Telecom Billing and Revenue Management Market Size and Forecast 2025 to 2034

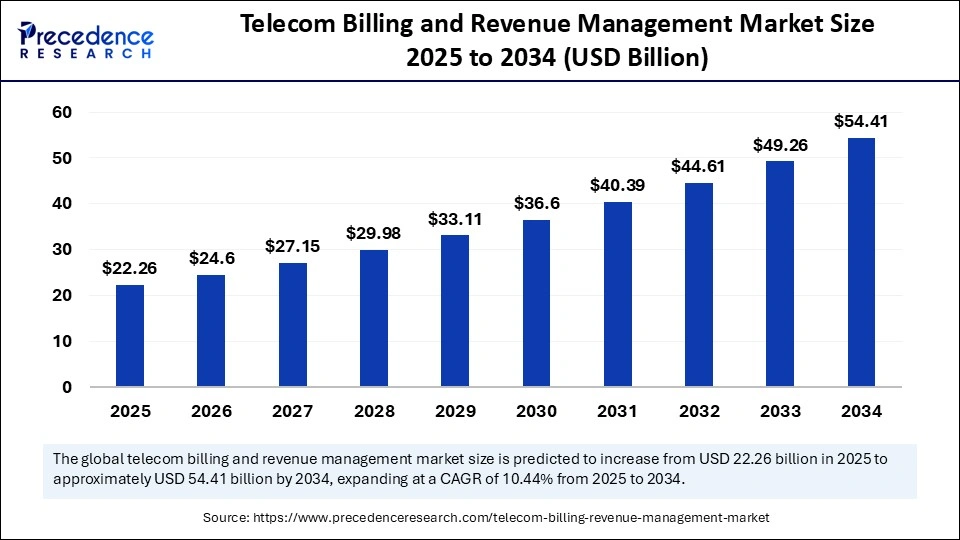

The global telecom billing and revenue management market size accounted for USD 20.16 billion in 2024 and is predicted to increase from USD 22.26 billion in 2025 to approximately USD 54.41 billion by 2034, expanding at a CAGR of 10.44% from 2025 to 2034.The growth of the market is attributed to the rising demand for real-time digital billing solutions, which improve service offerings and improve customer experience.

Telecom Billing and Revenue Management MarketKey Takeaways

- The global telecom billing and revenue management market was valued at USD 20.16 billion in 2024.

- It is projected to reach USD 54.41 billion by 2034.

- The market is expected to grow at a CAGR of 10.44% from 2025 to 2034.

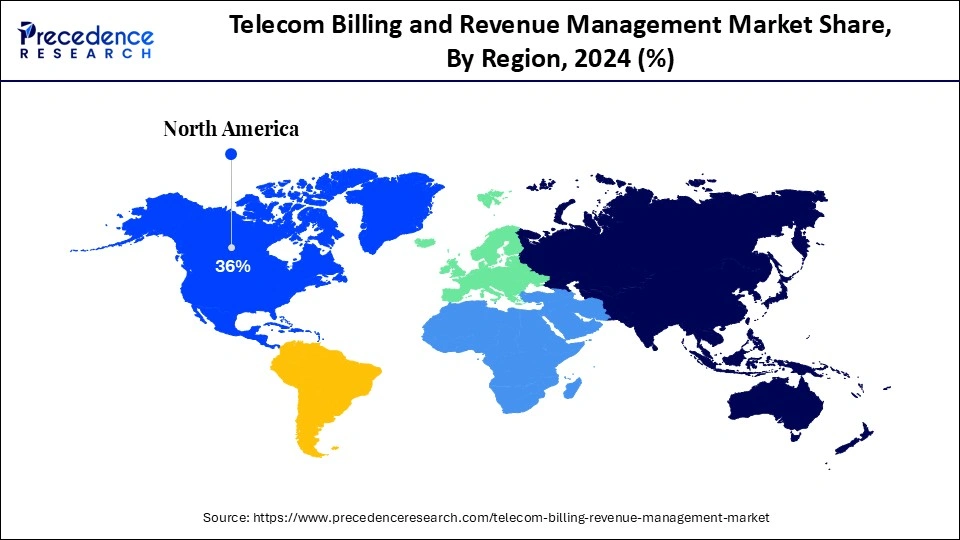

- North America dominated the global market with largest market share of 36% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR of 12.24% during the period.

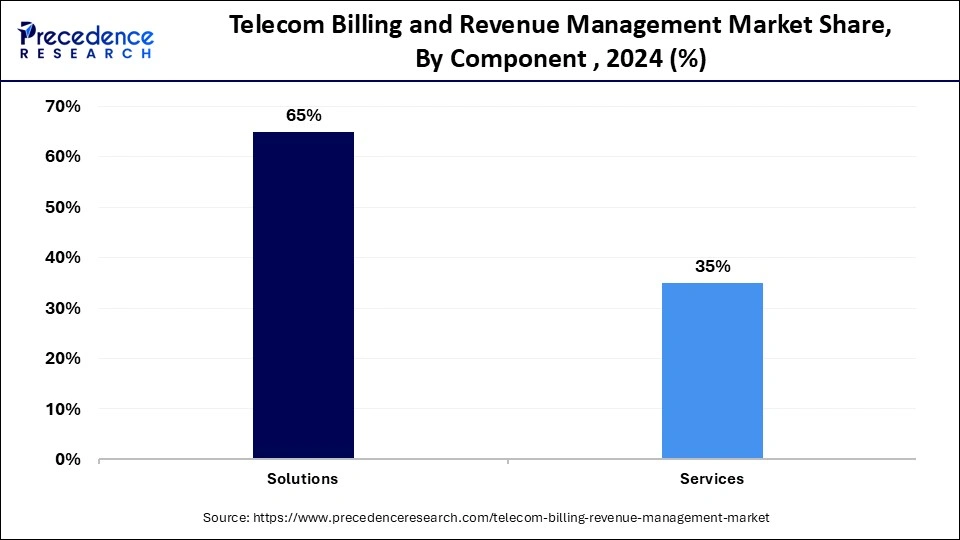

- By component, the solutions segment held the largest market share of 65% in 2024.

- By component, the services segment is expected to grow at the fastest CAGR over the forecast period.

- By deployment, the on-premise segment captured the biggest market share in 2024.

- By deployment, the cloud segment is expected to grow at the highest CAGR over the forecast period.

- By application, the mobile operators segment held a major market share in 2024.

- By application, the internet service providers segment is expected to expand at the rapid pace in the upcoming period.

How is AI Revolutionizing the Telecom Billing and Revenue Management Market?

Artificial Intelligence is positively influencing the telecom billing and revenue management industry by enabling automation, enhancing accuracy, and getting customer insights. Businesses can now process data immediately and automate billing functions through AI, reducing errors and costs. AI helps companies detect fraud efficiently by analyzing customer behavior and price card usage. AI chatbots enhance customer service, providing easy access to billing information. Telecom providers can maximize revenue, improve efficiency, and offer better customer service with AI.

U.S. Telecom Billing and Revenue Management Market Size and Growth 2025 to 2034

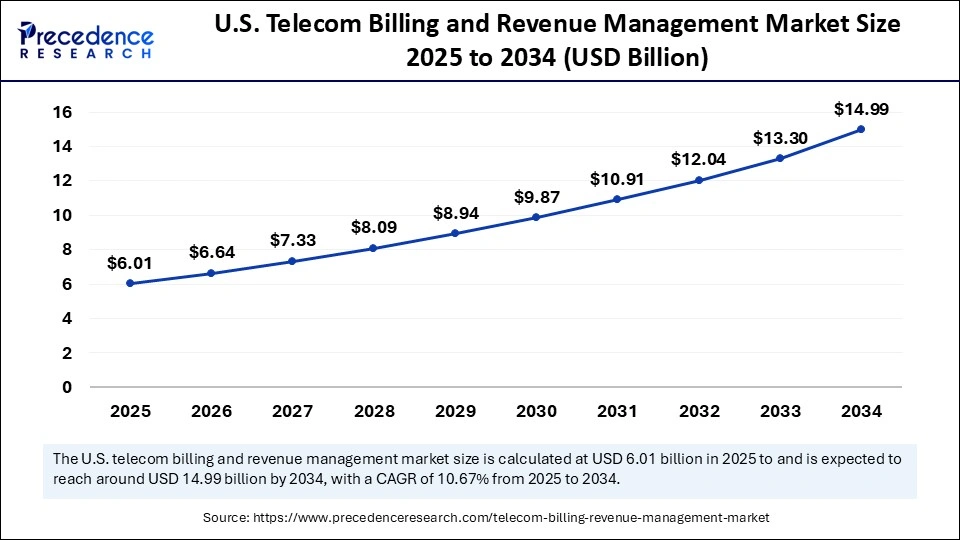

The U.S. telecom billing and revenue management market size was exhibited at USD 5.44 billion in 2024 and is projected to be worth around USD 14.99 billion by 2034, growing at a CAGR of 10.67% from 2025 to 2034.

What Factors Contributed to North America's Dominance?

North America dominated the telecom billing and revenue management market with the largest share in 2024. This is mainly due to the increased mobile subscribers and data usage. North American telecom operators face increased service complexity due to digital advancements in IoT, OTT platforms, and cloud computing. Companies rely on updated billing and revenue systems to manage diverse services, flexible pricing, and instant data processing. These operators prioritize updating their billing systems for ease of operation, scalability, and compliance with current regulations.

The U.S. is a major player in the market. The U.S. telecommunications industry is impacted by constant technological advances, widespread mobile service use, and intense competition. With 5G networks rolling out nationwide, businesses seek billing systems capable of managing newer pricing models, high data usage, and all their service offerings.

Asia Pacific Telecom Billing and Revenue Management Market Trends

Asia Pacific is expected to grow at the fastest CAGR during the forecast period. The growth of subscribers and data usage in China, India, and South Korea is driving the need for robust BRM tools. The rollout of 5G and the expansion of IoT devices further boost the demand for sophisticated BRM solutions, enabling enterprises to discover new ways of exchanging value. Telecom operators in the region are using advanced BRM programs to improve pricing, manage diverse service offerings, and leverage real-time data efficiently.

China is emerging as a prominent player in the market due to its vast telecom industry. Telecom companies are adopting modern billing technologies that process large amounts of data, enabling them to offer new IoT, cloud, and digital entertainment services. Demand for flexible and scalable billing has surged due to government initiatives promoting digital and smart city advancements.

European Telecom Billing and Revenue Management Market Trends

Europe is expected to grow at a significant rate during the projection period. There is a high demand for personalized services, highlighing the need for flexible BRM platforms. The growing demand for automated and digital payment solutions also contributes to market growth. Germany is leading the charge in Europe. There is high adoption of 5G technology, encouraging telecom operators to update their billing infrastructure. The popularity of cloud-based billing systems is increasing as German providers serve a larger customer base with a wider array of services.

Market Overview

Telecom billing and revenue management (BRM) encompasses the complete set of systems and procedures used to record customer usage, charge for services, produce invoices, handle payments, and control overdue debts. Telecom billing solutions simplify billing and revenue generation for providers. The growth of the market is driven by the proliferation of mobile and internet, the rising need for instant billing updates, and the global rollout of 5G.

Telecom operators are facing increased competition. Thus, they are offering complex plans and effective billing systems to stay ahead of the competition. These systems enable flexible pricing. By adopting cloud software and automation, healthcare businesses are reducing their workload. They must keep up with regulations, driving them to update their billing platforms, which helps the market grow faster in both developed and underdeveloped countries.

What are the Key Trends in the Telecom Billing and Revenue Management Market?

- Expanding telecom operation: Increased demand for mobile, internet, and digital services globally is fueling rapid growth in the telecom industry. As companies gain more subscribers, managing complex services and ensuring accurate revenue becomes crucial, prompting service providers to invest in updating their billing and revenue control systems.

- Using services on the cloud: Moving operations to the cloud enables telecom companies to expand services, reduce infrastructure costs, and improve service quality. Cloud platforms allow organizations to process data faster, experience fewer disruptions, and enhance customer service and operational efficiency.

- Increased need to optimize revenue: Due to increased competition and a wider range of services, telecom businesses must effectively manage revenue and minimize financial losses. Advanced billing and revenue management tools provide better support for future budgeting and accurate customer billing.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 54.41 Billion |

| Market Size in 2025 | USD 22.26 Billion |

| Market Size in 2024 | USD 20.16 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 10.44% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Deployment, Application, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Expansion of the Telecom Industry

The rapid expansion of the telecom industry is boosting the demand for effective billing and revenue management solutions. With the broader availability of telecom services and government approvals for new bands and licenses, interest in advanced billing and revenue management is growing among more companies. Competition leads telecom companies to lower plan prices, attract more customers, and quickly process more billing transactions. In addition, growth in 5G, Internet of Things, and OTT services, which require advanced billing capabilities, further boosts the growth of the market. IoT generates vast amounts of data and requires complex billing models.

New over-the-top (OTT) platforms focused on generating profits encourage revenue management solution suppliers to introduce flexible, combined billing systems. Traditional telecom companies are now offering streaming, cloud storage, and IoT as part of their services to handle complex revenue management operations. With these tools, organizations can control their pricing, maximize sales, and run their operations smoothly.

Restraint

Regulatory Compliance and Data Protection

The telecom billing and revenue management market faces significant regulatory compliance and data security challenges. Strict and evolving laws govern billing accuracy, customer rights, and personal data protection. A major hurdle for telecom operators is adapting BRM systems to changing legal requirements. Data security is crucial for operators managing extensive customer data. BRM solutions must adhere to stringent security protocols to safeguard data and avoid regulatory penalties. These regulations complicate operations and market entry, potentially hindering innovation in telecom billing and revenue management.

Opportunity

Need for Data Monetization and Analytics

The rising need for data monetization and analytics creates immense opportunities in the telecom billing and revenue management market by enabling revenue generation through customer behavior analysis, optimized pricing, and targeted marketing. They enhance network efficiency and facilitate data monetization while ensuring customer data protection. Advanced analytics within BRM systems enable telecom operators to unlock additional revenue streams through data monetization. Analyzing user behavior allows for optimized pricing, targeted marketing, and network efficiency improvements. In addition, the rising demand for personalized billing options and customer-centric billing models opens new growth avenues in the market.

Component Insights

The solutions segment dominated the telecom billing and revenue management market with the largest revenue share in 2024. This is mainly due to the increased need for flexible and robust billing and revenue management solutions. These solutions enable telecom companies to manage diverse services and analyze continuous customer data flow. They enable telecom operators to automate their billing processes and ensure compliance with industry changes. The integration of new billing technologies, AI, and analytics is driving growth in this segment.

The services segment is expected to grow at the fastest CAGR over the forecast period. With increasing digital challenges, telecom operators are turning to experts for service and financial management through managed services. These services help reduce operating costs, enable proper scaling, and ensure better service quality. The rapid digital transformation makes these services crucial for assisting operators in handling billing and enhancing customer satisfaction.

Deployment Insights

The on-premise segment dominated the telecom billing and revenue management market with a major share in 2024 and is expected to grow at a steady rate throughout the projected period. This is mainly due to the increased need for robust security. On-premises BRM solutions enable telecom operators to have control over their data, reducing the risks of data breaches. Many telecom companies opt for on-premises solutions, installing systems within existing infrastructure. This approach reduces costly modifications.

Local system operation enhances setup management and secure client data monitoring, complying with internal policies and legal requirements. Despite many telecom companies gradually shifting toward cloud environments, the on-premise deployment model is still reliable and gives users flexibility and control.

The cloud segment is expected to grow at the highest CAGR during the forecast period. Cloud deployment is attractive due to its affordability, accelerated timelines, and scalability, which are crucial for 5G service providers and new IoT and data services. Telecom operators are increasingly adopting cloud models for modern, flexible, and reliable solutions to quickly adapt their billing operations. Cloud solutions enable remote monitoring and access to data, which is helpful in improving decision making.

Application Insights

The mobile operators segment dominated the market with the biggest revenue share in 2024. The global increase in smartphone and mobile device ownership has driven Mobile Network Operators (MNOs) and Mobile Virtual Network Operators (MVNOs) to seek better billing and revenue management tools. The transition to 5G and the rise in mobile data usage emphasize the need for fast, reliable billing to ensure customer satisfaction. These systems enable operators to introduce new offerings, improve business efficiency, and maintain competitiveness in the digital landscape.

The Internet service providers (ISPs) segment is expected to grow at a rapid pace in the upcoming period due to the increasing adoption of high-speed internet, broadband, and optical fiber. With users relying on OTT, cloud, e-learning, and e-commerce, all demanding high internet speeds. Telecom companies are upgrading their revenue management systems. The rising need for modern billing and revenue management solutions that provide fast updated statistics, varied rates, and improved customer satisfaction further supports market growth.

Recent Developments

- In March 2024, Hrvatski Telekom (Croatia) announced an agreement with Netcracker Technology to begin upgrading the billing platform for its fixed and mobile customers. The Croatian operator is looking to achieve operational improvements, cost reductions, and IT function improvements.

- In May 2024, Ooredooa (a Multinational Network Technology Solutions Company in Qatar) and Nutcracker (a major player in telecom billing & revenue management) extended their partnership. The Middle East operator uses managed services support and a digital BSS product suite.

- In October 2023, Covenant Telecom announced an agreement with OneBill to upgrade their billing and revenue management. The purpose of this arrangement is to improve efficiency in their wholesaler/retailer billing while improving revenue management.

(Source: https://www.netcracker.com)

(Source: https://www.businesswire.com)

(Source: https://www.prnewswire.com)

Telecom Billing and Revenue Management Market Companies

- Amdocs

- Cerillion Technologies Ltd

- Comarch SA

- CSG Systems, Inc.

- Formula Telecom Solutions Ltd

- Huawei Technologies Co., Ltd

- Intracom Telecom

- Comviva

- Netcracker

- Optiva, Inc.

- Oracle

- SAP SE

- STL Tech

- SUBEX

- Telefonaktiebolaget LM Ericsson

Segments Covered in the Report

By Component

- Solutions

- Services

By Deployment

- On-premise

- Cloud

By Application

- Mobile operators

- Internet service providers

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting