What is the Real Estate Market Size?

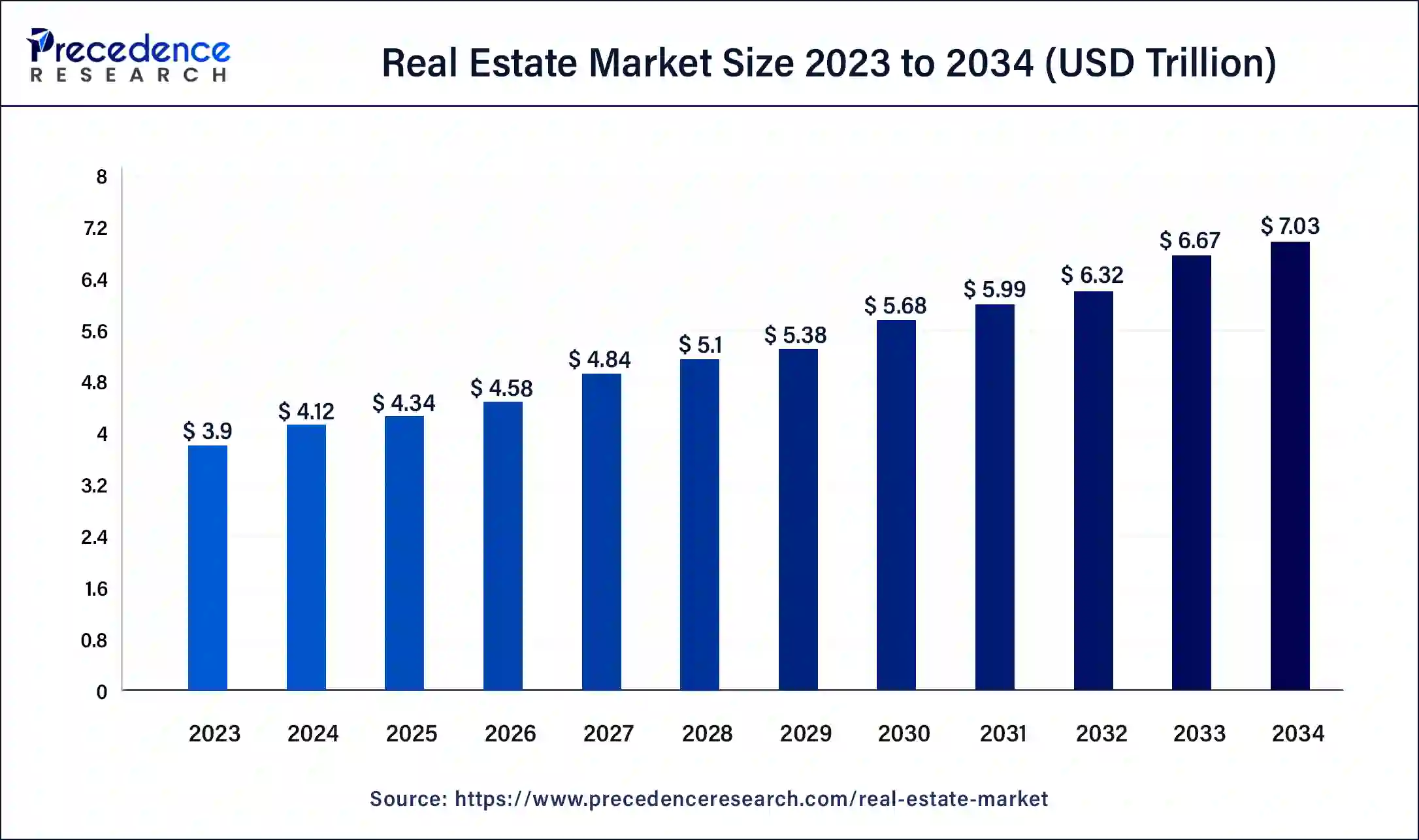

The global real estate market size accounted for USD 4.34 trillion in 2025 and is predicted to increase from USD 4.58 trillion in 2026 to approximately USD 7.03 trillion by 2034, expanding at a CAGR of 5.5% from 2025 to 2034.

Market Highlights

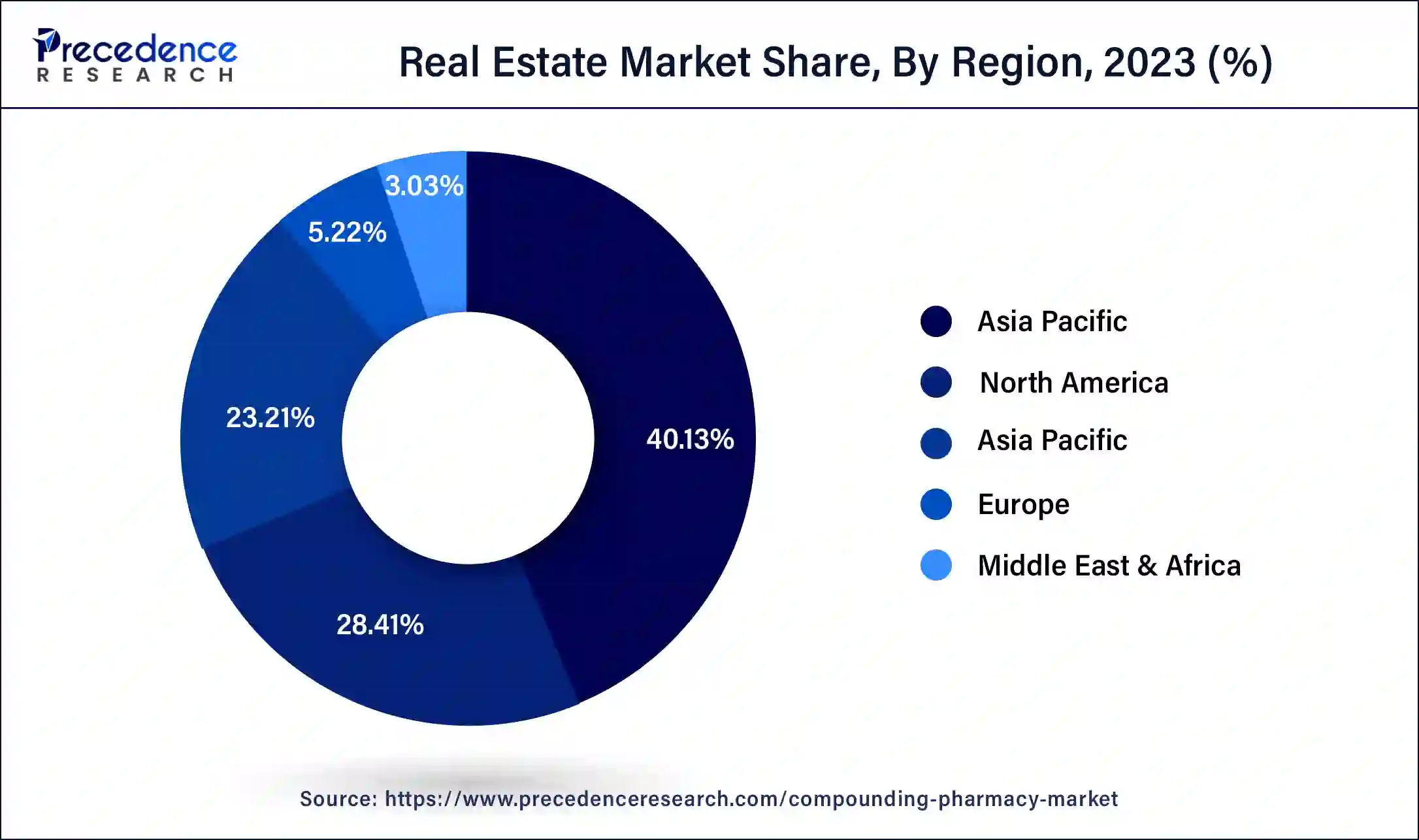

- Asia Pacific contributed more than 40.13% of revenue share in 2024.

- Middle East & Africa regions are expected to grow at a CAGR of 6.52% between 2025 and 2034.

- By Property, the residential property segment dominated the market in 2024 with the largest market share of 37% in 2024.

- By Property, the commercial real estate segment is anticipated to grow at a CAGR of 5.37% from 2025 to 2034.

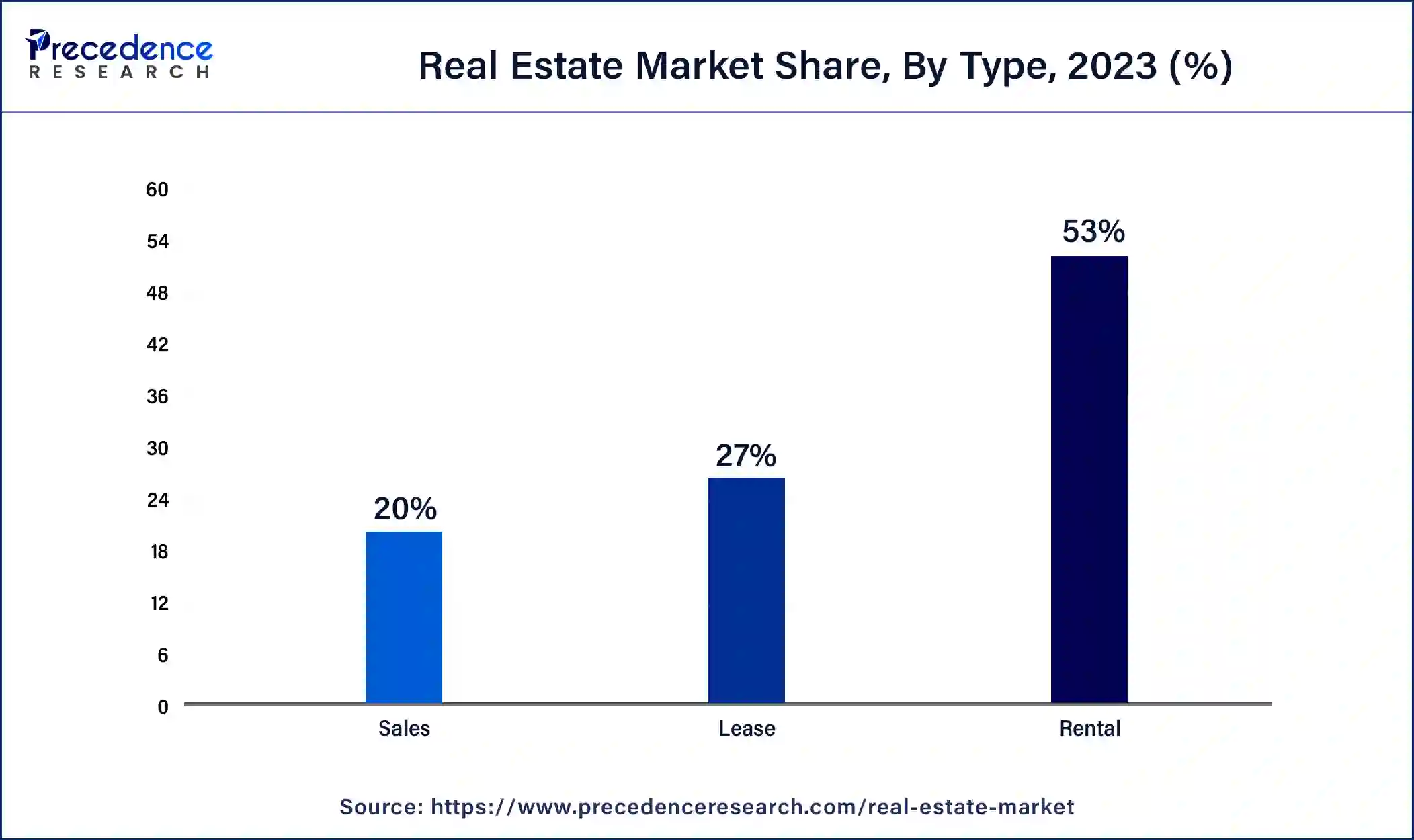

- By Type, the rental segment led the market in 2024 with the largest market share of 53% in 2024.

- By Type, the sale segment is expected to expand at the fastest CAGR of 6.20% between 2025 and 2034.

Market Size and Forecast

- Market Size in 2025: USD 4.34 Billion

- Market Size in 2026: USD 4.58 Billion

- Forecasted Market Size by 2034: USD 7.03 Billion

- CAGR (2025-2034): 5.5%

- Largest Market in 2024: Asia Pacific

- Fastest Growing Market: Middle East & Africa

Market Overview

Real estate is referred to as the land as well as any permanent, whether natural or man-made, structures or improvements related to the property, such as a house. One type of real property is real estate. It varies from personal property, such as cars, boats, jewellery, furniture, and farm equipment, which is not permanently affixed to the land.

Market trends

- In July 2025, a strategic investment in Anta Builders, which is a leading construction and property development company based in Kerala, was announced by Beta Group, which is the $4 billion diversified transnational conglomerate which focuses on food products, commodity trading, and other high-growth sectors, and has now officially entered into India's real estate and infrastructure space by this agreement. The director of Beta Group, Rajnarayan Pillai, and the managing director of Anta Builders, Midhun Kuruvila Kurien, signed this shareholding agreement in Thiruvananthapuram. At this signing ceremony, the chairman of Beta Group, Rajmohan Pillai, and the managing director of Kirloskar Industries Ltd, George Varghese, were also present.

- In July 2025, to develop a joint framework for conducting technical and regulatory studies, a memorandum of cooperation was signed between Dubai Land Department (DLD) and Emirates NBD, which is a leading banking group in the MENAT (Middle East, North Africa, and Turkey) region. Two forward-looking studies that will focus on regulatory and procedural aspects will be conducted by this collaboration. The optimization of the registration process for real estate transactions carried out outside the UAE will be the first study, while providing financial services to simplify the registration of real estate sales transactions will be the second study. By reinforcing confidence, enhancing trust, and simplifying processes, in the real estate sector of the emirate dynamic, will be provided by this collaboration by supporting the effort of Dubai to attract international investors.

Real Estate Market Growth Factors

Consumers are now more aware of online real estate services because of the Internet's influence on the real estate business. To increase their market share, major players are providing a range of services, including live-streaming rooms. For instance, according to Alibaba, more than 5,000 real estate agencies in China have embraced the live-streaming rooms technique, enabling homebuyers to browse properties and close purchases from the comfort of their own homes.

Additionally, a number of government programs from different countries are probably going to help the market to expand. The Indian government, along with the governments of numerous states, has launched a number of initiatives to encourage sector development. The Smart City Project, which aspires to construct smart cities, presents an opportunity for real estate.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 4.34 trillion |

| Market Size in 2026 | USD 4.58 Trillion |

| Market Size by 2034 | USD 7.03 Trillion |

| Growth Rate from 2025 to 2034 | CAGR of 5.32% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Property, Type and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Social factors

In the real estate market, social factors, such as evolving lifestyle choices, have a big impact. The demand for various types of properties might change as a result of changes in society attitudes and behaviors. A growing interest in flexible workspaces and home offices, for instance, is a result of the expansion of remote work and the digital economy. As a result, there is a higher demand for buildings with designated office space or co-working amenities. Similar to this, shifting interests in leisure and entertainment may increase demand for homes close to parks, recreation areas, and cultural attractions. The real estate market is also impacted by trends in household formation and marriage rates.

The desire for smaller, more inexpensive housing options, including studios or one-bedroom apartments, is rising as a result of postponed weddings and an increase in single-person families. Contrarily, households made up of couples or families tend to prefer bigger homes with more bedrooms and living space. These trends determine the demand for various sorts of residential properties and have an impact on the types and sizes of units that are built by developers. There are several ways that cultural diversity might affect the real estate market.

Housing alternatives that meet various cultural tastes and demands are frequently in demand in cities and regions with diverse populations. This can apply to homes built with particular architectural elements, amenities, or close proximity to cultural or religious institutions. The demand for commercial real estate that includes ethnic food markets, eateries, or shopping centres that serve certain cultural communities can also be influenced by cultural variety.

Restraint

Government regulations

Various government restrictions have a big impact on the real estate industry. These rules are in place to safeguard the public's interests, promote sustainable growth, and preserve a steady housing market. For buyers, sellers, and investors, they can, however, also pose restrictions and difficulties. Government restrictions that affect real estate include zoning laws. These regulations set down the permitted uses of land in certain areas, such as residential, commercial, or industrial zones. By avoiding incompatible land uses, zoning restrictions support the preservation of a balanced community. But they might restrict the freedom of landowners and developers, preventing them from using or developing their holdings as they see fit.

Another set of rules that affect real estate is the building codes. These guidelines make sure that buildings adhere to strict safety and quality requirements. Although they are essential for maintaining public safety, they can raise construction costs and present difficulties for property owners, especially when remodelling or building new homes. Building code observance can be time-consuming and expensive, which has an impact on project timeframes and costs. The real estate market is significantly impacted by tax laws as well. Property taxes, capital gains taxes, and transfer taxes may have an impact on investment choices and property prices. The affordability of homeownership, the allure of real estate as an investment, and the general demand for homes can all be impacted by changes in tax regulations.

The real estate market may be impacted by rent control laws that are imposed by some governments to protect tenants. These regulations place restrictions on the amount that landlords can raise rents, which can lower rental income and deter property owners from making rental property investments. Due to decreased incentives for property owners to maintain or improve their units, rent control regulations can occasionally result in housing shortages and deteriorating property conditions.

Opportunity

Commercial real estate

Acquiring properties that are predominantly used for commercial activities, such as office buildings, retail establishments, industrial warehouses, or multifamily apartment complexes, constitutes investing in commercial real estate. In comparison to residential homes, commercial properties have a bigger potential for rental income. Long-term leases are frequently signed by businesses, giving investors a consistent cash stream. Commercial real estate can aid in portfolio diversification. Compared to residential buildings, it is less vulnerable to market changes brought on by tenant turnover. Commercial properties that are well-located and well-maintained may increase in value over time, offering potential capital appreciation when it comes time to sell.

Under triple net leases, tenants may occasionally be liable for all property costs, such as taxes, insurance, and upkeep. By doing this, the landlord's ongoing costs can be reduced and net rental income can rise.

Segments Insights

Property Insights

With a 37% revenue share, residential property dominated the market in 2024. The millennial generation, who have recently shown a greater propensity for homeownership, is mostly responsible for the growth. For instance, the homeownership percentage among millennials rose to 48% in 2021, according to Apartment List's Homeownership study.

- From 2025 to 2034, commercial real estate is anticipated to grow at a CAGR of 5.37%. The market is expanding at a remarkable rate as a result of the expansion of the tourism industry.

Additionally, the need for bathroom furniture is anticipated to increase as hotels and resorts continue to expand. Citadines Apart' Hotels was the most active hotel brand in Thailand in 2020, according to TOPHOTELPROJECTS GmbH, with five projects comprising of 945 rooms.

Type Insights

With a share of 53% in terms of revenue, the rental type led the market in2024. This is a result of growing property costs in industrialized countries, which has led to an increase in renters and favoured segment development. For instance, a blog written by Mansion Global claims that in 2021, 60% of the residences in Germany will be rented, making it the country of renters.

Over the forecast period, it is predicted that sales type would increase at a CAGR of 6.20%. Luxury homes, villas, and second homes are in more demand as a result of how the COVID-19 pandemic has altered consumer attitudes regarding home ownership. For instance, a blog post by Construction Week Online claims that between January and September 2021, new residential supply from India's top 7 cities increased by almost 163,000 units.

Technological Advancement

Technological advancement in the real estate market features blockchain technology, virtual reality, augmented reality, artificial intelligence, digital twins, drones, and other high-tech devices. With the highest range of mobile applications and online platforms, the market is a successful emerging one among all. The transitional AR and VR technology allows buyers to take virtual tours and visualize furnished rooms. Blockchain technology helps secure real estate transactions, prevents safety from fraud. IoT supports smart home automation for owners to control lighting and set the temperature remotely.

Big data analytics analyzes a vast amount of data, which helps professionals learn and understand trends, helping to invest securely. Mobile applications and online portals help buyers connect and search properties with various listing options. Drones in technology inspection (protect) property includes mapping. The virtual representation of physical properties supports analysis with the help of digital twin technology. The advancement and enhancement deliver success to the real estate industry companies. It empowers innovation.

Regional Insights

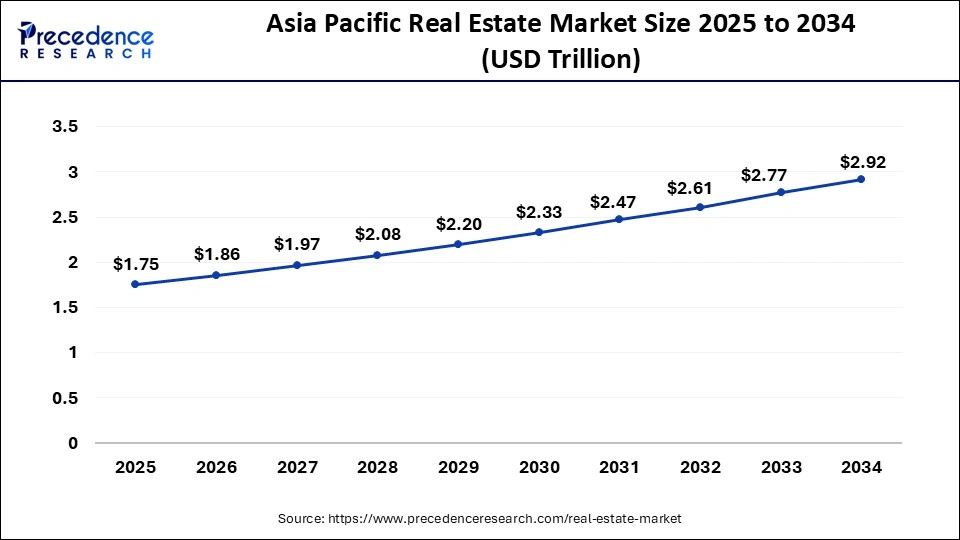

Asia Pacific Real Estate Market Size and Growth 2025 to 2034

The Asia Pacific real estate market size was estimated at USD 1.75 trillion in 2025 and is predicted to be worth around USD 2.92 trillion by 2034, at a CAGR of 5.8% from 2025 to 2034.

- In 2024, Asia Pacific held the majority of the market, with a share of 40.13%. The region's rising homeownership rates are mostly responsible for the growth. According to estimates, China holds the majority of the market share in the region.

Additionally, it is anticipated that the rising number of tourists in emerging nations like Vietnam, Thailand, Indonesia, the Philippines, India, and the Philippines will encourage market expansion in the region.

Middle East & Africa is projected to experience a CAGR of 6.52% between 2025 and 2034. The country's growing pipeline of residential and commercial projects is primarily responsible for the growth. Additionally, a contract for the development of 18 private homes in Bahrain was signed in July 2021 by Durrat Marina and Tamcoon.

North America and the Middle East region contribute greatly to the real estate market. The Middle East is a strong performer in the global market, while North America is leading in global property management with its excellent property infrastructure.

Real Estate Market Companies

- Brookfield Asset Management Inc.

- ATC IP LLC.

- Prologis, Inc.

- SIMON PROPERTY GROUP, L.P.

- Coldwell Banker

- RE/MAX, LLC.

- Keller Williams Realty, Inc.

- CBRE Group, Inc.

- Sotheby's International Realty Affiliates LLC.

- Colliers

Recent Development

- In May 2025, Asia Pacific Commercial real estate stays resilient amidst volatility. Due to US President Donald Trump's reciprocal tariffs, the Asia Pacific faced a hard policy shift.

- In May 2025, New Jersey proposed a $400 million real estate separate account with Townsend. The New Jersey Division of Investment is contributing to the real estate separate account relationship with the Townsend Group. This will strengthen the real estate market and the individual business.

- In May 2025, MAG signs a strategic partnership with a multibank group to tokenise real estate assets. MAG, the competent real estate developer in the UAE, has climbed the ladder of success by signing a tokenization agreement with Multibank Group.

Segments Covered in the Report

By Property

- Residential

- Commercial

- Industrial

- Land

- Others

By Type

- Sales

- Rental

- Lease

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting