What is the Liquid Fertilizers Market Size?

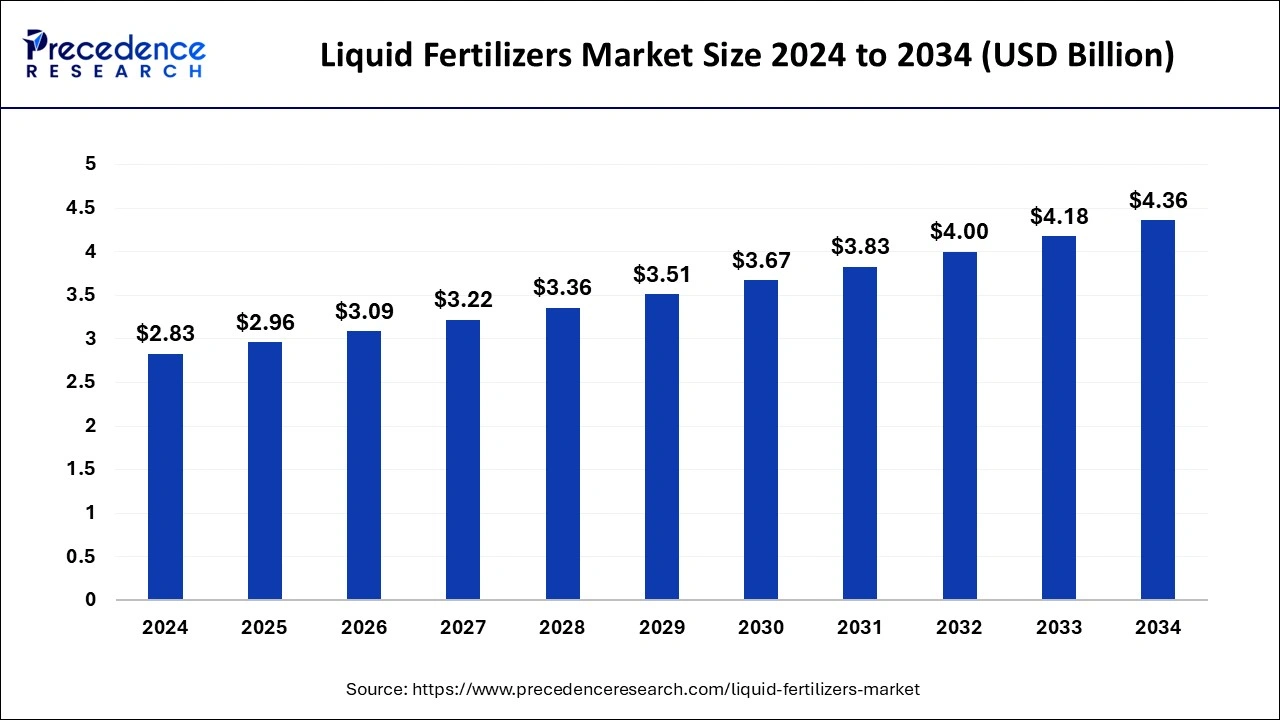

The global liquid fertilizers market size is calculated at USD 2.96 billion in 2025 and is predicted to increase from USD 3.09 billion in 2026 to approximately USD 4.36 billion by 2034. Advances in agricultural technology, newer formulations, and the unique benefits of innovative fertilizers are all propelling growth in the liquid fertilizers market.

Liquid Fertilizers Market Key Takeaways

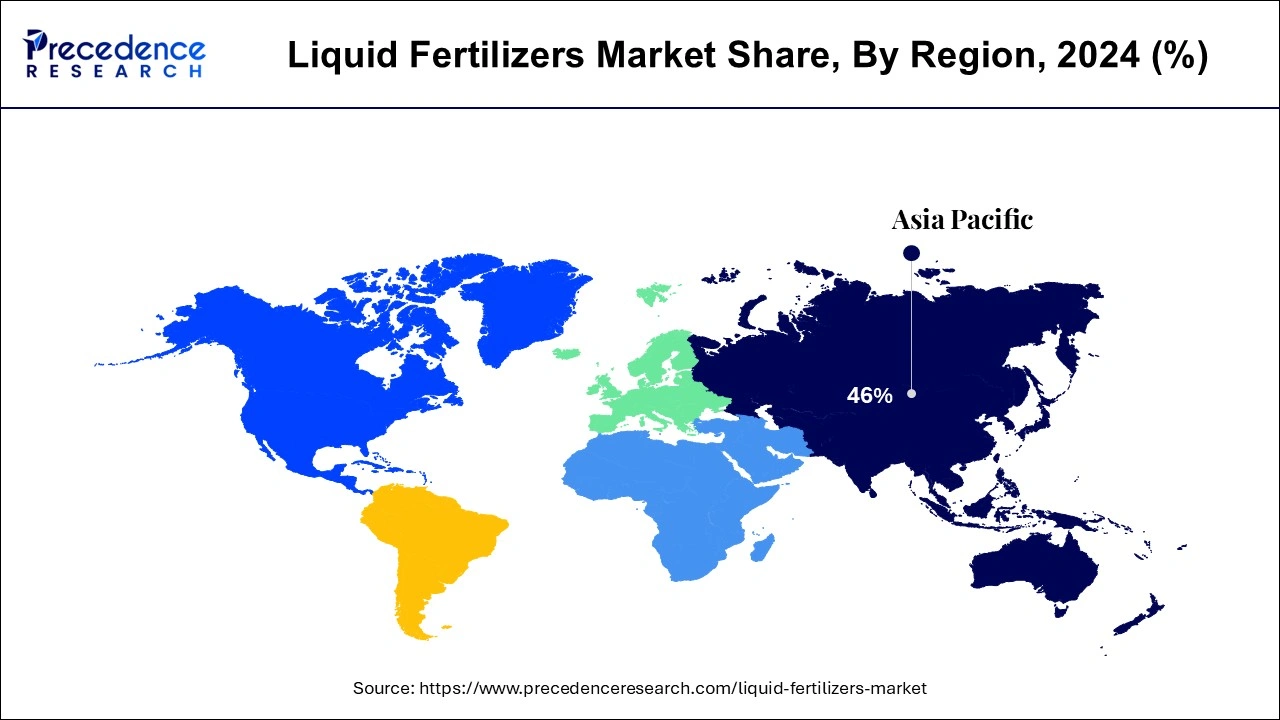

- Asia Pacific dominated the global liquid fertilizers market with the largest market share of 46% in 2024.

- North America is expected to expand at a solid CAGR during the forecast period.

- By crop type, the fruits and vegetables segment dominated the market in 2024.

- By crop type, the cereals and grains segment is expected to grow at the fastest CAGR during the forecast period.

- By type, the nitrogen segment dominated the global market in 2024.

- By compound, the calcium ammonium nitrate (CAN) segment contributed the highest market share in 2024.

How is AI changing liquid fertilizers?

Artificial intelligence (AI) allows to predict the trend of nitrogen in soil, avoiding fertilizer overuse and related environmental damage. It can help in the optimization of crop management practices. AI in fertilizers aims to demonstrate that the prediction of optimal fertilization timings and amounts using a short-term forecast is feasible and can enhance upon current fertilization strategies in a changing climate. Generally, AI based fertilizer systems have lower upfront costs, consistent & easy application, and fast acting for quick results. These factors help the growth of the liquid fertilizers market.

Recent Government Initiatives Worldwide

- Many governments are incentivising farmers to reduce nutrient wastage and adopt environmentally sustainable fertilizers.

- Subsidies and funding schemes are being promoted for liquid fertilization technologies that reduce environmental harm.

- Several regulatory bodies are encouraging the adoption of fertigation techniques through infrastructure support for irrigation-based fertilization.

- Some countries have initiated public-private partnerships to develop regional liquid fertilizer production plants to cut down import dependence.

Liquid Fertilizers Growth Factors

- Liquid fertilizers offer required nutrients to the plants on specific time along with varied conditions.

- Liquid fertilizers are predicted to be absorbed by plants or trees through their roots and leaf pores.

- They are rich in micronutrients and growth hormones; henceforth, are immensely used in growing crops, for example maize. They act as a catalyst that increases a plant's nutrient intake capacity.

- Liquid fertilizers also help in the rapid formation of seedlings as well as support early growth of plants.

Liquid Fertilizers Market Trends

- Surge in precision agriculture: With farmers moving towards data-driven crop management, liquid fertilizers are increasingly integrated into sensor-based, real-time fertilization systems.

- Shift to sustainable farming: There is a growing preference for eco-friendly, low-runoff liquid nutrients that support organic and sustainable agricultural practices.

- Crop-specific formulations: The market is increasingly demanding customised liquid fertilizer blends, tailored to specific crop needs and climatic conditions.

- Growing micronutrient demand: Nutrient-rich liquid formulations, especially those fortified with zinc, iron, and boron, are witnessing a rise in demand to tackle soil deficiencies.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD4.36 Billion |

| Market Size in 2025 | USD2.96 Billion |

| Market Size in 2026 | USD3.09 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.42% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Crop Type, Compounds, Type, Ingredient, Application, Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Opportunity

On the other hand, presently available land for agriculture has reduced because of soil erosion, urbanization, and pollution. The only possible way to produce large quantity of food for everyone is by growing the yield per area of the available lands. This is possible only through the intelligent application of fertilizers along with other advanced farming techniques which will help the growth of the liquid fertilizers market.

- In April 2024, Indian startup Fuselage Innovations enabled the adoption of drones in collaboration with KAMCO to spray biofertilizers across paddy fields to reduce labor costs. The firm assembles agricultural drones with specialized cameras that are used for soil monitoring, identification of disease, and management of crops, allowing farmers to reduce costs and time.

Crop Type Insights

During the studied period, the fruits and vegetables segment dominated the liquid fertilizers market. Fruit consumption has increased dramatically over the last two decades, and this trend is expected to continue in the next years. Report published by FAO says China is the top producer of fresh fruits and vegetables in the world, which is greater than US and Indian production and growth in 2018. Increased fruit and vegetable exports have resulted in an increase in crop plantation area, which has resulted in enlarged output levels. As a result, the market for chemical fertilizers and pesticides for fruits and vegetables is expected to grow substantially. As an outcome, the market is expected to grow.

The cereals and grains segment is expected to witness the highest growth rate during the forecast period. Liquid fertilizers for these crops, notably in Asian and North American nations. Furthermore, owing to increased demand for crops such as corn, wheat, rice, and sorghum across many sectors, crop protection chemical consumption is expected to rise in order to improve the output of these cereals. As a result of these factors, the segment is expected to develop at the fastest rate during the forecast period. Asia Pacific accounted for the highest share of the liquid fertilizer market for cereals and grains, owing to high crop output in nations such as the United States, China, India, and Japan.

Type Insights

Nitrogen segment dominated the global market. Macro and microelements are of great importance for plant growth. Nitrogen is heavily ingested nutrient for all the current farming practices in the world. It's utilized to make amino acids, which turn into proteins, and it's involved in nearly every metabolic reaction in a plant. Farmers generally face the problem of low availability of nitrogen in the soil. As a result, more liquid nitrogen fertilizer is needed to solve the problem. Further, multiple mixtures of nutrients are created and utilized to feed plants. As a result, global demand for liquid nitrogen fertilizers remains high.

Potash is expected to witness the highest growth rate during the forecast period. The market for potash fertilizers is expected to increase at a 4.47% CAGR from USD 21.6 billion in 2017 to USD 30.87 billion by 2032. This market's expansion may be linked to an increase in the requirement for increased productivity utilizing limited land area, as well as an increase in the application of potash fertilizers. As an increasing number of agricultural producers adopt these products, the benefits of employing these fertilizers are driving market expansion.

Compound Insights

Calcium Ammonium Nitrate (CAN) captured high revenue share in the global liquid fertilizer market as it is the significantly and widely used nitrogen fertilizer because of its comparatively high nutrient content along with physical properties, such as high solubility that helps in quick dissolving of the fertilizer into the soil. It contains magnesium and calcium that helps in upgrading the efficiency for absorbing nitrogen by the roots along with reducing nitrogen losses that makes the fertilization more profitable; this also protects subsoil waters counter to pollution by nitrogen compounds. Henceforth, the aforementioned factors help in driving the market growth for CAN in the upcoming years as well.

Application Insights

Fertigation captures notable revenue share in the global liquid fertilizers market owing to its numerous benefits. It is basically a profitable agriculture technique that includes fertilizer and water application by means of irrigation. The entire process offers lucrative opportunity to increase the yield capacity of land as well as to minimize the environment pollution. Moreover, increased focus of government bodies along with rising awareness among people triggers the growth and demand for such techniques. Therefore, the above mentioned factors drive the market growth for fertigation during the upcoming period.

Regional Insights

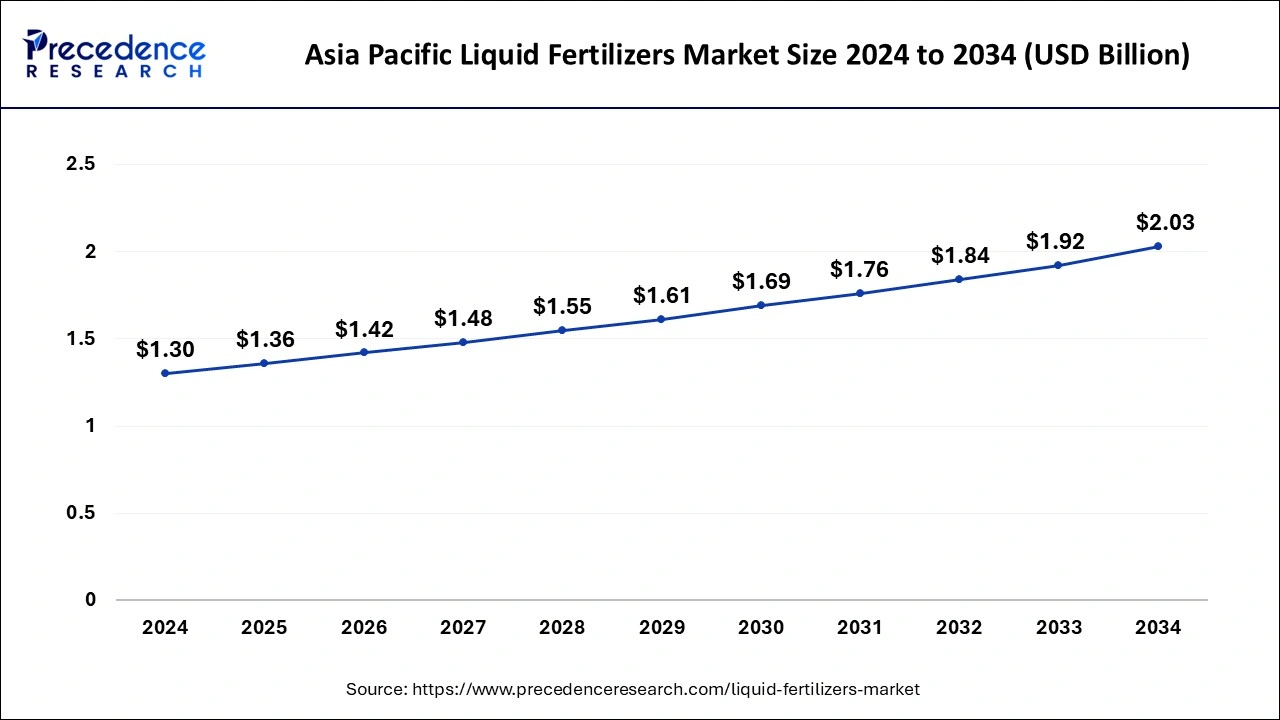

Asia Pacific Liquid Fertilizers Market Size and Growth 2025 to 2034

The Asia Pacific liquid fertilizers market size is estimated at USD 1.36 billion in 2025 and is anticipated to surpass around USD 2.03 billion by 2034, rising at a CAGR of 4.55% from 2025 to 2034.

Asia Pacific dominated the global liquid fertilizers market with the largest market share of 46% in 2024. The growing expense of conventional fertilizers, as well as their negative environmental effects, has led in a tremendous increase in the usage of high-efficiency fertilizers in agriculture, such as liquid potassium fertilizers. Rising food consumption, high crop yields, and developments in automated irrigation systems are driving demand for liquid fertilizers in the Asia-Pacific area. China has the region's largest market share (46.5 percent), while Australia is expected to grow the fastest in the coming years. Due to extraordinary economic growth, population growth, and support from governments; Asia-Pacific is the largest and fastest-growing market for liquid fertilizers.

Asia-Pacific_ Top countries key contributors

Cultivating Efficiency through Technology

- India: The most significant contributor due to large-scale commercial agriculture, innovation in Agri-tech, and strong support for fertigation systems.

- Japan: Known for advanced agricultural practices and research-backed usage of micronutrient-rich liquid fertilizers. Leveraging liquid fertilizers in its

- thriving banana and coffee plantations to boost export quality

- South Korea: Rising adoption in maize and vegetable farming, supported by government irrigation infrastructure upgrades. Emerging market with government efforts to modernise farming practices

How is Asia-Pacific leading in the Liquid Fertilizers Market?

The global liquid fertilizers market is mainly dominated by the Asia-Pacific region, which is supported by large-scale farming activity, a variety of crops, and the quick use of modern irrigation methods. The awareness of sustainable agronomy practices is on the rise, and the focus on crop productivity is increasing, which is further pushing the market. Precision agriculture is the region's continuous movement towards and also the use of digital technologies in nutrient management, which turns out to be a factor that drives the liquid fertilizer demand consistently.

North America is expected to expand at a solid CAGR during the forecast period. The existence of a diverse variety of fertilizer producers in the area, as well as the creation of new manufacturing facilities and distribution channels, will drive market expansion throughout the projection period. Furthermore, increased knowledge regarding the use of organic fluid fertilizers, as well as rising demand for high-value goods, would promote market expansion.

North America

Precision and Sustainability Drive Growth

- Stringent environmental regulations that encourage low-impact fertilization practices.

- Increased adoption of fertigation systems in vineyards, horticulture, and high-value crops.

- A strong focus on research and development, leading to tailored solutions for diverse European climates.

- Robust government backing for sustainable and organic agriculture, promoting eco-friendly fertilizers.

- Rising awareness among farmers regarding the economic and agronomic benefits of targeted liquid fertilization.

How is North America performing in the Liquid Fertilizers Market?

The liquid fertilizer market in North America is a mature and technologically advanced one, and its major plus point is the widespread use of precision farming and smart irrigation. All farmers in the area have brought out their main concerns of efficiency, sustainability, and yield maximization. The government proposals that prioritize the use of eco-friendly fertilizers along with the development of new technologies in nutrient application continue to be the main force behind market growth and thus, the steady use of fertilizers in both large agricultural and small specialty crop farms.

United States Liquid Fertilizers Market Trends

No doubt, the United States is the biggest North American market; it has been so in the past and is still so today, thanks to its cutting-edge agriculture and the strong push for sustainability. The research and development of next-generation liquid fertilizers compatible with precision agriculture practices are being heavily funded. The combination of AI, nanotechnology, and sophisticated nutrient management systems is the one that allows getting more while producing fewer toxic emissions.

Europe is the third-largest market for liquid fertilizers. The market in this region is expected to grow significantly during the forecast period due to a variety of factors such as increased access to subsidized fertilizers, hydroponic system field areas, and an increase in automation, which has resulted in the growing acceptance of technologies such as liquid fertilizer sprayers. Along with market expansion, companies in the liquid fertilizers market are focusing not just on product quality and marketing, but also on expanding their presence into emerging markets.

What are the driving factors of the Liquid Fertilizers Market in Europe?

The liquid fertilizer market in Europe has a strong focus on environmental sustainability and efficient nutrient use, all of this under strict regulatory frameworks. Farmers are now switching to organic and bio-based fertilizers at an increasing rate, a process that is greatly facilitated by digital farming innovations and accurate monitoring of nutrient application. The region is not only concerned about cutting down on emissions from agriculture but also about practicing the circular economy, and thus, the demand for liquid fertilizers with advanced technology is consistent.

Germany Liquid Fertilizers Market Trends:

Germany is the first in the liquid fertilizer market in Europe, thanks to its highly mechanized farming and very sophisticated precision agriculture technology. Sustainability, soil quality, and environmentally safe products have become the main drivers for the demand for bio-based and controlled-release fertilizers. The use of digital technologies in the fertilizer application and thus the efficiency of this whole process has increased, and the effect of this in terms of sustainability, productivity, and the environment has been positive in the long run.

China Liquid Fertilizers Market Trends:

China is the biggest player in the market and leads the regional market by virtue of its strong agricultural modernization and government support for sustainable fertilizer practices. The use of AI-based nutrient management systems and sensor-driven precision technologies increases productivity and, thereby, also efficiency. While the country is looking to achieve high yields while being bottom-line sustainable environmentally, this scenario continues to dictate market dynamics and fortify its position as a major global contributor in the liquid fertilizers industry.

India Liquid Fertilizers Market Trends:

India's liquid fertilizer market is on a very fast track of growth, which is mainly facilitated by the modernization of irrigation systems and the increasing demand for organic solutions. The government incentives for eco-friendly farming and the advancement of nano and bio-based liquid fertilizers help in increasing the market penetration. Farmers' increasing knowledge about effective nutrient delivery and the significance of soil health are the key factors that support the market growth in major crop-producing areas.

Liquid Fertilizers Market Companies

- Yara International ASA

- Nutrien Ltd

- Israel Chemical Ltd.

- Haifa Chemical Ltd

- GrupaAzoty

- The Mosaic Company

- SociedadQuímica y Minera de Chile S.A.

- K+S Aktiengesellschaft

- Plant Food Company Inc.

- EuroChem Group

Latest announcement by industry leaders

- In March 2024, EuroChem announced the opening of a new phosphate fertilizer production facility in Serra do Salitre, Brazil. The complex features state-of-the-art integrated phosphate fertilizer production with lower water consumption along with a self-sufficient water circuit that enables clean energy generation. The facility, which drew US$ 1 billion in investment, boasts an annual production capacity of 1 million tonnes. EuroChem Group President Oleg Shiryaev commented on the development, stating, “The launch of our new facility moves us one step closer to our customers and allows us to provide Brazilian farmers with access to the highest quality fertilizers via our well-established distribution network in this important global breadbasket. EuroChem operates on a mine-to-farm basis, ensuring reliability and quality across the entire fertilizer supply chain, from raw material extraction to production and delivery to the end consumer.”

Recent Developments

- In July 2024, a Nano Fertilizer Usage Promotion Mahaabhiyan by selecting 200 model nano village clusters in Haryana was launched by the Indian Farmers Fertiliser Corporative Limited (IFFCO).

- In August 2024, Rallis India Limited launched a new water-soluble fertilizer called AQUAFERT fertigation Tomato. The fertilizer is designed to significantly boost the yield of tomato crops and comes in three grades: Bloom Stage, Fruit Set Stage, and Subsequent Fruit Growth Stages. AQUAFERT fertigation Tomato is expected to improve vegetative growth, improve crop durability, and leaf health.

- In September 2025, Rashtriya Chemicals & Fertilizers Limited began commercial operations of a new Liquid Carbon Dioxide Plant at its Trombay Unit, expanding production capabilities since September 12, 2025.

https://scanx.trade/stock-market-news - In July 2025, Yara completed a £7 million upgrade of its Chedburgh liquid fertilizer terminal, part of its investment program in Great Britain. This project enhances safety, efficiency, and product quality at the East Anglia facility, a key UK operation.

https://www.worldfertilizer.com

Value Chain Analysis

- Raw Material Procurement: It is the process of obtaining the necessary primary materials like nutrients, additives, and solvents for the production of liquid fertilizers

Key Players: Nutrien Ltd., Yara International ASA, ICL Group - Processing and Packaging: Fertilizer's mixing, bottling, labeling, and sealing are done to ensure secure handling and convenient application.

Key Players: Uflex, Essel Propack, Huhtamaki PPL - Storage and Cold Chain Logistics: Application of appropriate temperature and humidity conditions to maintain the quality of fertilizer during transportation and storage.

Key Players: Ryder, Americold Logistics, Lineage - Distribution to Wholesalers/Retailers: Ensures effective delivery of fertilizers in packages to intermediaries and agricultural retailers for market availability.

Key Players: Delhivery, DTDC, and TCI Express - Export and Trade Compliance: International trade laws, product labeling standards, and customs requirements for global shipment are ensured through the process of compliance.

Key Players: Yara International, Nutrien, Haifa Chemicals

Segments Covered in the Report

By Crop Type

- Cereals & Grains

- Corn

- Wheat

- Rice

- Others (sorghum, barley, and oats)

- Oilseeds & Pulses

- Soybean

- Others (canola, cotton, and sunflower)

- Fruits & Vegetables

- Others (turf, ornamentals, and nursery plants)

By Type

- Nitrogen

- Phosphorous

- Potash

- Micronutrients

By Compounds

- Calcium Ammonium Nitrate (CAN)

- Urea-Ammonium Nitrate (UAN)

- Potassium Nitrate

- Phosphorus Pentoxide (P205)

- Others (boron, chloride, and iron)

By Ingredient Type

- Crop-based Fertilizers

- Synthetic

- Organic

By Application

- Soil

- Foliar

- Aerial

- Fertigation

- Agricultural fields

- Hydroponics

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting