Vertical Farming Market Revenue to Attain USD 70.70 Bn by 2033

Vertical Farming Market Revenue and Trends

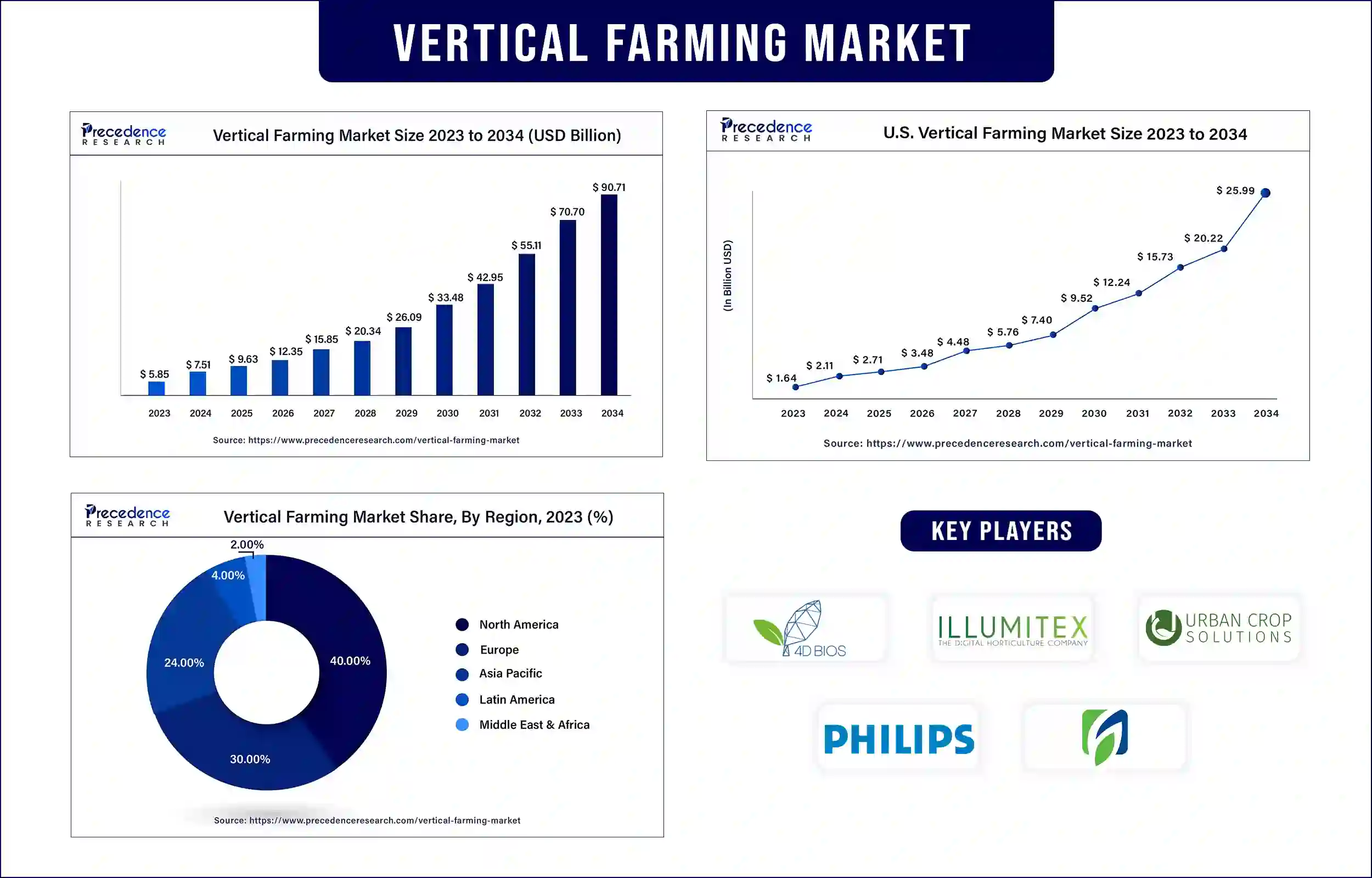

The global vertical farming market revenue reached USD 7.51 billion in 2024 and is predicted to attain around USD 70.70 billion by 2033 with a CAGR of 28.3% during the forecast period. Rising health consciousness among consumers, escalating urbanization, and rising per capita income, are all contributing factors to the expansion of the global vertical farming market.

Market Overview

Many people refer to vertical farming as "future farming" since it employs environmentally controlled agricultural technology to maximize the utilization of indoor farming practices. This is particularly true given that most of the world's population will have migrated to cities by 2050. In such an environment, with a constantly growing population, there will be a greater need for natural and organic local food.

A novel agricultural technique called vertical farming has the potential to address the looming food problem. It increases water efficiency while also reducing or eliminating the need for soil for crops. Based on its regulated environment, which includes temperature, light, humidity, and artificial intelligence, vertical farming may ensure consistent produce output and increase crop yields.

There are various types of vertical farming:

Vertical farms in buildings: Although abandoned structures are converted for vertical farming, frequent usage of such structures is not required. Vertical farms can also be built using new structures, depending on the needs.

Shipping-container vertical farms: Used or repurposed shipping containers are outfitted with monitoring sensors, climate controls, vertically stacked farms, and LED lights. Such farms can reduce their need for space while increasing their productivity.

Underground vertical farms: These vertical farms sometimes referred to as "Deep Farms," are constructed in tunnels, mine shafts, or other underground spaces. As the temperature and humidity are consistent, less energy is needed to heat them, and an underground water source may be used for water supply. In addition, these farms may generate 7 to 9 times as much food as a typical farm.

Report Highlights of the Vertical Farming Market

- The lighting segment led the market in 2023 based on component. Lighting is among the important hardware elements required for a vertical farming arrangement. In place of sunshine, artificial light produces light levels sufficient for crop development. It is possible to alter the grow lights' outputs' hues, temperatures, and spectral compositions as well as their intensity to provide different lighting situations outside. High-intensity discharge (HID) and LED grow lights are now the most popular choices for vertical farming.

- Based on the growth mechanism, the hydroponics segment dominated the market in 2023 due to the ease of installation and economic creation of vertical farms. Since mineral nutrients dispersed in water are delivered directly to the plant's roots in a hydroponics system, the plant develops primarily upward, encouraging faster growth, quicker harvesting, and better yield. Herbs, greenery, and food products are grown year-round using hydroponic systems indoors and outdoors using an inert growing medium to secure the plant's roots. Less water usage is one of the main benefits of employing this technique since it recycles water.

- The shipping container segment led the market in 2023 by structure. This is mainly due to the structure's capability to help crops grow regardless of the geographical site.

Vertical Farming Market Trends

- Need for high-tech solutions: Vertical farms provided a novel solution that addressed various societal issues. "Vertical farming" arose in response, providing high-tech solutions that entailed growing vegetables indoors utilizing rising structures like shelves, buildings, shipping containers, and even abandoned shafts. Startups in vertical farming raised billions of dollars and promised quick expansion.The majority of vertical farming firms promoted high-tech solutions to assist development and make the farming industry more effective. A few ideas include employing AI to monitor indoor plant conditions, robotic farming to save labor expenses, and genetically modified soil.

- Advancement in agriculture technology: Microgreens are crops grown using vertical farming techniques. They contain high levels of polyphenols, a type of antioxidant that helps reduce the risk of illnesses, including heart disease, Alzheimer's disease, diabetes, and several malignancies. Agricultural technologies are advancing because of increased innovation, garnering both public and private interest. Commercial farmers are increasingly implementing high-capital-outlay technology, including sophisticated hydroponic systems and computerized traceability systems. Growers are also investing significantly in LEDs and other cutting-edge lighting goods to lessen their exposure to associated hazards by carefully monitoring and acquiring new technology.

Regional Analysis

North America dominated the vertical farming market with the largest share in 2023. Increasing concerns about nutrition and food security are projected to provide several brand-new chances for the business to thrive. It is projected that the U.S. will contribute significantly to supporting the ecology of future foods. Freshly picked veggies are becoming more widely available in retail establishments as customer preferences shift toward "fresh-from-farm-to-table" products (which is also the pioneer in adopting this concept). Urbanization in New York, Chicago, and Milwaukee has fueled the market in the region. Vertical farming has increased the output of freshly cultivated food.

The vertical farming market in Europe is anticipated to expand rapidly in the coming years. The U.K. is one of the leading nations in the European vertical farming sector, along with France, Germany, Spain, and Italy. The popularity of vertical farming in certain regions has been spurred by rising customer demand and technological developments in those countries and across the continent.

Vertical Farming Market Coverage

| Report Attribute | Key Statistics |

| Market Revenue in 2024 | USD 7.51 Billion |

| Market Revenue by 2033 | USD 70.70 Billion |

| CAGR | 28.3% from 2024 to 2033 |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2023 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market News

- In March 2024, Vertical Future (VF) partnered with the World Green Economy Organisation (WGEO) to advance shared sustainability objectives. VF's role as a technology-driven advocate for resource-efficient crop production aligns with WGEO's mission to promote a green economy as the optimal path to global prosperity and safety.

- In March 2023, BrightFarms, a pioneer in the indoor farming industry, is growing by establishing four additional regional greenhouse centers that introduce sustainably farmed leafy greens to a broader audience in the Eastern and Central United States. The newly built greenhouse centers are expected to meet the rising demand for organic food and initiate distribution to retailers by 2024. With this expansion, the company is expecting 10x revenue growth by 2024.

- June 2023, Freight Farms announced a partnership with Local Line to provide farming businesses with the resources they require to achieve successful businesses. With the collaboration, farmers can make use of Local Line and Freight Farms in tandem to begin a profitable farm business.

- January 2023, ams OSRAM and Energous collaborated to design and develop a wirelessly driven multi-spectral light sensor solution for CEA (controlled-environment agriculture). The combined solution is powered by the multi-channel AS7343 sensor spectral of ams OSRAM and Energous's WattUp PowerBridge.

Market Segmentation

By Growth Mechanism

- Hydroponics

- Aeroponics

- Aquaponics

By Component

- Lighting

- Climate Control

- Sensor

- Irrigation

- Others

By Fruits, Vegetables & Herbs

- Bell & Chili peppers

- Strawberry

- Tomato

- Lettuce

- Cucumber

- Herbs

- Leafy Greens (excluding lettuce)

- Others

By Structure

- Shipping Container

- Building-based

Get this report to explore global market size, share, CAGR and trends, featuring detailed segmental analysis and an insightful competitive landscape overview@ https://www.precedenceresearch.com/checkout/1229

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344