What is the Revenue Assurance Market Size?

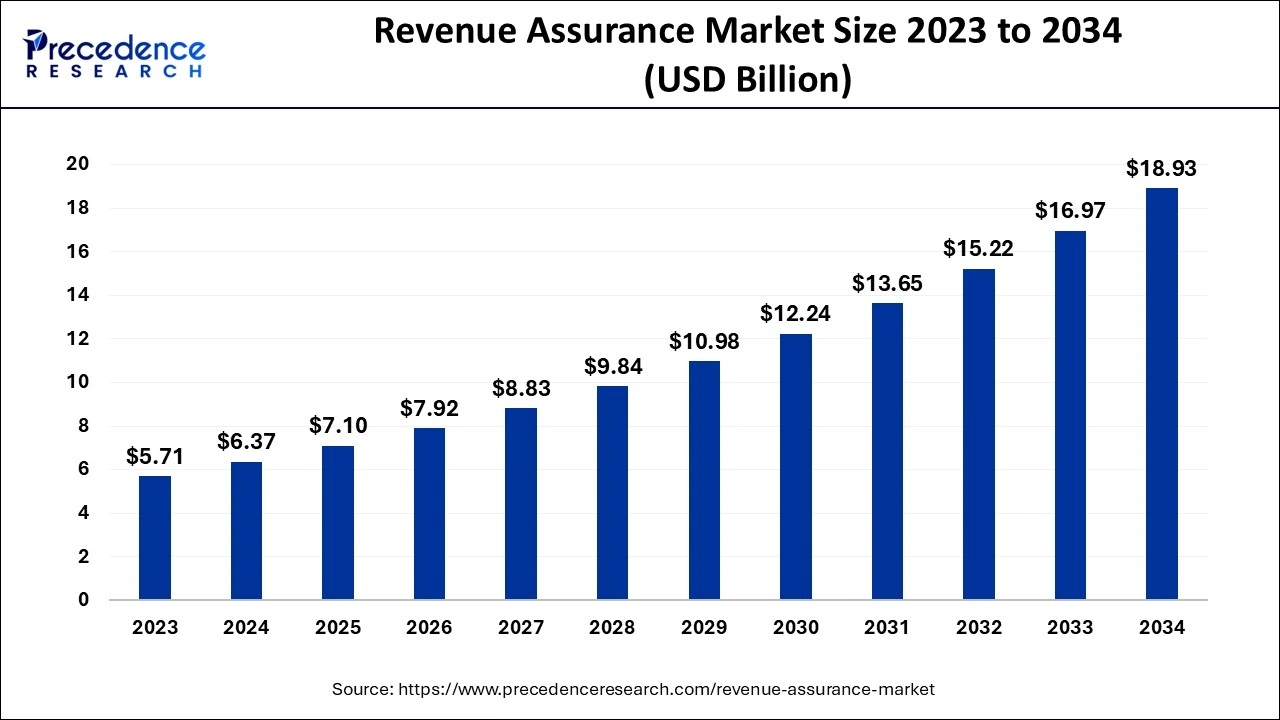

The global revenue assurance market size is calculated at USD 7.10 billion in 2025 and is predicted to increase from USD 7.92 billion in 2026 to approximately USD 20.75 billion by 2035, expanding at a CAGR of 11.32% from 2026 to 2035.

Revenue Assurance Market Key Takeaways

- In terms of revenue, the market is valued at $7.10 billion in 2025.

- It is projected to reach $20.75 billion by 2035.

- The market is expected to grow at a CAGR of 11.32% from 2026 to 2035.

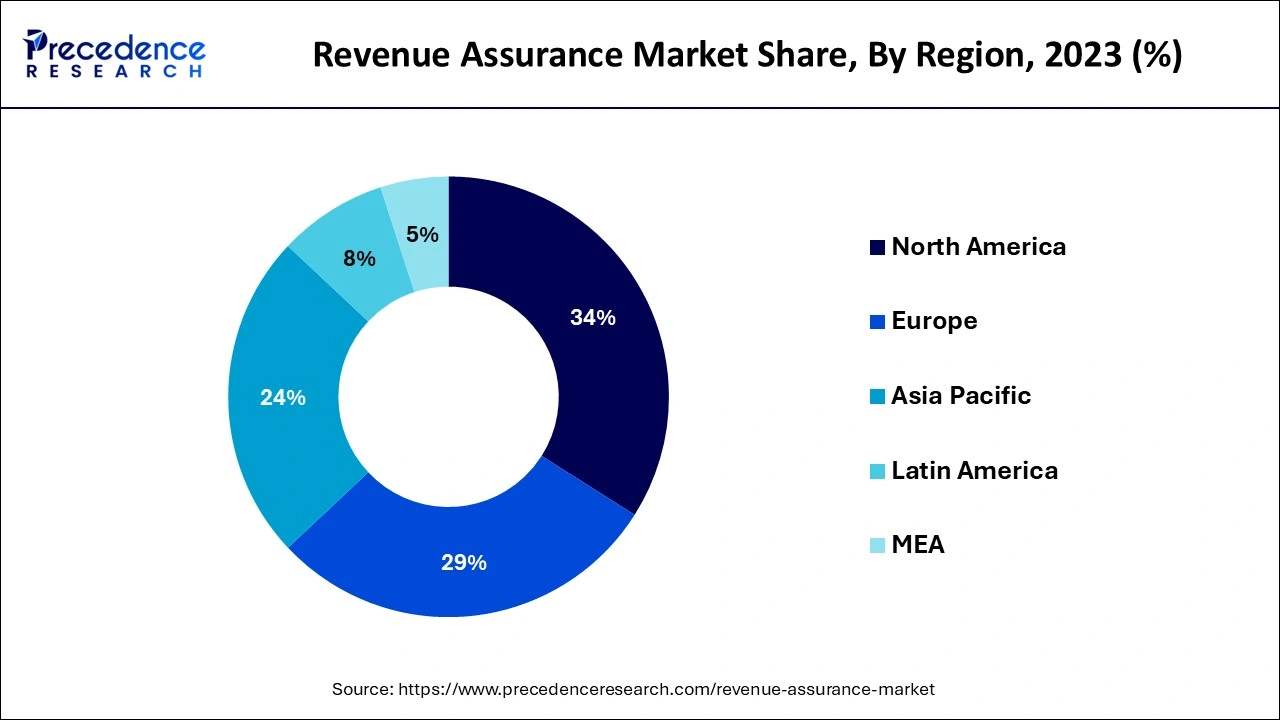

- North America dominated the revenue assurance market and generated then 34% of market share in 2025.

- Asia Pacific is anticipated to grow at the fastest CAGR of 15.22% over the projected period.

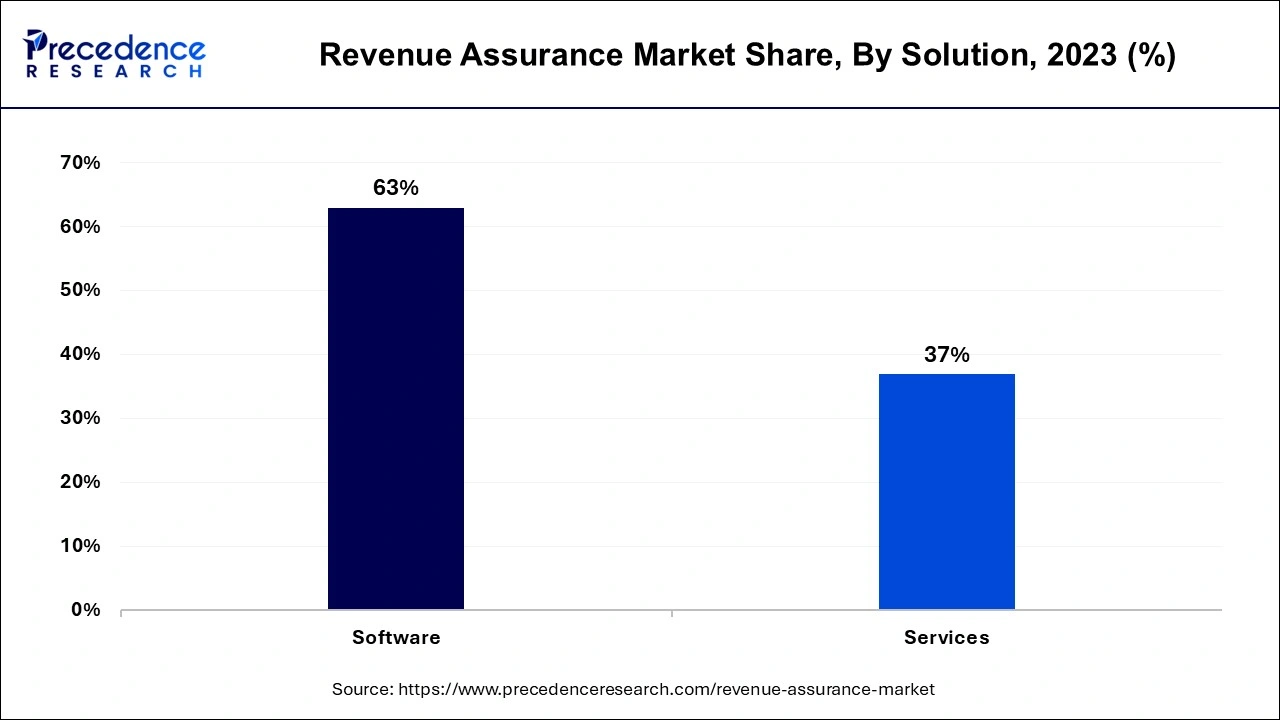

- By solution, the software segment accounted for the biggest market share of 63% in 2025.

- By solution, the services segment is expected to show fastest growth over the forecast period.

- By deployment, the cloud segment dominated the revenue assurance market in 2025.

- By deployment, the on-premises segment is anticipated to experience significant growth during the forecast period.

- By end use, in 2025, the telecom segment led the market by holding the largest market share.

- By end use, the BFSI sector is estimated to witness the fastest growth over the studied period.

What is Revenue Assurance?

Revenue assurance is the utilization of workflow improvement attributes and high-quality data to increase revenue, cash flows, and income. A substantial part of revenue assurance strategies includes correcting information just before it enters the billing system and searching and improving leakage points in the network and overall system. Revenue assurance can also help to safeguard revenue leakage by maximizing both revenue and cash flow.

Why is AI Playing a Crucial Role in the Revenue Assurance Industry?

Artificial Intelligence (AI) is transforming revenue assurance by analyzing high sets of data into actionable insights. Processing complex patterns and faults within contracts, billing systems, and customer usage data enables businesses to prevent and identify revenue leakage with more precision and accuracy. Furthermore, artificial intelligence and machine learning algorithms can detect fraudulent activities like unauthorized access, fake accounts, and billing discrepancies by searching patterns that differ from normal behavior.

- In August 2024, -Mobileum Inc., a global provider of analytics and network solutions, announced the partnership with Bangladesh's biggest telecommunications service provider, Mobileum, A next-generation revenue assurance and fraud management (RAFM) solution built on its flagship Active Intelligence Platform (AIP), to conduct its AI-driven risk management transformation.

Market trend

- In June 2025, an expanded service was revealed by Alpine Mar, which is a fast-growing, modern-day accounting firm along with a digital-first footprint. At the same time, a company seeking financing or investment, it is important to have reviewed and audited financials, as well as assurance services, which will be provided by the expanded services of Alpine Mar. Moreover, by acquiring Elliot Melamed PA, which is a boutique certified public accounting (CPA) firm, Alpine Mar has gained expertise in the assurance services area. Furthermore, this launch is a milestone achievement for Alpine Mar.

(Source:https://www.usatoday.com)

- In March 2025, for the development of an advanced revenue assurance solution that can optimize and protect SMS Application-to-Person (A2P) revenues, a collaboration between Openmind Networks and XL Axiata was announced. Moreover, the current SMS and SMSC Firewall implementation, which has been protecting and powering Indonesians for the last 8 years, this revenue assurance product sits on top of it.

(Source:https://www.thefastmode.com)

Revenue Assurance Market Growth Factors

- An increase in the use of a subscription-based economy is expected to boost market growth soon.

- An increase in the focus of businesses on improving customer experience can propel market growth further.

- The surge in the adoption of BDT and the rise in the demand for innovative payment services will likely help in the market expansion over the forecast period.

Revenue Assurance Market Outlook

Between 2025 and 2030, this market is expected to rise significantly due to the growing adoption of cloud-based solutions by healthcare brands, coupled with technological advancements in the BFSI sector.

Numerous market players are actively entering this market, drawn by partnerships, R&D and investments. Several revenue assurance brands, such as Accenture, Amdocs, Araxxe and some others have started investing rapidly for developing advanced revenue assurance solutions for the end-users.

Various startup brands are engaged in developing revenue assurance solutions across the globe. The prominent startup companies dealing in revenue assurance consist of Arintra, Charta Health, Comulate and some others.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 18.93 Billion |

| Market Size in 2025 | USD 7.10 Billion |

| Market Size in 2026 | USD 7.92 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 11.32% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Solution, Deployment, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Rising demand for revenue assurance solutions in the telecommunications industry

The telecom industry has been facing hardships due to numerous developments that have a direct impact on income streams. The launch of connected devices is smoothly manipulating the landscape of technology in the telecommunications sector. Hence revenue assurance becomes more crucial in this industry. Additionally, Consumer behavior is being impacted by advances and innovative technology, which will boost the demand for new services. There are various technologies, items, systems, and procedures in the telecom revenue chain.

- In May 2023, Beyond Now, a fast-growing digital platform provider, and Adamo, a Spanish fiber optic service provider, announced that the telco has raised its subscriber base by 237%, adding 297,500 new customer services in a highly competitive market for telecoms services.

Restraint

Lack of organizational growth

End-use companies cannot often grow their resources to invest in revenue leakage solutions and services. Moreover, the shortage of focus on modification can lead to adverse instances that have financial impacts, like unpredicted revenue leakages that influence billing because of alterations in the web, especially if risk management activity is not that strong.

Opportunity

Growth of the subscription economy

The growth of the subscription economy is fuelling the revenue assurance market growth. The need for revenue assurance solutions rises as the number of users making real-time transactions increases. Furthermore, the revenue assurance solutions are meant to enhance organizational competence while managing revenue capacity. The increasing number of mobile banking network services & online services will drive the growth of the revenue assurance market during the projected period.

- In June 2023, Trustly unveiled a new AI-powered recurring payment service to expand Europe's subscription economy. The company intends to improve how merchants manage repeat transactions via a single integration. The newly introduced technology is set to allow businesses to accept recurring transactions directly from customer's bank accounts, thus cutting the limitations created by traditional payment methods.

- In April 2024, the visa introduced Subscription Manager to the booming subscription economy. A new, all-in-one service for financial institutions to offer Visa cardholders a simple, convenient way to track their subscriptions, all from the palm of their hands.

Revenue Assurance Market Segment Insights

Solution Insights

The software segment led the revenue assurance market in 2025. The dominance of the segment can be attributed to the availability of innovative and highly flexible software. The unique methodology of this software improves service providers' business and financial health by identifying revenue leakages in the network. Additionally, it allows traffic to be controlled and monitored, underscoring all irregularities that can cause inappropriate utilization of services by delivering efficient and easy-to-use environmental events.

The services segment is expected to show the fastest growth in the revenue assurance market over the forecast period. The growth of the segment can be linked to the rising requirement for an organization to analyze the future impact of revenue leakage in the market. Furthermore, the services enhance the revenue assurance portfolio by providing customers with operational flexibility, competitive advantage, and value creation. The planning and consulting services also help service providers to identify affected fields more precisely.

- In February 2025, Ericsson launched new service orchestration and assurance products, solutions, and services. Designed to enable communication service providers (CSP) across the globe to capitalize at scale on the increasing variety and volume of high-impact use case opportunities made possible by 5G and 5G Standalone.

Deployment Insights

The cloud segment dominated the revenue assurance market in 2025. The dominance of the segment can be driven by opportunities provided by the paradigm shift from on-premise to cloud. Cloud enables users to access agility, high speed, and effective management of fraud and revenue. Also, various cloud service platforms offer improved fraud detection and prevention abilities by using Google Cloud's scalability to control rising volumes of transactions and data.

In October 2024, the global leader of the Ecosystem Integration software category and provider of the Cleo Integration Cloud (CIC) platform, released Cleo Retailer Relationship Manager, a powerful solution created to strengthen supplier-retailer relationships by offering proactive real-time intelligence that enables dynamic course correction, enhances relationships with key customers and ensures higher order capture rate.

The on-premise segment is anticipated to experience significant growth in the revenue assurance market during the forecast period. This is due to increasing demand for on-premises software as many enterprises are transferring from manual to automated systems to perform various tasks. Many organizations are preferring on-premises deployment due to enhanced security features. Moreover, confidential data can be saved in an on-premise software with no third-party access.

End-use Insights

In 2025, the telecom segment led the revenue assurance market by holding the largest market share. This is because of the increasing prevalence of telecom fraud. The main motive of revenue assurance is to cover the telecom revenue by seeking income losses and searching for the prime reasons for those losses. Furthermore, Telecom giants have faced a large number of incidents connected to revenue leakages. Which, in turn, drives the demand for revenue assurance in the telecom market.

In June 2024, inwi selected Subex, a top telecom analytics solutions provider, for a five-year contract to update its current Revenue Assurance and Fraud Management (RAFM) system to the advanced HyperSense Business Assurance and Fraud Management platform.

The BFSI segment is estimated to witness the fastest growth over the studied period. The growth of the segment can be credited to the increasing revenue leakages in almost all bank departments. Both retail and commercial customers can contribute to the reduction in income. The deployment of revenue assurance projects is accomplishing good results in the banking sector by offering numerous growth opportunities in the revenue assurance market.

In July 2024, RAKBANK, a prominent financial organization in the United Arab Emirates, announced that it has partnered with Wipro Limited, a leading technology services and consulting company, to establish a Testing Center of Excellence (TCoE) created to accelerate innovation and improve the quality and efficiency of the bank's digital services.

Revenue Assurance Market Regional Insights

The U.S. revenue assurance market size is evaluated at USD 1.69 billion in 2025 and is projected to be worth around USD 5.07 billion by 2035, growing at a CAGR of 11.61% from 2026 to 2035.

North America dominated the revenue assurance market in 2025 by holding the largest market share. The dominance of the segment can be attributed to the increasing number of new incidents of revenue leakages coupled with the strong consumer base, which stimulates innovative projects and a surge in technology investments. Furthermore, the growing need for real-time revenue monitoring in the telecommunications industry is propelled by the rising number of advanced technologies and services.

- In March 2024, Deloitte unveiled the biggest overhaul of its global operations. The Big Four firm seeks to cut costs and decrease the organization's complexity in the face of a probable market slowdown. Deloittes' main business units will be cut into four parts: audit and assurance, risk, strategy, and transactions, as well as technology and transformation.

Asia Pacific's revenue assurance market is anticipated to grow at the fastest growth over the projected period. The growth of the region can be driven by a raised demand for cloud-based services from mid and small-sized companies. Moreover, nations like Japan, India, and China also contribute a substantial share to the region's economy. There is a significant increase in expenditure on advanced technologies, such as the virtualization of networks and 5G technology in the region.

Europe is expected to grow significantly in the revenue assurance market during the forecast period. Due to the increasing need for accurate billing and tracking the revenue the demand for revenue assurance systems is increasing in Europe. At the same time, growing digitalization, various cloud-based or IoT-based revenue assurance and billing platforms are being developed. Thus, this promotes the market growth.

The advancing industries in the UK are increasing the use as well as demand for revenue assurance systems to avoid billing errors and revenue leakage. Thus, innovative platforms for the same are being developed.

The industries are utilizing advanced technologies to enhance the application as well as the performance of revenue assurance in Germany. Thus, various automated revenue assurance platforms are being launched to recover and monitor revenues.

Latin America held a considerable share of the industry. The rapid expansion of the BFSI sector in numerous countries, including Brazil, Argentina, Peru, Venezuela and some others, has boosted the market expansion. Additionally, the numerous government initiatives aimed at developing the telecom industry are expected to propel the growth of the revenue assurance market in this region.

The Middle East and Africa held a notable share of the market. The rise in the number of software development companies in several nations such as Saudi Arbia, UAE, Qatar, South Africa and some others has driven the industrial growth. Also, the rapid growth of the energy and utilities industry, along with technological advancements in the healthcare sector, is expected to foster the growth of the revenue assurance market in this region.

Revenue Assurance Market Companies

Accenture is a global professional services company that provides strategy, consulting, technology, and operations services to clients across more than 40 industries. It combines its capabilities in areas like digital, cloud, and security with its workforce of nearly 700,000 people to deliver solutions and create value for businesses worldwide.

Amdocs is a multinational company that provides software and managed services primarily to communications, media, and entertainment companies. Its solutions help these clients with digital transformation, customer experience, and operational efficiency.

Araxxe is a French company founded in 2005 that provides Revenue Assurance, End-to-End Billing Verification, and Interconnect Fraud Detection solutions to telecom companies. It operates a global network of software robots and experts to monitor services, ensuring accuracy and minimizing fraud for its clients through a subscription-based, managed service.

Hewlett Packard Enterprise Development LP (HPE) is a technology company that provides IT infrastructure products and services, specializing in hybrid cloud solutions, AI, and high-performance computing. This company offers a wide range of products, including servers, storage, networking (HPE Aruba), and software.

IBM, or International Business Machines Corporation, is a global technology company headquartered in Armonk, New York, that provides hybrid cloud, AI, and consulting services. It offers a wide range of software, infrastructure, and business services, including analytics, automation, and cybersecurity, and serves industries such as finance, healthcare, and manufacturing.

Subex Limited is an Indian telecom AI company that provides digital trust products and solutions to Communications Service Providers (CSPs) globally. The company helps its clients maximize revenue, manage risks, ensure frictionless operations using AI, and safeguard trust across every interaction.

Tata Consultancy Services (TCS) is an Indian multinational information technology (IT) services and consulting company that provides IT, BPO, infrastructure, engineering, and other business solutions to global clients. This company offers a wide range of services, including application development and management, digital transformation, cloud services, AI, data analytics, and cybersecurity.

Other Major Key Players

- Tech Mahindra Limited

- Telefonaktiebolaget LM Ericsson

- TEOCO

- Mobileum

Recent Developments

-

In September 2025, OneBill Software Inc. launched RevAssure360. RevAssure360 is an AI-based billing platform that finds application in numerous end-user sectors.

(Source: www.onebillsoftware.com) -

In August 2025, Shiprocket launched RevProtect. RevProtect is a new revenue assurance solution designed for the MSME sector.

(Source: smestreet.in) -

In June 2025, Subex Redefines launched the HyperSense revenue assurance & fraud management platform. This is an AI-enabled platform designed for the telecom sector in different parts of the globe.

(Source: www.subex.com)

Segments Covered in the Report

By Solution

- Software

- Services

By Deployment

- On-premise

- Cloud

By End-use

- BFSI

- Telecom

- Healthcare

- Retail

- Energy and Utilities

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting