What is the Software Defined Perimeter (SDP) Market Size?

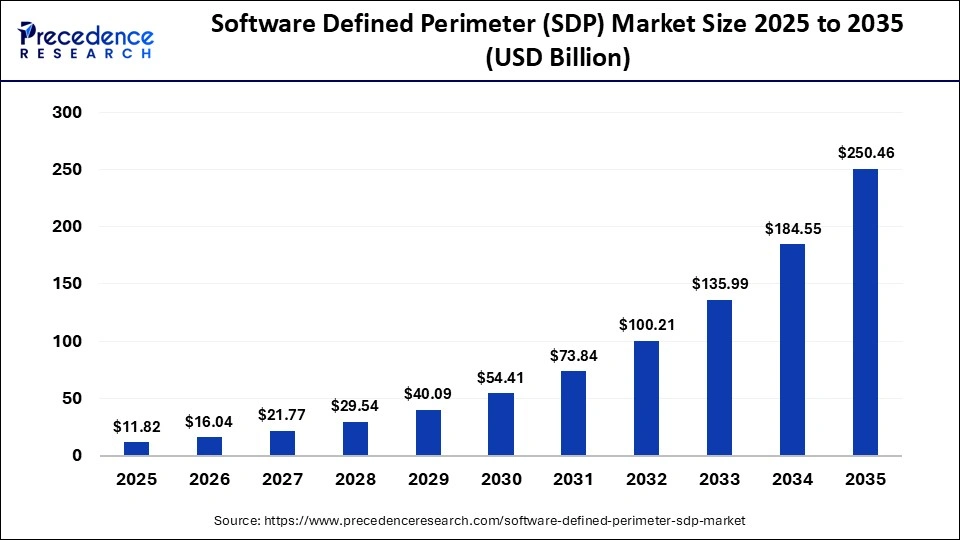

The global software defined perimeter (SDP) market size accounted for USD 11.82 billion in 2025 and is predicted to increase from USD 16.04 billion in 2026 to approximately USD 250.46 billion by 2035, expanding at a CAGR of 35.71% from 2026 to 2035. The market is driven by the rising issues of cyberattacks in the telecom sector globally, along with the increasing popularity of remote work.

Market Highlights

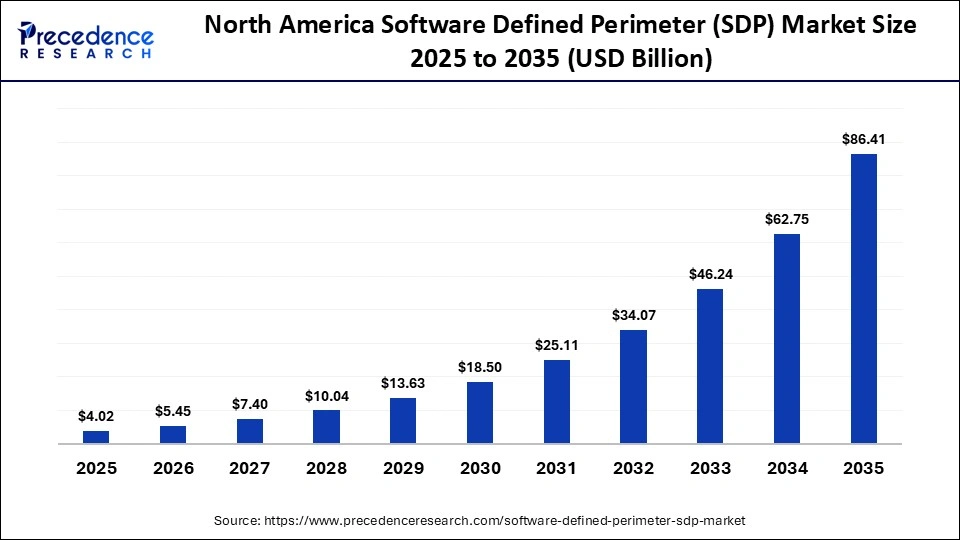

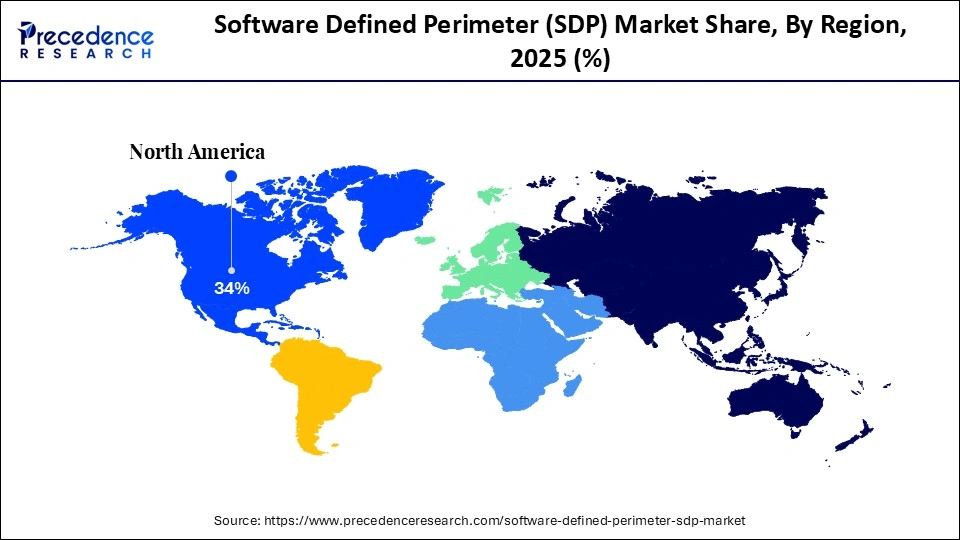

- North America led the market with the largest market share of 34% in 2025.

- Asia Pacific is expected to grow at the fastest CAGR during the forecast period.

- By deployment model, the cloud segment held the largest share of the market in 2025.

- By deployment model, the hybrid segment is expected to expand at the fastest CAGR during the forecast period.

- By solution type, the identity and access management (IAM) segment held the largest share of the market in 2025.

- By solution type, the endpoint security segment is expected to grow at the highest CAGR between 2026 and 2035.

- By organization size, the small and medium-sized enterprises segment held the largest share of the market in 2025.

- By organization size, the large enterprises segment is expected to grow at the fastest CAGR during the forecast period.

- By end user industry, the BFSI segment held the highest share of the market in 2025.

- By end user industry, the IT and telecom segment is expected to grow at a significant CAGR during the forecast period.

Market Overview

The software defined perimeter (SDP) market is a significant branch of the ICT sector. This market deals with the development and distribution of software-defined perimeter solutions for different industries. A software-defined perimeter (SDP) is an identity-centric security framework that creates a virtual boundary around network resources by protecting them from unauthorized users. The rising demand for network security solutions from the telecom sector, as well as technological advancements in cloud platforms, is driving the market. Additionally, the rapid expansion of the IT sector in different parts of the world contributes to market expansion.

What is the role of AI in the Software Defined Perimeter (SDP) Industry?

Artificial intelligence is reshaping the overall landscape of the cybersecurity sector. In cybersecurity platforms, AI helps in detecting threats, enhancing vulnerability management, improving predictive intelligence, and advancing behavioral analytics. In recent times, SDP providers have started integrating AI in their data prevention platforms to protect sensitive data, identify high-value information, advance data discovery, and anomaly detection. Thus, AI plays a prominent role in driving the growth of the software defined perimeter industry.

- In September 2025, SPTel launched PatchSense AI. PatchSense AI is an AI-based tool designed for assessing cybersecurity risks in small and medium-sized enterprises (SMEs).

Software Defined Perimeter (SDP) Market Trends

- Rising Adoption of Zero Trust Security Models: Organizations are increasingly implementing SDP as a core component of Zero Trust architectures to eliminate implicit trust, reduce attack surfaces, and secure access to applications regardless of user location.

- Integration with Cloud and Hybrid IT Environments: The growing shift toward cloud-native and hybrid infrastructures is driving demand for SDP solutions that provide secure, identity-based access to cloud workloads, SaaS applications, and multi-cloud environments.

- Increased Demand for Remote and Hybrid Workforce Security: The expansion of remote work is accelerating SDP adoption, as enterprises seek scalable and secure alternatives to traditional VPNs for protecting distributed users and endpoints.

- Collaborations: Various tech companies are collaborating with cloud providers to develop AI-enabled cloud security solutions. For instance, in September 2025, Check Point collaborated with Wiz. This collaboration aims at designing an AI-enabled network security solution for the cloud servers.

- Opening New Cyber Security Centers: Numerous telecom companies are engaged in opening cybersecurity centers for small and medium businesses. For instance, in March 2025, Vodafone Germany opened a new cybersecurity center in Düsseldorf. This cybersecurity center is inaugurated to protect and support small and medium-sized enterprises (SMEs) in the digital world.

- Product Launches: Several market players are engaged in launching a wide range of cybersecurity solutions for the end-users. For instance, in March 2025, Axonius launched Axonius Identities. Axonius Identities is a unified identity management & security solution designed for identifying threats in the finance sector.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 11.82 Billion |

| Market Size in 2026 | USD 16.04 Billion |

| Market Size by 2035 | USD 250.46 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 35.71% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Solution Type, Deployment Model, Organization Size, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Deployment Model Insights

Why Did the Cloud Segment Dominate the Software Defined Perimeter (SDP) Market?

The cloud segment dominated the software defined perimeter (SDP) market with the largest share in 2025. This is mainly due to the increased adoption of cloud-based cybersecurity solutions in the telecom sector across various countries, including India, France, Saudi Arabia, and Australia. Also, collaborations among AI companies and cloud platform providers to deliver cloud-based cybersecurity solutions to end-users are playing a prominent role in bolstering the segment. Moreover, numerous advantages of cloud solutions, including cost efficiency, improved flexibility and scalability, enhanced security, and superior performance, have supported the segment's leadership.

The hybrid segment is expected to grow at the fastest CAGR during the forecast period. This is primarily due to the increasing deployment of hybrid access management solutions in the healthcare sector. The surging focus of the IT companies on deploying AI-enabled endpoint security solutions in their organizations is positively contributing to the segmental growth. Moreover, several benefits of hybrid solutions, such as cost optimization, flexibility, improved security, superior reliability, and increased performance, are expected to propel the growth of this segment, thereby contributing to industrial growth.

Solution Type Insights

What Made Identity and Access Management (IAM) the Leading Segment in the Software Defined Perimeter (SDP) Market?

The identity and access management (IAM) segment led the market in 2025 due to its central role in enforcing identity-centric security within zero-trust frameworks. As organizations move away from perimeter-based defenses, IAM enables granular, user- and device-level authentication and authorization, ensuring that only verified entities can access protected applications. The rapid rise in remote work, cloud adoption, and bring-your-own-device (BYOD) environments has further increased reliance on IAM-driven SDP solutions to minimize attack surfaces and prevent unauthorized access. Additionally, the surging adoption of identity and access management (IAM) software in the BFSI sector to manage digital identities is expected to foster the growth of this segment.

The endpoint security segment is expected to grow at the highest CAGR between 2026 and 2035 due to the surging deployment of endpoint security solutions for securing remote and mobile workforces. SDP solutions increasingly integrate endpoint security to verify device posture, health, and compliance before granting access, reducing risks from compromised or unmanaged endpoints. Rising cyberattacks targeting laptops, mobile devices, and IoT endpoints have further pushed organizations to adopt SDP-enabled endpoint protection as part of a zero-trust security approach. Additionally, partnerships among AI providers and electronics brands for developing advanced endpoint security solutions are expected to drive the segmental growth.

Organization Size Insights

Why Did the Small and Medium-Sized Enterprises Segment Dominate the Software Defined Perimeter (SDP) Market?

The small and medium-sized enterprises segment dominated the market in 2025 because SMEs increasingly need enterprise-grade cybersecurity but lack the resources to deploy and manage complex, traditional network security infrastructure. The rise in the number of SMEs in numerous countries, such as China, India, Germany, France, and the UAE, has bolstered the segmental growth. Additionally, numerous government initiatives aimed at strengthening the SME sector, along with technological advancements in the small enterprises, are positively contributing to segmental growth. Moreover, partnerships among SMEs and tech providers to deploy advanced cybersecurity solutions are expected to ensure the long-term dominance of the segment.

The large enterprises segment is expected to grow at the fastest CAGR during the forecast period. The surging deployment of cloud-based cybersecurity solutions in large enterprises for providing additional protection against cyberattacks is driving segmental growth. Also, the rise in the number of large manufacturing companies in the U.S. and Italy, along with surging cases of cyber crimes in large organizations, is contributing to segmental growth. Moreover, collaborations among AI companies and large MNCs to deploy AI-enabled cybersecurity solutions in their organizations are expected to drive the growth of this segment, thereby contributing to the overall market development.

End User Industry Insights

Why Did the BFSI Segment Dominate the Software Defined Perimeter (SDP) Market?

The BFSI segment dominated the market while holding the largest share in 2025. This is because financial institutions handle highly sensitive data and are prime targets for cyberattacks, making robust security a top priority. SDP's zero-trust architecture enables secure, authenticated access to applications and data for employees, partners, and remote users, reducing the risk of breaches and insider threats. Additionally, stringent regulatory requirements in the BFSI sector, such as GDPR, PCI DSS, and local data protection laws, have driven widespread adoption of advanced security solutions like SDP to ensure compliance and protect critical financial assets.

The IT and telecom segment is expected to grow at a significant CAGR during the forecast period. The growing emphasis of the IT companies on deploying high-quality cybersecurity solutions in their offices to provide additional protection against cybercrimes is driving segmental growth. Also, the rapid investment by IT companies in developing advanced cybersecurity solutions is contributing to the segmental growth. Moreover, rising partnerships among telecom companies and AI providers to design advanced cybersecurity platforms are expected to propel the segmental expansion.

Regional Insights

How Big is the North America Software Defined Perimeter (SDP) Market Size?

The North America software defined perimeter (SDP) market size is estimated at USD 4.02 billion in 2025 and is projected to reach approximately USD 86.41 billion by 2035, with a 35.90% CAGR from 2026 to 2035.

Why Did North America Dominate the Software Defined Perimeter (SDP) Market?

North America dominated the software defined perimeter (SDP) market by holding the largest share in 2025. The region's dominance in the market is attributed to the early adoption of advanced cybersecurity solutions across enterprises and government sectors. The region has a high concentration of large organizations and technology vendors investing heavily in digital infrastructure, cloud computing, and zero-trust security frameworks. Additionally, strict regulatory requirements, growing cyber threats, and the presence of key SDP solution providers have further strengthened market penetration and driven North America's leadership in the SDP space.

- In June 2025, Zscaler, Inc., launched Zero Trust Everywhere. Zero Trust Everywhere is an advanced security solution designed for the end-user industries in the U.S. region.

What is the Size of the U.S. Software Defined Perimeter (SDP) Market?

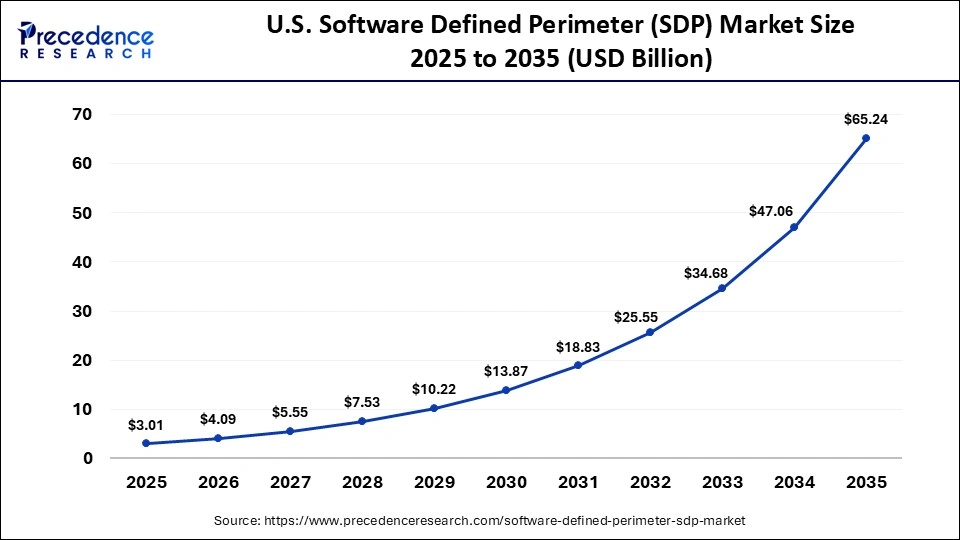

The U.S. software defined perimeter (SDP) market size is calculated at USD 3.01 billion in 2025 and is expected to reach nearly USD 65.24 billion in 2035, accelerating at a strong CAGR of 36.02% between 2026 and 2035.

U.S. Software Defined Perimeter (SDP) Market Trends

The market in the U.S. is growing due to the increasing demand for high-quality cybersecurity solutions from the retail sector and technological advancements in the telecom industry. Moreover, the surging focus of the government on deploying advanced cybersecurity solutions in its offices is boosting the market expansion.

What Makes Asia Pacific the Fastest-Growing Region in the Market?

Asia Pacific is expected to expand at the fastest CAGR during the forecast period. The surging adoption of on-premises cybersecurity solutions by organizations in the BFSI sector in several nations, including Japan, China, India, South Korea, and Australia, is driving the market growth. Additionally, numerous government initiatives aimed at strengthening the SME sector, coupled with rising cases of phishing attacks, are contributing positively to the market. Moreover, the presence of several market players, including Trend Micro, Sangfor Technologies, Venustech, and Topsec, is expected to propel the growth of the software defined perimeter (SDP) market in this region.

- In June 2025, Sangfor Technologies launched Sangfor Athena in China. Sangfor Athena is a new cybersecurity brand designed for the consumers of this nation.

Japan Software Defined Perimeter (SDP) Market Analysis

The market in Japan is driven by the rising deployment of cloud-based cybersecurity solutions in the healthcare sector, along with the increase in the number of large enterprises. Moreover, the growing cases of cyberattacks in the telecom sector, as well as the surging awareness about cybersecurity, is playing a prominent role in shaping the industrial landscape.

Who are the Major Players in the Global Software Defined Perimeter (SDP) Market?

The major players in the software defined perimeter (SDP) market include VMware, Fortinet, Check Point Software, Akamai Technologies, Microsoft, Zscaler, Cloudflare, Cisco Systems, and Palo Alto Networks.

Recent Developments

- In November 2025, Rockwell Automation launched SecureOT. SecureOT is an advanced platform that is designed to boost cybersecurity in the industrial sector. (Source: https://securitybrief.com.au)

- In September 2025, Huawei launched the Xinghe AI Network Security Solution. This solution is designed to protect enterprises against cybersecurity threats in China. (Source: https://e.huawei.com)

- In May 2025, Cisco launched Duo Identity and Access Management (IAM). Duo Identity and Access Management (IAM) is a new security solution designed to prevent phishing attacks.(Source: https://newsroom.cisco.com)

Segments Covered in the Report

By Solution Type

- Identity and Access Management

- Network Security

- Application Security

- Endpoint Security

By Deployment Model

- Cloud

- On-Premises

- Hybrid

By Organization Size

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

By End User

- BFSI

- Government

- Healthcare

- IT and Telecom

- Retail

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting