What is the Spinosad Active Ingredient Market Size?

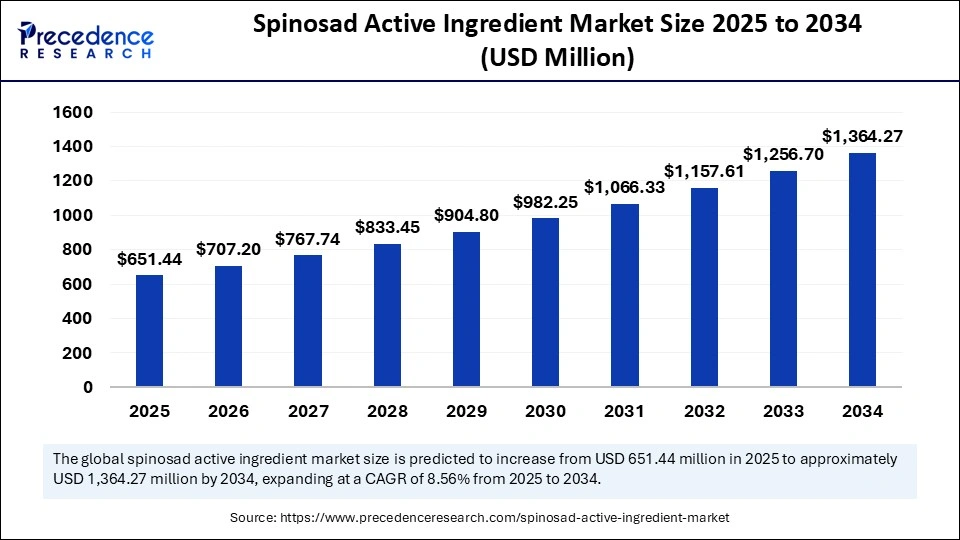

The global spinosad active ingredient market size accounted for USD 600.07 million in 2024 and is predicted to increase from USD 651.44 million in 2025 to approximately USD 1,364.27 million by 2034, expanding at a CAGR of 8.56% from 2025 to 2034. The market is expanding globally, driven by rising demand for eco-friendly pest control, organic farming adoption, and regulatory support for bio-based insecticides.

Market Highlights

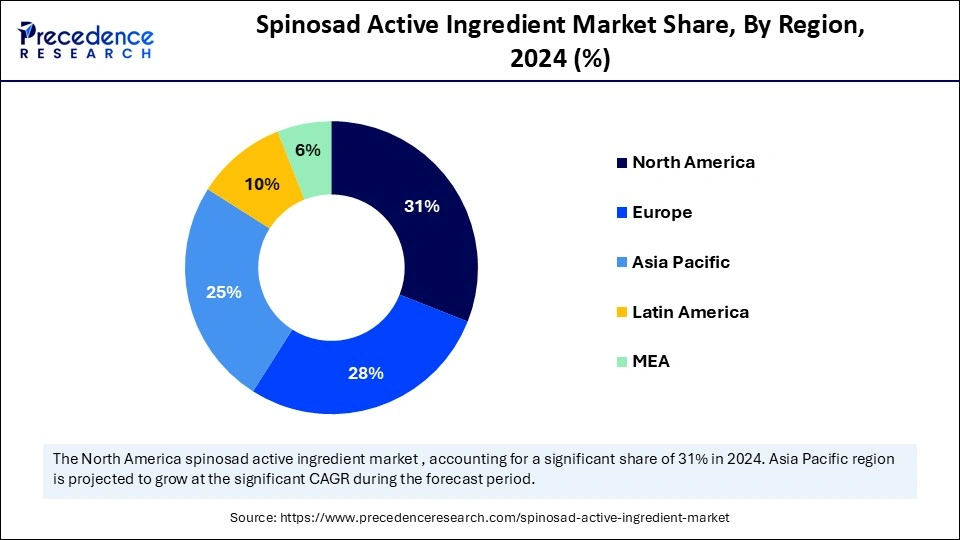

- North America dominated the spinosad active ingredient market with the largest market share of 31% in 2024.

- Asia Pacific is estimated to expand the fastest CAGR between 2025 and 2034.

- By product form/commercial product type, the technical grade segment held the biggest market share in 2024.

- By product form/commercial product type, the suspension concentrate (SC) segment is anticipated to grow at a remarkable CAGR between 2025 and 2034.

- By concentration/grade, the standard technical grade segment captured the highest market share in 2024.

- By concentration/grade, the high-purity technical (≥95%) segment is expected to expand at a notable CAGR over the projected period.

- By application method, the foliar spray segment led the market in 2024.

- By application method, the controlled-environment application segment is expected to expand at a notable CAGR over the projected period.

- By crop/end-use, the fruits and nuts segment captured the highest market share in 2024.

- By crop/end-use, the protected cultivation segment is expected to expand at a notable CAGR over the projected period.

- By end-user/customer type, the Large commercial farms/agribusiness segment accounted for the significant market share in 2024.

- By end-user/customer type, the smallholder/small farms segment is anticipated to grow at a remarkable CAGR between 2025 and 2034.

- By sales and distribution channel, the direct B2B to formulators/agrochemical manufacturers segment generated the major market share in 2024.

- By sales and distribution channel, the e-commerce/direct-to-user online sales segment is anticipated to grow at a remarkable CAGR between 2025 and 2034.

Market Size and Forecast

- Market Size in 2024: USD 600.07 Million

- Market Size in 2025: USD 651.44 Million

- Forecasted Market Size by 2034: USD 1,364.27 Million

- CAGR (2025-2034): 8.56%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

What are Spinosad Active Ingredients?

Spinosad active ingredient, is a naturally derived insecticidal complex (mainly spinosyn A and D) produced by fermentation of Saccharopolyspora spinosa. It is supplied as technical-grade Artificial Intelligencefor formulators or as finished formulations (EC, SC, WG, granules, baits, dusts, RTU) and is used across agriculture, horticulture, turf, protected cultivation, and public-health/household pest control. The spinosad active ingredient market is commonly sized by product form, concentration/grade, application method, crop/end-use, end-user, distribution channel, regulatory/certification status, manufacturing/technology route, pricing tier, and geography to capture volume vs value flows.

Spinosad Active Ingredient Market Growth Factors

- Increased Bio-Based Appeal: There is a progressive movement from farmers and consumers to apply natural, environmentally aware insecticides. As a microbial product, spinosad is consistently being embraced as a more sustainable alternative to synthetic insecticides, as it can be a part of both conventional and organic farming systems.

- Favorable Regulation and Certification: As a low-toxicity and low-residue product, spinosad is favored by global regulatory agencies and organic certifying bodies. Favorable regulation and certification help facilitate faster product registration, increase market access, and are supported by farmers around the world.

- Broader Applications: In addition to broad field and crop program usage, spinosad's appeal is growing in turf, ornamentals, stored product defences, and household pest management programs. The versatility of spinosad provides opportunities for demand expansion across the value chain, which also means continued market growth.

- Role in Resistance Management: As traditional insecticides lose efficacy due to pest resistance, spinosad's novel mode of action may effectively control these pests. Using spinosad as a part of an integrated pest management (IPM) program can enhance the durability of the product while also decreasing reliance on single-site synthetic insecticides.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 600.07 Million |

| Market Size in 2025 | USD 651.44 Million |

| Market Size by 2034 | USD 1,364.27 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.56% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Form/Commercial Product Type, Concentration/Grade, Application Method, Crop/End-use, End-User/Customer Type, Sales and Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Is the organic farming boom supporting spinosad use?

A chief growth driver for the spinosad active ingredient market is the rapid global transition to organic and sustainable farming techniques. Spinosad, which takes its name from the word, has been found in natural fermentation, is approved for use on organic crops, and is known for its efficacy against a wide variety of insects and other agricultural pests with low environmental residues. Safety and pollinator protection are a very attractive profile for growers looking to substitute synthetic insecticides.

- Accordingly, the World of Organic Agriculture report at BIOFACH (11 February 2025) noted that globally, organic land increased to 2.5 million hectares in 2023 to almost 99 million hectares, and organic food sales were in line with EU136 billion. An expanding organic realm of use is an underlying support for spinosad use. (Source: https://www.ifoam.bio)

Restraint

What regulatory barriers exist to the spinosad active ingredient market?

A significant difficulty in the spinosad active ingredient market is the strict and uncertainty regulatory frameworks, which slow down and increase costs for regulatory approvals. While spinosad with increased behavioral complexity is intended in part to be friendlier than many synthetic and organic insecticides, many jurisdictions still require long periods of testing, quasi-rigid assessments of safety, and/or challenging Maximum Residue Level (MRL) policies.

- For example, in the EU, the recent changes in Acceptable Daily Intake (ARfD) resulted in MRL changes for leafy green vegetables and peppers, which affected spinosad registrations. In India, surveyed farmers and biological input companies reported that regulatory delays and long timeframes because of limited policy and future direction continue to be barriers to scaling up their use. With tightening regulations on sustainability and food safety, companies must incur more costs and risk having disallowed products before they enter the market.

Opportunity

Could Spinosad's role in organic and IPM agriculture be its biggest growth engine?

The Spinosad active ingredient industry has one big opportunity based on the increased movement to organic agriculture and integrated pest management (IPM) systems, and recent data points to this opportunity in 2024. A case study of 24 EU member states looking at specialty crops showed spinosad had 70%-80% efficacy on average, which seriously competes with traditional insecticides. Also, spinosad has a different mode of action that, in traditional pest management practices, can outperform the pest resistance mechanisms. Recent evidence highlights that spinosad performs well against resistant pests that have developed resistance to many insecticides. If producers, regulators, and users act on this evidence, and even more so where more restrictions on synthetic pesticides exist, spinosad could become the trusted, ecoâ€friendly pest management tool in a growing category.

Segment Insights

Product Form/Commercial Product Type Insights

Which product form/commercial product type dominates the spinosad active ingredient market in 2024?

Technical grade formulations are the main product type in the spinosad active ingredient market because they are the main active ingredient for large-scale agrochemical manufacturing. Formulators prefer these forms because they can prepare an array of custom formulations, they last longer, and are more cost-effective to produce, making these formulations the go-to backbone for widespread uses in fruits, nuts, and other crops that are commercially grown.

The suspension concentrate (SC) is growing the fastest as they are easy to use in liquid formulations, easy to mix, and easier to disperse in water. They provide lower dust exposure compared to powders and better accuracy in application. With the increasing demand for safer, effective, and ready-to-use formulations for crop protection, suspension concentrates are gaining traction with farmers through different farming systems.

Concentration/Grade Insights

What is the concentration/grade dominant in the spinosad active ingredient market?

Standard technical grade spinosad is the most prevalent grade produced globally, and generally provides a reasonable tradeoff between cost and efficacy. It is used with more frequency, and thus greater certainty, in large-scale agricultural practices, especially with fruit and nut crops, due to its reliably proven efficacy for pest control among many crops. This grade is commonly found in the supply chain, and is the preferred grade for bulk buyers and formulators, meeting costs vs efficacy performance of broad-spectrum crop protection products.

High-purity technical spinosad is the grade that is growing the most quickly, and is being driven by demand in premium agriculture and organically grown systems. Essentially, the increased purity of spinosad improves performance, lowers residues, and helps meet the demands of more stringent compliance with regulatory standards. This trend is more pronounced in high-value crops grown in sustainable and eco-friendly farming systems, as these systems can drive growing adoption of controlled environments.

Application Method Insights

Which application method segment dominates the spinosad active ingredient market in 2024?

Foliar spray has the largest market share in 2024, because the product is delivered directly to the target organism, effectiveness is apparent quickly, and spinosad can provide broad coverage. Foliar applications are commonly used in open-field agriculture, particularly with fruit and nut crops, where large, commercial-scale farms often use ground boom sprayers and hand-held equipment to manage potentially damaging pests, while protecting fruit and nut crops from the environment.

Controlled-environment application is a rapidly expanding method of application, because the recent expansion of farming in greenhouses and shadehouses has fueled its rise. Misting and foliar methods in this protected environment maximize accuracy while minimizing waste and enhancing crop quality. As the demand for high-value crops, as well as for crops free of insecticide residue, increases, growers are immediately adopting spinosad in controlled-environment agriculture for sustainable pest management practice and increased production.

Crop/End-Use Insights

Which is the most dominant crop/end-use?

Fruits and nuts (citrus, pome, stone fruit, berries, tree nuts) were the dominant crop/end-use in 2024, due to their high-value crop characteristics and susceptibility to insect damage. Spinosad is a common choice for pests owing to its effectiveness, low level of residues, and exemption from the compulsory gap for certain pests in integrated pest management solutions. Commercially produced fruits and nuts rely heavily on spinosad applications to maintain quality and export standards.

The protected cultivation end-use segment is the fastest-growing segment, driven by the rise of controlled farming systems for vegetables, ornamentals, and specialty crops. Spinosad is well-suited for use in controlled environments, and the demands of consumers for residue-free products have facilitated this growth trend. Growers of construction tunnels and greenhouses are increasingly adopting spinosad, as it is environmentally sustainable and amply safeguards yields in intensive production systems.

End-User/Customer Type Insights

Which end-user/customer type has the largest spinosad active ingredient market share?

Large commercial farms and agribusinesses are the most dominant end-users that have strong purchasing power, allowing them to buy in bulk and have extensive crop protection programs. Agricultural users are interested in technical-grade formulations of spinosad, which are generally more cost-effective and have been proven impactful; they are also created to apply to many different crops. Since large-scale fruit and nut species require multiple applications for consistent pest control, agribusiness is seen as the strongest demand method for spinosad products within commercial agriculture.

Smallholder farmers are the fastest-growing category of spinosad users and are seen using spinosad in sachets and small packs for convenience and affordability. A growing number of consumers are aware of alternatives to synthetic pesticides that have strong pest management impacts, and improved distribution for rural markets is supportive of continued access. Through e-commerce and the use of local cooperatives, spinosad micro-content can be accessed in current and future pest protection systems that are decently sustainable.

Sales and Distribution Channel Insights

What sales and distribution channel dominated the spinosad active ingredient market?

Business-to-business (B2B) sales directly to agrochemical manufacturers lead the spinosad active ingredient market in 2024, as active ingredients are sold primarily in bulk as technical-grade products. This system allows formulators to develop customized crop protection products that are specific to their region and crop. Relationships with larger agribusinesses have been developed over time to allow the steady flow of demand, which further establishes B2B sales as the primary channel.

E-commerce is a rapidly growing distribution channel, providing farmers with easier access to spinosad products in smaller pack sizes. Digital platforms provide greater reach, price competition, and doorstep delivery, particularly for smallholder farmers. As the agri-input market digitizes rapidly, online sales are growing quickly to fill supply gaps and support the adoption of environmentally sustainable pest control solutions in multiple areas.

Regional Insights

U.S. Spinosad Active Ingredient Market Size and Growth 2025 to 2034

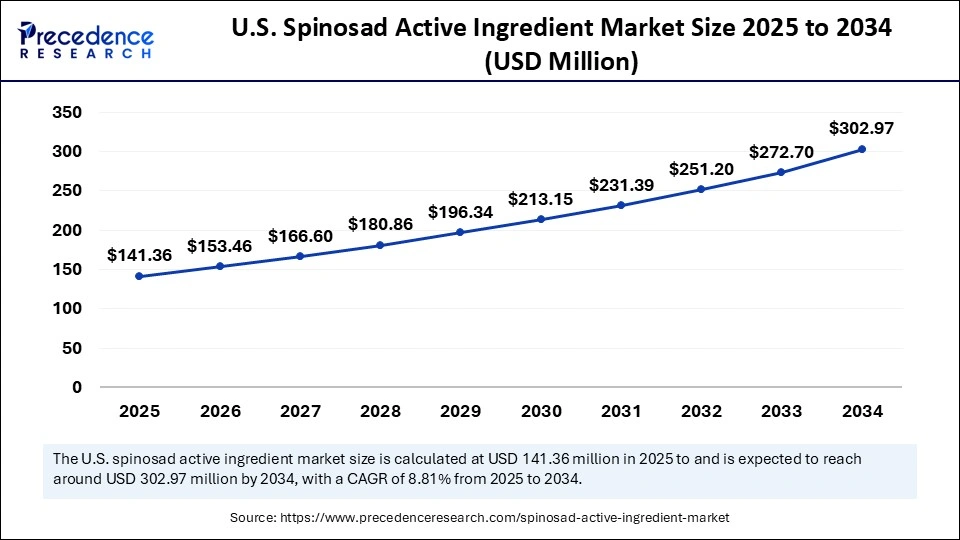

The U.S. spinosad active ingredient market size was evaluated at USD 130.22 million in 2024 and is projected to be worth around USD 302.97 million by 2034, growing at a CAGR of 8.81% from 2025 to 2034.

Why is North America dominating the spinosad active ingredient market?

North America dominated the spinosad active ingredient market, holding the largest market share of 31% in 2024.In North America, spinosad usage is leading the spinosad active ingredient market due to regulatory constraints surrounding synthetic chemistries, increased consumer demands for food free of residues, and an increase in acreage of organic production. Specialty crops, including berries, citrus, and leafy vegetables, are a growing area of interest due to growers' desire for targeting low-toxicity products primarily focused on insect control and not beetles or other diseases, yet they can fit into an integrated pest management (IPM) program. Regular regulatory reviews have expanded and reviewed tolerances within labels.

The U.S. is the leading area of North America due to a high regulatory framework coverage, diverse crops, and high adoption rates in organic agriculture. The Environmental Protection Agency's (EPA) recent updates have expanded approved uses of spinosad and worked on re-assessing tolerances; this is critically important for both growers and formulators, as this process creates clarity. The U.S. also has strong extension services that promote adaption of spinosad to specialized crops. The U.S. also has a strong body of research on resistance management and field efficacy; ultimately, the U.S. will be the primary driver for increasing spinosad adoption in North America.

Why is Asia-Pacific projected to be the fastest-growing region during the forecast period?

Asia-Pacific is the fastest-growing region, aided by vertically integrated supply chains with fermentation capabilities, formulation clusters, and cost-effective production capacity. Large-scale horticulture for protected cultivation provides reliable off-take of selective biopesticides, and regional regulators are gradually permitting biocontrols in IPM systems. Complementary service networks, including extension programs, distributor networks, and localized formulation labs, predictably spur adoption and develop products for tropical and sub-tropical pest populations and thus serve as both a production anchor and commercial demand centre in the region.

China provides an extensive fermentation infrastructure, concentrated agri-chemical industrial parks, and active R&D of agricultural processes, enhancing spinosyn yields and lowering unit costs, which drive manufacturing investment and expedite the launching of production capability. Significant domestic demand generated from relatively high-value protected crops (berries, vegetables, tea) provides stability to domestic consumption, and an established export system supplies formulators across Asia.

Value Chain Analysis

- Raw Materials: Spinosad is produced via fermentation from Saccharopolyspora spinosa. Sourcing and access to microbial cultures, growth media, and bioreactor inputs will ensure consistent production and quality of the active ingredient.

- Fermentation and Production: Raw inputs are used for fermentation to create spinosyn compounds on a commercial scale. Conditions, optimization of the microbial strain, and downstream recovery will ensure high yields and purity in accordance with regulatory requirements.

- Formulation Development: Spinosad is developed into technical-grade concentrates and granules, or suspension formulations. The design of product types supports different agricultural, veterinary, and household pest control needs and specific uses for effectiveness.

- Distribution and Supply Chain: Global logistical management of specialized agrochemical distributors, veterinary supply houses, and retailers will manage the distribution of spinosad to farming and animal health markets in cold storage and regulatory handling, as it requires timely delivery to agriculture end users.

- End Use Applications: The final applications of spinosad from farming, horticulture, and veterinary end users utilize spinosad that is environmentally friendly, and minimal residue applications for integrated pest management in organic farming, and animal ectoparasite treatments from non-toxic alternatives.

Spinosad Active Ingredient Market Comapnies

- Corteva Agriscience

- FMC Corporation

- BASF SE

- Bayer CropScience

- Syngenta Group

- UPL Limited

- Nufarm Limited

- ADAMA

- Sumitomo Chemical/Certis entities

- Marrone Bio Innovations

- Andermatt Biocontrol

- Koppert Biological Systems

- Isagro S.p.A.

- Gowan Company

- Certis

Recent Developments

- In May 2025, Parkers Pharma launched Spinomax XRT, a 180-day extended-release larvicide tablet formulated with 6.25% Spinosad for mosquito control in regions affected by malaria, dengue, Zika virus, chikungunya, and Rift Valley fever. (Source: https://www.prfire.co.uk)

- In June 2025, Insecticides (India) Limited (IIL) launched a patented insecticide ‘Turner', having unique properties and residual control. It is also effective against white grub and termites on a variety of crops.(Source: https://www.global-agriculture.com)

Segments Covered in the Report

By Product Form/Commercial Product Type

- Technical grade (AI: powder/concentrate/paste)

- Emulsifiable concentrate (EC)

- Suspension concentrate (SC)

- Water-dispersible granule (WG/WDG)

- Wettable powder (WP)

- Granules (G)

- Baits/attract-and-kill formulations

- Dusts

- Ready-to-use (RTU) packs (garden/home)

By Concentration/Grade

- Crude technical/fermentation cake

- Standard technical grade (commercial AI)

- High-purity technical (≥95%)

- Low-dose/micro-dose formulations

- Mid-concentration field formulations

By Application Method

- Foliar spray (ground boom/handheld/air-assisted)

- Soil application/in-furrow/soil granules

- Seed treatment/seed coating

- Chemigation/drip irrigation

- Baiting/attract-and-kill

- Post-harvest/stored-product application

- Controlled-environment application (greenhouse foliar, misting)

By Crop/End-use

- Row crops (cotton, corn, soybean, canola)

- Fruits and nuts (citrus, pome, stone fruit, berries, tree nuts)

- Vegetables (leafy, solanaceous, brassicas)

- Protected cultivation (greenhouses, shadehouses, tunnels)

- Ornamentals and turf (nurseries, golf courses, landscaping)

- Forestry and non-crop/public health/stored-product

By End-User/Customer Type

- Large commercial farms/agribusiness (bulk buyers)

- Smallholder/small farms (sachets and small packs)

- Greenhouse and nursery operators

- Turf and landscaping professionals/municipalities/golf courses

- Pest management companies (urban/public health)

- Household/consumer garden market (RTU)

By Sales and Distribution Channel

- Direct B2B to formulators/agrochemical manufacturers (technical AI sales)

- Distributors/agrodealers/cooperatives (bulk and retail repack)

- Retail (garden centers, agro-retail)

- E-commerce/direct-to-user online sales

- Contract manufacturing/tolling (CDMO)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting