What is Web3 in Real Estate Market Size?

Explore the Web3 in real estate market trend, where NFTs, DeFi, and blockchain technologies are reshaping how real estate is bought, sold, and owned. The market growth is attributed to increasing adoption of blockchain for property tokenization, enhance transparency, and reduce reliance on intermediaries.

Market Highlights

- North America dominated the global web3 in real estate market with the largest revenue share in 2024.

- Asia Pacific is expected to grow at a notable CAGR between 2025 and 2034.

- By application, the tokenization of real estate assets segment held the major revenue share in 2024.

- By application, the smart contracts for transactions segment is projected to grow at a solid CAGR from 2025 to 2034.

- By property type, the commercial segment contributed the biggest revenue share in 2024.

- By property type, the mixed-use segment is projected to grow at a significant CAGR from 2025 to 2034.

- By end user, the real estate developers segment dominated the market in 2024.

- By end user, the investors segment is growing at a solid CAGR from 2025 to 2034.

- By technology, the blockchain segment dominated the global market with the largest revenue share in 2024.

- By technology, DAO-based real estate platforms segment is expected to grow at a fastest CAGR between 2025 and 2034.

How Does Blockchain Technology Support Web3 in Real Estate?

Web3 in real estate introduces decentralized platforms that help make all property transactions more secure and efficient. Blockchain technology allows smart contracts to carry out agreements automatically and without the help of third parties, saving money on deal processes. The tokenization of real estate assets makes it possible for more people to invest and increases how quickly investments are bought and sold. Additionally, DeFi-based Web3 services allow for many different finance models, which open up property investment for more people.

The Web3 real estate market has been witnessing significant growth, driven by increased use of blockchain technology for making transactions easier and safer. Blockchain acts as a shared electronic record stored on multiple computers to keep records safe, unchangeable, and easy to check. It makes it possible to split real estate into digital tokens, each representing a small part of the property. People with small amounts of money take on a share in a property. In 2025, Dubai's Land Department introduced the 'Real Estate Tokenization Project' within the Real Estate Innovation Initiative (REES). This made them the first authority in the Middle East to record real estate title deeds on a blockchain network.

Impact of Artificial Intelligence on the Web3 in Real Estate Market

Artificial Intelligence AI significantly impacts the market for web3 in real estate by identifying vulnerabilities in smart contracts. AI enhances the security of smart contracts. It provides accurate property valuations by analyzing market data. AI also detects fraudulent activities in transactions, reduces human error in real estate transactions, and ensures the accuracy and reliability of data.

Web3 in Real Estate MarketGrowth Factors

- Expanding Smart City Initiatives: Growing government-backed smart city projects are driving demand for blockchain-enabled property infrastructure.

- Rising Cross-Border Investment Demand: Increasing global interest in international real estate is fuelling the adoption of decentralized investment platforms.

- Rising Institutional Involvement: The rising participation of institutional investors is propelling the market through scalable tokenization frameworks.

- Growing Interest in Digital Identity Solutions: The adoption of blockchain-based identity verification is driving trust and efficiency in property transactions.

- Increasing Demand for Real-Time Settlements: The push for instant, automated transaction settlement is boosting smart contract usage in real estate deals.

- Elevated ESG Compliance Requirements: Web3 tools are fuelling sustainable and transparent property management to meet evolving ESG regulations.

- Surging Developer-Platform Collaborations: Stronger partnerships between real estate developers and blockchain platforms are driving innovation and operational scalability.

Web3 in Real Estate Market Outlook:

- Global Expansion: The overall growth is propelled by a rise in demand for transparency, efficiency, and accessibility in property transactions.

- Major Investors: Firms including a16z, Coinbase Ventures, and Pantera Capital are increasingly investing in early-stage blockchain and crypto startups.

- Startup Ecosystem: Navanc As an Indian startup that integrates AI, the Internet of Things (IoT), and blockchain to escalate the security and efficiency of real estate transactions.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

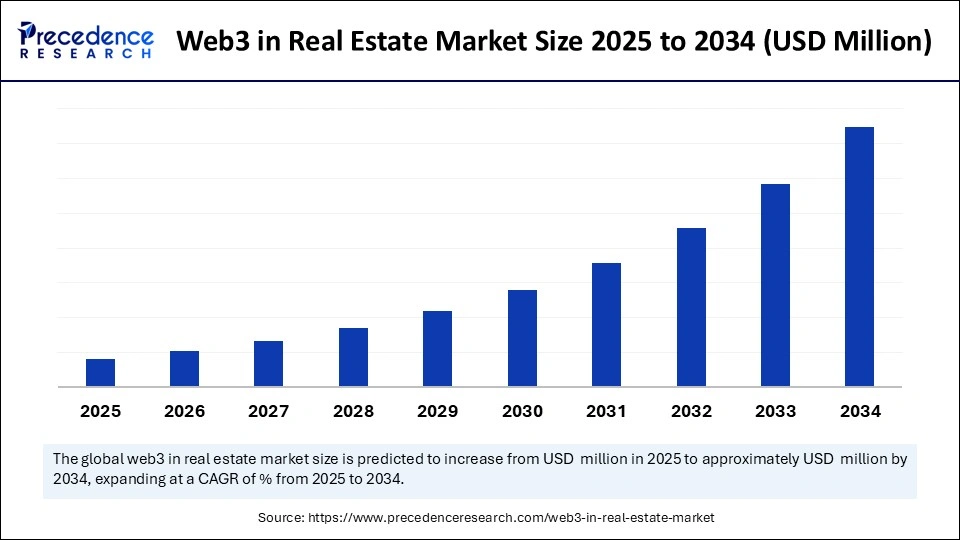

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application, Property Type, End User,Technology, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How does Blockchain Technology Enhance Transparency and Efficiency in Property Transactions?

Increasing the adoption of blockchain technology for unparalleled transparency and security is expected to drive the market. As blockchain technology is used more widely, it is predicted to give property transactions a new level of openness and safety. Blockchain's unchangeable ledger and fraud checks are straightforward. Using a decentralized platform, stakeholders can automatically execute smart contracts that enforce agreements instantly. Managers are able to speed up the closing process and cut down on what it takes to complete deals. According to the Real Estate Blockchain Association, the number of projects using Blockchain for fractional ownership went up by about 50% in 2024. Furthermore, the real estate smart contract deployments increased over the last few years, which represents a quick shift toward automation and decentralized records.

Restraint

Regulatory Uncertainties Hamper Widespread Adoption of Web3 in Real Estate

Regulatory uncertainties are expected to limit the widespread adoption of Web3 technologies in real estate. Though governments and regulatory authorities are coming up with new structures for Blockchain, tokenization, and decentralized finance, the absence of clear rules remains a difficulty. The lack of similar rules in different places can cause trouble for companies trading internationally and increase compliance issues. Problems with how property rights, smart contracts, and digital assets are defined reduce the confidence of traditional real estate players and create legal risks.

Opportunity

Rising Institutional Adoption Drives the Integration of Blockchain in Traditional Real Estate

Rising institutional interest in digital asset integration is accelerating the fusion of traditional real estate with blockchain innovations, creating lucrative growth opportunities for market players. Some of the major financial institutions are now looking to add tokenized assets and decentralized trading platforms to their investments. Trusted institutions rely on blockchain technologies to enhance transparency in real estate transactions. The Word Economic Forum pointed out in 2025 that a high number of institutional investors plan to consider tokenized real estate in their digital transformations. Furthermore, more companies in the sector support research and development that boosts the infrastructure and compatibility of several decentralized real estate solutions.

Segment Insights

Application Insights

The tokenization of real estate segment dominated the web3 in real estate market in 2024 due to its ability to split ownership and improved capability to trade difficult-to-trade property assets. This strategy enables both big investors and the general public to participate and benefit from investing in lots of different properties, as it offers digital tokens that represent shares. A significant increase in tokenized assets inspired more people to buy and sell. Furthermore, the growth of the segment was aided by strict rules introduced by authorities in key areas.

The smart contracts for transactions segment is projected to grow at a CAGR of XX% in the coming years. Experts predict that transactions made through smart contracts will soon be the main developer of future innovations in Blockchain. With automation, it is possible to make property sales, lease deals, and escrow transactions much faster and less likely to include errors. Smart contracts are being used more often by developers in decentralized systems to make sure deals are completed fast. Moreover, smart contracts are beneficial in property management systems, benefiting both tenants and investors.

Property Type Insights

The commercial segment held the largest share of the web3 in real estate market in 2024, as big investors are attracted by the substantial costs associated with commercial properties. Many investors have shown interest in larger real estate asset types, including office buildings, shopping centers, and hotels. This provides steady cash flow and the ability for owners to share parts of the properties. Recently, the World Economic Forum reported that tokenization activity for commercial real estate assets increased rapidly in the last few years, indicating investor trust is growing and boosting the segment's growth.

The mixed-use segment is projected to expand at a significant CAGR during the forecast period. These places mix homes, offices, and recreation, bringing together a range of investors and tenants. Integrating blockchain technology reduces the management and rental processes for projects that consist of many property types by using smart contracts to manage payments and contracts. Because more people are living in cities and changing what they need from real estate, developers are including digital services and tokenization to draw investors. According to Gartner's 2024 report, mixed-use assets are seen as top areas where blockchain introduces new funding and management methods. (Source : https://www.gartner.com)

End User Insights

The real estate developers segment dominated the web3 in real estate market in 2024 as developers heavily rely on blockchain technology to improve transparency in transactions. Property developers are turning to tokenization to let more people own part of a building. This allows them to seek funding around the world without needing traditional sources. Using this method made it easier for cash-strapped projects to obtain financing and place capital more rapidly. Furthermore, developer-led token projects grew rapidly, underlining their main role in growing the ecosystem.

The investors segment is expected to grow at the fastest rate over the projected period. The current expansion of both fractional and decentralized real estate investment is expected to make investors the main drivers of future market growth. Web3 services provide investors with a chance to spread their investments across countries and real estate with less required capital. Strong transparency and a tamper-proof history of ownership support investors, which attract both individual and large investors. ConsenSys and the Real Estate Blockchain Association reported in 2024 that the number of wallets investing in tokenized real estate assets had exploded.

Technology Insights

The blockchain segment held the largest share of the web3 in real estate market in 2024. The use of blockchain technology has increased as it makes property deals clear, secure, and efficient. Developers and investors used the unchangeable ledger of blockchain to prove ownership and ensure contracts were executed automatically. Blockchain technology provides transparent property records and reduces fraud.

The DAO-based real estate platforms segment is expected to grow at the fastest rate in the coming years. DAOs are the latest real estate technology, which is gaining popularity. DAO-based platforms allow property owners to manage and decide matters collectively. Funding, managing, and guiding projects are all possible for members when using DAO through its token voting system.

Regional Insights

What Made North America Dominant in the Market in 2024?

North America led the web3 in real estate market by capturing the largest share in 2024. This is mainly due to the increased use of blockchain and web3 technology in real estate. The region has a mature real estate sector and a high level of digital literacy, facilitating faster adoption of web3 and blockchain technologies. The U.S. is a major market in the region. This is mainly due to high levels of investments and interest from crypto investors. Additionally, players like Propy made their services accessible in various states, whereas Roofstock onChain has been making faster progress with tokenized single-family home sales, fuelling the market growth in this region.

Promoting Property Development is Driving the Asia Pacific

Asia Pacific is anticipated to witness rapid growth during the forecast period, owing to the rising use of blockchain technology and strong efforts from governments to develop digital infrastructures. Singapore, South Korea, and Japan have made progress in building regulatory sandboxes and rules for digital assets that encourage property development using tokens. According to the Real Estate Blockchain Association, smart property solutions for commercial real estate are likely to be tested first in Seoul and Tokyo. As Hong Kong and Singapore implement blockchain in their land titles and business processes, the industry expects greater growth and support within both the residential and commercial sectors. DappRadar reports that over 30 decentralized real estate applications in Asian countries went live in 2024 as people wanted to purchase just a fraction of city properties. Furthermore, the DAOs are successfully being integrated into projects in dense areas, such as Singapore's Marina Bay and South Korea's Gangnam District, supporting regional market growth.

Emerging Tokenization Platforms are Fueling Europe

A notable growth of the European web3 in the real estate market has been stepping towards the development of platforms for notarized real estate tokenization, which leverages the creation of digital tokens representing the economic rights of a property to allow fractional investment, such as Blocksquare, a notarized real estate tokenization framework that enables fractional ownership and accelerated liquidity for traditionally illiquid assets.

Execution of Legal Status of Digital Assets: UK Market Trend

In May 2025, the UK government made significant progress with the Property (Digital Assets etc) Bill, which completed its third reading in the House of Lords. This bill clarifies that digital assets, particularly cryptocurrencies and NFTs, can be legally referred to as personal property under the laws of England and Wales, affording them the same legal protections as traditional assets and reducing fraud risk.

Progression of Investment Platforms is Encouraging Latin America

The web3 in the real estate market in Latin America is blooming, with Spanish tokenized real estate investment platform Reental, which boosted its operations into multiple Latin American markets, like Mexico, Argentina, and the Dominican Republic. In Argentina, Reental introduced the "Salta-1 project" by collaborating with local developer MDay Group, providing fractional access to commercial real estate.

Extensive Institutional Partnerships: Brazil Market Trend

In this era, Brazil is witnessing a substantial growth with leveraging Brazil's Mercado Bitcoin, one of the region's largest crypto exchanges, partnered with Polygon Labs to expand tokenized real-world asset (RWA) offerings, focusing on the development of Brazil as a hub for regulated blockchain-based asset issuance.

Key Players in Web3 in Real Estate Marke and Their Offerings:

- Filecoin- A vital leader facilitates decentralized data storage and infrastructure that empowers Web3 real estate applications.

- Helium Systems, Inc.- It is focused on building and incentivizing a decentralized physical infrastructure network (DePIN) for wireless connectivity.

- Kadena LLC- It specifically assists real-world asset (RWA) tokenization.

- Kusama- It offers infrastructure to support real-world asset (RWA) tokenization and as a testing ground for dApps.

- Livepeer, Inc.- It usually offers a decentralized video processing network and real-time AI video infrastructure for Web3 applications.

Web3 in Real Estate Market Companies

- Filecoin

- Helium Systems, Inc.

- Kadena LLC

- Kusama

- Livepeer, Inc.

- Ocean Protocol Foundation Ltd.

- Polygon technology

- Terra

- Web3 Foundation (Polkadot)

- Zel Technologies Limited.

Latest Announcements by Industry Leaders

- In January 2025, The Dubai Multi Commodities Centre (DMCC), in collaboration with REIT Development, has announced the construction of a 17-storey “Crypto Tower” in Jumeirah Lakes Towers (JLT), designed to cater to the growing community of blockchain, DeFi, and Web3 companies. This landmark project aims to expand DMCC's innovation ecosystem and reinforce Dubai's global leadership in emerging technologies. The Crypto Tower will serve as an extension of the DMCC Crypto Centre's existing headquarters in Uptown Tower, providing state-of-the-art infrastructure to foster collaboration, innovation, and business growth within the digital asset space. Positioned as a real-world intersection of blockchain, Web3, and real estate, the tower symbolizes the increasing integration of physical infrastructure with decentralized technologies. Ahmed Bin Sulayem, Executive Chairman and CEO of DMCC, remarked: “The Crypto Tower is a pioneering development that sits at the interface of blockchain, Web3, and real estate. The launch of Crypto Tower is both a real-world demonstration of the future of Web3, where transparency and ownership are ensured by blockchain technology, as well as a statement of our intent as we continue to consolidate Dubai's position as the world's leading innovation hub.” This strategic move aligns with DMCC's broader vision to create a comprehensive and future-ready environment for tech-forward enterprises in the UAE.(Source: https://www.portugalglobal.pt)

Recent Developments

- In November 2024, Reltime, a prominent Web3 and blockchain solutions provider, has partnered with Norwegian Holding Limited's ISON project to launch a €150 million real estate tokenization program. This initiative includes four major construction developments, starting with the Oslofjord Project, and aims to democratize global investment in high-value Norwegian real estate. Using Reltime'sReal-World Asset (RWA) Tokenization Platform, investors can acquire digital tokens that represent fractional ownership in these projects, streamlining access to property markets while enhancing transparency and security. (Source: https://news.cision.com)

- In January 2024, In Ukraine, Kitsoft, in collaboration with the Public Association 'Virtual Assets of Ukraine' (VAU), developed a prototype of a Web3-powered real estate and land registry. The initiative draws on the conceptual work of blockchain researcher Dr. Oleksiy Konashevych and received technical and institutional support from the Dfinity Foundation. The platform showcases how blockchain can enhance transparency, reduce fraud, and modernize land administration systems, particularly in emerging economies.(Source: https://kitsoft.ua)

Segments Covered in the Report

By Application

- Tokenization of Real Estate Assets

- Smart Contracts for Transactions

- Decentralized Property Marketplaces

- Real Estate Crowdfunding Platforms

- Immutable Property Records

- Cross-Border Real Estate Transactions

By Property Type

- Residential

- Commercial

- Industrial

- Mixed-Use

By End User

- Property Buyers

- Real Estate Developers

- Investors

- Real Estate Platforms

By Technology

- Blockchain

- NFTs

- DAO-Based Real Estate Platforms

- DeFi Integration

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting