Radioimmunotherapy Market Size and Forecast 2025 to 2034

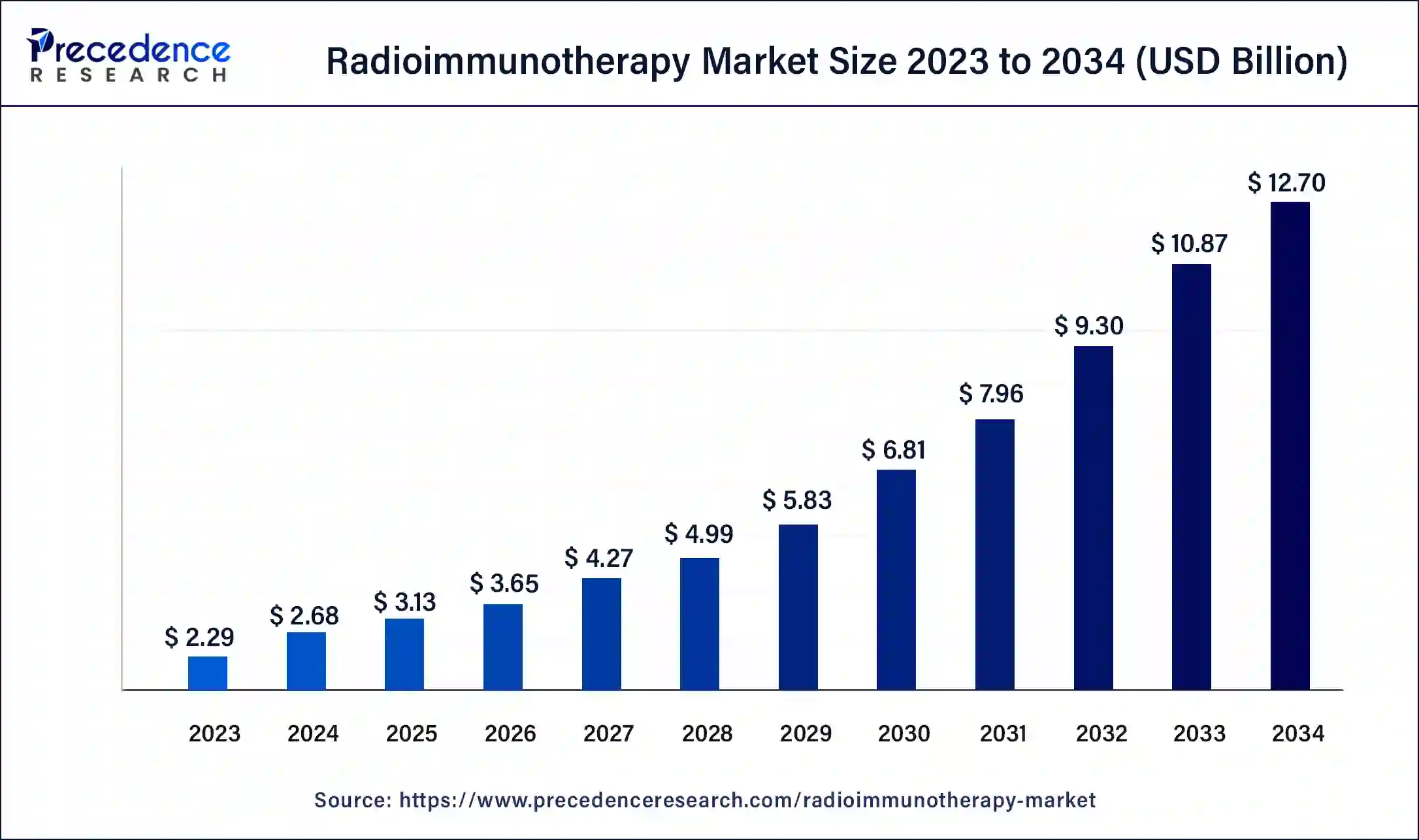

The global radioimmunotherapy market size accounted at USD 2.68 billion in 2024 and is predicted to surpass around USD 12.70 billion by 2034, growing at a CAGR of 16.83% during the forecast period 2025 to 2034. The radioimmunotherapy market growth is attributed to increasing demand for advanced cancer treatments.

Radioimmunotherapy Market Key Takeaways

- The global radioimmunotherapy market was valued at USD 2.68 billion in 2024.

- It is projected to reach USD 12.70 billion by 2034.

- The radioimmunotherapy market is expected to grow at a CAGR of 16.83% from 2025 to 2034.

- North America dominated the global radioimmunotherapy market in 2024.

- The Asia Pacific is projected to host the fastest-growing market in the coming years.

- By indication, the non-Hodgkin lymphoma segment held a significant presence in the market in 2024.

- By indication, the leukemia segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034.

- By target antigen, the CD20 segment accounted for a considerable share of the market in 2024.

- By target antigen, the CD19 segment is anticipated to grow with the highest CAGR in the market during the studied years.

- By radioisotope, in 2024, the iodine-131 segment led the global market.

- By radioisotope, the yttrium-90 segment is projected to expand rapidly in the market in the coming years.

- By administration route, the intravenous segment dominated the global market in 2024.

- By administration route, the intraperitoneal segment is projected to grow at the fastest rate in the market in the future years.

Impact of Artificial Intelligence on Radioimmunotherapy Market

The technological advance paved the way for the enhancement of recognizing patterns and trends in big data sets, which are crucial in the radioimmunotherapy market. They are most relevant to drug discovery and development, where AI helps identify new therapeutic targets and predict patients' responses. AI leads to improvements in practical performances, gaining time, cutting expenses for clinical trials, and obtaining the approvals of relevant authorities. Additionally, the integration of technology is accelerating at a very fast rate as companies take advantage of AI to stand out and improve patients' statuses.

Market Overview

The growing availability of radioimmunotherapy solutions for cancer and other harmful diseases creates novel demand for the radioimmunotherapy market services. These new approaches of using radiation therapy in combination with immunotherapy involve the effective use of monoclonal antibodies combined with radioactive isotopes that effectively target the cancerous cells only with minimal effects on the other normal cells. The National Cancer Institute has described radioimmunotherapy as especially beneficial for the treatment of such types of cancer as non-Hodgkin's lymphoma and other variations of leukemia. Furthermore, the increasing FDA approvals of other new radioimmunotherapy drugs show the increasing trend of using this technology in the oncology field. According to the WHO, the global burden of cancer and the lack of available treatment options for cancers are boosting radioimmunotherapy, supported by regulatory policies and governmental support in the research of this technology.

Radioimmunotherapy Market Growth Factors

- Rising Demand for Personalized Medicine: Increased emphasis on personalized treatment plans is likely to boost the adoption of tailored radioimmunotherapy solutions.

- Technological Advancements in Imaging Techniques: Innovations in imaging technologies enhance the precision of radioimmunotherapy, contributing to market growth.

- Increased Funding for Cancer Research: Growing government and private funding for cancer research is expected to drive the development of new radioimmunotherapy products.

- Expansion of Clinical Trial Programs: The rise in clinical trials exploring radioimmunotherapys efficacy and safety will likely promote market expansion.

- Growing Awareness and Education About Radioimmunotherapy: Increased awareness among healthcare professionals and patients about the benefits of radioimmunotherapy is expected to drive market growth.

- Emergence of New Radioisotopes: The development of novel radioisotopes with improved therapeutic efficacy is anticipated to enhance the market.

- Enhanced Regulatory Support for Innovative Therapies: Favorable regulatory policies for the approval of new therapies are likely to accelerate the introduction of advanced radioimmunotherapy options.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 12.70 Billion |

| Market Size in 2025 | USD 3.13 Billion |

| Market Size in 2024 | USD 2.68 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 16.83% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Indication, Target Antigen, Radioisotope, Administration Route, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

The growing prevalence of cancer is driving demand for radioimmunotherapy

The growing prevalence of cancer is projected to drive the demand for the radioimmunotherapy market in the coming years. The incidence of cancer continues to rise, especially lymphoma and leukemia, creating the need for the use of targeted therapy products that embody the features of monoclonal and destructive radiation. With the higher number of cancer instances in patients, medical practitioners are likely to use radioimmunotherapy. This treatment gives the patients better management than before, especially when conventional treatments do not work. Furthermore, the availability of advanced therapies for cancer, such as radioimmunotherapy, facilitates increasing survival.

- The WHO has estimated that the cancer incidence is projected to increase by 47% from 2020 to 2040. It is estimated that there are about 5 million new cases annually.

Restraints

Limited reimbursement policies

Limited reimbursement policies are anticipated to restrain the growth of the radioimmunotherapy market. Insurance companies and other healthcare providers tend to set strict insurance eligibility criteria for applying ATs, including radioimmunotherapy. Of the numerous conclusions that the American Society of Clinical Oncology (ASCO) has made, one is that most insurance plans fail to cover the costs of new expensive treatments, which translate to patient costs. This financial burden hinders patients and even medical practitioners from opting for these therapies, hence restraining growth in the market. Furthermore, the non-uniformity of the reimbursement policies in different areas and the time-consuming procedures required for approval of insurance coverage restrict the availability of these treatments.

Opportunity

Increasing investment in research and development

Increasing investment in research and development (R&D) is expected to create immense opportunities for the players competing in the radioimmunotherapy market. The drug makers and the research bodies are investing a lot of money into the research and development of new radioisotopes and the proper functioning of the conjugation process. This flow of funds helps to come up with new and unique radioimmunotherapy treatments and enhances the performance and safety standards of the developed therapeutic methods. Moreover, influenza and improvements in imaging and biomarkers facilitate radioimmunotherapy accuracy and precision.

- According to the report, estimated oncology R&D spending worldwide will reach USD 72 billion by 2025.

Indication Insights

The non-Hodgkin lymphoma segment held a significant presence in the radioimmunotherapy market in 2024 due to the high incidence rate of NHL. Non-Hodgkin lymphoma is described by the National Cancer Institute (NCI) as the most prevalent type of lymphoma, whose incidence is projected to reach 80,000 in the United States in 2024. Radioimmunotherapy has been useful in the management of different subtypes of NHL, especially when standard treatments are rewarding. Radioimmunotherapy agents such as Y-90 ibritumomab tiuxetan have been found to be acceptable in clinical trials.

The leukemia segment is expected to grow at the fastest rate in the radioimmunotherapy market during the forecast period of 2024 to 2034, owing to the growing frequency of leukemia and enhanced treatment methods that yield better results for the patients. The therapeutic use of radioimmunotherapy has demonstrated a lot of potential in managing leukemia, especially in ALL and CLL. New treatment approaches combined with the application of further refined methods of targeting further improve the prospects of radioimmunotherapy with leukemia. Furthermore, there is a growing emphasis on specialty coatings.

- According to the American Cancer Society (ACS) estimates, 62,000 new leukemia patients detected in the United States in 2024.

Target Antigen Insights

The CD20 segment accounted for a considerable share of the radioimmunotherapy market in 2024 due to the effectiveness of CD20-targeted treatments in formulating B-cell malignancy, especially non-Hodgkin's lymphoma, and types of leukemia. The CD20 antigen is a cell surface protein found on B-cells and is proven to be a promising target for radioimmunotherapy, as the uniformity of the antigen across almost all the B-cell malignancies. Y-90 Ibritumomab tiuxetan and I-131 tositumomab used in the treatment of CD20 B-Cell have been reported by the NCI to have good clinical benefits in the management of tumors and patient treatment. These treatments have a well-established clinical basis and large amounts of data from clinical trials as to their efficacy. The high response rates have been observed with CD20-targeted therapies, as well as their acceptable safety profile.

The CD19 segment is anticipated to grow with the highest CAGR in the radioimmunotherapy market during the studied years, owing to the novel treatments involving the therapies aimed at the CD19 antigen becoming more developed and utilized in clinical practice for the treatment of B-cell malignancy, including ALL and CLL. CD19 is highly specific to B cells, wherein about 95 percent of B cells bear the receptor, making it easier to target affected cells with high efficiency. The new strategies, such as CAR-T cell and radioimmunotherapy that utilize CD19 targets, have shown wondrous outcomes and elevated complete remission in clinical trials. According to the ACS, new therapies directed at CD19, including the newly developed radioimmuno conjugates and engineered T-cells, seem effective, additionally, with additional advancement of CDs19-targeted treatments receiving the respective research and regulatory approval.

Radioisotope Insights

The iodine-131 segment led the global radioimmunotherapy market due to its properties of iodine-131. Iodine-131 has been long-established and is recommended as the most effective therapy for thyroid cancer and specific types of lymphoma. Iodine-131 gives out radiation, which is selectively absorbed by thyroid cells since they have an affinity for thyroid tissue and hence have a high ratio of tumor-killers to normal tissue killers. The NIH says that Iodine-131 therapy has been widely used for thyroid cancer treatment for several decades and that it has proved to be clinically effective in patients, particularly in the management of the size of the tumor and overall survival.

The yttrium-90 segment is projected to expand rapidly in the radioimmunotherapy market in the coming years, owing to the increased usage of Yttrium-90 for treating different types of cancers, including non-Hodgkin lymphoma and liver cancer. Yttrium-90 produces beta radiation that penetrates deeply into the tissue and, therefore, is suitable in the treatment of larger or more diseased tumors. New development of Yttrium-90-based treatment regimes has made better Y-90 ibritumomab tiuxetan, which has given a better prognosis with a high response percentage and prolongation of progression-free survival. Yttrium-90 has also emerged as a treatment agent in clinical trials that aims at effectively managing hard-to-treat cancers, according to the NCI. Furthermore, the continuous emergence of new Yttrium-90-based therapies and additional evidence proving the efficiency of radioisotopes are expected to fuel the segment.

Administration Route Insights

The intravenous segment dominated the global radioimmunotherapy market in 2024, as therapeutic agents are administered directly into the blood vessels, whereby they will circulate in the body to the various tissues. IV administration is especially useful for treating systemic malignancies, such as non-Hodgkin lymphoma, and certain types of leukemia since it guarantees that the agents get to the cancerous cells spread throughout the body. According to the NCI, intravenous infusion is widely practiced in clinical settings and was the standard way of delivering numerous radioimmunotherapy agents. These features include the fast delivery of high doses of therapeutic agents and compatibility with various cancer treatments.

The intraperitoneal segment is projected to grow at the fastest rate in the radioimmunotherapy market in the future years. This technique is particularly beneficial in the management of malignancies that are limited to the peritoneal cavity. Intraperitoneal administration entails administering the therapeutic agent into the peritoneum where the tumor cells are found, hence offering high selectivity and minimal system toxicity. New developments have shown in several clinical trials that this method has improved effectiveness and local tumor control in patients. IPO for ovarian cancer shows encouraging outcomes from techniques such as intraperitoneal administration. Clinical trials are ongoing, which has increased the interest in this method.

Regional Insights

North America dominated the global radioimmunotherapy market in 2024 due to the better healthcare facilities, paramount investment in cancer research, innovation, and adoption of innovative treatment across the region. Radioimmunotherapy has been developed and used in the United States, particularly with support from reputable institutions, such as the National Cancer Institute (NCI).

As the data from the CDC indicates, the expenses for cancer treatment in the U.S. remain one of the highest in the world, contributing to the process of incorporating new therapeutic methods. Furthermore, there is a strong population of cancer centers and a high healthcare expenditure.

| Year | U.S. New Cancer Cases (in Million) | U.S. Prevalence Rate (Per 100000) |

| 2020 | 1.8 | 566 |

| 2021 | 1.9 | 563 |

| 2022 | 2 | 570 |

| 2023 | 2.1 | 577 |

| 2024 | 2.2 | 584 |

The Asia Pacific is projected to host the fastest-growing radioimmunotherapy market in the coming years, owing to the rapidly growing healthcare industry in the region, rising cancer incidence rates, and high investment in cancer research. The report published by the World Health Organization reveals that cancer incidence rates in the Asia Pacific are likely to increase in the future due to increasing population and aging factors.

The governments of the Asia Pacific are also increasing investments in the development of the healthcare industry and increasing access to specialized treatments, which strengthens the market growth. Furthermore, increased investment in research and development in countries such as China and India for the development of new therapies for cancer is improving the rate of adoption of new therapies.

Radioimmunotherapy Market Companies

- AbbVie

- Amgen

- Astra Zeneca

- Bayer

- Bristol-Myers Squibb

- Eli Lilly and Company

- Gilead Sciences

- Johnson Johnson

- Merck Co

- Novartis

- Pfizer

- Roche

- Sanofi

- Takeda Pharmaceutical Company

Recent Developments

- In July 2024, Triton Therapeutics announced the launch of a new radioimmunotherapy drug aimed at treating various types of lymphoma. The drug integrates a cutting-edge radioisotope with a monoclonal antibody to enhance targeting and efficacy.

- In August 2024, OncoMed Pharmaceuticals unveiled a new radioimmunotherapy product designed to target advanced-stage cancers. This new medicine utilizes a novel combination of radioisotopes and antibodies to improve treatment precision.

- In September 2024, PharmaTech Inc. launched a new radioimmunotherapy drug aimed at treating multiple myeloma. This new product combines a sophisticated radioisotope with a targeted monoclonal antibody, offering improved efficacy and reduced side effects compared to previous therapies.

- In October 2024, ImmunoGen announced the release of a new radioimmunotherapy medicine targeting relapsed lymphoma. This innovative therapy combines an advanced radioisotope with a targeted antibody to enhance treatment precision and effectiveness.

Segments Covered in the Report

By Indication

- Hodgkin lymphoma

- Leukemia

- Non-Hodgkin lymphoma

- Multiple Myeloma

- Others

By Target Antigen

- CD33

- CD20

- CD52

- CD19

- Others

By Radioisotope

- Yttrium-90

- Lutetium-177

- Thallium-201

- Iodine-131

- Others

By Administration Route

- Intrathecal

- Intravenous

- Intraperitoneal

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting