Scleral Lens Market Size and Forecast 2025 to 2034

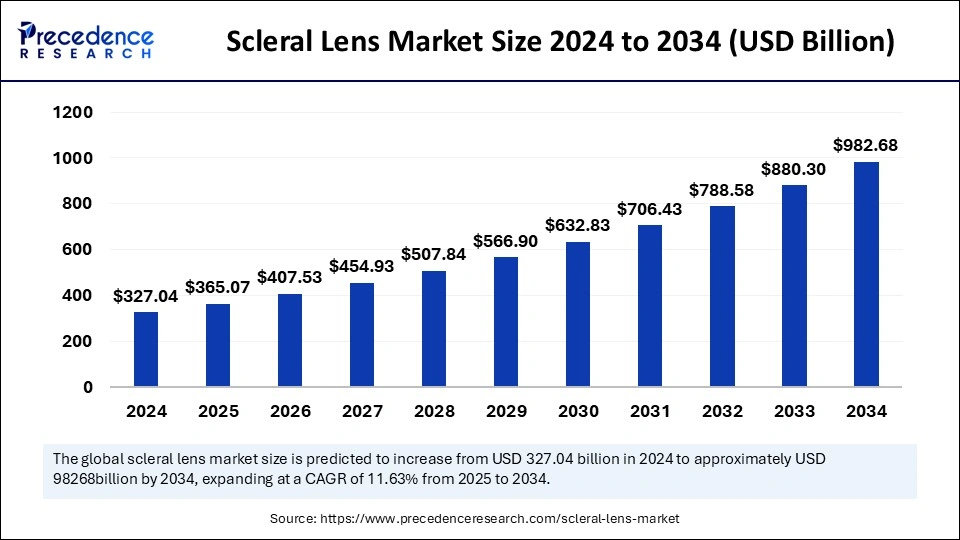

The global scleral lens market size accounted for USD 327.04 billion in 2024 and is predicted to increase from USD 365.07 billion in 2025 to approximately USD 982.68 billion by 2034, expanding at a CAGR of 11.63% from 2025 to 2034. The increasing incidence of ocular disorders is the key factor driving the market's growth. Also, favorable reimbursement policies, coupled with the key benefits offered by scleral lenses, can fuel market growth further.

Scleral Lens Market Key Takeaways

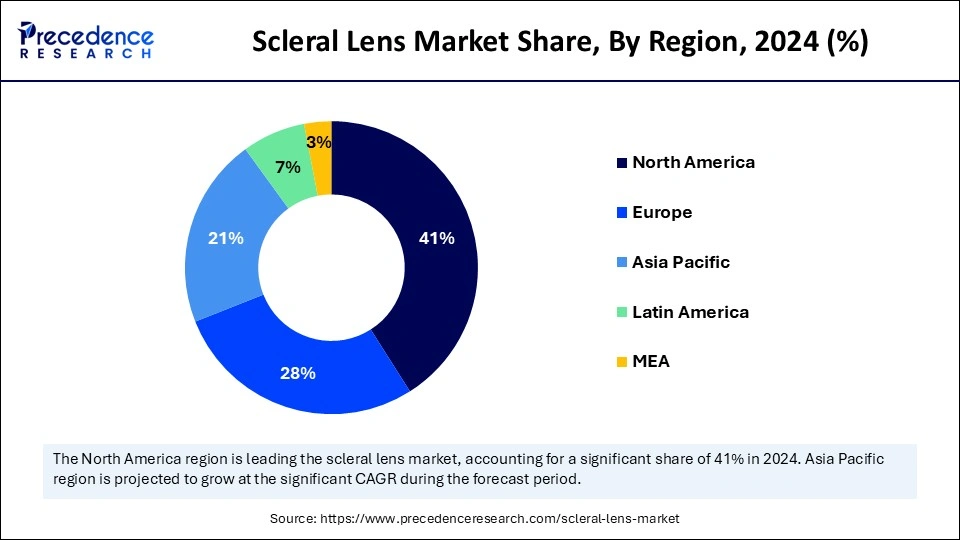

- North America dominated the global market with the largest market share of 41% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR during forecast period.

- By type, the corneo-scleral lenses and semi-scleral lenses segment dominated the market in 2024.

- By type, the mini-scleral lenses segment is expected to grow at the fastest CAGR over the forecast period.

- By application, the irregular cornea segment held the largest market share in 2024.

- By application, the ocular surface disease segment is anticipated to grow at the fastest rate over the forecast period.

- By end user, the eye clinics segment led the market by holding the largest share in 2024.

- By end user, the hospital segment is estimated to grow at the fastest CAGR during the projected period.

Role of Artificial Intelligence (AI) in the Scleral Lens Market

Artificial intelligenceis poised to transform the market by improving design, production, and fitting processes, leading to enhanced patient outcomes with a more individualized approach to ocular surface disease management and vision correction. Furthermore, AI algorithms can process large amounts of patient data to optimize lens designs, ensuring enhanced vision correction with the best fit.

- In July 2024, GlassesUSA.com, a leading eyewear retailer in the United States, announced the launch of the groundbreaking "Pairfect Match AI™" technology, revolutionizing online eyewear shopping by seamlessly matching customers with the perfect pair of glasses.

U.S. Scleral Lens Market Size and Growth 2025 to 2034

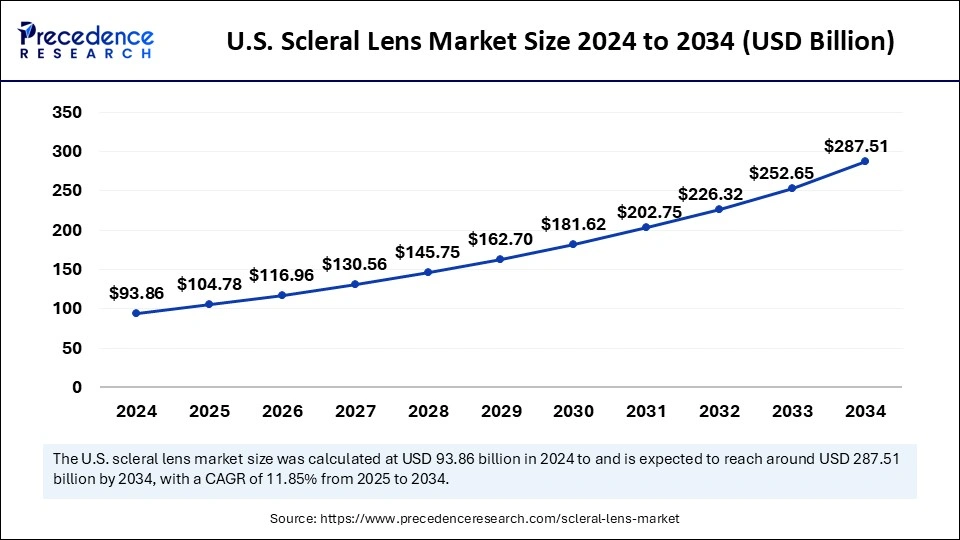

The U.S. scleral lens market size was exhibited at USD 93.86 billion in 2024 and is projected to be worth around USD 287.51 billion by 2034, growing at a CAGR of 11.85% from 2025 to 2034.

North America dominated the global scleral lens market in 2024. The dominance of the region can be attributed to the increasing patient pool suffering from numerous vision-related conditions coupled with the rising deployment of research & development activities in the region. Furthermore, the growing adoption of scleral contact lenses among contact lens users is a major factor driving the market growth.

- In December 2023, Xpanceo unveiled prototypes of its smart contact lens, which aims to mimic the technology featured in the Iron Man films, its founder and managing partner has said;

The U.S. Market Trends

In North America, the U.S. led the scleral lens market owing to the increasing acceptance among individuals seeking reliable vision correction solutions and enhanced quality of life, further boosting the country's growth in the market. Also, the region benefits from a strong healthcare infrastructure.

Asia Pacific is expected to grow at the fastest rate in the scleral lens market over the studied period. The growth of the region can be credited to the ongoing innovations in medical technology and government initiatives backing eye problem solutions, which lead to a substantial patient base. Furthermore, rising regional awareness regarding the benefits and availability of scleral lenses over conventional lenses will contribute to the market expansion.

China Market Trends

In Asia Pacific, China led the scleral lens market in 2024. The dominance of the country is due to the ongoing awareness programs initiated by various private organizations and governments in the country. The country also from a large aging population, facilitated by the rising adoption of innovative medical devices.

Market Overview

Scleral lenses are unique contact lenses manufactured to cover the whole corneal surface along with the sclera. These lenses are generally utilized to treat a number of eye diseases, such as uneven corneas, keratoconus, and severe dry eye syndrome. The scleral lenses are bigger than traditional contact lenses. The scleral lens market provide in convenient choices with feasible rates for an extensive group of patients due to technological developments.

Scleral Lens Market Growth Factors

- The growing demand for advanced treatment options, along with the unique benefits of these lenses, is expected to boost scleral lens market growth shortly.

- The surge in the geriatric population across the globe can soon propel market growth.

- The rising need for eye movement analysis will likely contribute to market growth over the forecast period.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 982.68 Billion |

| Market Size in 2025 | USD 365.07 Billion |

| Market Size in 2024 | USD 327.04 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 11.63% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, End User, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Increasing incidence of corneal disorders

The growing incidence of corneal disorders like corneal dystrophies and keratoconus has raised the demand for advanced vision correction solutions that conventional lenses cannot address properly. In addition, scleral lenses offer superior vision enhancement and comfort by covering the cornea and creating a safe layer of fluid. This increased need for efficient management of corneal diseases fuels market growth.

- In November 2024, Alcon announced the launch of Precision7, a 1-week replacement contact lens containing a new technology that provides up to 16 hours of comfort and precise vision in both sphere and toric designs.

Restraint

Complicated fitting process

The complicated fitting process in the scleral lens market includes accurate adjustments and measurements to ensure proper fit because these lenses cover the whole cornea and remaining sclera. Moreover, this complex fitting process can hinder market expansion by deterring users and medical professionals due to the raised cost, time, and need for specialized training.

Opportunity

Increasing adoption of advanced solutions

There is a surge in the number of individuals with vision-related problems across the globe, which in turn results in a rise in screen time and unhealthy lifestyles due to the impact of games, social media, and videos, creating significant opportunities in the scleral lens market. Furthermore, the increasing proliferation of technological innovations and advancements has led to a raised demand for emerging solutions by consumers to control their eye issues.

- In June 2024, Kits Eyecare Ltd., the leading vertically integrated eyecare provider, announced the launch of its KITS branded Daily Contact Lens lineup. The new 30-pack of KITS Daily Silicone Hydrogel lenses is priced at just USD 28, significantly lower than other daily silicone hydrogel branded lenses.

Type Insight

The corneo-scleral lenses and semi-scleral lenses segment dominated the scleral lens market in 2024. The dominance of the segment can be attributed to the increasing incidence of corneal transplantation along with the advantages it offers in patient comfort. In addition, the major market players are increasingly focusing on combining new technologies, such as digital imaging, which can lead to more precise measurements of these lenses.

- In December 2023, Azalea Vision announced the demonstration of its ALMA Lens, the first functional prototype of the Azalea smart contact lens platform. According to Azalea Vision, the lens is designed to offer a non-surgical solution for patients suffering from keratoconus, corneal irregularities, photophobia, and presbyopia.

The mini-scleral lenses segment is expected to grow at the fastest rate over the forecast period. The growth of the segment can be credited to the ongoing enhancements and advancements in these lenses' features and abilities, which offer better wearability, comfort and higher stability. Also, the surge in cases of dry eye syndrome and ocular diseases can impact the segment's growth positively.

Application Insights

The irregular cornea segment held the largest scleral lens market share in 2024. The dominance of the segment can be linked to the increasing prevalence of corneal diseases such as keratoglobus and pellucid marginal degeneration (PMD). Scaler lenses are popular for their comfort and do not touch the delicate cornea but rest on the less sensitive sclera. The specialized designs of lenses enhance stability and decrease friction.

The ocular surface disease segment is anticipated to grow at the fastest rate over the forecast period. The growth of the segment can be driven by the increasing incidence of many ocular surface diseases like keratoconus, dry eye syndrome, and many others. Moreover, rising awareness among individuals about the potential availability and benefits of innovative treatment options, such as scleral lenses, can soon propel market growth.

End-User Insight

In 2024, the eye clinics segment led the scleral lens market by holding the largest share. The dominance of the segment is owing to the increased awareness and raised availability of scleral goods at the local level. Furthermore, Major market players are emphasizing distributing their products through medical professionals, and eye clinics are increasingly adopting a patient-specific approach.

The hospital segment is estimated to grow at the fastest rate during the projected period. The growth of the segment is due to the substantial expansion in the world healthcare sector along with the ongoing development of hospital infrastructure, such as the integration of the most sophisticated equipment and technologies for precise measurement of eye disorders, further impacting the positive market.

Scleral Lens Market Companies

- ABB Optical Group

- Alden Optical Laboratories

- Art Optical Contact Lens Inc.

- Bausch Health Companies Inc.

- Blanchard Lab

- Boston Sight

- Essilor

- SynergEyes

- TruForm Optics Inc.

- Valley Contax

- Visionary Optics

Latest Announcements by Market Leaders

- In February 2025, ABB Optical Group announced the launch of the Delta Scleral, the next generation of scleral contact lenses, which premiered at GSLS 2025. ABB also announced the launch of HydroPure MPS and HydroPure Lubricating Eye Drops for both soft and gas-permeable lenses. HydroPure is an exclusive product line for ECPs through ABB Optical Group.

- In February 2023, Visionary Optics announced the launch of Europa Tangent, a new scleral lens that provides a customizable design and a three-zone step system for optimal fitting; according to the release, the lens design was based on clinical experience and analysis of data from more than 10,000 fittings.

Recent Developments

- In May 2024, Bausch + Lomb Corporation announced the U.S. launch of Zenlens ECHO, a non-prosthetic, custom scleral contact lens technology designed to fit a wide variety of corneal shapes and sizes, including patients who have advanced ocular conditions such as corneal degeneration and certain postoperative conditions.

- In February 2023, Visionary Optics launched Europa Tangent, a new scleral lens that provides a customizable design and a three-zone step system for optimal fitting. The lens design was based on clinical experience and analysis of data from more than 10,000 fittings.

Segments Covered in the Report

By Type

- Corneo-Scleral Lenses and Semi-Scleral Lenses

- Mini-Scleral Lenses

- Full Scleral Lenses

By Application

- Irregular Cornea

- Ocular Surface Disease

- Refractive Error

- Other Applications

By End-User

- Hospitals

- Eye Clinics

- Other End Users

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting