What is the Real Estate and Infrastructure Market Size?

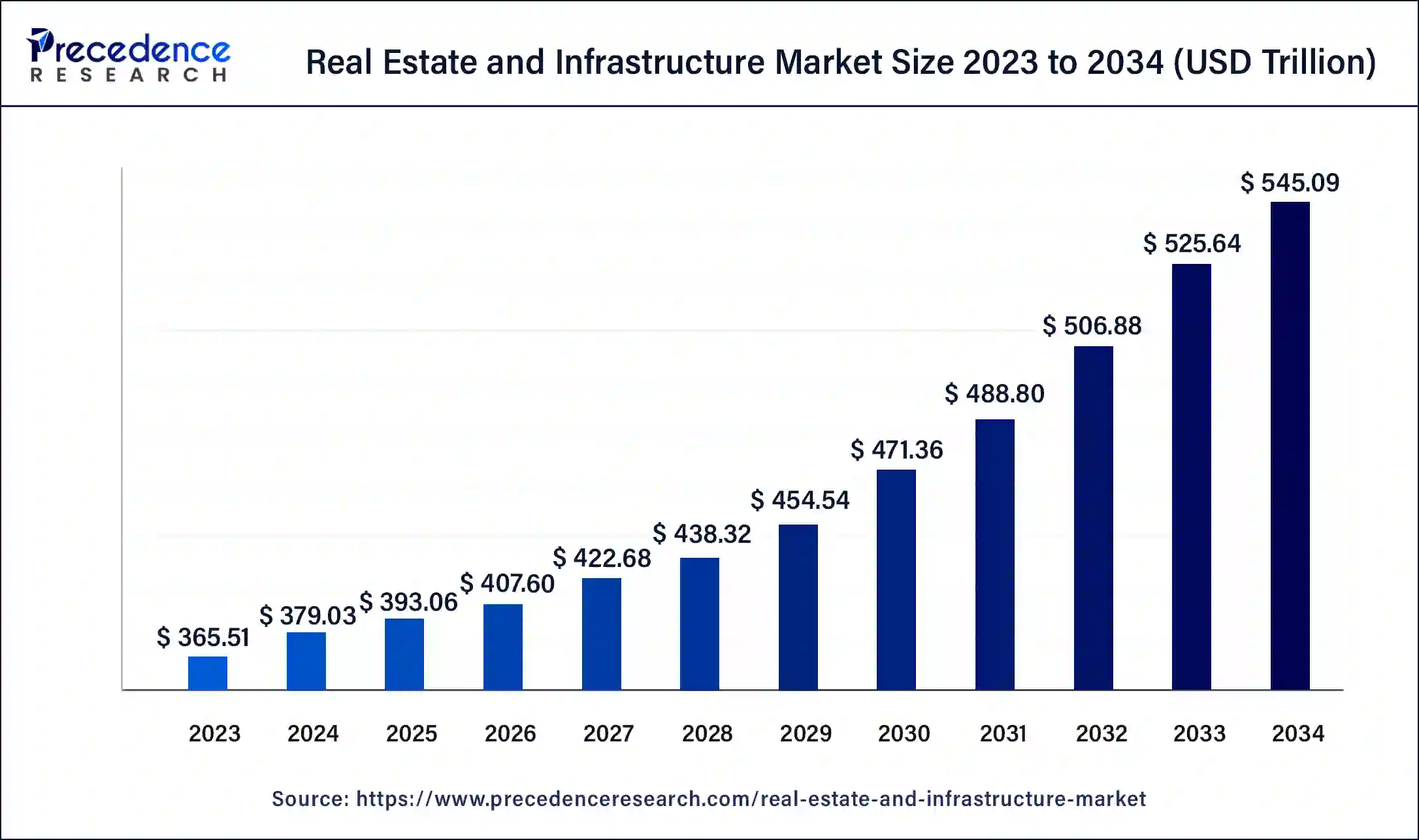

The global real estate and infrastructure market size is calculated at USD 393.06 trillion in 2025 and is predicted to increase from USD 407.60 trillion in 2026 to approximately USD 564.08 trillion by 2035, expanding at a CAGR of 3.68% from 2026 to 2035.

Market Highlights

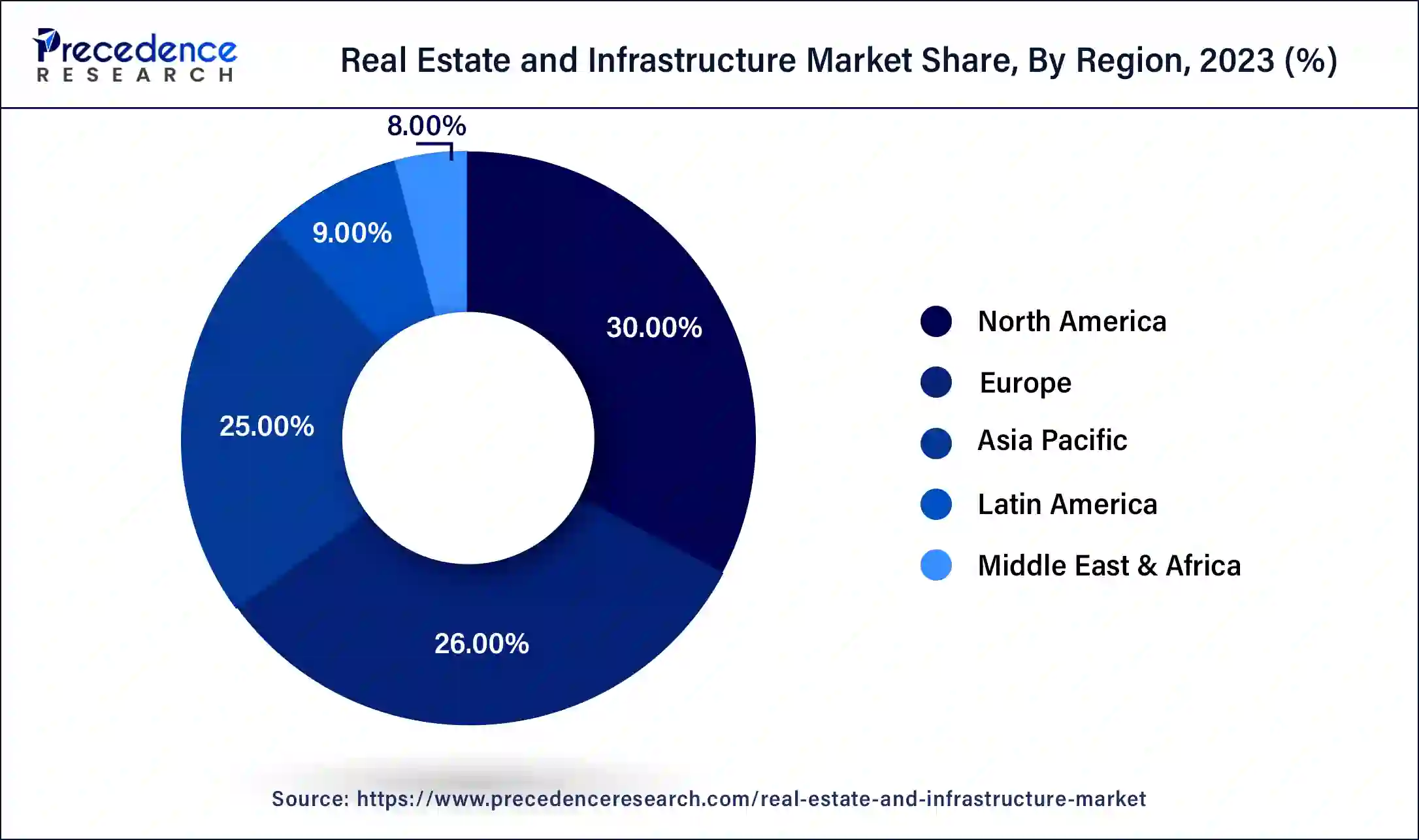

- North America dominated the real estate and infrastructure market with the largest market share in 2025.

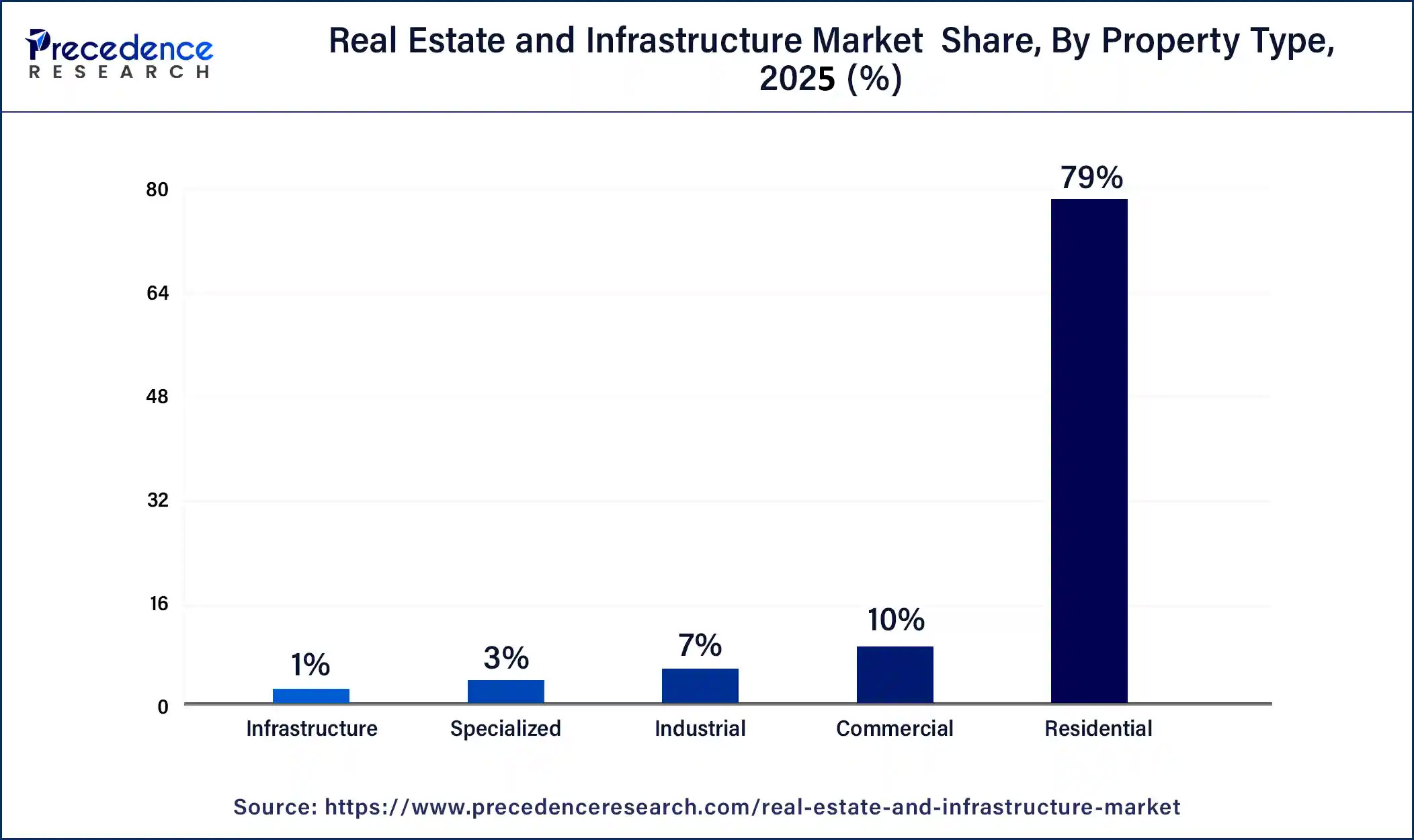

- By property type, the residential segment dominated the real estate market in 2025.

- By property type, the commercial real estate market is expected to grow with a CAGR of 2.9% from 2026 to 2035.

- By business type, the buying segment dominated the real estate market in 2025.

- By business type, the rental segment is expected to grow with a CAGR of 2.9% from 2026 to 2035.

What is Real Estate and Infrastructure?

Real estate refers to property consisting of land, buildings, and natural resources. The real estate market encompasses buying, selling, leasing, and managing these properties. Infrastructural developments, like highways, transportation networks, metro systems, and airports are contributing to the growing demand for development and increasing value of real estate in several regions around the world.

The increasing population around the world demands efficient and cost-effective residential as well as commercial properties for living and business, respectively. There are several components that play the role of catalysts in the growth of the real estate market such as transportation networks, highways, metros, urbanization, and economic growth in the population. All these factors collectively contribute to the growth of the real estate and infrastructure market.

Real Estate and Infrastructure Market Growth Factors

- Real estate and infrastructure are directly related to each other in most regions. Infrastructural development directly impacts the growth of the real estate market. Infrastructural developments such as office spaces, buildings, malls, hospitals, colleges, schools, and other commercial buildings are all real estate construction work.

- Developing infrastructure pushes the property prices indicating the demand growth of the real estate. Increasing government investments for making smart cities with all the infrastructure and amenities to make life easier also boosts the demand for the real estate market.

- Increasing foreign investments and rising participation of the government in terms of beneficial subsidies for people to buy properties drive the growth of real estate around the world. Infrastructural development impacts the prices of the properties in and also gives other industries opportunities to grow.

- Increasing tendencies to buy properties for residential or commercial purposes or future investment drives the growth of the real estate and infrastructure market along with the desire for urban living and convenience. In today's era, most people choose to live in urban areas due to work commitments, better entertainment options, and cultural amenities, this boosts the demand for real estate in urban areas and drives the growth of the real estate and infrastructure market.

Market Outlook

- Industry Growth Overview:The real estate and infrastructure market is experiencing significant growth due to increasing awareness of psychiatric services. The World Health Organization (WHO) is influencing a move from psychiatric hospitals to combined community-centric models.

- Major investors:Major investors in mental health treatment include prominent venture capital (VC) and private equity (PE) firms like General Catalyst, KKR, Carlyle Group, Bain Capital, and Arch Venture Partners.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 393.06 Trillion |

| Market Size in 2026 | USD 407.60 Trillion |

| Market Size by 2035 | USD 564.08 Trillion |

| Growth Rate from 2026 to 2035 | CAGR of 3.68% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Property Type, Commercial Property Type, Specialized Property Type, Infrastructure Property Type, Business Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Urbanization and shift in economies

Increasing tendencies to shift life to urban areas for better connectivity, workplaces, career opportunities, and entertainment purposes are driving the growth in urbanization. The rising population boosts the demand for residential and commercial buildings driving the growth of real estate in urban areas. Increasing infrastructural development like hospitals, commercial spaces, and retail hubs boost entrepreneurship and drive economic growth in urban areas. The rise in the buying properties due to the higher proficiency in housing loans and lower interest rates is driving the buying rate of properties in urban areas. Moreover, shift in disposable incomes along with per capita income is also contributing to the growth of the real estate and infrastructure market.

Restraint

Economic downturns

Economic downturns can negatively impact real estate and infrastructure development. Economic instability, recessions, or financial crises can lead to reduced demand, financing difficulties, and delays in projects. Changes in interest rates can affect the cost of financing for real estate and infrastructure projects. Higher interest rates may lead to increased borrowing costs, making projects less financially viable.

Opportunity

Rising industrialization in developing countries

Industrialization often necessitates improvements in transportation, energy, and utilities infrastructure. Governments and private investors may undertake large-scale infrastructure projects, leading to increased demand for construction and real estate development. The establishment and expansion of industries requires additional office spaces, manufacturing facilities, warehouses, and logistics centers. This surge in demand can drive the growth of the commercial real estate sector. As industrialization attracts a workforce to urban areas, there is a need for housing, creating opportunities for residential real estate development. This includes the construction of housing complexes, apartments, and supporting amenities.

Segment Insights

Property Type Insights

The growth of the residential segment in the real estate and infrastructure market is attributed to the increasing population around the world. The residential sector majorly focuses on selling and buying properties houses or homes. It includes single-family homes, condominiums, apartments, planned development, and others. Increasing urban population, rising household disposable income, and financial institutions offering lower interest rates for decades are some factors driving the growth of the residential segment in the real estate and infrastructure market. Furthermore, rising involvement of private developers in the residential infrastructure development sector of the real-estate business contributes to the growth of the real estate and infrastructure market.

The growth of the commercial segment of the real estate and infrastructure market is attributed to a rising demand for commercial products and services among the population. Increasing commercialization tends to generate more disposable income and lifestyle changes. The commercial segment includes office buildings, hospitals, retail, etc. Increasing investment by public and private investors for commercial development like malls, office buildings, and multi-specialty hospitals is driving the growth of the commercial segment. An increasing number of startup companies and the growth of multi-national companies with bigger workforces in different cities demand high-end office buildings which will drive demand for the commercial real estate and infrastructure market.

Business Type Insights

The buying segment will dominate the real estate and infrastructure market in 2025 due to the rising participation of financial institutions with efficient home loan plans with minimum interest rates over longer durations is driving the tendency to buy homes or properties in people. Additionally, increasing urbanization and the rise in real estate projects by several builders are promoting competition and variety in the real estate market. Buying properties as a future investment is also one of the major contributing factors in the growth of the buying segment in the real estate and infrastructure market.

Property renting is gaining popularity in urban areas of the world due to high selling rates. The rising value of infrastructure is a driving factor of the rental segment in the real estate and infrastructure market. An increasing urban population further drives the demand for residential or commercial spaces for living and occupational needs which is also drives the growth of the rent segment in the real estate and infrastructure market.

Regional Insights

U.S. Real Estate and Infrastructure Market Size and Growth 2026 to 2035

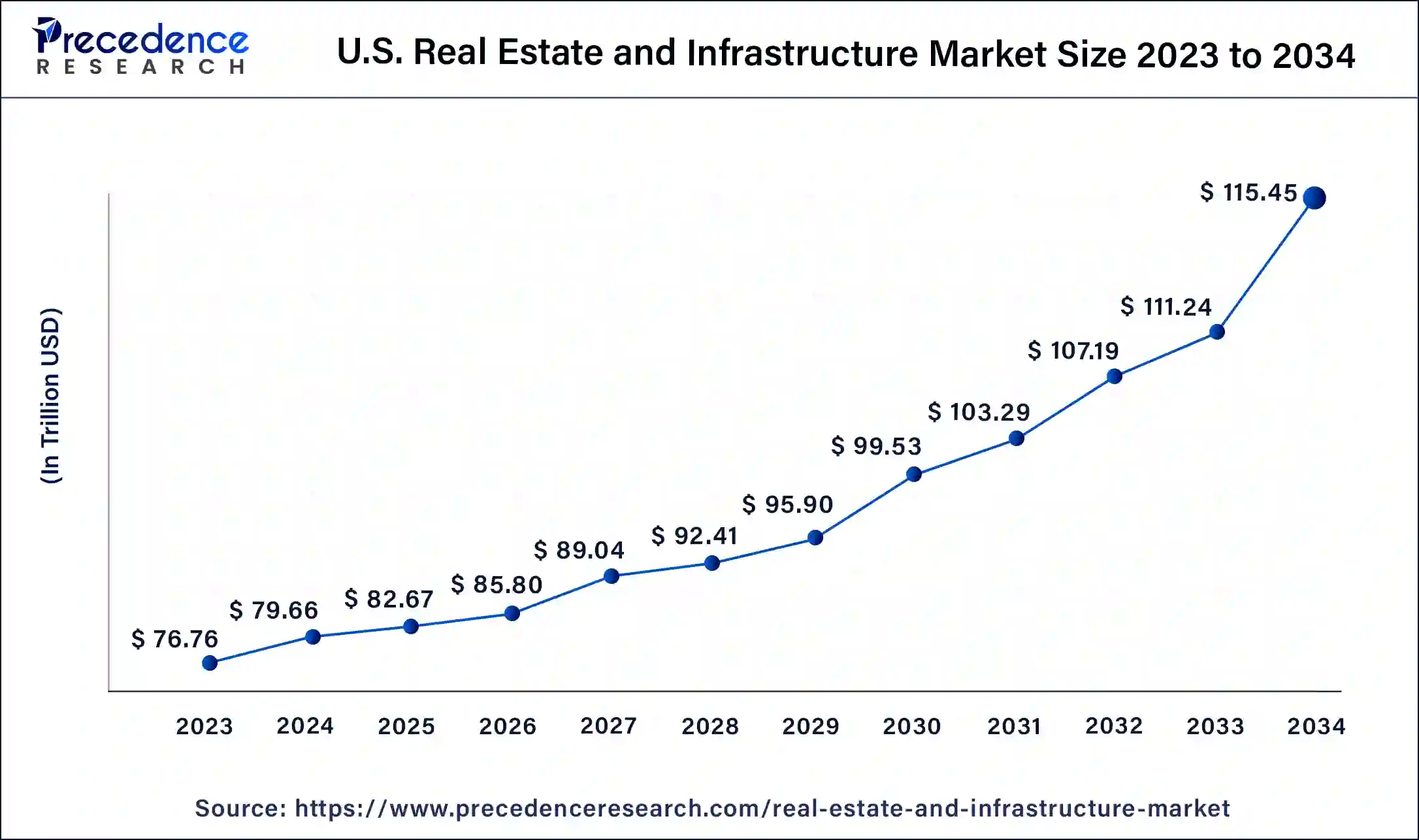

The U.S. real estate and infrastructure market size is estimated at USD 82.67 trillion in 2025 and is expected to reach USD 119.55 trillion by 2035, growing at a CAGR of 3.76% from 2026 to 2035.

U.S. Real Estate and Infrastructure Market Trends

In the U.S., AI and 5G technology created massive opportunities for both real estate and infrastructure depositors. Home prices have grown at the slowest pace in over a decade, offering slightly better affordability and increased inventory for buyers. Commercial real estate growth remains steady, with logistics, multifamily, and technology-related assets like data centers and digital infrastructure attracting strong investor interest.

North America: Increasing Government Strategy

North America dominates the real estate and infrastructure market. The growth of the real estate market in North America dominates the market owing to the increasing population and need for residential buildings as well as commercial sectors. Expanding construction and real estate in countries like the United States and Canada drives the growth of the real estate and infrastructure market. The residential sector dominated the real estate and infrastructure market in the region due to significant growth and rising demand in the commercial sector which significantly contributes to the overall market growth. Increasing preferences towards urban living and trends focusing on innovation and technology are observed in the region. Additionally, consumers are shifting towards sustainable and energy-efficient properties that drive the growth of the real estate and infrastructure market.

Europe: Growing investment

Europe is expected to grow with a CAGR of 4.0% during the forecast period. The growth of the real estate market in the region is expected to increase due to a growing investment by the major companies in the real estate market due to the geopolitical conditions. Europe is considered one of the major attractions for investors in the real estate and infrastructure market. Cities like Paris, London, and Berlin have the highest prospectus in the real estate market due to their excellent performance and outstanding quality with the existing market investments. Increasing commercial sectors in European countries also drives the growth of the real estate and infrastructure market.

The UK Real Estate and Infrastructure Market Trends

In the UK, noteworthy investment is focused on transport and energy, such as clean energy, nuclear power, and digital infrastructure, like fiber optics and data centers. As the population increases, the rising demand for housing has completely outstripped the supply, contributing to skyrocketing property expenses.

Top Companies in the Real Estate and Infrastructure Market & Their Offerings

|

Company |

Headquarters |

Key Strengths |

Latest Info (2025) |

|

United States |

Operational excellence and redevelopment expertise |

In November 2025, Simon announced that it had closed on the acquisition of the remaining 12% interest in The Taubman Realty Group Limited Partnership, which it did not own, in exchange for 5.06 million limited partnership units in Simon Property Group L.P. |

|

|

United States |

Diversified service offerings |

In March 2025, CBRE Group, Inc. announced that it had posted on its Investor Relations website certain recast historical financial information, including revenue by business line and operating profit, for the novel business segment structure. |

|

|

JLL |

United States |

Technology and innovation |

JLL identified 28 AI use cases in the real estate value chain, with major companies aggressively pursuing five pilot projects simultaneously. |

|

Homie Real Estate |

Utah |

Streamlined process and technology |

Homie provides a technology-based platform intended to streamline the home buying and selling process. |

Other Major Companies

- Houwzer

- American Tower

- RE/Max

- Equity Residential

- Vornado Realty

- BrazilOasis

Recent Developments

- In November 2023, the Dubai Land Department accepted the responsibility of combining the private and government sector resources to revolutionize the real estate future of Dubai. The workshop held by the Dubai Land Department, aided the exchange of experiences, expertise, strategic vision, and ideas to shape the real estate future in Dubai.

- In November 2023, a frequently expanding real estate development, ACUBE Real Estate Development,” shared its plans to expand its operations in the UAE market due to the increasing demand for real estate and larger return on investment.

- In November 2023, Blackfinch Group, a specialist in investment management, launched two new funds: IFSL Blackfinch NextGen Property Securities, and IFSL Blackfinch NextGen Infrastructure. The primary purpose of these funds is to align with worldwide trends such as urbanization, digitalization, and aging demographics.

- In November 2023, Uzbekistan announced its plans for the expansion of its green energy infrastructure. Uzbekistan is about to launch ten wind power plants with a total capacity of 4400 MW by the end of 2027.

Segments Covered in the Report

By Property Type

- Residential

- Commercial

- Industrial

- Specialized

- Infrastructure

By Commercial Property Type

- Offices

- Hospitals

- Retails

- Others

By Specialized Property Type

- Healthcare

- Education

- Leisure

By Infrastructure Property Type

- Energy

- Telecom

- Utilities

- Transportation

By Business Type

- Buy

- Rental

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting