Vascular Grafts Market Revenue to Attain USD 9.43 Bn by 2033

Vascular Grafts Market Revenue and Trends 2025 to 2033

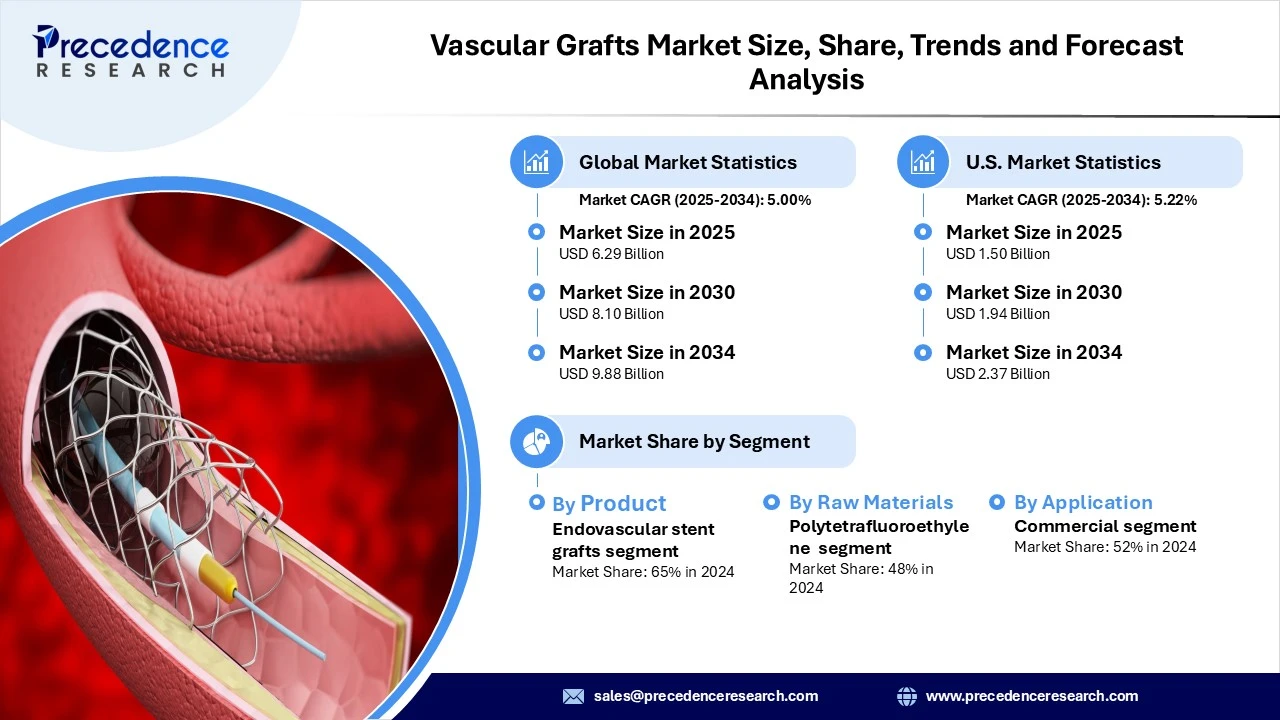

The global vascular grafts market revenue reached USD 6.29 billion in 2025 and is predicted to attain around USD 9.43 billion by 2033 with a CAGR of 5.00%. A vascular graft or vascular bypass is a surgical treatment used to divert blood from one generally normal location to another in order to circumvent a damaged artery. Based on the indication and the raw materials utilised for the graft to suit the host tissue, there are several vascular grafts. Hemodialysis vascular access, endovascular aneurysm repair, and thoracic aneurysm repair all require vascular grafts.

The rise in vascular diseases like atherosclerosis, deep vein thrombosis, pulmonary embolism, and other cardiac disorders, as well as the rise in hospitals and surgery centres, which facilitate disease diagnosis and treatment, are the main factors driving the growth of the global vascular grafts market. For instance, the American Heart Association reported that in 2019, 197.2 million people had ischemic heart disease (IHD). Additionally, one of the major factors influencing the market is the rise in cardiovascular diseases. The World Health Organization (WHO) estimates that 17.9 million individuals passed away in 2019 as a result of cardiovascular diseases (CVDs).

Moreover, improvements in vascular disease devices are projected to aid in the market's expansion. New product introductions also contribute to the market's expansion. However, throughout the anticipated timeframe, product failure and recalls are anticipated to limit market growth.

Segment Insights

- Due to the rising frequency of cardiovascular disease and the shifting trend toward minimally invasive procedures, the worldwide market is expected to reach USD 3.12 billion by 2030.

- The endovascular stent-grafts product category led the market in 2021 as a result of an increase in aneurysm cases and patient preference for these devices.

- Due to the increased frequency of cardiovascular disorders throughout the world in 2021, the cardiac aneurysm application segment dominated the market.

- The market for polytetrafluoroethylene raw materials was dominant in 2021, mostly because of the surge in demand for designed prostheses items.

- The creation of innovative goods, rising R&D activity, and a strong healthcare infrastructure helped North America lead the market in 2021.

Vascular Grafts Market Report Coverage

| Report Attribute | Key Statistics |

| Market Revenue in 2025 | USD 6.29 Billion |

| Market Revenue by 2033 | USD 9.43 Billion |

| CAGR from 2025 to 2033 | 5.00% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2024 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Regional Insights

North America dominated the global vascular grafts market by generating the highest revenue share in 2024. The dominance of the segment is attributed to the higher prevalence of cardiovascular and vascular diseases like atherosclerosis, aneurysm and peripheral artery diseases. For instance, vascular diseases are a major public health issue in the U.S., with cardiovascular disease (CVD) being the leading cause of death, accounting for approximately 950,000 deaths annually. This has led to the higher government focus on adopting technologies and procedures for early detection, which can control this at an early stage. (Source: https://www.ucsfhealth.org)

The United States stands as the leader in the region due to the presence of a mature audience that uses such techniques on a larger scale. As a result, the healthcare organizations in the country have been highly loaded with advanced technologies and equipment. Moreover, they have shifted their focus to R&D to enable smoother healthcare procedures for individuals.

Asia Pacific is expected to grow at the fastest CAGR during the forecast period of 2025 to 2034. The growth of the segment is attributed to the rising disease prevalence in countries like Japan, China and India due to the aging population and lifestyle changes. The higher population base in the region also makes it a popular spot for such healthcare innovations and adoptions.

China holds a popular share in the growth due to the higher patient volume, which has attracted investments from the government. For instance, ‘Healthy China 2030’, is a major initiative by the government where they are focusing on expanding the adoption of surgical and endovascular solutions. In 2024, the aging population in China continued to grow, with around 310.31 million people aged 60 or over, making up approximately 22% of the total population. (Source: https://www.acuitykp.com)

Market Dynamics

Drivers

The University of California estimates that 2 million people worldwide have ESRD. In the US, ESRD affects about 650,000 people yearly. The countries with the greatest rates of ESRD now include Japan, Taiwan, Mexico, the US, and Belgium.

Dialysis is the sole option to kidney transplantation and is widely utilised by ESRD patients. Three times a week, hemodialysis is performed. Vascular grafts are still the only way to maintain hemodialysis since many patients' superficial veins are worn out after extended dialysis.

- Additionally, the National Institute of Diabetes and Digestive and Kidney Diseases (2016) estimates that 14% of Americans have CKD overall. Kidney failure affects more than 0.6 million people in America. 0.4 Million of these people receive dialysis.

The need for vascular grafts has grown as a consequence of an increase in cardiac aneurysms and cardiovascular illnesses throughout the world, which has led to the entry of several new vascular graft producers into the market. These market participants are producing value-grab potential by developing vascular grafts for the treatment of critical limb ischemia.

Restraints

Patients who have product failures may develop serious, even fatal, consequences. Numerous corporate goods have been taken off the market throughout the years because of flaws or other problems. The adoption of grafts in therapeutic operations may be impacted by market trends that negatively impact end-user perceptions of the safety of grafts.

The healthcare industry has experienced rapid technological advancements, which has led to an ongoing need for highly qualified employees. It is essential to comprehend cutting-edge technology and use them properly when executing vascular bypass surgery. As a result, highly qualified employees are needed to fulfil the aim in the most effective and efficient manner. But there has consistently been a shortage of qualified workers in the sector. This has been severely impeding market expansion and, if not resolved quickly, will continue to limit future industry growth. When advantageous reimbursement scenarios are absent in developing nations, industry demand will be hampered.

Opportunities

Players in the vascular grafts market have a lot of room to develop in emerging regions like Australia, Singapore, Japan, and China. 985 out of 999 patients in Japan who had EVAR between 2007 and 2015, according to the NCBI, were above the age of 50. The incidence of aortic aneurysms will rise as this demographic segment expands since Japan has the greatest percentage of elderly people. The Ministry of Internal Affairs and Communication estimated in 2014 that 33.0 percent of the Japanese population was over 60. 40 percent of Japan's population is projected to be over 65 by 2050.

Due to their relatively lax regulatory practises and the rising burden of aneurysms, these markets are predicted to rise rapidly in the upcoming years. Major players have been driven by this to broaden their geographic presence into new regions. For example, to support and improve its activities in 80 sites in the Asia Pacific, Medtronic Inc. (US) launched its Asia Pacific regional headquarters in Singapore in May 2016.

Challenges

Consumer health may suffer serious negative consequences if a vascular transplant fails. Vascular graft dysfunction poses a risk to the consumer's life, which will significantly hinder the adoption of new, cutting-edge technology and could slow the market's growth throughout the projection period. The greater price tag attached to these types of graphs is a significant obstacle for the emerging industry. Failure of a vascular graft also results in increased costs associated with having to repeat the procedure. All of these elements proven to be a significant obstacle to the market expansion for vascular grafts.

Recent Developments

- In December 2024, the FDA approved Humacyte’s Symvess, an off-the-shelf bioengineered artery implant, a breakthrough treatment for vascular repair.

(Source: https://www.fiercebiotech.com) - In February 2025, VERIGRAFT secured a €1.2 million Eurostars grant to fund its PREPPER project, advancing 3D-printed arteria grafts that closely mimic natural arteries and aim to improve the integration and durability in vascular surgery. (Source: https://3dprintingindustry.com)

- A biotechnology company called Somahlution published the findings of a clinical research based on DURAGRAFT in January 2019 and claimed it has been demonstrated to have decreased clinical risk during coronary bypass grafting (CABG).

- The first-ever bio-absorbable vascular graft was created and patented by Cardiovate, a biomedical technology start-up business, in January 2016. It is anticipated to improve blood flow and ultimately stop amputations.

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/1758

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com |+1 804 441 9344