What is the Punnet Packaging Market Size?

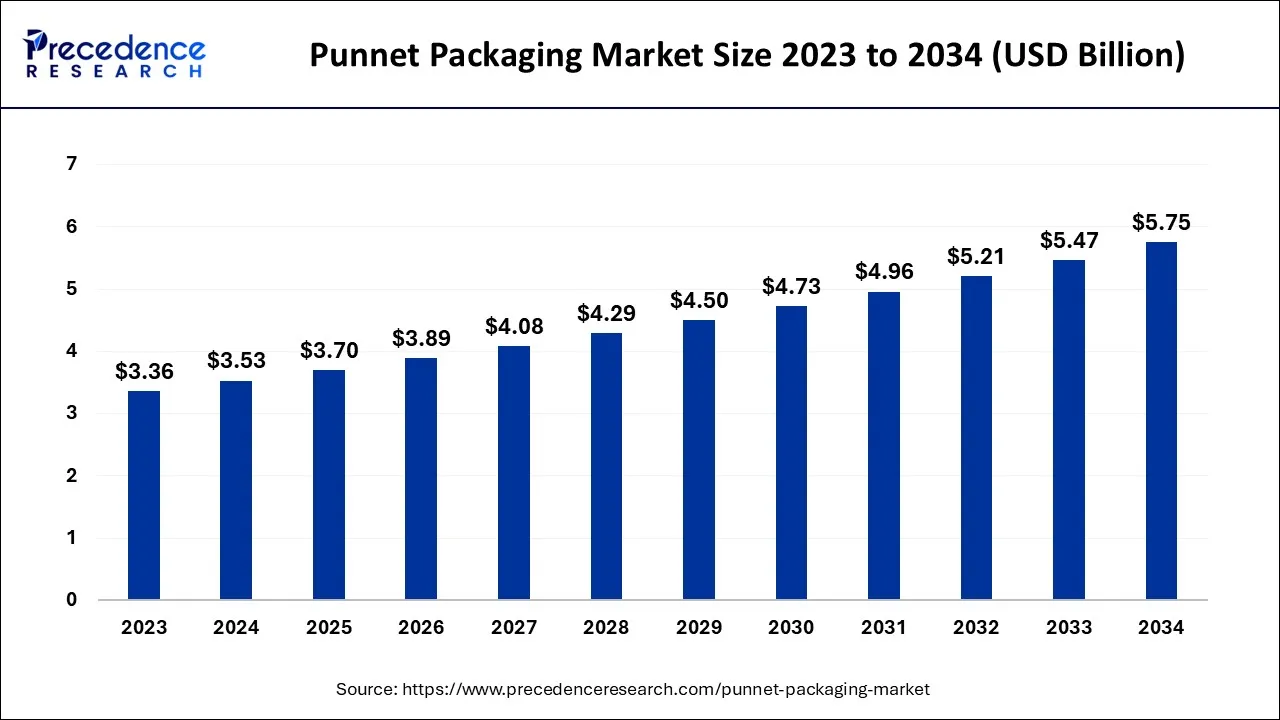

The global punnet packaging market size is calculated at USD 3.70 billion in 2025 and is predicted to increase from USD 3.89 billion in 2026 to approximately USD 6.02 billion by 2035, expanding at a CAGR of 4.98% from 2026 to 2035.

Punnet Packaging Market Key Takeaways

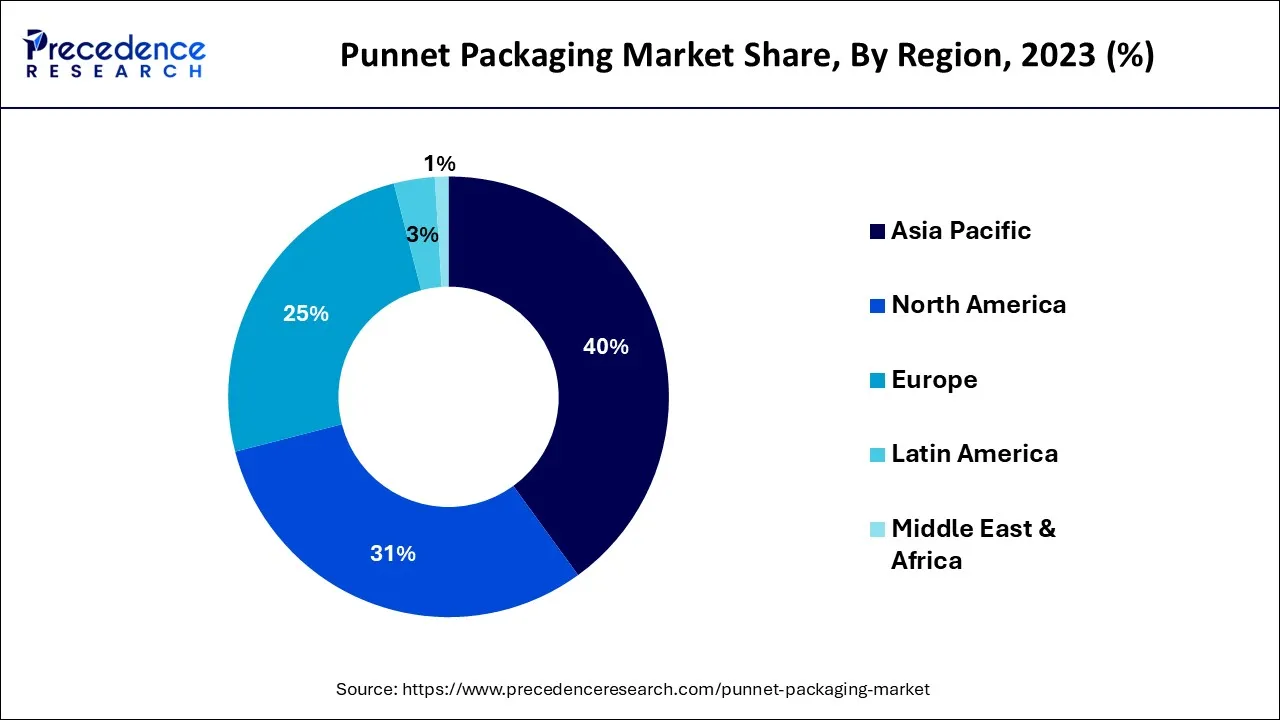

- Asia-Pacific dominates the global market, and the region will see substantial growth during the forecast period.

- By material, the plastic packaging segment led the market.

- By capacity, the market for punnet packaging was dominated by containers with a capacity of 301 to 500 grams.

- By application, the fruits and vegetables segment led the application segment in the market.

Market Overview

The global punnet packaging market revolves around the production, design, and distribution of packaging solutions in a compact box form. Punnets, small baskets, are utilized to pack soft vegetables and fruits like grapes, berries, mushrooms, cherries, and others. Punnet packaging increases the shelf life of soft fruits and vegetables by reducing bruising, squashing, and spoiling. Punnet packaging can be divided into several categories depending on the type of material used, such as paper, plastic, or molded fiber. Punnets made of plastic are often used for packaging fresh soft fruits practically. The producers are concentrating on creating recycled plastic punnets as a secure replacement for effectively storing food and fulfilling legal requirements for product safety.

Punnet Packaging Market Growth Factors

Punnet packaging is expanding because of its recyclable qualities and convenience, reversing the worldwide trend away from traditional packaging. The market is expected to grow due to the rising demand for punnet packaging for horticultural output. The conventional polypropylene punnet packaging for mushroom storage is being replaced by R-PET or recyclable polyethylene films and polypropylene thin gauge sheets, which can lessen their environmental impact.

The market for punnet packaging is anticipated to be driven by the rising demand for paper and fiber punnets as alternatives to plastic punnets for food product packaging. Punnet packing is also a cost-effective packaging method due to its cheap disposal costs, minimal inventory requirements, and simple packaging procedure. The market for punnet packaging is driven by punnet packaging's ability to decrease food product damage during transit.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.70Billion |

| Market Size in 2026 | USD 3.89 Billion |

| Market Size by 2035 | USD 6.02Billion |

| Growth Rate from 2026 to 2035 | CAGR of 4.98% |

| Largest Market | Asia-Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Material, By Capacity, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

The rising demand for sustainable alternatives to plastic packaging

Bans on plastic packaging are becoming more prevalent across the globe. For instance, plastic wrapping for fruits and vegetables will be gradually prohibited in France over the next few years. It is anticipated that other European nations will soon follow France's lead in light of the EU guidelines. Additionally, there is a growing market need for environmentally friendly packaging.

To meet this growing need, Smart Packaging Solutions created sustainable punnets. The demand for environmentally friendly consumer packaging is rising, and our innovative fruit and vegetable punnets are the answer. The use of lightweight solid cardboard ensures robust and sturdy packaging, and it is the perfect choice for packing plums, berries, tomatoes, pears, brussels sprouts, and other fruits and vegetables.

Optimal protection offered by punnet packaging

The journey from gardener to consumer of fruits and vegetables is long. Fruits and vegetables are fully safeguarded possible throughout the entire supply chain because of the use of lightweight cardboard and the packaging's design. Consequently, they reach the consumer unharmed, and no goods are lost enroute. Therefore, punnet smart packaging solutions are also observed to reduce food waste. The punnets also resist dampness and maintain their strength. As a result, the punnets are ideal for storing items that naturally retain a lot of moisture in humid environments, such as refrigerators.

Restraint

Slower adoption of technological advancements and the growing cost of raw materials

One of the primary basic materials for food packaging is the punnet. PET plastic, which is clear, light, semi-rigid, and has lockable caps, is used for punnet packaging. These raw materials' fluctuating prices impact the punnet packaging industry. The cost of these raw materials is also rising due to laws the government and groups have set around resource conservation, preventing the punnet packaging market from expanding. The lack of readily available raw materials hinders technological growth in punnet packaging solutions. Many new packaging technologies are becoming costly because of the high cost of raw materials, and enterprises have to rely on conventional packaging, which adversely affects the environment and the economy.

Opportunity

Growing demand for exotic packaging of fruits and vegetables

Due to the increasing population and personal discretionary income, there is a growing need for exotic packaged vegetables and fruits, driving up the price of punnet packing. The need for vegetables and fruits has increased due to consumers looking for nutrient-dense foods that are better for their diets. To meet the rising demand for vegetables and fruits, many economies import products from other producing nations, which promotes the expansion of punnet packaging companies. Additionally, new fruit varieties and flavors are piquing the curiosity of European consumers. Most imported goods increase the market value of exotic fruit in Northern Europe. More exotics with a higher value are imported annually than imports. The need for packaging is rising as the market steadily grows. As a result, the punnet packaging market is driven by the increasing demand for exotic fruits and vegetables.

Segment Insighst

Material Insights

The punnet packaging market is dominated by the plastic packaging segment. PET and polypropylene are the two most common materials used to make plastic punnets worldwide. Multiple prominent market players are focused on the development of plastic punnet packaging solutions to sustain the competition. For instance, a leading producer of fruit packaging solutions, INFIA Srl, provides a variety of plastic punnets produced from recycled PET and Polypropylene. Many people use plastic punnets as an easy method for storing fresh food. Although they are made of many types of plastic and are not recyclable, it is challenging for customers to recycle them. Additionally, plastic punnets have a shorter shelf life since they cannot absorb moisture from food like fruit.

On the other hand, the increasing awareness about the severe hazards caused due to plastic material will accelerate the penetration of paper material punnet packaging in the global market. Punnets made of paper are a great substitute that combines sustainability, function, and design, which will promote the segment's growth during the forecast period.

Capacity Insights

The market for punnet packaging was dominated by containers with a capacity of 301 to 500 grams. It is used since most retail chains offer leafy greens in cans that can accommodate 400 g of berries, other soft fruits, and up to 150 g of leafy vegetables. Furthermore, a sizable market growth rate is predicted for the 150-300 gm category. The majority of vegetables and fruits that are fresh are packaged in these two volume sizes. Numerous plastic punnets are additionally provided by well-known companies in various packing sizes.

Application Insights

The fruits and vegetables segment held the largest share of the market in 2023; the segment will continue to grow at a significant rate during the forecast period. Fruits and vegetables are highly perishable products that require safer packaging solutions. By utilizing punnet packaging solutions for fruits and vegetables, it is possible to protect them from transport hazards, microbial damage, and insect damage. Punnet boxes are capable of enhancing the shelf life of fruits and vegetables. The rising emphasis on packaged fruits and vegetables and the growing e-commerce sales of fruits and vegetables will supplement the segment's growth during the predicted timeframe.

On the other hand, the poultry segment is expected to be the most lucrative segment of the market. Poultry products such as eggs require firm protection from external damage, micro-organisms, and other predators present in nature. In addition, poultry products are temperature sensitive. At the same time, punnet packaging solutions offer perfect protection for such delicate products during logistics and transportation. The rising penetration of online grocery shops has made poultry products available online; this factor is observed to highlight the growth of the segment.

Regional Insights

Asia Pacific Punnet Packaging Market Size and Growth 2026 to 2035

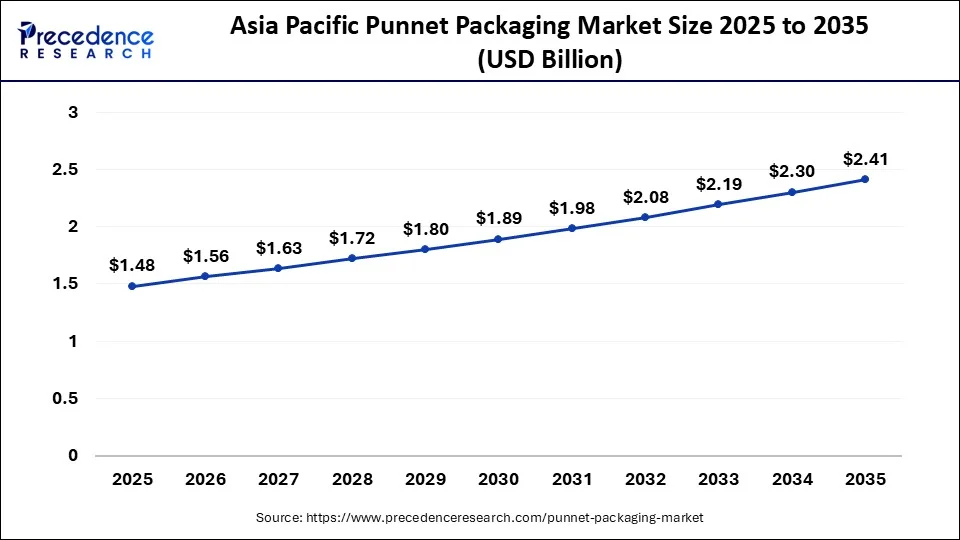

The Asia Pacific punnet packaging market size is exhibited at USD 1.48 billion in 2025 and is projected to be worth around USD 2.41 billion by 2035, growing at a CAGR of 5% from 2026 to 2035.

How is the Remarkable Dominating Position of the Asia Pacific in the Punnet Packaging Market in 2025?

Asia-Pacific dominated the punnet packaging market in 2025,and the region will see substantial gains during the forecast period. This is because of rising urbanization, industrialization, globalization, and the expansion of the packaging industry. China, India, Malaysia, and Japan will emerge as significant contributors from this region owing to the increased application of punnet packaging by the food and beverages industry. The rising emphasis on packaged vegetables and fruits in the region promotes the growth of the punnet packaging market.

India Punnet Packaging Market Trends

India is progressing through sustainability and regulatory shifts, including the adoption of eco-friendly materials and the implementation of the circular economy. There is a rapid shift of Indian consumers towards ready-to-eat food. Emerging consumer preferences for convenient and safe packaging formats are further supporting this trend.

In May 2025, India launched a national packaging innovation challenge to redefine its packaging sector, which aims to strengthen its export capabilities and align with global sustainability trends.

What Factors Drive North America's Fastest-Growing Lead in the Punnet Packaging Market?

North America's punnet packaging market is anticipated to experience stable revenue growth throughout the forecast period because established retail chains sell fresh vegetables in elaborate packing configurations like punnets. Proper packaging is necessary to ensure that the delivered product is adequately protected.

U.S. Punnet Packaging Market Trends

The U.S. supports the integration of smart technologies, sustainability, and plastic-free initiatives. E-commerce and direct-to-consumer sales of fresh produce are also influencing packaging choices. As grocery delivery and online orders grow, punnets that offer sturdy protection and clear visibility help maintain product quality during transit and enhance the unboxing experience.

- In July 2024, the Biden-Harris Administration invested up to $1.6 billion to create and boost domestic capacity for advanced packaging. The federal and national programs aim to combat plastic pollution, while the reuse and retail initiative aims to design scalable reuse systems for retail.

How is Europe Growing Notably in the Punnet Packaging Market?

Europe is expected to experience notable growth during the forecast period, driven by the expansion of retail and e-commerce, government regulations, and increasing consumer demand for fresh products. The new EU regulation in support of the European Commission aims to promote the procurement of sustainable packaging.

What are the Major Factors Contributing to the Punnet Packaging Market within South America?

South America is expected to experience significant growth during the forecast period due to the expansion of fresh food exports, health and lifestyle shifts, and a surge in poultry and meat demand. The extended producer responsibility (EPR) programs for packaging in South America aim to manage, fund, and collect the packaging waste in 6 nations.

What Opportunities Exist in the Middle East and Africa in the Punnet Packaging Market?

MEA is expected to grow at a lucrative rate in the market in the coming years, driven by the emerging material trends associated with paper, fiber, and smart packaging, and retail modernization. The major government programs are launched by the regional countries, like South Africa, including export-ready punnets and the plastic reboot project.

- In January 2024, the Public Investment Fund (PIF) announced the acquisition of a 23.08% stake in the Middle East Paper Company (MEPCO), which is a leader in the manufacturing and recycling of paper-based products.

Punnet Packaging Market - Value Chain Analysis

- Raw Material Sourcing (Plastic, Paper, Glass, etc.)

This stage is accelerated by the increased shift towards recycled polyethylene terephthalate (rPET), molded fiber, and sustainable paperboard.

Key Players: Amcor Plc, Berry Global, INFIA S.r.l., AVI Global Plast, Groupe Guillin, Smurfit Kappa Group, Mondi Group. - Logistics and Distribution

The emerging trends in this stage are traceability, smart labelling, automation, shelf-ready and vented designs, and the expansion of e-commerce.

Key Players: Smurfit Kappa, Amcor, Berry Global, Mondi Group, Coveris, AVI Global Plast, Huhtamaki, DHL Service Point. - Recycling and Waste Management

This stage is transitioning due to regulatory shifts, sustainable alternatives, and digital traceability.

Key Players: Smurfit Kappa, Veolia, Mondi Group, Berry Global, AVI Global Plast, Huhtamaki.

Punnet Packaging MarketCompanies

- Coveris Holdings SA

- LC Packaging International BV

- Smurfit Kappa Group Plc.

- Groupe Guillin SA

- Leeways Packaging Services Ltd.

- Paccor Netherlands BV

- Tacca Industries Pty Ltd.

- InfiaS.r.l.

- Raptis Pax Pty Ltd.

- Alta Global

Recent Developments

- In August 2025, Coveris Holdings SA introduced sustainable packaging innovations, such as next-generation plastic and paper packaging in the FachPack 2025 exhibition. A broad spectrum of applications in the food, beverage, logistics, and supply chain sectors are served through these innovations.

(Source: coveris.com ) - In October 2024, LC Packaging International BV reported the energy efficiency and carbon footprint reduction training initiative at Dutch-Bangla Pack Ltd. (DBPL). The initiative is aims to advance sustainability and promote clean energy within its operations.

(Source: lcpackaging.com ) - In February 2022,the UK government enacted The Plastic Packaging Tax, and took effect. According to the new regulation, a fee of £200 per tonne will be applied to any plastic packaging imported or produced into the UK that contains less than 30% recycled plastic. A plastic packaging element will also be assumed to have less than 30% recycled plastic unless the opposite can be demonstrated. PET punnet manufacturer and exporter AVI Global Plast introduced ready-to-adopt rPET or recycled PET punnets with 30% post-consumer recycled content, generally recycled bottles, which was verified by international certification and testing company InterTek, to assist customers in aligning with the upcoming strict tax system. All of these punnets are recyclable.

- In November 2022,Nespak, a member of the Guillin Group dedicated to sustainability, introduced Securipack, a cutting-edge plastic punnet with built-in tamper evidence. For individuals searching for packaging which combines security, aesthetics, use, and sustainability, Securipack offers a new choice. It is a fresh punnet made of rPET with a seal button and is entirely recyclable. The bag may travel everywhere, including the office, the classroom, and the vehicle. The seal breaks when the punnet is initially opened, but the movable top makes it simple to shut it again. The lid is kept attached to the punnet after it has been extended to keep it from lying around and damaging the environment. The device has an excellent design, is simple to operate, and is very visible.

- In January 2023,The Future line of packaging solutions from Solidus, which comprises modified atmosphere packaging (MAP), skin packaging, and punnets, received an investment of €11 million. The product line was already introduced in Benelux, Germany, France, Poland, the United Kingdom, and Spain. According to the business, its MAP and skin packaging solutions utilize at least 80% less plastic, which can be readily separated to allow its paper-based materials to be recycled after use. The trays enable the switch from plastic to packaging made of paper with just minor modifications to the machinery already in use for packaging. Skin packaging is a cost-effective alternative to other methods because it employs deep vacuum technology to extend the product's shelf life and reduce the demand forprotective packagingfillers.

Segment Covered in the Report

By Material

- Paper

- Plastic

By Capacity

- 150 gm

- 151-300 gm

- 301-500 gm

- over 500gm

By Application

- Vegetables And Fruits

- Frozen Food

- Poultry

- Meat And Sea Food

- Ready-To-Eat Food

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting