Rockets and Missiles Market Size To Rise USD 5.23 Bn By 2032

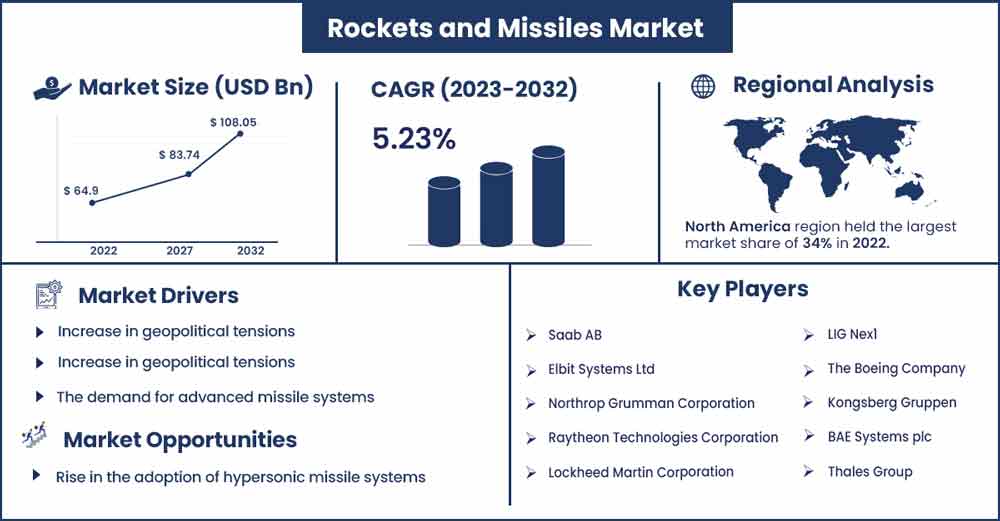

The global rockets and missiles market size surpassed USD 64.9 billion in 2022 and is projected to rise to USD 108.05 billion by 2032, anticipated to grow at a CAGR of 5.23 percent during the projection period from 2023 to 2032.

Market Overview

The rockets and missiles market refers to the global industry involved in the research, development, production, and deployment of rocket systems and guided missiles for various purposes, including military, defense, space exploration, and commercial applications. Rockets and missiles are technologically advanced, self-propelled vehicles designed to travel through the Earth's atmosphere and, in some cases, beyond into space. It plays a vital role in national security, scientific research, and the commercialization of space, with continuous advancements and innovations shaping its trajectory.

The rockets and missiles market is driven by several factors including growing concern over national security, increasing geopolitical tensions, technological advancements, growing space exploration initiatives and rising government funding and support. In March 2023, a hypothetical 7.2 percent rise from the $229.6 billion in 2022, China announced a $224.8 billion annual military budget. According to the Council on Foreign Relations, a record NT$606.8 billion (US$19.1 billion), or 2.6 percent of GDP, in additional defense spending was announced by Taiwan.

In addition, the growth of the commercial space industry, with companies like SpaceX, Blue Origin, and others offering launch services, drives innovation and competition in the rocket category. Reduced launch costs and increased accessibility to space contribute to market expansion.

- As per the Union Budget of India 2022-23, one-quarter of the defense R&D budget has been set aside for startups and the private sector, paving the path for the development of innovative defense technology in India.

- In 2023, using a single small antenna, Quasar Satellite Technologies' multibeam phased array ground station technology accommodated hundreds of satellite communications at once, according to a $5.3 million contract it received from the Defense Innovation Hub.

- In August 2023, the investment of more than $1.7 billion in some of the most potent and cutting-edge weaponry ever deployed by the Australian Defense Force was announced by the Albanese Government. For almost $1.3 billion, the government has opted to buy more than 200 Tomahawk cruise missiles from the US for the Royal Australian Navy's Hobart Class destroyers to develop this crucial capacity.

Regional Insights

North America is expected to dominate the market during the forecast period as the region is a hub for both military and commercial aerospace and defense industries. The United States, in particular, is a major player in the global rockets and missiles market due to its status as a military superpower. The US department of defense invests heavily in missile development, procurement, and missile defense systems. Regional defense companies like Lockheed Martin, Boeing, Raytheon Technologies and Northrop Grumman are key players in missile technology, supplying not only the US military but also international customers. According to the U.S. Congressional Budget Office, defense spending increased from $746 billion in 2022 to $1.1 trillion in 2023.

The Departments of the Navy and the Air Force are responsible for the main components of the budget. It is stated that between 2013 and 2022, the United States spent $392 billion on nuclear weapons, $97 billion on missile defenses. Besides, the United States is a leader in space exploration, with NASA being one of the prominent space agencies in the world. Commercial space companies, such as SpaceX, Blue Origin, and United Launch Alliance, have a strong presence in the region.

They rely on rockets and launch services for various missions, including satellite deployments, crewed missions, and interplanetary exploration. For instance, in September 2023, Space Launch Complex 40 at Cape Canaveral Space Force Station in Florida served as the launch pad for a SpaceX Falcon 9 rocket that sent 22 Starlink satellites into low-earth orbit. Thus, this is expected to propel the market growth over the forecast period.

On the other hand. Canada is expected to capture a significant market share over the forecast period. Canada has a well-established aerospace industry with companies like Bombardier and Magellan Aerospace. These companies produce components, avionics, and technologies that are essential for rockets and missiles. Canada exports aerospace technology and components to global aerospace and defense markets, contributing to the supply chain for missile systems. Thereby, driving the market growth in the country.

Rockets and Missiles Market Report Scope:

| Report Coverage | Details |

| Market Revenue in 2023 | USD 68.29 Billion |

| Projected Forecast Revenue by 2032 | USD 108.05 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 5.23% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing space exploration

The global interest in space exploration and commercial ventures is a significant driver for the rockets and missiles market. Government space agencies and private companies require reliable launch vehicles to deliver payloads into space, such as satellites, scientific instruments and crewed missions. For instance, in September 2023, India recently put up a rocket called "The Aditya-L1" to investigate the sun. The spacecraft is reportedly carrying "seven scientific payloads for systematic study of the sun," all of which were created domestically through partnerships between India's space agency and academic institutions.

Technological advancements

Ongoing advancements in missile technology, such as propulsion systems, guidance and navigation, and materials, led to the creation of more sophisticated and capable missiles. Innovations like hypersonic missiles, improved targeting systems, and miniaturized warheads enhance missile performance. For instance, in August 2023, a Hypersonics Capability Center (HCC) was established by Northrop Grumman Corporation in Elkton, Maryland to develop cutting-edge propulsion technologies that can propel hypersonic missiles faster than Mach 5. Thus, this is expected to drive the market growth over the forecast period.

Restraints

High development cost

Developing advanced rocket and missile systems can be extremely expensive. Research and development, testing, and production costs can run into billions of dollars, which can be a barrier for some countries and private companies. For instance, the initial production cost estimate for the Tamir interceptor was $100,000. Thus, these facts impede the market growth to some extent.

Complexity of technology

Missile and rocket technology is complex, requiring expertise in various fields, including propulsion, guidance systems, material science, and electronics. Maintaining and advancing these technologies can be challenging. Thus, this is expected to limit the market growth during the forecast period.

Opportunities

Growing investment in hypersonic missiles

The development of hypersonic missiles, which travel at speeds exceeding Mach 5, is a significant opportunity. These missiles offer enhanced manoeuvrability and shorter response times, making them valuable for both defense and strategic purposes. For instance, in February 2023, to provide surface ships with hypersonic strike capabilities, Lockheed Martin collaborated with the U.S. Navy. If all options are used, the U.S. Navy awarded Lockheed Martin a contract for the integration of the Conventional Prompt Strike (CPS) armament system aboard ZUMWALT-class guided missile destroyers (DDGs) valued at more than $2 billion. The CPS is a hypersonic boost-glide weapon system that allows long-range missile flight at velocities faster than Mach 5, with exceptional survivability against adversary defenses.

International collaboration

Collaborations between countries and defense contractors can lead to cost sharing, technology transfer, and joint development efforts. Such partnerships can open new markets and accelerate innovation. For instance, in July 2023, as part of their increased defense cooperation to fight China's expanding influence in the Indo-Pacific, the United States will assist Australia in producing guided missiles and rockets for both nations over two years. Thereby, offering a lucrative opportunity to the market growth.

Recent Developments

- In March 2023, as part of its efforts to increase its footprint in Southeast Asia, the military company BrahMos Aerospace, based in India, recently won a deal to sell Indonesia supersonic cruise missiles for at least $200 million.

- In September 2023, a framework agreement for the Homar-A Multiple Launch Rocket System (MLRS) was signed between the Polish Ministry of National Defense's Armaments Agency and Lockheed Martin. As part of the deal, the Polish business will collaborate with Lockheed Martin to attach important HIMARS rocket launcher parts to a Jelcz 6x6 truck. The arrangement strengthens the expanding Polish cooperation ecosystem for Lockheed Martin. It also includes orders for HIMARS ammunition manufacture and technology transfer. Polska Grupa Zbrojeniowa (PGZ), Huta Stalowa Wola (HSW), WZU, and MESKO are important Polish business players. 486 Homar-A cars will be built in Poland according to the conditions of the framework agreement, with the first deliveries beginning in 2026. Thousands of rocket ammunition missiles will also be developed.

- In September 2023, at the World Satellite Business Week in Paris this year, Accenture unveiled a partnership and investment with Open Cosmos, a space technology firm that specializes in the design, production, and integration of satellites. By developing and managing space missions, Open Cosmos enables worldwide access to high-quality satellite data and insights through a data services platform. To address business issues on Earth, particularly those about sustainability, the two businesses will assist clients in tracking and analysing data from space. As part of its larger Project Spotlight strategy, Accenture Ventures oversaw the investment.

Major Key Players

- Saab AB

- Elbit Systems Ltd

- Northrop Grumman Corporation

- Raytheon Technologies Corporation

- Lockheed Martin Corporation

- LIG Nex1

- The Boeing Company

- Kongsberg Gruppen

- Israel Aerospace Industries Ltd

- BAE Systems plc

- Thales Group

Market Segmentation:

By Speed

- Subsonic

- Supersonic

- Hypersonic

By Product

- Cruise Missiles

- Rockets

- Ballistic Missiles

- Torpedoes

By Guidance

- Guided

- Unguided

By Platform

- Naval

- Ground

- Airborne

Buy this Research Report@ https://www.precedenceresearch.com/checkout/3279

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 9197 992 333