Soda Maker Market Size and Growth 2025 to 2034

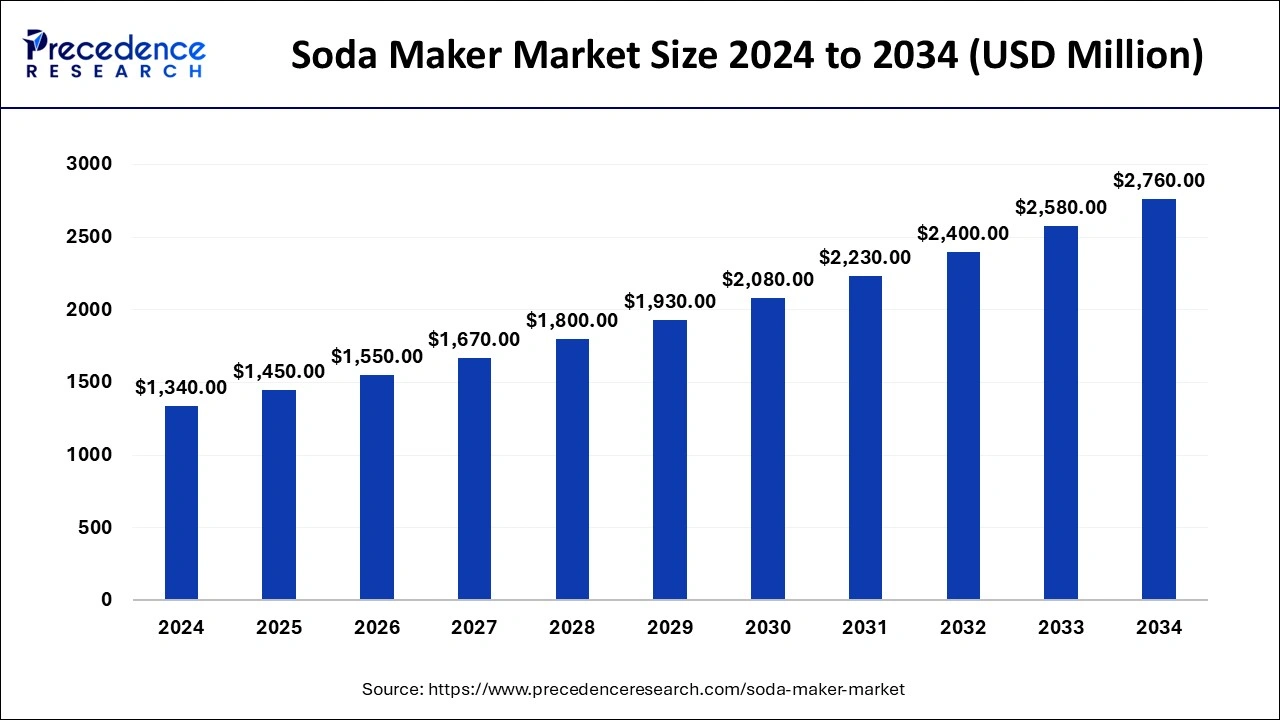

The global soda maker market size was estimated at USD 1,340 million in 2024 and is predicted to increase from USD 1,450 million in 2025 to approximately USD 2,760 million by 2034, expanding at a CAGR of 7.49% from 2025 to 2034. The rising hospitality industry and the popularity of carbonated drinks in the millennial generations are boosting the growth of the soda maker market.

Soda Maker MarketKey Takeaways

- In terms of revenue, the global soda maker market was valued at USD 1,340 million in 2024.

- It is projected to reach USD 2,760 million by 2034.

- The market is expected to grow at a CAGR of 7.49% from 2025 to 2034.

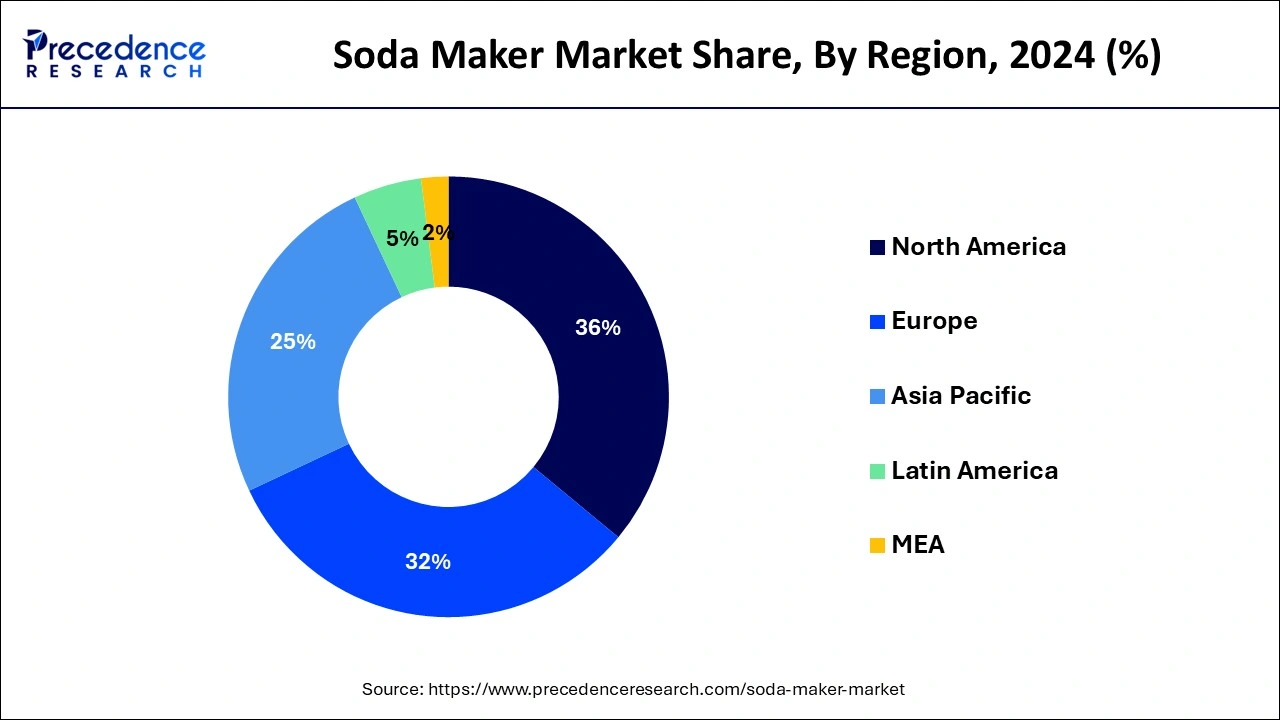

- North America dominated the market with the largest share of 36% in 2024.

- Europe witnessed a significant share while growing at an impressive CAGR for the forecast period.

- By modes of operation, the manual segment dominated the soda maker market with the largest share in 2024.

- By modes of operation, the electric soda maker segment is expected to grow at the fastest CAGR during the forecast period.

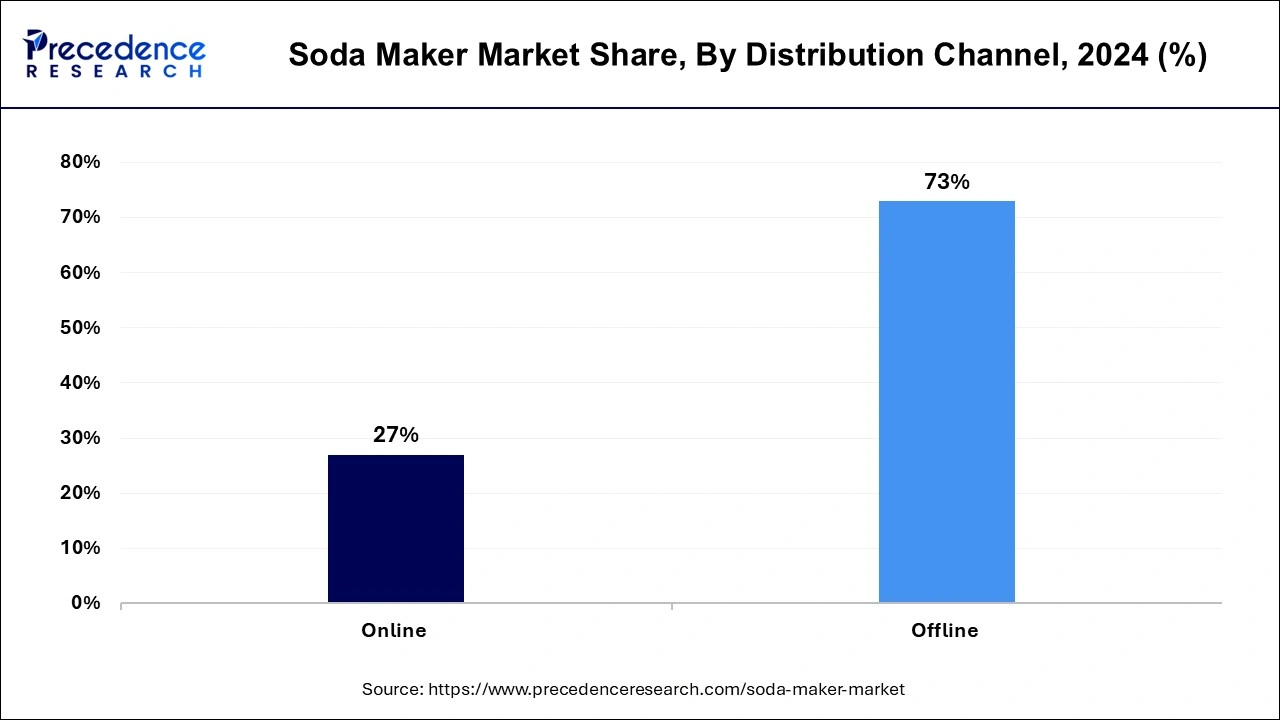

- By distribution channel, the offline segment dominated the market with the largest share of 73% in 2024.

- By distribution channel, the online segment is expected to grow at a significant rate during the forecast period.

U.S.Soda Maker Market Size and Growth 2025 to 2034

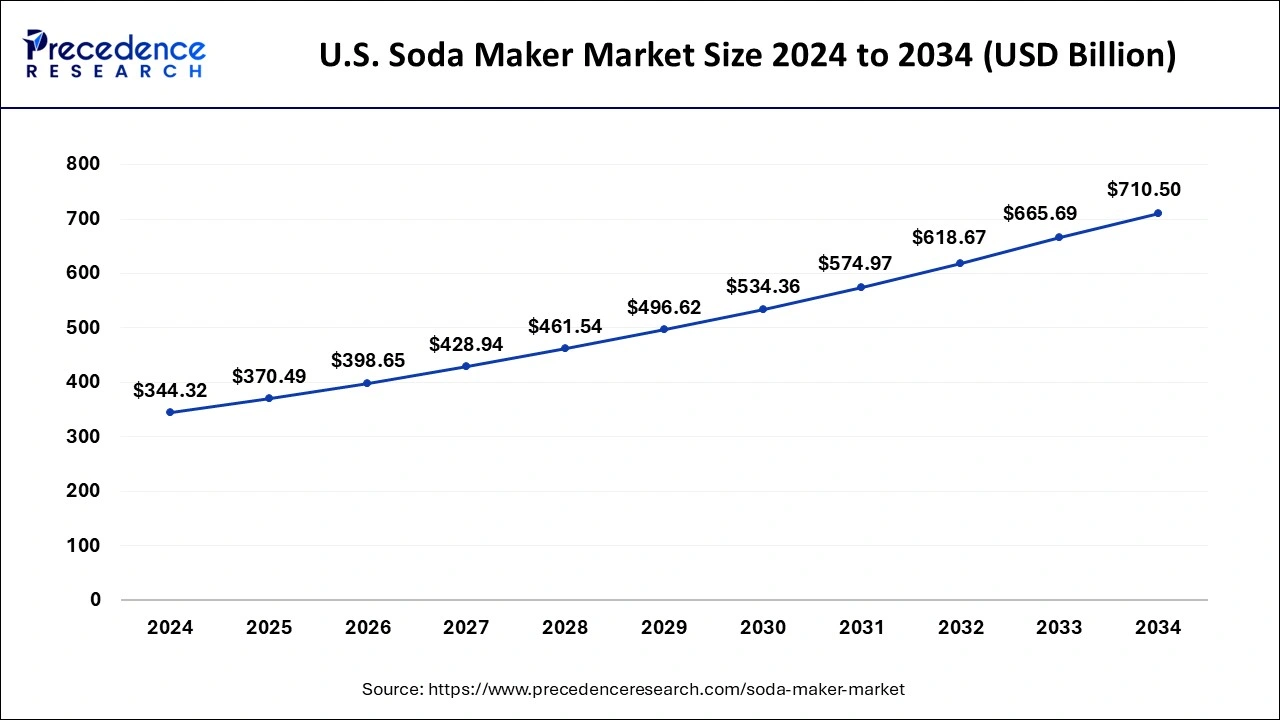

The U.S. soda maker market size was valued at USD 344.32 billion in 2024 and is anticipated to reach around USD 710.50 billion by 2034, poised to grow at a CAGR of 7.51% from 2025 to 2034.

North America dominated the soda maker market with the largest revenue share of 36% in 2024.The dominance of the market is attributed to the rising demand for soda makers in domestic and commercial utilization. Many consumers in American countries are seeking healthier beverage options, and soda makers allow them to create their own carbonated drinks using water and flavorings of their choice, which can be perceived as healthier alternatives to store-bought sodas. North America has a strong culture of soda consumption, with a large portion of the population enjoying carbonated beverages regularly. The preference for soda and other carbonated drinks creates a substantial market for soda makers in the region.

North American consumers are increasingly concerned about environmental sustainability and reducing single-use plastic waste. Soda makers promote sustainability by reducing the need for disposable plastic bottles and cans, which resonates with environmentally conscious consumers in the region. Soda maker brands invest significantly in marketing and brand-building efforts in North America, leveraging advertising campaigns, sponsorships, and endorsements to increase brand awareness and consumer engagement. Strong brand recognition and marketing initiatives help drive sales and market dominance in the region.

Europe is expected to witness significant growth in the soda maker market during the forecast period.The growth of the market in the region is attributed to the rising demand for soda makers in several areas of the region and the rising consumption of carbonated water or drinks rather than excess sugary drinks. The increasing demand for healthier and personalized beverages is prioritized which boosts the demand for the soda maker machine in the domestic as well as in commercial places which contributes to the growth of the soda maker market across the region. The trend for dine-out services in European countries along with the rising tourism industry acts as a major driver for the soda maker market in Europe.

Market Overview

The soda maker market revolves around the innovation, development and distribution of appliances used in creating fizzy drinks. Soda makers allow users to experiment with different flavors and ingredients to create personalized beverages tailored to their taste preferences. With a variety of flavoring options available, users can create a wide range of fizzy drinks to suit their mood or dietary restrictions. These soda makers typically work by injecting carbon dioxide (CO2) gas into water, which creates carbonation and gives the water a fizzy texture. Some soda makers also come with flavoring options, allowing users to customize their drinks according to their preferences. Polystyrene soda makers are the most popular form of such appliances. The increasing expenditure on dining out restaurants, rising health awareness living standards, and growth of hospitality industry are driving the growth of the soda maker market.

Soda Maker MarketGrowth Factors

- With the increase in population, majorly younger generation is attracted to carbonated drinks and fancy drinks are fueling the demand for advanced soda makers, while promoting the growth of the soda maker market.

- The increasing consumer preference for on-the-go drinks in the new age generation is boosting the demand for soda makers. Additionally, the increasing demand for low-calorie and low-carb drinks is propelling the demand for the same.

- Convenience in the availability of the product in supermarkets and retail stores acts as a growth factor for the market.

- The growth in hospitality industry, corporate culture, and other activities are boosting the growth for the market. The rising emphasis on buying luxury products with the presence of disposable incomes, especially in urban areas, acts as another growth factor for the soda maker market.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1,450 Million |

| Market Size by 2034 | USD 2,760 Million |

| Growth Rate from 2025 to 2034 | CAGR of 7.49% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Mode of operation, By Distribution |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Growth of the hospitality sector

The growth in the hospitality industry due to the rise in tourism activities across the world and the rising per capita income globally is enhancing the expenses on luxury and standard lifestyle which certainly acts as a driver for the soda maker market. With the focus on hospitality and services, businesses look for creating and offering high-quality beverages to their customers and guests. Along with this, the rising demand for dine-out services at cafes and restaurants drives the market's growth while boosting the demand for advanced soda makers.

Soda makers enable hotels, restaurants, bars, and other hospitality establishments to offer customized and personalized beverage options to their guests. Customers can create their own soda flavors by mixing different syrups and carbonation levels, providing a unique and interactive experience that enhances customer satisfaction and loyalty. Sustainability is increasingly becoming a priority for consumers and businesses alike. Soda makers offer a more environmentally friendly alternative to traditional bottled or canned sodas by reducing plastic waste and carbon emissions associated with transportation. Hospitality establishments can promote their commitment to sustainability by offering house-made carbonated beverages using soda makers.

Restraint

Rising health consciousness

Rising health concerns and consciousness for the same acts as a restraint for the soda maker market. Health-conscious consumers are increasingly prioritizing natural, organic, and minimally processed foods and beverages. Traditional sodas often contain artificial flavors, colors, and preservatives, which are perceived as less healthy options. As a result, consumers are gravitating towards beverages made with natural ingredients and free from artificial additives, which may not align with the offerings of traditional soda makers. Health-conscious consumers are more aware of the link between soda consumption and health problems such as obesity, type 2 diabetes, and cardiovascular diseases. As a result, they are more inclined to avoid or limit their consumption of traditional sodas and opt for healthier beverage options, such as water, herbal teas, or natural fruit juices.

Opportunity

Product advancements

The development in the soda maker machine such as the electric soda maker which is more efficient in use. Major manufacturers in the industry of appliances are focusing on the development of electric appliances that can save efforts as compared to manual products. The electric soda maker is faster and easier to use. The industry is likely to choose an automatic machine that needs to be set up at once and works according to the instructions. Electric soda makers are more user-friendly as compared to traditional or manual soda maker machines. It saves time and effort, while enhancing the productivity and profitability of the business. Thereby, the development and innovation of such advanced products act as an opportunity for the soda maker market.

Mode of Operations Insights

The manual segment dominated the soda maker market with the largest share in 2024. The growing demand for manual soda maker machines for households and the easy use of manual machines offer a sustainable growth factor for manual soda makers. A manual soda maker is compact and used for the making of soft drinks, club sodas, and seltzer water.

Manual soda-making machines typically require 24 hours to make a beverage. The manual soda makers are specifically designed for domestic purposes and also can be found in commercial spaces. The commercial type of manual soda makers can produce more drinks at one time. The commercial model has a built-in carbonator, and it can produce more bubbles on drinks compared to the domestic models. Thus, the rising demand for both the domestic and commercial soda maker models promises growth for the segment in the market.

The electric soda maker segment is observed to witness the fastest growth of expansion during the forecast period. The growth of the segment is attributed to the rising acceptance of the developed product with enhanced features. The electric soda maker offers features like a flavor dispenser, adjustable carbonated settings, and digital display for carbonation monitoring which drives the growth of the segment. The increasing demand for electric soda makers from commercial places like hotels, restaurants, and cafes, propels the advancements in the products while promoting the segment's growth.

Electric soda makers offer consistent carbonation levels with each use, ensuring that users can achieve their preferred level of fizziness reliably. These models often feature customizable carbonation settings, allowing users to adjust the carbonation intensity according to their taste preferences. Consistency in carbonation quality enhances the overall user experience and satisfaction.

Distribution Channel Insights

The offline segment dominated the soda maker market with share of 73% in 2024. The increasing number of supermarkets and hypermarkets that have larger consumer bases already and are considered ideal for the distribution channel. The easy availability of various products on offline distribution channels like retail shops, supermarkets, and wholesalers is boosting the sales for soda makers by the offline distribution channel. Offline distributors like retailers and supermarkets enable a wider variety of beverage brands. The offline distributing outlets allow a wider consumer base and offer a different variety of products with various brands, driving the growth of the segment.

The online segment is expected to grow at the fastest CAGR during the forecast period in the soda maker market. The rising preference for online shopping from clothing to food items is driving the growth of the segment. The online segment creates brand awareness among consumers and expands the potential reach to consumers globally. The rising adaptation of online outlets is due it's a wider variety of products and cost efficiency. It works on the business-to-customer model, so it eliminates the intermediaries and distribution costs which results in increased profits in the business and boosts the sales that drive the growth of the online distribution channel segment.

Soda Maker Market Companies

- SodaStream Inc.

- AARKE AB

- i-Drink Products Inc

- Hamilton Beach Brands Holding Company

- Mysoda

- iSi GmbH

- Drinkpod

- Mr. Butler

- Spärkel Beverage Systems

- CO-Z

Recent Developments

- In January 2024, Rebar launched a line of personalized beverages for diabetes in collaboration with the DMC Medical Center in the celebration of Diabetes Awareness Month. The beverages are solely based on fruit sugar without adding honey or silicon and use sugar-free yogurt.

- In February 2024, Health-Ade, a Kombucha maker introduces its functional beverages space with the launch of SunSip a prebiotic soda. According to the organization, the launch is to meet the requirement of the consumer looking for a better alternative in the soda market. The sodas are available in flavors like Cherry Cola, Raspberry Lemonade, Root Beer, and Strawberry.

- In February 2024, Echo Falls increased its portfolio with the launch of kiwi and watermelon-flavored wine. The launch consists of 9% ABV taps into the demand for sweet ciders and RTD cocktails for attracting the consumer if these products towards the fruit wine.

Segments Covered in the Report

By Mode of Operations

- Manual Soda Maker

- Electric Soda Maker

By Distribution Channel

- Offline

- Online

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting