Transparent Plastics Market Revenue to Attain USD 230.18 Bn by 2033

Transparent Plastics Market Revenue and Trends

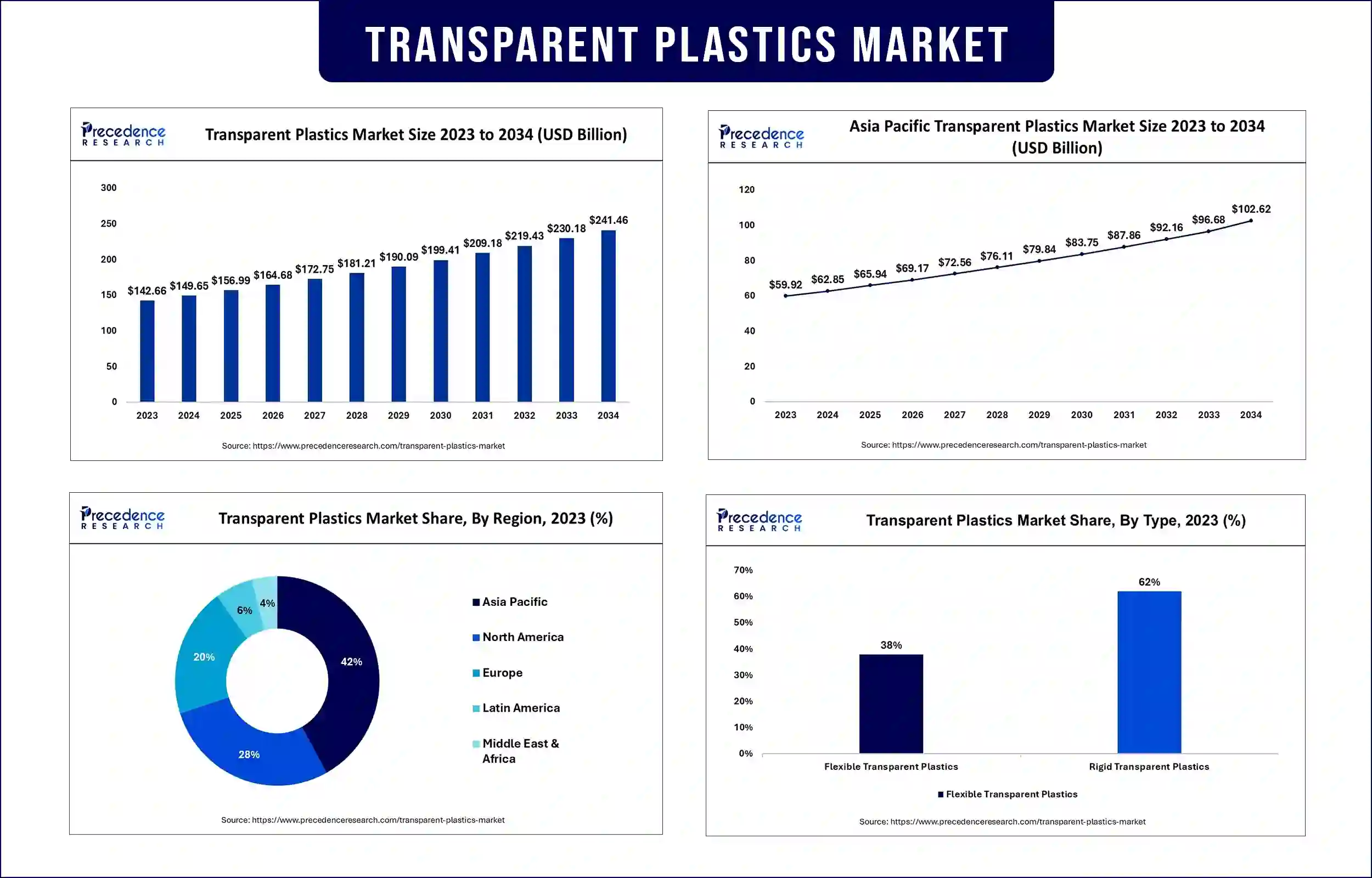

The global transparent plastics market revenue was valued at USD 149.65 billion in 2024 and is expected to attain around USD 230.18 billion by 2033, growing at a CAGR of 4.90% during forecast period. The demand for transparent plastic is rising in the packaging industry. Packaging made from transparent plastic enhances the visual of products.

Market Overview

Lightweight plastic that may be made to be partially or completely stiff is known as transparent plastic. It is easily transparent to light. Transparent plastics have a repelling effect, which prevents food or liquid items from sinking out of them and prevents dust particles from entering. Plastic can be molded into any shape while still being flexible and then quickly set into a somewhat elastic or hard form, depending on the situation.

The need for transparent plastic is rising across various sectors, including consumer products, construction, and automobiles. Additionally, plastic is frequently used in the packaging of food and drinks. Thus, the rising demand for packaged food significantly boosts the growth of the market. Acrylic, also known as Poly Methyl Methacrylate (PMMA), is a thermoplastic clear substance used as a strong, lightweight glass. It is commonly used in sawmills and other items. Products like acrylic mirrors and plexiglass are frequently made using acrylic in sheet form. Transparent polymers like acrylic and polycarbonate, which are stronger than many other types of clear sheet metal, are frequently used in glazing systems for buildings that need to be transparent and high-performing mechanically.

Highlights of the Transparent Plastics Market Report

- On the basis of application, the packaging segment dominated the market in 2023 and is expected to continue its dominance throughout the forecast period. This is mainly due to the increasing demand for packaging films in various industries for packaging various products. The rising demand for consumer goods further bolstered the segment.

- Based on polymer type, the polyethylene terephthalate (PET) segment led the market in 2023. PET is widely used for packaging food items due to its distinctive qualities, such as clarity, excellent barrier property, and recyclability.

- On the basis of form, the rigid transparent plastics segment dominated the market in 2023 due to their excellent barrier property. In addition, rigid transparent plastics are used in a variety of applications, including packaging, automotive, medical, and building & construction.

Transparent Plastics Market Trends

- Increasing demand for flexible packaging: The demand for flexible packaging is rising in various industries due to its ease of use and versatility. With the increasing adoption of consumer goods, there is a huge demand for flexible packaging materials, which boosts the market.

- Growing demand for sustainable plastics: The growing environmental concerns worldwide led to the shift toward sustainability. Therefore, many prominent companies have begun developing bioplastic, which has the least amount of negative impact on the environment. As people have become more conscious of the environment than before, the demand for sustainable and recyclable packaging materials has increased.

- Regulatory Support: The continuous evolution of the transparent plastic market has resulted in regulatory support for bio-based materials, which is further encouraging industries to adopt plant-based transparent plastics. As a result, many research and developmental activities are being conducted at a wider scale to develop alternate solutions for it.

Regional Insights

In 2023, Asia Pacific dominated the market with the largest share. This is primarily due to the increasing demand for flexible and transparent packaging from various industries. Rapid industrialization further contributed to regional dominance. China held a large portion of the Asia Pacific transparent plastics market. China is the world’s largest producer of plastics, accounting for 31% of the overall plastic production worldwide.

Transparent Plastics Market Coverage

| Report Attribute | Key Statistics |

| Market Revenue in 2024 | USD 149.65 Billion |

| Market Revenue by 2033 | USD 230.18 Billion |

| CAGR | 4.90% from 2024 to 2033 |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market News

- In November 2023, Tomra Recycling Sorting, a Norwegian multinational corporation involved in recycling, unveiled a plastic flake sorting technology for high throughput purification of plastic flakes.

- In March 2022, Nichols PLC, a British soft drinks company, launched recyclable clear plastic bottles for Caribbean Crush.

Segments covered in the report

By Type

- Rigid

- Flexible

By Application

- Packaging

- Building & Construction

- Electrical & Electronics

- Automotive

- Consumer Goods

- Healthcare

- Others (Aerospace, Agriculture)

By Polymer Type

- Polyethylene Terephthalate (PET)

- Polyvinyl Chloride (PVC)

- Polypropylene (PP)

- Polystyrene (PS)

- Polycarbonate (PC)

- Polymethyl Methacrylate (PMMA)

- Others (Polyamide, ABS & SAN, Polyethylene, TPU)

By Form

- Rigid Transparent Plastics

- Flexible Transparent Plastics

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

Get this report to explore global market size, share, CAGR and trends, featuring detailed segmental analysis and an insightful competitive landscape overview@ https://www.precedenceresearch.com/checkout/2065

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344