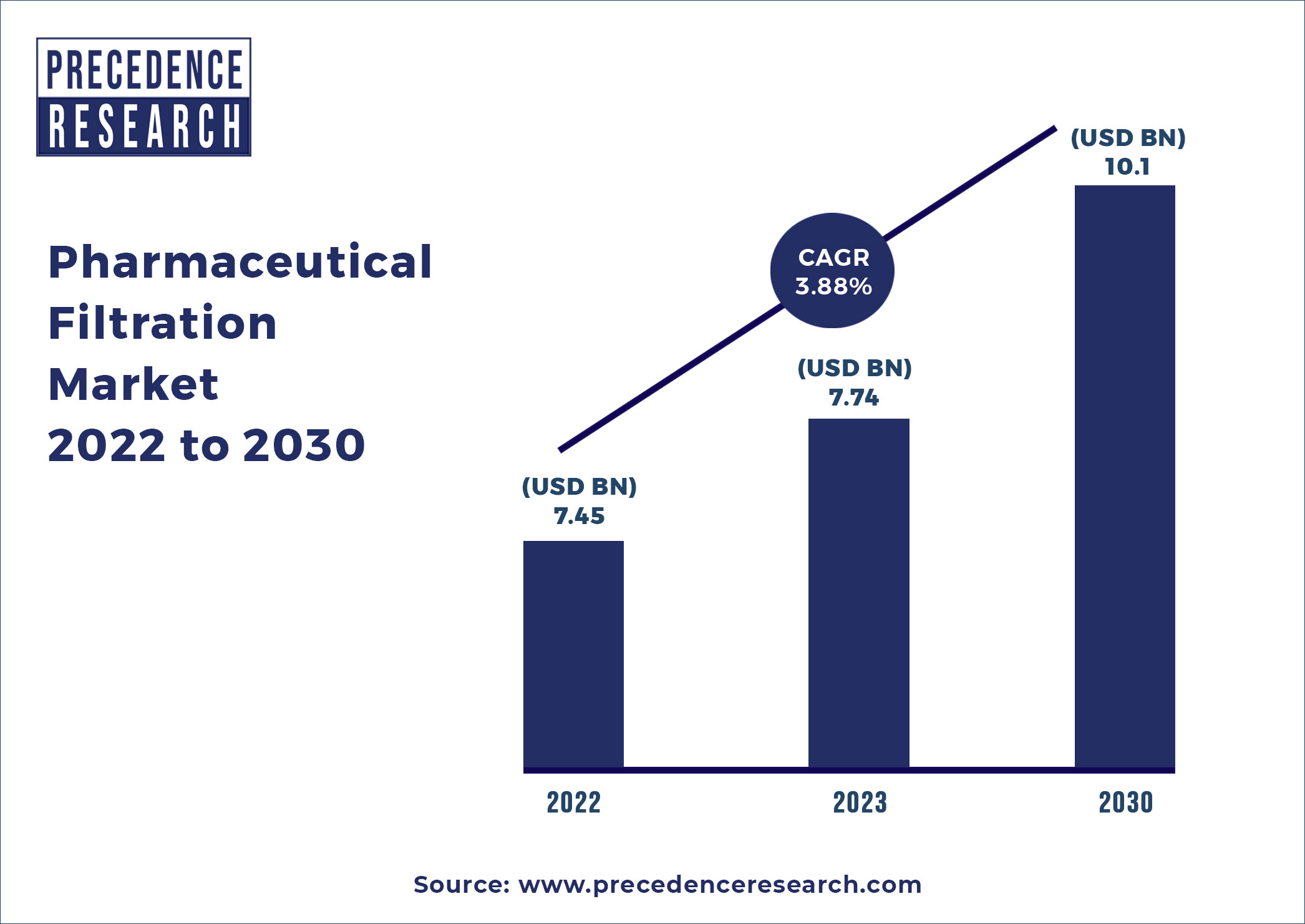

Pharmaceutical Filtration Market Size To Gain USD 10.1 Bn By 2030

The global pharmaceutical filtration market size accounted for USD 7.45 billion in 2022 and it is expected to gain around USD 10.1 billion by 2030 poised to grow at a compound annual growth rate (CAGR) of 3.88% over the forecast period 2022 to 2030.

Growing investments and financing in research and development activities are propelling the worldwide pharmaceutical filtration market forward. Furthermore, advanced therapeutic approaches and methods are becoming more widely accepted. Furthermore, a growing number of industry competitors are spending considerably in production plants around the world. The implementation of novel technologies by industry players is another factor driving the growth of the worldwide pharmaceutical filtration market. Furthermore, market participants are investing in research and development projects in order to introduce new and innovative goods to the worldwide market. In addition, the market for pharmaceutical filtration is expanding as the prevalence of chronic diseases such as asthma and cancer rises. Over the forecast period, the development of improved pharmaceuticals and medications will also boost the worldwide pharmaceutical filtration market.

Report Highlights

- On the basis of product, the membrane filters segment holds the largest market share in the global pharmaceutical filtration market. This is attributed to the increasing development of pharmaceutical and biologics firms.

- On the basis of technique, microfiltration segment holds the largest market share in the global pharmaceutical filtration market. The large particles such as yeast and proteins are frequently separated from liquid feed streams using this approach.

- On the basis of application, final product processing segment holds the largest market share in the global pharmaceutical filtration market. The utilization of innovative filters for final product processing is expected to increase due to advancements in various technologies such as nanofiber and cross flow filtration.

- On the basis of scale of operation, manufacturing scale segment holds the largest market share in the global pharmaceutical filtration market. The surge in demand for innovative therapeutic proteins and biologics is predicted to boost segment growth.

Pharmaceutical Filtration Market Report Scope

| Report Coverage | Details |

| Market Size In 2022 | USD 7.45 Billion |

| Market Size By 2030 | USD 10.1 Billion |

| Growth Rate from 2022 to 2030 | CAGR of 3.88% |

| Base Year | 2022 |

| Forecast Period | 2022 to 2030 |

| Segments Covered | By Product, By Technique, By Application, By Scale of Operation, By Systems, By Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East and Africa |

Regional Snapshot

Asia-Pacific is the largest segment of the pharmaceutical filtration market in terms of region. China and India are dominating the pharmaceutical filtration market in the Asia-Pacific region. The presence of biopharmaceutical and pharmaceutical companies in the Asia-Pacific region drives the pharmaceutical filtration industry. In addition, the Asia-Pacific pharmaceutical filtration market is being driven by increasing financing and investments by contract research organizations and contract manufacturing organizations. Furthermore, favorable government laws for biologics, pharmaceuticals, and treatment development are boosting the worldwide pharmaceutical filtration industry.

Europe region is the fastest-growing region in the pharmaceutical filtration market. The UK holds the highest market share in the Europe pharmaceutical filtration market. The implementation of novel and cutting-edge technology is credited with driving the pharmaceutical filtration market in Europe. Furthermore, the rising demand for biopharmaceuticals, as well as the expansion of the healthcare sector, are moving the pharmaceutical filtration market in Europe forward. Furthermore, the region's excellent distribution network is helping the European pharmaceutical filtration industry grow and thrive.

Market Dynamics

Drivers: Technological advancements

The nanofiltration membranes are a comparatively recent technique that combines reverse osmosis with ultrafiltration. The nanofiltration membranes have the ability to allow monovalent ions, such as sodium chloride, to pass through while denying divalent and multivalent ions, such as sodium sulfate.

Restraints: Low speed and yield

As some present downstream activities, such as nanofiltration, are not compatible with continuous processing, avoiding bottlenecks, and increasing processing speed is part of the efficiency problem. This diminishes yield and increases the time and effort necessary for processing, causing problems. Thus, low speed and yield is restricting the expansion of the worldwide pharmaceutical filtration market.

Opportunities: Growing adoption of single use technologies

Biopharmaceutical organizations are adopting single use technologies on large scale. The data given by BioPlan Associates in the Survey of Biopharmaceutical Manufacturing Capacity and Production, 2019 demonstrates this. According to the survey, 85.6% of respondents utilized disposable filter cartridges, and 79.3% used single-use tangential filtration flow devices for biopharmaceutical manufacture at any stage. Thus, the growing adoption of single use technologies is supporting the growth of the global pharmaceutical filtration market during the projected period.

Challenges: Concerns regarding membrane fouling

The membrane fouling is caused by an excessive amount of organic, biological, or colloidal debris in the source water, as well as inappropriate preparation. As a result, the concerns regarding membrane fouling are major challenge for the growth of global pharmaceutical filtration market.

Recent Developments

- Eaton Corporation PLC, a power management firm, said in January 2020 that it had finalized the purchase of TransDigm Group’s Souriau-Sunbank connection technologies division.

- Danaher purchased Pall-Austar Lifesciences Ltd. in March 2021 to expand its manufacturing capacity in China to meet the demand for single use technology supply chains.

- Exotic Metals Forming, a leader in motion and control technology, was acquired by Parker Hannifin Corporation in December 2020.

Key Players in the Report

- Graver Technologies, LLC

- Meissner Filtration Products, Inc.

- Merck & Co., Inc.

- Parker-Hannifin Corporation

- Sartorius Stedim Biotech S.A.

- 3M Company

- Amazon Filters Ltd.

- Danaher Corporation (Pall Corporation)

- Eaton Corporation Plc

- General Electric Company (GE Healthcare)

Market Segmentation

By Product

- Membrane Filters

- MCE membrane filters

- Coated cellulose acetate membrane filters

- PTFE membrane filters

- Nylon membrane filters

- PVDF membrane filters

- Other membrane filters

- Pre-filters & Depth Media

- Glass fiber filters

- PTFE fiber filters

- Single-use Systems

- Cartridges & Capsules

- Filter Holders

- Filtration Accessories

- Filtration Assemblies

- Others

By Technique

- Microfiltration

- Ultrafiltration

- Crossflow filtration

- Nanofiltration

- Others

By Application

- Final Product Processing

- Active pharmaceutical ingredient filtration

- Sterile filtration

- Protein purification

- Vaccines and antibody processing

- Formulation and filling solutions

- Viral clearance

- Raw Material Filtration

- Media buffer

- Pre-filtration

- Bioburden testing

- Cell Separation

- Water Purification

- Air Purification

By Scale of Operation

- Manufacturing scale

- Pilot-scale

- Research & development scale

By Systems

- Single Use

- Reusable

By Type

- Sterile Filtration

- Non-Sterile Filtration

Buy this Research Report@ https://www.precedenceresearch.com/checkout/1742

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 9197 992 333