Pressure Pumping Market Size and Growth 2025 to 2034

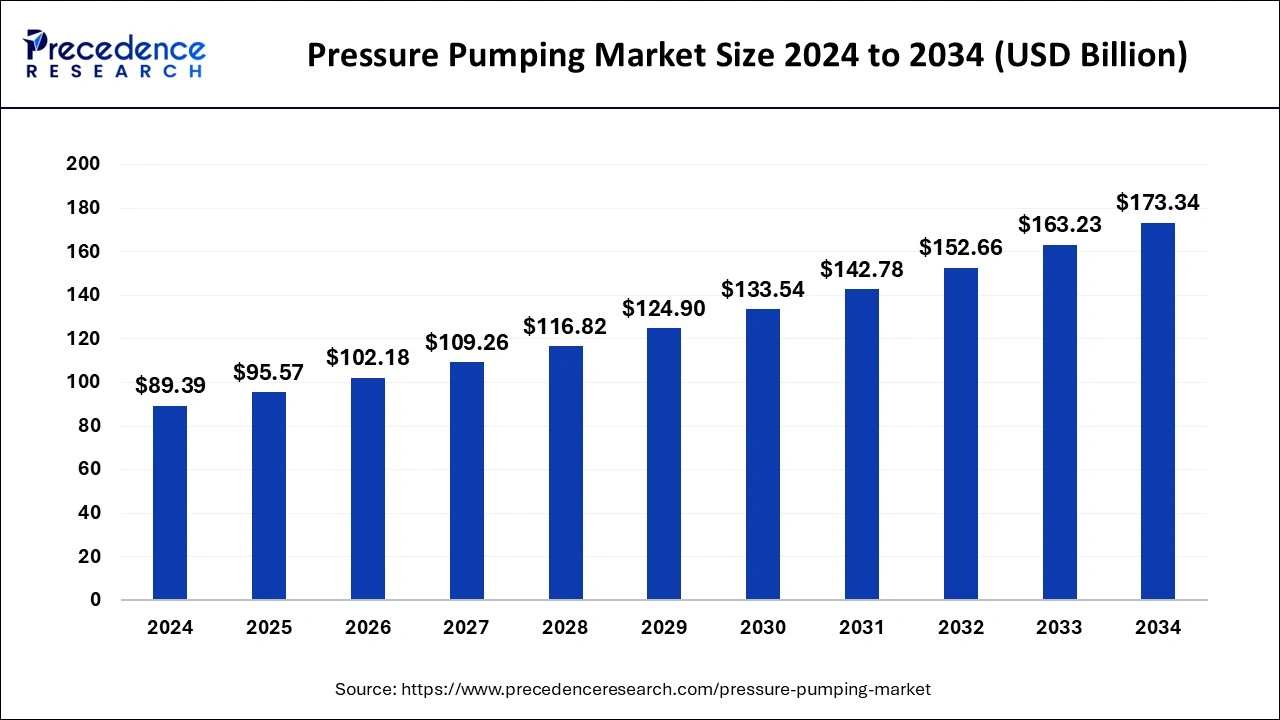

The global pressure pumping market size was estimated at USD 89.39 billion in 2024 and is predicted to increase from USD 95.57 billion in 2025 to approximately USD 173.34 billion by 2034, expanding at a CAGR of 6.85% from 2025 to 2034. The pressure pumping market is driven by the rise in the number of horizontal wells.

Pressure Pumping Market Key Takeaways

- In terms of revenue, the global pressure pumping market was valued at USD 89.39 billion in 2024.

- It is projected to reach USD 173.34 billion by 2034.

- The market is expected to grow at a CAGR of 6.85% from 2025 to 2034

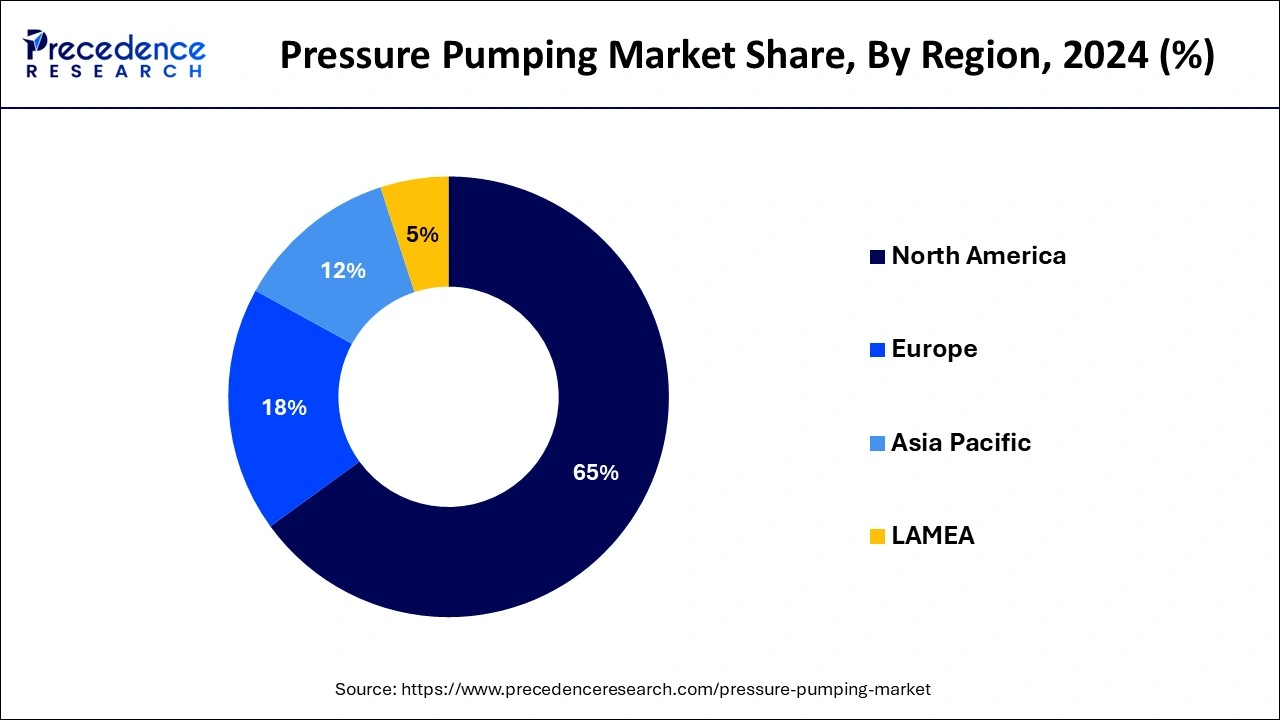

- North America dominated the market with the largest revenue share of 65% in 2024.

- Asia- Pacific is observed to be the fastest growing in the market during the forecast period.

- By service type, the hydraulic fracturing segment dominated the pressure pumping market in 2024.

- By service type, the cementing segment is observed to be the fastest growing market during the forecast period.

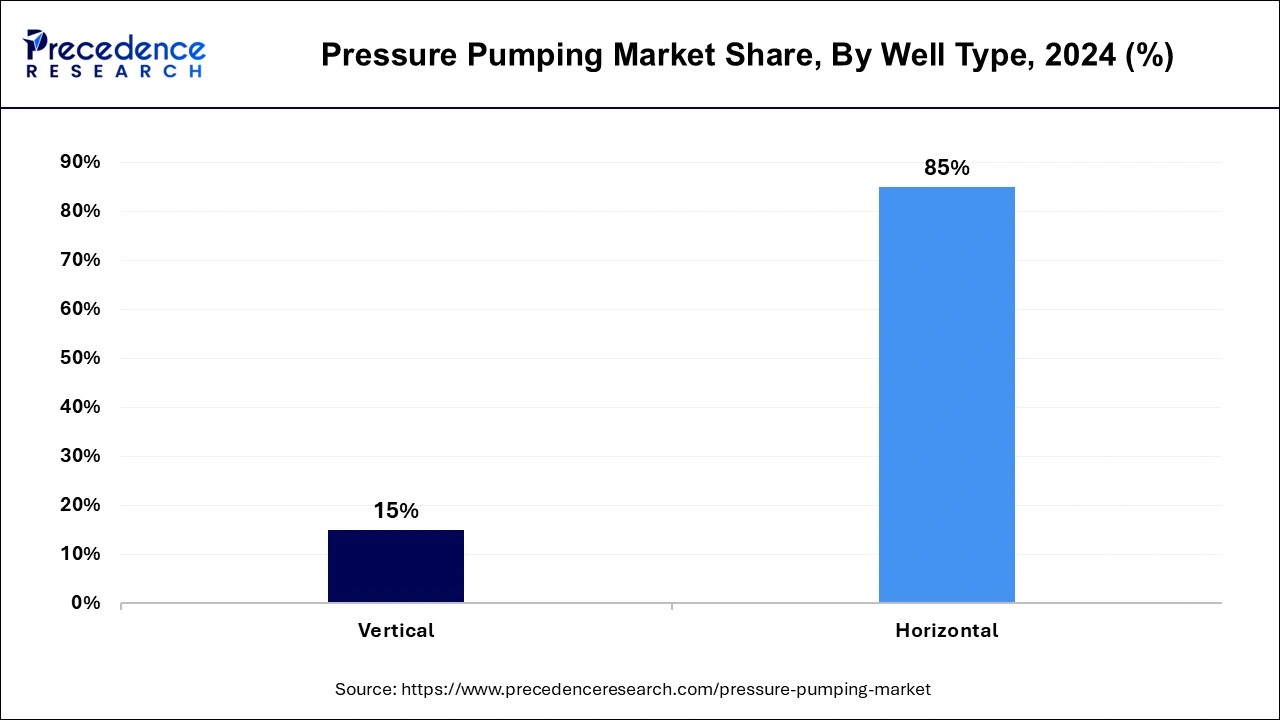

- By well type, the horizontal segment has held the largest revenue share of 85% in 2024.

- By well type, the vertical segment is observed to be the fastest growing market during the forecast period.

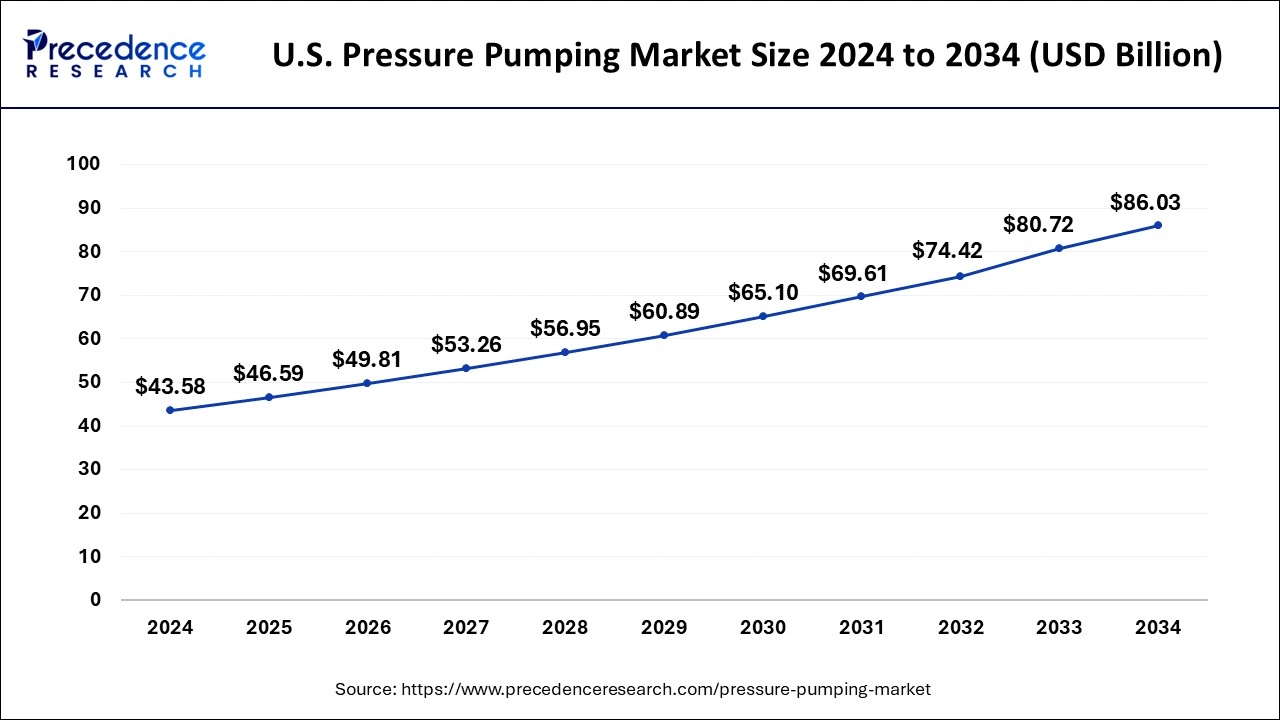

U.S. Pressure Pumping Market Size and Growth 2025 to 2034

The U.S. pressure pumping market size was estimated at USD 43.58 billion in 2024 and is predicted to be worth around USD 86.03 billion by 2034 with a CAGR of 7.04% from 2025 to 2034.

North America had the largest market share in 2024 in the pressure pumping market. Shale formations, prime oil, and natural gas extraction sources by hydraulic fracturing (fracking) are abundant in North America, especially in the United States. The pressure pumping industry now revolves around key basins like the Marcellus Shale, Permian Basin and Eagle Ford Shale. Because of these basins' enormous reserves, there is a constant need for pressure pumping services to increase extraction productivity and efficiency. Another critical factor has been the strategic alliances, mergers, and acquisitions among significant competitors in the market. These partnerships have made sharing resources, knowledge, and technology easier, improving pressure pumping operations' effectiveness and economy.

Asia-Pacific is observed to be the fastest growing in the pressure pumping market during the forecast period. Energy consumption has dramatically expanded in China, India, and Southeast Asia due to rapid industrialization and urbanization. Significant international investments are being made in numerous Asian nations to expand their infrastructure related to gas and oil. These expenditures frequently result in technology transfers that improve the capacity for local pressure pumping. Governments are enacting advantageous laws and regulations to encourage investment in the oil and gas industry. For example, India has passed laws that permit 100% foreign direct investment in several oil and gas industrial sectors.

- In April 2023, the newest offering from top Indian pump manufacturer Kirloskar Brothers Limited is the DBxe Pump. The pump has broad characteristics and unique design parameters that will transform the pumping business.

Market Overview

The pressure pumping market is an industry segment offering services and equipment for pumping different fluids into wells at high pressure during oil and gas extraction. Cementing, hydraulic fracturing (fracking), and other stimulation methods that raise the output of oil and gas wells are some of these services. It significantly contributes to the economy through job creation, supporting ancillary sectors, and stimulating technological developments. Oil and gas production and efficiency gains can reduce energy costs and improve energy security. Because the pressure pumping market makes it possible to extract domestic oil and gas resources, it significantly lowers dependency on energy imports. This guarantees a consistent supply of energy, enhancing national security and stability.

- In March 2023, one of the top producers of pumps, valves, and systems worldwide, KSB Limited, recently revealed that it had acquired Technology from Bharat Pumps and Compressors Ltd. in Naini, Prayagraj. Following this transaction, KSB Limited acquires all rights to the technology used in the BP&CL products, making it the exclusive and exclusive owner.

- In November 2022, Stuart Turner, the well-known producer of pumps and water-boosting systems for residential and commercial applications, has purchased Aquatronic Group Management (AGM), a major supplier of tools and services for cold-water boosting installation and maintenance in the United Kingdom.

Pressure Pumping Market Growth Factors

- Hydraulic fracturing is necessary for extracting hydrocarbons from shale gas and tight oil, and pressure pumping services are crucial to this process. The surge in non-traditional resources is a major catalyst.

- The industry wants to extract as much money as possible from current wells. Pressure pumping methods like acidizing and hydraulic fracturing increase productivity.

- Higher energy demands result from the growing global population, urbanization, and development of new economies. Pressure pumping makes extraction easier, which helps meet this need.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 95.57 Billion |

| Market Size by 2034 | USD 173.34 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6.85% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service Type, Well Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Expansion of unconventional oil and gas resources

Hydrogen fracturing (fracking) and other sophisticated drilling and completion methods are critical to extracting unconventional oil and gas deposits. In this procedure, pressure pumping, specifically hydraulic fracturing, is essential. To release trapped hydrocarbons, chemicals, sand, and water are poured under high pressure into subterranean formations to produce fractures. The need for pressure pumping services has increased due to technological advancements that have made extraction techniques more successful and economical. This drives the pressure pumping market growth.

Enhanced oil recovery (EOR) techniques

As more conventional oil and gas fields approach maturity, there's a rising focus on using enhanced oil recovery (EOR) techniques to maximize production from these reservoirs. Pressure pumping is essential to applying EOR techniques in mature fields, reviving production, and prolonging field life. Pressure pumping services are in more demand as the number of mature fields sought for EOR rises.

Restraint

Increasingly stringent environmental regulations

Large amounts of water combined with chemicals are needed for hydraulic fracturing, a common pressure-pumping technique, to crack underground rock formations and release gas or oil. Water conservation and pollution control are becoming increasingly important topics in environmental regulations. Businesses must follow strict rules for the procurement, use, treatment, and disposal of water. Investing in cutting-edge water recycling and treatment technology is frequently necessary for compliance, which raises operational costs and complicates operations.

Pressure-pumping operations can potentially damage nearby ecosystems and wildlife habitats, especially in delicate places like wetlands or habitats that support endangered species. Environmental rules may limit the time and location of pressure pumping operations to reduce their negative ecological effects. Businesses could have to wait longer for permits or meet more mitigation standards to comply with habitat conservation laws. This eventually hinders the growth of the pressure pumping market.

Opportunities

Growth in exploration and production of unconventional resources

Innovations in horizontal drilling and hydraulic fracturing have brought considerable attention to unconventional resources like coalbed methane, tight oil, and shale gas. Because of these procedures, significant hydrocarbon resources that were previously inaccessible or economically unviable to extract have now become accessible. The pressure pumping market is segmenting and becoming more specialized as it ages. Service providers provide customized solutions to satisfy various non-traditional resource plays' unique needs. This entails modifying fluid compositions, streamlining pumping schedules, and deploying specialist equipment for certain geological formations. This kind of specialization increases productivity and efficiency, increasing demand for pressure pumping services.

Advancements in pressure pumping technology

Operators can now access hydrocarbon deposits that were previously unreachable due to advanced pressure pumping techniques. Engineers can increase the contact area between the hydrocarbons and the wellbore by improving the fracturing process to produce longer and more widespread fractures in the reservoir rock. This enhanced access to reservoirs maximizes the economic potential of oil and gas assets and raises eventual recovery rates. Research and development in several disciplines, including materials science, fluid dynamics, geomechanics, and data analytics, are fueled by the pursuit of improvements in pressure-pumping technologies. This opens an opportunity for the pressure pumping market.

Businesses spend money on R&D to create new reservoir characterization and monitoring technologies, optimize fracturing methods, and enhance equipment design. These ongoing efforts continuously improve the efficiency, safety, and environmental performance of pressure pumping operations.

Service Type Insights

The hydraulic fracturing segment dominated in the pressure pumping market in 2024. The practice of hydraulic fracturing has significantly benefited from technical advancements. These developments have improved the efficacy and efficiency of the fracking process, increasing its attractiveness to oil and gas companies. Drilling techniques like horizontal drilling and hydraulic fracturing have transformed the process of reaching and extracting gas and oil from previously unreachable shale layers. Due to fracking, gas and oil may now be extracted from sources that would otherwise be difficult to access. Hydraulic fracturing makes fissures in the rock formations by injecting high-pressure fluid, facilitating the free flow of hydrocarbons to the production wells. Oil and gas fields have a longer lifespan thanks to this maximizing resource extraction from already-existing wells, raising the overall recoverable reserves.

- In May 2022, SPM Oil & Gas, an upstream supplier of pressure pumping and pressure control equipment and services, has unveiled an advancement to improve the hydraulic fracturing process: the new, more efficient SPM Simplified Frac Iron System. The Simplified Frac Iron System enhances the often fragmented process seen in traditional ground iron.

The cementing segment is observed to be the fastest growing in the pressure pumping market during the forecast period. Exploration and production of oil and gas have increased with the rise in the world's energy needs. Cementing is a crucial procedure during the drilling and completion phases of these operations. Cement slurry is injected into the well to stabilize and seal the wellbore, stop fluids from transferring between various subterranean formations, and safeguard the well's integrity. Cementing services become increasingly in demand as businesses grow to reach new markets. There has been an increase in offshore drilling, especially in deepwater and ultra-deepwater areas.

These locations are challenging to work in, and sophisticated cementing procedures are needed to withstand the high pressures and difficult circumstances. The need for cement services is rising partly because of the necessity for dependable wellbore and zonal isolation in these demanding situations.

Well Type Insights

The horizontal segment dominated the pressure pumping market in 2024. Drilling a well horizontally entails drilling it vertically up to a predetermined depth and then bending the wellbore horizontally. By increasing the well's contact with the reservoir, this technique makes it possible to extract oil and gas more effectively. Drilling technology advancements have made horizontal drilling more practical and economical. Regulations have changed in several areas to facilitate and expedite the hydraulic fracturing and horizontal drilling permitting process. Favorable regulatory environments have further stimulated investment in these technologies.

The vertical segment is observed to be the fastest growing in the pressure pumping market during the forecast period. Vertical pressure pumping is an essential component of enhanced oil recovery (EOR) methods. Improved techniques for extracting oil from mature wells, like surfactant flooding, CO2 injection, and polymer flooding, have improved EOR efficiency. These approaches frequently call for vertical pressure pumping to optimize the injection process, which raises demand. The increasing global energy consumption drives the need for effective techniques for extracting oil and gas. Countries in Asia-Pacific and Latin America, with expanding industrial and population demands, make significant investments in vertical pressure pumping technology to improve their capacity to produce oil and gas.

Pressure Pumping Market Companies

- C&J Energy Services

- Calfrac Well Services

- FTS International

- Keane Group

- Pro Petro Holding Corp.

- RPC Inc.

- Schlumberger

- Halliburton

- Baker Hughes

- Weatherford International

Recent Developments

- In April 2024, Xylem introduced the Jabsco PureFlo 21 single-use pump as a ground-breaking product for the biotechnology and pharmaceutical industries. For the first time in single use pumping technology, the new pump has an adjustable, integrated pressure release valve that maximizes operator safety while reducing the possibility of fluid contamination.

- In October 2023, With the release of the innovative and adaptable Bredel NR Transfer hose, Watson-Marlow Fluid Technology Solutions (WMFTS) has announced that Bredel hose pumps have increased the variety of hoses it offers for general fluid transfer applications at pressures up to 12 bar (174 psi). Food and beverage waste, abrasive slurries, and sludge with a high solid content can all be handled by the Bredel NR (Natural Rubber) Transfer hose. This solution is an addition to the Bredel NR Metering hose, offered by Bredel hose pumps and intended for more challenging tasks with a pressure capability of up to 16 bar (232 psi).

- In July 2023, To increase awareness of the value of correctly inflated tires, GasBuddy and CSC ServiceWorks announced a deal to integrate a new feature into the GasBuddy mobile app. The GasBuddy App now makes it simpler for drivers to locate air pumps directly with the help of this new function.

Segments Covered in the Report

By Service Type

- Hydraulic Fracturing

- Cementing

- Others

By Well Type

- Horizontal

- Vertical

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting