What is the Hydrogen Fueling Station Market Size?

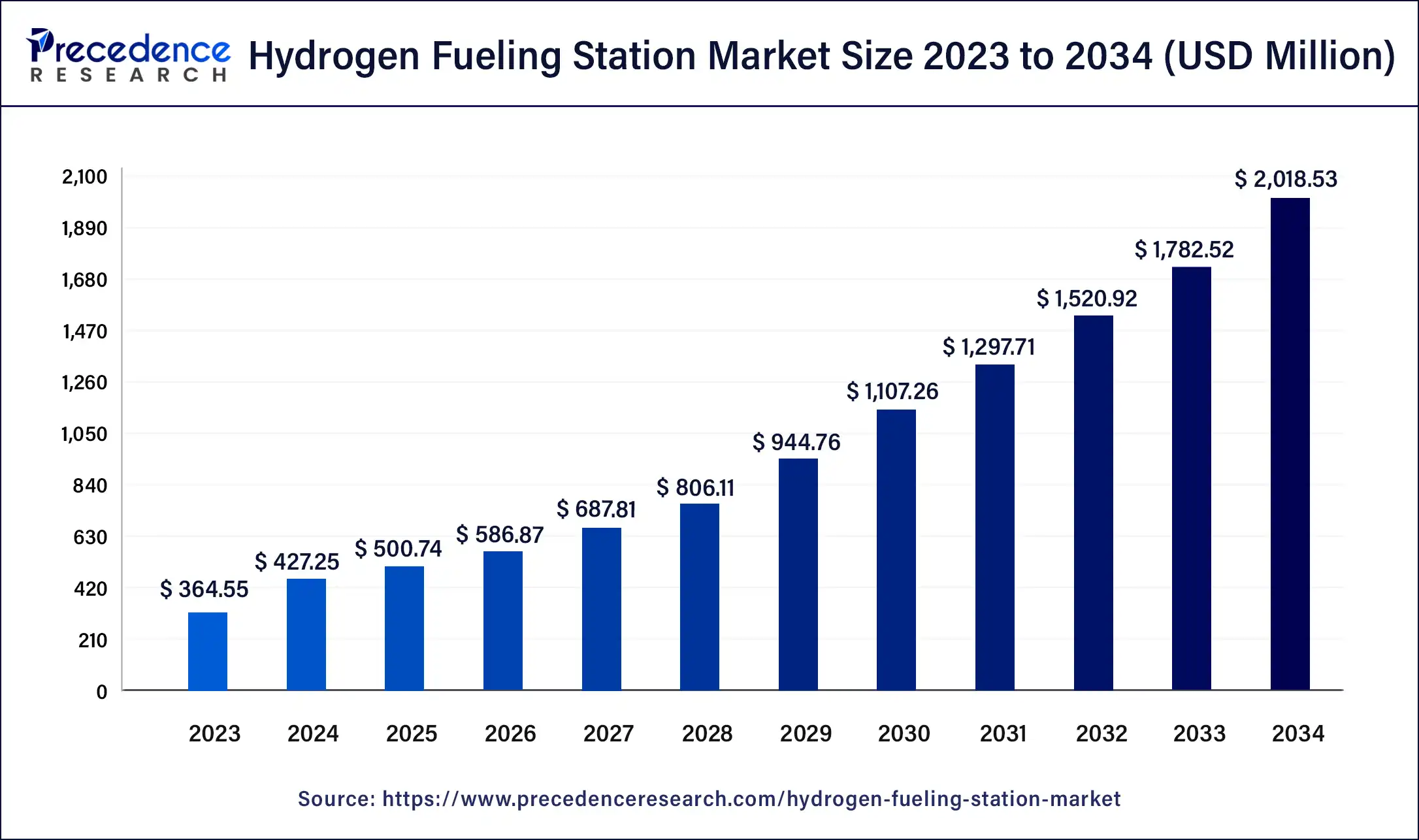

The global hydrogen fueling station market size is accounted at USD 500.74 million in 2025 and predicted to increase from USD 586.87 million in 2026 to approximately USD 2,271.60 million by 2035, representing a CAGR of 16.32% from 2026 to 2035. The hydrogen fueling station market is driven by the global drive for decarbonization and even zero-emission transport, boosted by strict government regulations, rising adoption of Fuel Cell Electric Vehicles (FCEVs) in passenger cars and mainly heavy-duty transport, and rising investments in hydrogen as a clean energy carrier.

Hydrogen Fueling Station Market Key Takeaways

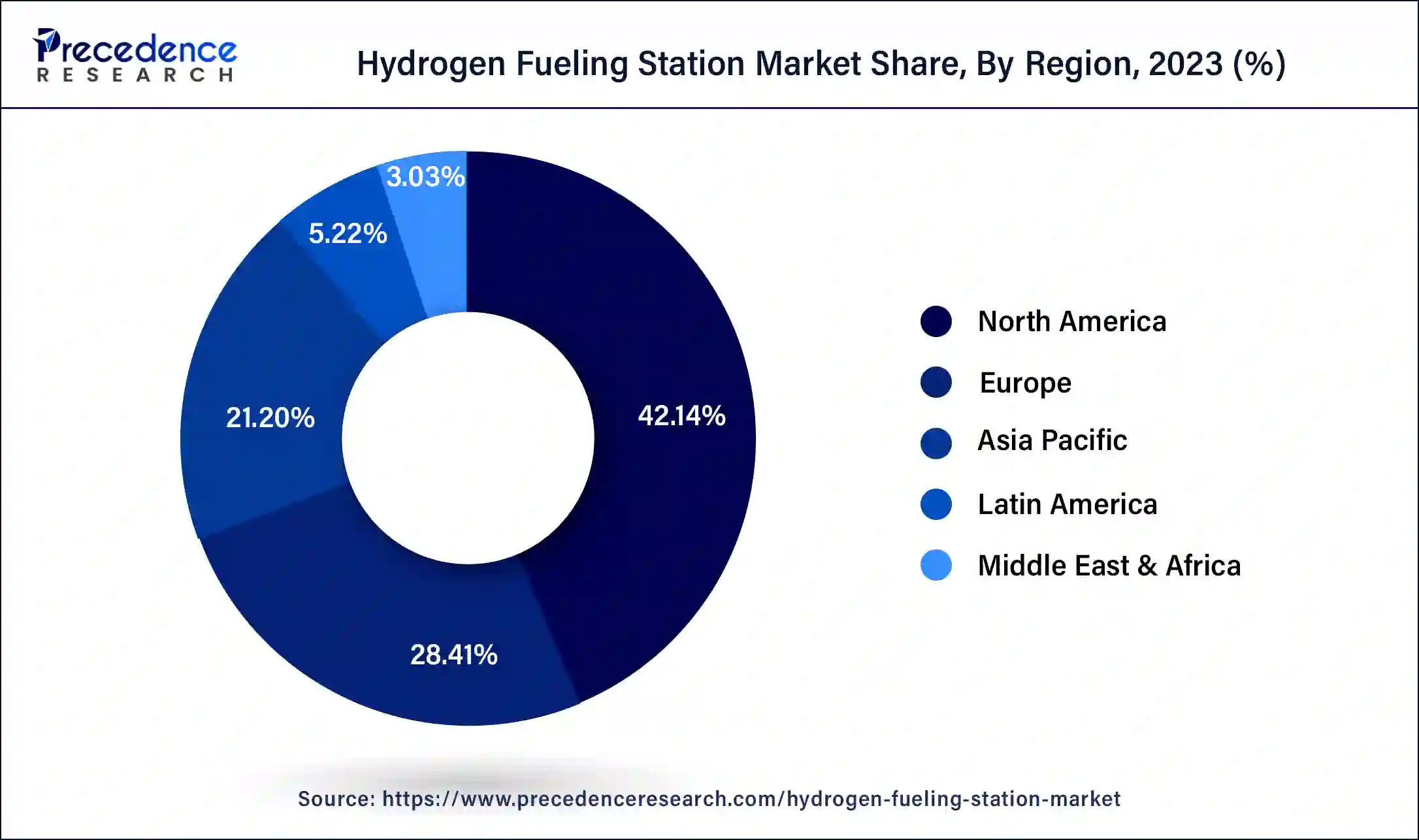

- North America dominated the global market with a revenue share of 42.14% in 2025.

- By Station Size, the small stations segment held the greatest market share 78% in 2025.

- By Supply Type, the on-site segment had the largest revenue share in 2025.

- By Pressure, the high-pressure segment is predicted to dominate the market from 2026 to 2035.

- By Station Type, the fixed hydrogen stations segment is anticipated to dominate the market from 2026 to 2035.

What is a Hydrogen Fueling Station?

A hydrogen refueling station is built with a broad range of accumulators and compressors to store and fill gaseous or liquefied hydrogen effectively. Hydrogen has emerged as an effective alternative to various fossil fuels. The rising concerns for a carbon-neutral environment and numerous initiatives from respective government authorities are enhancing the adoption of fuel cell electric vehicles (FCEVs) across various countries in the world. A usual passenger car emits around 4.6 metric tons of carbon dioxide (CO2) every year. For mitigating harmful carbon emissions, particularly in the transport sector, various governments are offering incentives, tax reliefs, and subsidies for new car buyers.

To enhance the effectiveness of hydrogen fueling stations, research and development (R&D) activities are carried out to develop innovative technologies. Some of the innovative technologies include electrolyzer-based onsite hydrogen refueling stations.

The increasing inclination towards owning a personal vehicle and rising disposable income are prominently contributing to clean vehicle sales in various developed countries. According to the data published by the U.S. Bureau of Economics, Disposable Personal Income increased by $2.13 trillion and personal income rose by about $1.97 trillion (10.5%) in April 2020. The stringent norms with respect to carbon dioxide (CO2) and the introduction of Carbon Pollution Standards by the U.S. Environmental Protection Agency (EPA) are encouraging the demand for environmentally friendly vehicles considerably.

In December 2020, California Energy Commission approved a plan that involves an investment of around $115 million. This plan is aimed to support the construction of hydrogen fueling stations. This investment is expected to support California in achieving its goal of deploying 200 public hydrogen fueling stations.

Government authorities in the United States (US), the United Kingdom (UK), Canada, South Korea, Germany, and Mexico have implemented various policies for developing H2-based fuels. To ensure a steady supply of hydrogen for clean-fuel vehicles, the South Korean government has decided to deliver 17,000 hydrogen vehicles and construct 91 hydrogen refueling stations. By mid-2021, 48 retail hydrogen fueling stations were opened in the US. Most of the hydrogen fueling stations are planned for California, 14 for the Northeastern states, and 1 for Hawaii.

The count of large hydrogen fueling stations in the US is estimated to be around 4,300 by 2030. This estimated count is around 70 times the count of operational large hydrogen fueling stations in the US in 2019.

Key AI Integration in the Hydrogen Fueling Station Industry

AI determines data from a network of sensors (pressure, temperature, and hydrogen concentration) in real-time to analyse anomalies and potential leaks immediately. AI algorithms improve the complex energy flow within a station, mainly when integrating with intermittent renewable energy sources (solar and wind). Moreover, engineers can test different operational strategies and even predict how a plant will perform under numerous scenarios (e.g., extreme weather or varying needs) before physical construction, which can decrease capital costs and operational risks significantly.

Hydrogen Fueling Station Market Outlook

- Industry Growth Overview: The hydrogen fueling station market is driven by the global drive for zero-emission transport (FCEVs), strict emission regulations, along significant government support (subsidies, strategies such as the EU Green Deal).

- Major Investors: It includes industrial gas giants such as Air Liquide, Linde, and Air Products, equipment/technology manufacturers like Nel ASA and Plug Power, energy/automotive firms such as Cummins, Sinopec, and Toyota, and emerging players in India such as Adani and NTPC.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 500.74 Million |

| Market Size in 2026 | USD 586.87 Million |

| Market Size by 2035 | USD 2,271.60 Million |

| Growth Rate from 2026 to 2035 | CAGR of 16.32% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Station Size, By Supply Type, By Pressure, By Station Type, and By Solution |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rising fuel cell vehicle adoption

As more consumers adopt fuel cell vehicles, the demand for fueling stations is observed to increase. The availability of well-developed hydrogen fueling station network provides confidence to consumers interested in purchasing fuel cell vehicles. The growth in fuel cell adoption creates a positive feedback loop for the hydrogen refueling stations market. With this adoption, the increased demand for stations attracts multiple private investments for the expansion of station networks.

The need to fuel more fuel cell vehicles drives research and development activities in the hydrogen production market, leading to advancements and cost reductions in hydrogen generation methods. Thus, the rising fuel cell vehicle adoption is observed to act as a driver for the market.

- In July 2023, Toyota announced that the company will be focusing on strategies for sales of its fuel cell trucks in Europe and China. This decision aims to push the company's sales to reach approximately 200,000 units by 2030.

Restraint

Safety concerns

Hydrogen fuel is considered when handled properly. Though, multiple safety concerns are observed to create a restraint for the market's growth. Hydrogen is highly flammable as the risk of leakage from fueling stations or during transportation poses safety concerns. Although the fueling infrastructure employs safety measures and protocols to minimize such risks. Due to safety considerations, hydrogen fueling stations need to be located away from densely populated areas and potential ignition sources. This requirement can limit suitable locations for stations. Thus, such safety concerns hinder the growth of the market.

Opportunity

Government support and initiative

Governments in several countries are focusing on offering financial support in the form of subsidies and fundings to incentivize the establishment of hydrogen fueling infrastructure. This financial assistance can help offset the high initial costs and encourage private investments. Government's support also comes in the form of clear and favorable regulatory frameworks. Such guidelines and regulations by government can bring stability in the market. Recently, many governments have started setting ambitious emission reduction targets to combat climate change. This element also brings a chance for the market to achieve substantial support from government for the production of infrastructure for hydrogen fueling purposes.

- The Chinese government stated its plans for long-term development of hydrogen-powered stations. The government has stated that China aims to bring 50,000 hydrogen-fuel vehicles on road by 2025, the plan by government also consists of the requirement for building more advanced hydrogen fueling stations in the country.

Challenge

Lack of consumer awareness

Consumer awareness plays a crucial role in shaping the demand for any product. If potential consumers are not aware of the benefits and advantages of hydrogen-powered vehicles, they are less likely to consider purchasing them. Building and operating hydrogen fueling stations require private and substantial investment. Whereas the lack of consumer awareness about hydrogen-powered applications can limit the investments in the market by investors. Consumers often hesitate to adopt new solutions, the lack of awareness and education about the benefits of hydrogen-powered vehicles can create a wrong perception for consumers. Thus, the lack of consumer awareness is observed to pose a challenge for the market.

Station Size Insights

Based on station size, the global hydrogen fueling stations market is segmented into small stations, mid-size stations, and large stations. The mid-size stations segment held the largest market share in 2023. The mid-size stations segment is predicted to grow with the highest compounded annual growth rate (CAGR) during the study period.

Supply Type Insights

Based on supply type, the global hydrogen fueling stations market is segmented into off-site and on-site. The on-site segment had the highest revenue share in 2023. The on-site segment is estimated to grow with the highest compounded annual growth rate (CAGR) during the forecast period till 2034.

Pressure Insights

By pressure, the hydrogen fuel stations market is segmented into high-pressure and low-pressure. The high-pressure segment is anticipated to dominate the market during the forecast period.

Station Type Insights

Based on the station type, the global hydrogen fuel station market is segmented into fixed hydrogen stations and mobile hydrogen stations. The fixed hydrogen stations segment is estimated to dominate the market during the study period.

Regional Insights

U.S. Hydrogen Fueling Station Market Size and Growth 2026 to 2035

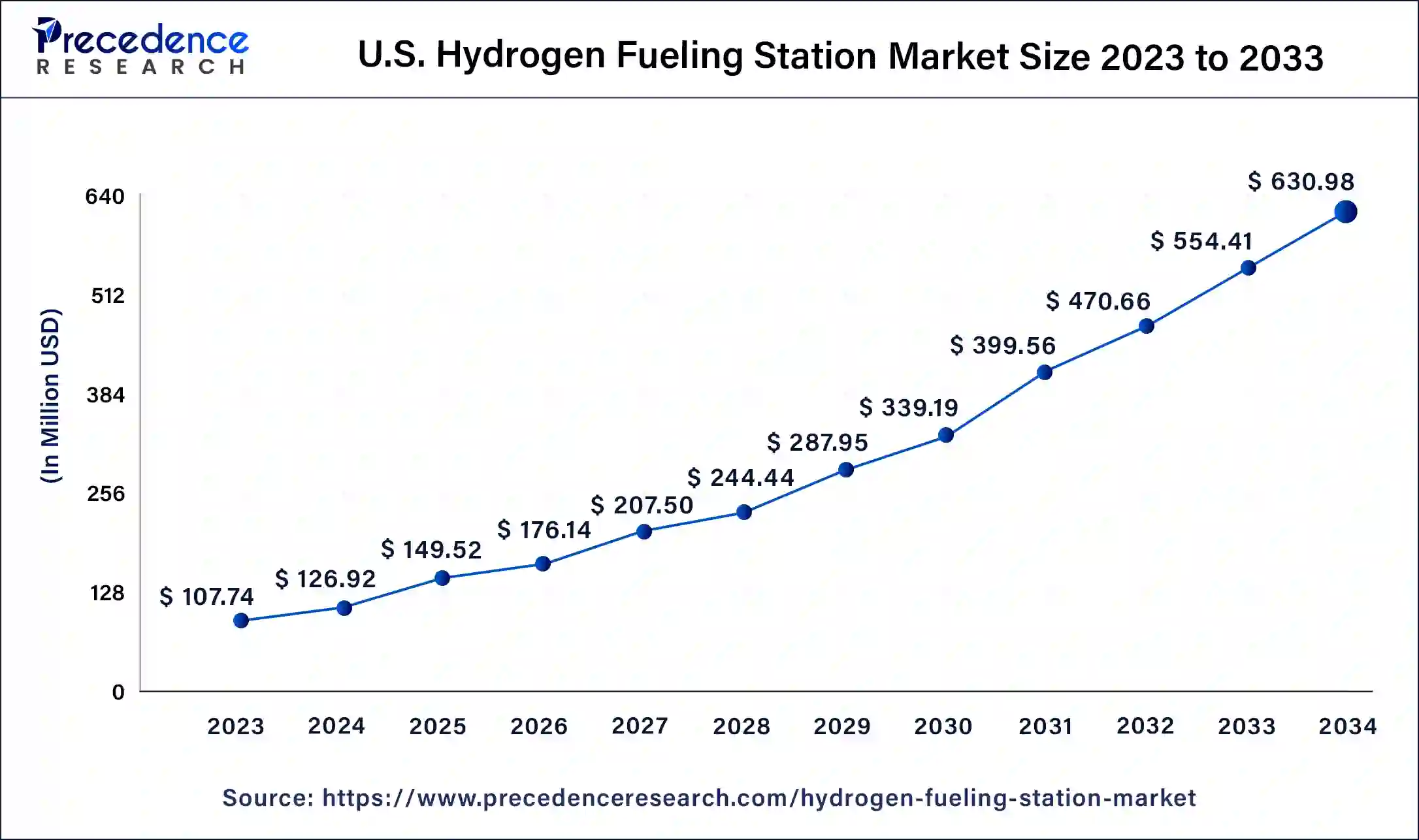

The U.S. hydrogen fueling station market size is estimated at USD 149.52 million in 2025 and is predicted to be worth around USD 712.34 million by 2035, at a CAGR of 16.90% from 2026 to 2035.

The hydrogen fueling stations market is spread across North America, Europe, Asia Pacific (APAC), the Middle East and Africa, and Latin America. North America (NA) held a high share of the global hydrogen fueling stations market in 2025. In 2023, the United States held the highest share followed by Canada and Mexico. Considering the presence of nations with lucrative economic policies, high gross domestic product (GDP), and early adoption of the latest hydrogen fuel station technologies, the North American hydrogen fueling stations market is anticipated to grow remarkably.

The U.S. Department of Energy launched H2USA for hydrogen infrastructure. H2USA is a public-private collaboration with automakers, federal agencies, fuel cell developers, hydrogen providers, national laboratories, and other stakeholders. H2USA is mainly focused to advance hydrogen infrastructure and providing more transportation energy alternatives for U.S. consumers.

The European hydrogen fueling stations market is segmented into France, Germany, the United Kingdom (UK), Italy, and the Rest of Europe. Germany is estimated to hold the highest share of the European hydrogen fueling stations market during the study period. In May 2020, the government of France announced an aid package of $8.8 billion (€8 billion) to support the automotive sector. This aid package was intended to help the automotive sector in recovering from the adverse effects of the pandemic of COVID-19.

European Union (EU) states have agreed to construct hydrogen fueling stations across all major cities. In March 2023, the European Parliament and the Council of Ministers reached a political agreement on the regulations for deploying alternative fuel infrastructure. A hydrogen fueling station will be built at least every 200 kilometers along the core Trans-European Transport Network (TEN-T).

The hydrogen fueling stations market in the Asia Pacific (APAC) region is segmented into China, India, Japan, South Korea, and the rest of the Asia Pacific (APAC) region. In 203, China dominated the Asia Pacific (APAC) hydrogen fueling stations market followed by Japan and India.

Latin America, Middle East, and African (LAMEA) hydrogen fueling stations market is segmented into South Africa, Saudi Arabia, North Africa, Brazil, Argentina, and the Rest of LAMEA. The Latin America region is expected to account for considerable growth in the hydrogen fueling stations market during the forecast period. In 2023, Brazil had the highest market share in the LAMEA hydrogen fueling stations market region. Owing to low literacy, uncertainty, and unfavorable conditions in African countries, the hydrogen fueling stations market in the African region is predicted to grow at a slower rate.

Value Chain Analysis of the Hydrogen Fueling Station Market

- Resource Extraction

It involves processing abundant source materials such as natural gas and water through numerous thermal or electrolytic methods. The resulting hydrogen is now purified, stored, and transported to the fueling stations. - Distribution Network Management

It includes a complex system of planning, logistics optimization, infrastructure selection (pipelines, trucks), and even integration with existing energy networks.

Top Companies in the Hydrogen Fueling Station Market & Their Offerings

- Linde Engineering: Linde Engineering provides a comprehensive, "one-stop-shop" for hydrogen fueling stations, offering everything from core compression technologies and even storage to full station design and mobile solutions, funding both gaseous and even advanced liquid hydrogen refueling for numerous vehicles, from cars to heavy trucks, ensuring efficient, safe, along scalable deployment for the rising hydrogen mobility market.

- McPhy Energy S.A.: McPhy Energy provides complete, integrated solutions for hydrogen fueling, offering everything from hydrogen production and even storage to the fueling stations themselves, including small-scale and large-capacity McFilling lines for cars, buses, and fleets, aiming for low-carbon mobility, energy efficiency, safety, and also supporting the energy transition for communities and businesses.

Hydrogen Fueling Station Market Companies

- AIR LIQUIDE

- Air Products and Chemicals, Inc.

- Beijing PERIC Hydrogen Technologies Co.

- Chart Industries

- Hydrogen Refueling Solutions

- Linde Engineering

- McPhy Energy S.A.

- Nel Hydrogen

- Powertech Labs Inc.

- Praxair, Inc.

Recent Developments

- In July 2022,The New South Wales and Victorian governments planned an expenditure of $20 million for hydrogen refueling stations in the country. To promote zero-emission technology for heavy vehicles, the New South Wales (NSW) and Victorian governments announced that at least 4 hydrogen refueling stations will be constructed along the 840 kilometers long Hume Highway between Melbourne and Sydney. Both these governments have decided to spend $10 million each for this hydrogen refueling station project.

- In February 2021,Naturgy Energy Group, a top multinational electrical energy, and natural gas company announced its plan to construct hydrogen refueling stations across the country. During the 1st phase, Naturgy Energy Group has planned to construct 38 hydrogen refueling stations across the nation by 2025. In the 2nd phase of the project, the company would build 82 more hydrogen refueling stations.

Segments Covered in the Report

By Station Size

- Small Stations

- Mid-Size Stations

- Large Stations

By Supply Type

- Off-Site

- Liquid

- Gas

- On-Site

- Steam Methane Reforming (SMR)

- Electrolysis

By Pressure

- High Pressure

- Low Pressure

By Station Type

- Fixed Hydrogen Stations

- Mobile Hydrogen Stations

By Solution

- Engineering Procurement and Construction (EPC)

- Components

- Compressors

- Dispensers

- Dispensing Chiller Systems

- Hydraulic Power Units and Controls

- Hydrogen Inlets

- Storage Units

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting