What is the Pharmaceutical Filtration Market Size?

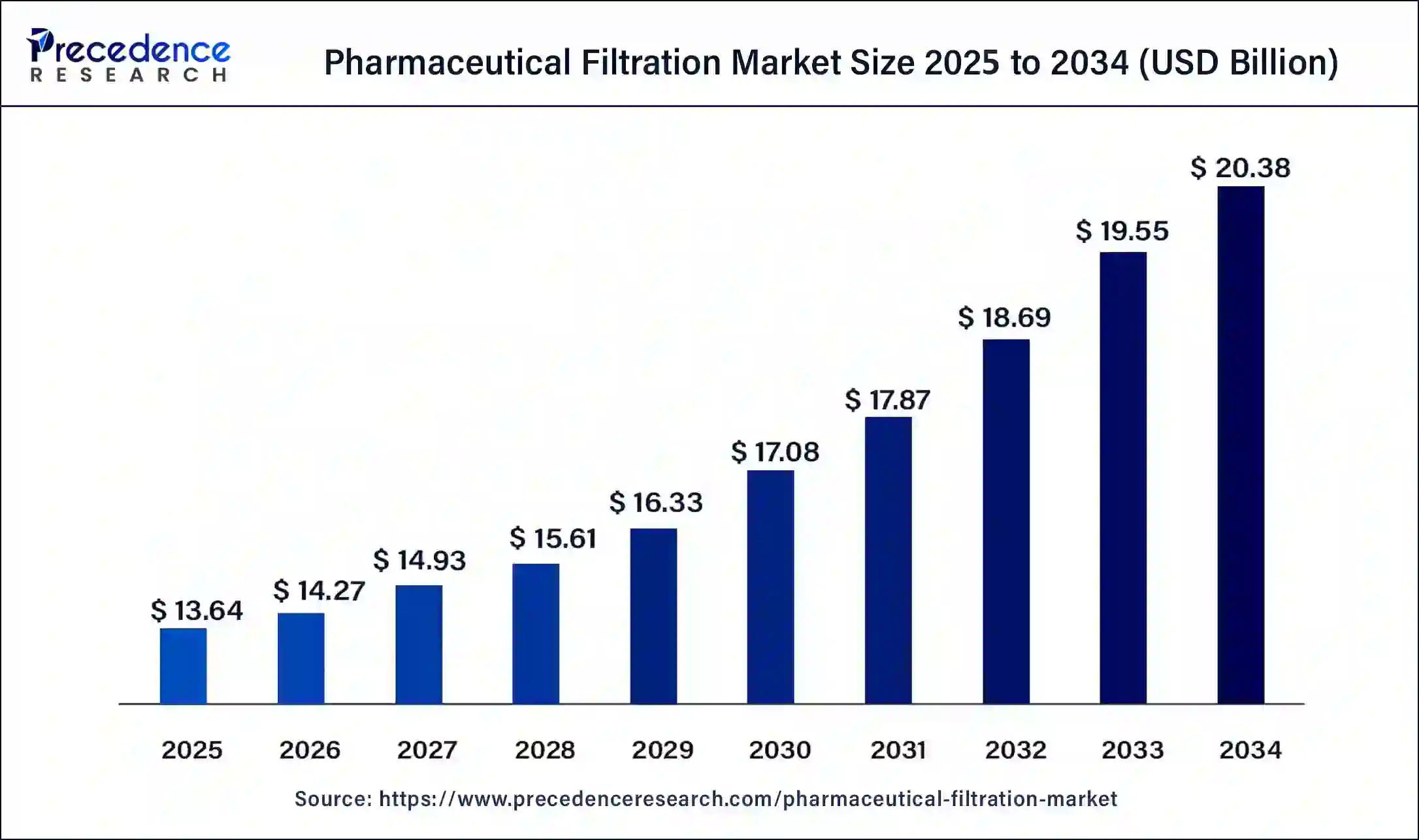

The global pharmaceutical filtration market size is accounted at USD 13.64 billion in 2025 and predicted to increase from USD 14.27 billion in 2026 to approximately USD 20.38 billion by 2034, growing at a CAGR of 4.57% from 2025 to 2034. Filtration can be easily applied to a large variety of pharmaceutical needs due to its flexibility, which helps the growth of the market.

Pharmaceutical Filtration Market Key Takeaways

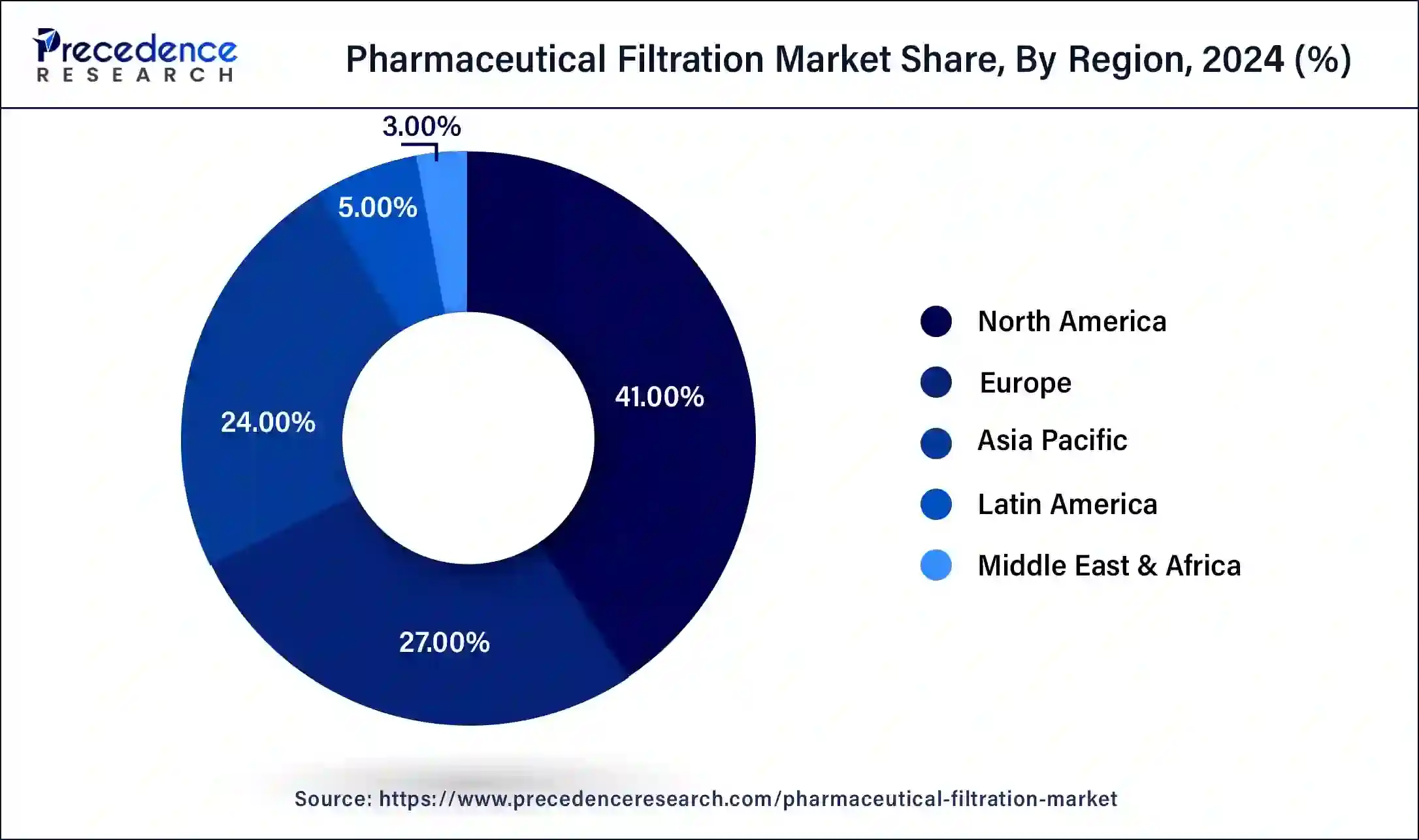

- North America dominated the pharmaceutical filtration market in 2024.

- By product, the membrane filters segment has the largest market share in 2024.

- By product, the single-use systems segment is the fastest-growing segment over the forecast period.

- By application, the final product processing segment dominated the pharmaceutical filtration market in 2024.

- By application, the cell separation segment is projected to hit significant growth from 2025 to 2034.

- By technique, the microfiltration segment captured the biggest revenue share in the pharmaceutical filtration market in 2024.

- By technique, the ultrafiltration segment is expected to witness significant growth over the forecast period.

- By the scale of operation, the manufacturing scale registered a maximum market share in 2024.

- By the scale of operation, the research and development scale segment is predicted to hit notable growth over the forecast period.

Strategic Overview of the Global Pharmaceutical Filtration Industry

The pharmaceutical filtration market refers to the production, distribution, and use of this filtration which is a mechanical or physical operation used to separate solids from fluids (liquids or gases) by interposing a medium through which the fluid can pass. It is a process in which a solid particulate matter is removed from a fluid, which can be either liquid or gas, using a gas or porous medium. The purpose of filtration in the pharmaceutical industry is to remove impurities in the product and ensure that the API or finished product meets the specified quality standards. There is a high demand for this filtration in air purification, water purification, cell separation, and media buffer, which will help the growth of the market.

Artificial Intelligence: The Next Growth Catalyst in Pharmaceutical Filtration

Artificial Intelligence (AI) offers pharmaceutical formulation development has streamlined has streamlined this process for a more precise, cost-effective, and efficient approach. By using experimental data, AI algorithms can identify correlations among drug formulations, operating parameters, and quality attributes of pharmaceutical products. AI is advantageous in water purification and wastewater treatment processes due to automation facilities. AI helps researchers cut water usage, and sewer management, maintain a stable water supply, avoid water loss, and identify anomalies that help the growth of the pharmaceutical filtration market.

Pharmaceutical Filtration Market Growth Factors

- This filtration helps to remove impurities in the product and ensure that API or finished product.

- It helps to separate solids, from solids or liquids, ensuring that the medications produced are free and pure from contaminants.

- These filtrations are essential for maintaining the safety and effectiveness of pharmaceutical products.

- Filtration technology will play an important role in reducing production costs, improving product purity, and enhancing overall efficiency.

Market Outlook

- Market Growth Overview: The Pharmaceutical Filtration market is expected to grow significantly between 2025 and 2034, driven by the rising focus on biologics, biosimilars, and vaccines, the adoption of single-use technology, and innovation in nanofiber membranes technology.

- Sustainability Trends: Sustainability trends focus on water conservation and wastewater management, integration of automation, IoT sensors, and AI/machine learning enables real-time monitoring and predictive maintenance of filtration systems.

- Major Investors: Major investors in the market include Danaher Corporation (Pall Corporation, Cytiva), Merck KGaA (MilliporeSigma), and Sartorius AG.

- Startup Economy: The startup economy in the market is focused on innovation in niche areas like advanced membranes and specialized solutions for cell and gene therapies. Many startups leverage single-use technologies and digitalization to enhance efficiency and agility in bioprocessing, allowing them to compete with larger players.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 13.64Billion |

| Market Size in 2026 | USD14.27 Billion |

| Market Size by 2034 | USD20.38 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.57% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Technique, Application, Scale of Operation, Systems, Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing demand for generic medications

The pharmaceutical filtration process is essential for many stages of drug development including drug formulation, manufacturing, and packaging. This separation process is used to remove unwanted particles, bacteria, and other contaminants from solids, gases, or liquids in drug production. These filtration techniques provide the pharmaceutical industry with effective and reliable means of purifying and separating substances. These also help to maintain product integrity and meet regulatory requirements requiring the production of high-quality pharmaceutical products which help the growth of the pharmaceutical filtration market.

Restraint

High operational costs and technological limitations:

High operational costs and technological limitations can hamper the growth of the pharmaceutical filtration market. The initial investment in the membrane technology and ongoing maintenance can be expensive mainly for smaller companies. Rising competition among manufacturers creates pricing pressures, forcing companies to innovate continuously at the time of cost management. While technological advancements have been made, some existing filtration technologies may not meet the evolving demands for sensitivity, scalability, and purity in drug production.

Opportunity

Adoption of advanced technologies and sustainability initiatives:

Adoption of advanced technologies and sustainability initiatives will help the growth of the pharmaceutical filtration market. The advancement in membrane materials like ultrafiltration and nanofiltration can improve performance, leading to better separation efficiency and lower fouling rates. The integration of real-time monitoring systems and automated systems with the membrane filtration process can reduce human error and improve operational efficiency, driving productivity. The development of sustainable manufacturing processes will help to improve environmentally friendly filtration solutions.

Segment Insights

Product Insights

The membrane filter segment has the largest pharmaceutical filtration market share in 2024. A membrane filter is a type of filter made from synthetic materials like Teflon, nylon, or cellulose acetate designed with fine interconnected channels. Membrane filtration is one of the methods of sterilization when heat sterilization cannot be performed. It is suitable for removing contaminating microorganisms, bacteria, particulates, and natural organic material.

The single-use systems segment is the fastest-growing segment over the forecast period. These single-use systems have one type of media, generally sand or crushed anthracite coal. The general purpose of these filters which are designed to suppress undesirable electrical disturbances. Single-use filtration systems are comprised of many fully disposable components, including entire pathways and filters.

Application Insights

The final product processing segment dominated the pharmaceutical filtration market in 2024. Final product processing in filtration in chemical processing is the most critical process, removing particles and clarifying the product are important and the quality and final product depend on the efficiency and cost-effectiveness of the final filtration process. The final filtration process can remove pharmaceutical residue, nitrites, nitrates, pesticides, hormones, and any heavy metals from the water.

The cell separation segment is projected to hit significant growth from 2025 to 2034. The most popular form of centrifugation used for cell separation is density gradient centrifugation. Density gradient centrifugation separates cell populations based on their respective densities with the help of a gradient medium. The most popular form of centrifugation used for cell separation is density gradient centrifugation.

Technique Insights

The microfiltration segment captured the biggest revenue share in the pharmaceutical filtration market in 2024. Microfiltration uses a microporous film to eliminate contaminations, foreign substances, protozoa, microbes, bacteria, viruses, micron-sized particles, and so on from a suspension/liquids/dissolvable. The microfiltration process is likewise a low-pressure driven layer process whose film pores are in the scope of 0.1-10 µm.

The ultrafiltration segment is expected to witness significant growth over the forecast period. Ultrafiltration systems contain extremely fine membrane filters which need to be properly cleaned. The cleaning process used depends on whether the ultrafiltration system is being used to remove organic or inorganic components or even both. Ultrafiltration is a type of filtration used in many industries like pharmaceutical and chemical manufacturing, wastewater treatment, and food and beverage processing to recycle flow or add value to later products.

Scale of Operation Insights

The manufacturing scale segment registered a maximum market share in the pharmaceutical filtration market in 2024. The manufacturing scale segment includes the use of pharmaceutical filtration products for full-scale manufacturing of biologics and pharmaceutical products, such as cell therapies, gene therapies, vaccines, and protein-based therapeutics. In pharmaceutical filtration in manufacturing which removes contaminants from air and gas streams in many industrial processes. They can filter out particles like vapors, moisture, oils, and dust.

The research and development scale segment is predicted to hit notable growth over the forecast period. The increased investment and funding in research and development which help to increase the growth of the market. Research and development cover the initial search for a molecule to treat the disease through to having a product ready to market.

Regional Insights

U.S. Pharmaceutical Filtration Market Size and Growth 2025 to 2034

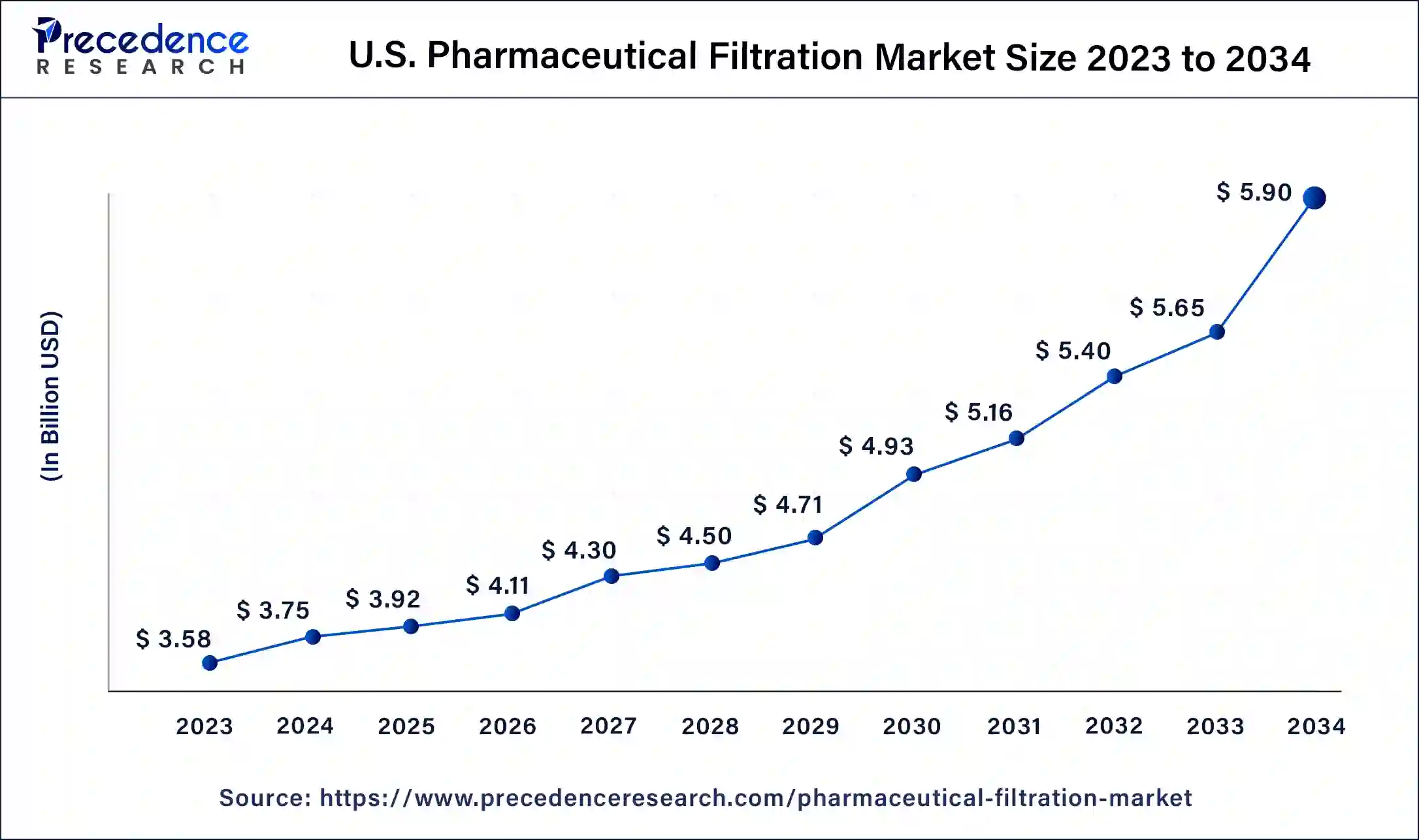

The U.S. pharmaceutical filtration market size is estimated at USD 3.92 billion in 2025 and is predicted to be worth around USD 5.90 billion by 2034, at a CAGR of 5% from 2025 to 2034.

North America dominates the pharmaceutical filtration market with a revenue share of 41% in 2024. The pharmaceutical industry in North America operates under strict regulatory standards set by agencies such as the U.S. Food and Drug Administration (FDA) and Health Canada. These regulatory bodies require pharmaceutical companies to adhere to high-quality standards in the production of drugs and therapeutic products. Filtration is a critical process in ensuring the purity and safety of pharmaceutical products, making advanced filtration technologies essential for compliance.

North America has a sizable biopharmaceutical sector that focuses on the production of biologics, including vaccines, antibodies, and other complex therapeutic proteins. The manufacturing processes for biopharmaceuticals often involve intricate filtration steps, driving the demand for specialized filtration technologies.

The presence of advanced pharmaceutical industries, supportive governmental regulations, and advanced healthcare facilities help the growth of the market in the North American region. Increasing investment in research and development activities and better healthcare expenditure, which help the growth of the market.

- In August 2024, new specialized bioanalytical testing services in North America were introduced by SGS. This service can be used for both biopharmaceutical and pharmaceutical applications.

U.S. Pharmaceutical Filtration Market Trends

The U.S. is growing biopharmaceutical sector, there is an increasing adoption of single-use technologies and advanced membrane filters to ensure sterility and reduce contamination risks. Stringent regulatory requirements from the FDA also compel manufacturers to use robust filtration systems for safety and quality.

The Asia Pacific region has a booming biopharmaceutical sector and increased healthcare spending. This demand is amplified by growing outsourcing to regional contract manufacturing and development organizations (CDMOs) and robust government initiatives supporting the pharmaceutical industry in countries like India and China.

China Pharmaceutical Filtration Trends

China is expanding its biopharmaceutical sector and making a significant move towards high-purity biologics and vaccines. Key trends include the widespread adoption of single-use filtration technologies to prevent contamination and the enforcement of stringent regulatory standards by the NMPA.

How is Europe Rising in the Pharmaceutical Filtration Market?

Europe's market is a robust biopharmaceutical industry and a strict regulatory environment, which necessitates high-quality filtration. Key growth drivers include significant R&D investments, the widespread adoption of single-use technologies for efficiency, and strong government support for healthcare initiatives.

United Kingdom Pharmaceutical Filtration Trends

The U.K. has strong biopharmaceutical and vaccine sectors, alongside the widespread adoption of single-use technologies for enhanced efficiency and reduced contamination risk. Stringent regulatory demands from the MHRA necessitate the use of reliable, high-performance filtration solutions.

Pharmaceutical Filtration Market Value Chain Analysis

- Raw Material Sourcing/Component Suppliers

This stage involves the procurement of essential materials such as polymers for membranes, resins, additives, and other components used to manufacture filtration products. The quality and availability of these materials are critical to the performance and consistency of the final filtration solution.

Key Players: Sartorius AG, Merck KGaA, and Danaher Corporation (Pall Corporation). - Manufacturing and Assembly

In this stage, raw materials are converted into finished filtration products like membrane filters, depth filters, single-use systems, cartridges, and capsules. Manufacturers invest heavily in R&D to develop innovative technologies, such as nanofiber membranes and automated systems, to meet the industry's stringent purity and efficiency requirements.

Key Players: Danaher Corporation (Pall Corporation), Sartorius AG, Merck KGaA, 3M Company, Thermo Fisher Scientific Inc., Parker Hannifin Corporation, and Eaton Corporation Plc. - Distribution and Logistics

This stage focuses on efficiently delivering the manufactured filtration products from the production facilities to the end-users. This involves managing complex supply chains, often globally, to ensure timely delivery and compliance with specific handling and storage conditions.

Key Players: McKesson and Cardinal Health

Pharmaceutical Filtration Market Companies

- Graver Technologies, LLC:

Focuses on highly specialized filtration, purification, and separation products, providing solutions for pharmaceutical water systems and process streams that meet stringent regulatory needs. They offer cartridge filters and other media designed for specific applications in sterile filtration and clarification. - Meissner Filtration Products, Inc.:

Specializes in microfiltration and single-use systems, providing a broad portfolio of filters and fluid management solutions for critical pharmaceutical and bioprocessing applications. They contribute through innovation in depth filtration, membrane technologies, and customized product designs to meet specific client needs.

Merck & Co., Inc. (Note: The filtration market segment is primarily part of Merck KGaA/MilliporeSigma):

A major contributor through its Life Science business (MilliporeSigma), providing a vast array of filtration products crucial for R&D and production of biologics and pharmaceuticals. Their products are essential for cell culture media preparation, protein purification, and sterile filtration processes globally. - Parker-Hannifin Corporation:

Through its Finite Air and other divisions, it provides high-purity process and sterile air filtration solutions essential for sterile manufacturing environments. Their technology ensures air quality and contamination control, vital for maintaining GMP compliance in pharmaceutical production areas. - Sartorius Stedim Biotech S.A.:

A leading international partner for the biopharmaceutical industry, offering integrated solutions for all steps of bioprocesses, including media preparation, cell culture, and downstream processing. Their filtration products are a core component of their extensive single-use technology portfolio, minimizing cross-contamination risks. - 3M Company:

Provides various advanced filtration solutions for both pharmaceutical water treatment and process stream clarification. Their depth filtration and microfiltration technologies are used across different stages of drug manufacturing to ensure product quality and safety. - Amazon Filters Ltd.:

A privately-owned European manufacturer offering a wide range of process filtration equipment for the water, chemical, and pharmaceutical sectors. They contribute with customized filter housings, depth filters, and pleated cartridges designed to meet specific regulatory requirements and production needs. - Danaher Corporation (Pall Corporation):

A dominant player offering a comprehensive range of separation, filtration, and purification technologies essential for bioprocessing and general pharmaceutical manufacturing. They are major innovators in single-use systems and advanced membrane filters crucial for large-scale biologics production. - Eaton Corporation Plc:

Provides industrial filtration systems, including depth filtration and automatic self-cleaning filters, often used in upstream processing and water treatment applications within pharmaceutical facilities. Their products focus on improving efficiency and reducing waste in bulk manufacturing processes. - General Electric Company (GE Healthcare - now Cytiva, a Danaher company):

(Now operating as Cytiva following acquisition by Danaher) Offers extensive bioprocessing solutions, including a wide range of filtration systems used in chromatography, cell harvesting, and final product polishing. Their technologies are integral to the efficient production of complex biologics and cell therapies.

Recent Developments

- In October 2024, Planova FG1, a virus removal filter featuring higher flux for the manufacture of biotherapeutics was launched by Asahi Kasei Medical.

- In December 2024, an enhanced high-temperature resistant membrane product aimed at vent applications across the global pharmaceutical and biotechnology markets was launched by the UK's Amazon Filters.

Segments Covered in the Report

By Product

- Membrane Filters

- MCE membrane filters

- Coated cellulose acetate membrane filters

- PTFE membrane filters

- Nylon membrane filters

- PVDF membrane filters

- Other membrane filters

- Pre-filters & Depth Media

- Glass fiber filters

- PTFE fiber filters

- Single-use Systems

- Cartridges & Capsules

- Filter Holders

- Filtration Accessories

- Filtration Assemblies

- Others

By Technique

- Microfiltration

- Ultrafiltration

- Crossflow filtration

- Nanofiltration

- Others

By Application

- Final Product Processing

- Active pharmaceutical ingredient filtration

- Sterile filtration

- Protein purification

- Vaccines and antibody processing

- Formulation and filling solutions

- Viral clearance

- Raw Material Filtration

- Media buffer

- Pre-filtration

- Bioburden testing

- Cell Separation

- Water Purification

- Air Purification

By Scale of Operation

- Manufacturing scale

- Pilot-scale

- Research & development scale

By Systems

- Single Use

- Reusable

By Type

- Sterile Filtration

- Non-Sterile Filtration

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting