What is the Crop Protection Chemicals Market Size?

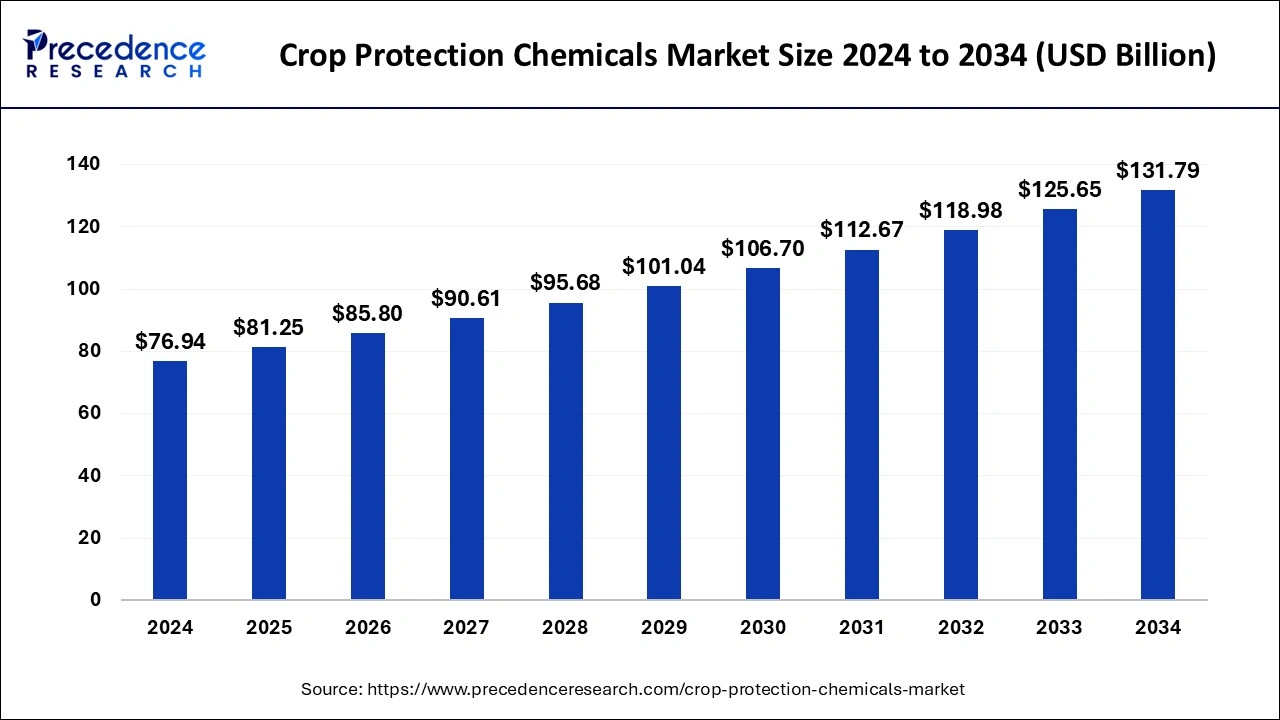

The global crop protection chemicals market size is valued at USD 81.25 billion in 2025 and is predicted to increase from USD 85.80 billion in 2026 to approximately USD 131.79 billion by 2034, expanding at a CAGR of 5.53% from 2025 to 2034.

Crop Protection Chemicals Market Key Takeaways

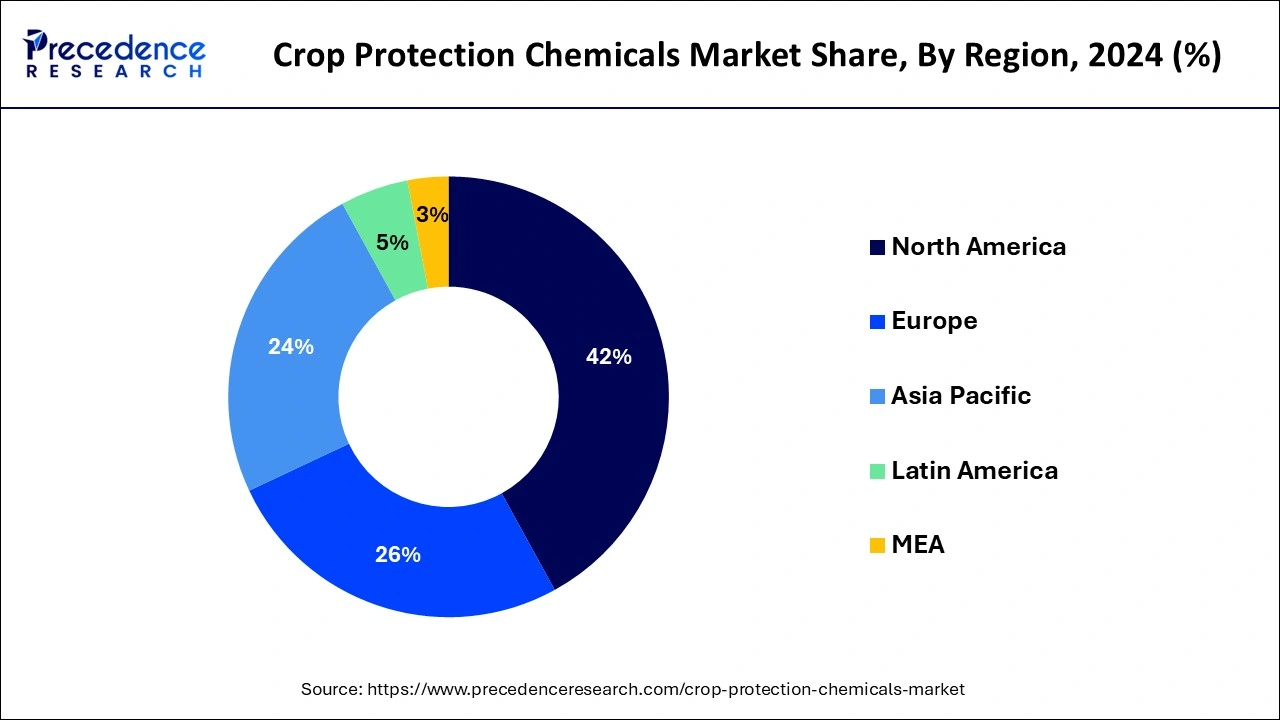

- North America region has generated a revenue share of over 41% in 2024.

- By products, the herbicides segment has held 41.7% in 2024.

- By crop type, the cereals & grains segment accounted for 45% of revenue share in 2024.

- By source, the synthetic chemicals segment generated over 80% of revenue share in 2024.

Market Size and Forecast

- Market Size in 2025: USD 81.25 Billion

- Market Size in 2026: USD 85.80 Billion

- Forecasted Market Size by 2034: USD 131.79 Billion

- CAGR (2025-2034): 5.53%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

Market Overview

The pesticides made without the use of chemicals are known as biopesticides. Due to environmental concerns and the potential to prevent insecticide development in biological environments, the key market players in the crop protection chemicals market are ramping up manufacturing of biopesticides. The biopesticides have been discovered to provide more targeted activity to desired pests, as opposed to traditional pesticides, which often harm a wide range of insects and birds. The biopesticides are becoming more popular among crop protection chemicals manufacturers, as standard insecticides have been linked to health risks for farmers and employees after continuous exposure. The demand for biopesticides is rising due to an increase in sustainable agriculture methods and organic farming combined with pest management.

The need for food grains has been spurred by the world's ever increasing population growth rate as well as an increase in calorie intake per capita. The crop production has increased dramatically as a result of new agricultural technologies. The widespread use of pesticides in the pre-harvesting crop growth process and post-harvesting storage procedures is credited with a considerable influence to the growth.

The chemical and synthetic pesticides are the most often utilized pesticides for crop protection. The herbicides, insecticides, and fungicides are the most commonly used pesticides. The pesticides used for crop protection and preservation are divided into fumigants, rodenticides, nematicides and other categories. The herbicides are used to eliminate undesired fungicides, plants, and weeds are used to defend against fungus and fungal spores, and insecticides are used to control insects' eggs and larvae.

The AI Revolution in Crop Protection: Smarter, Safer, Sustainable Farming

Artificial intelligence is significantly enhancing the crop protection chemicals industry through developments in precision application, predictive analytics, and R&D acceleration. By determining vast datasets, AI permits more accurate pest and disease forecasting, improving chemical usage, and advancing more effective along with sustainable crop protection solutions. AI-based systems, including drones and sensors, can determine pest hotspots and apply chemicals only where needed, decreasing overall chemical usage as well as environmental impact. AI-powered robots equipped with sprayers and sensors can navigate fields, detect and treat specific areas, and modify application rates based on real-time conditions.

Crop Protection Chemicals Market Outlook

- Industry Growth Overview: The market for crop protection chemicals is expected to grow significantly from 2025 to 2034, driven by the need to boost agricultural productivity to meet rising global food demand and combat pest resistance and disease outbreaks exacerbated by climate change.

- Sustainability Trends:The industry is shifting toward sustainable practices, with high demand for bio-based and eco-friendly solutions like biopesticides, green solvents, and low-residue formulations. Major companies are investing in R&D and collaborations to align with Integrated Pest Management (IPM) strategies.

- Global Expansion:Leading players are expanding their presence in high-growth regions, particularly in Asia-Pacific and Latin America, by establishing local production facilities and distribution networks.

- Major Investors: Private equity and venture capital firms are actively investing in the sector, drawn by the potential for high returns, the significance of food security, and alignment with ESG factors. Large corporations are also making strategic investments in biological and advanced technology solutions.

- Startup Ecosystem: There is a growing startup scene focused on innovation in biotechnology, nanotechnology, and digital agriculture. These new firms are creating solutions like AI-driven pest detection, drone-based applications, and new biopesticide formulations.

Crop Protection Chemicals Market Growth Factors

The crop protection chemicals are a type of pesticide used to keep crops safe from insects and pests. The chemicals for crop protection are a major aspect in the chemical industry. Many crops would suffer severe losses if they were not present. The insecticides are vital in the fight against human and animal disorders. The fungicides, insecticides, rodenticides, and microbicides are all used to kill and control weeds, fungus, insects, germs, and rodents. Many pesticides have been discovered to be hazardous to human and animal health as well as the environment. The weed, worm, and fungus outbreaks have become a major barrier to agricultural quality and output in the Asia-Pacific and North America regions as a result of developments in farming methods and evolving technologies.

During the predicted period, the market operations are on the verge of a big expansion. The propelling need among the target audience for food security and safer alternatives for consumption is one of the major crop protection chemicals market facts that is supporting this growth. This has positive implications for market operations. Furthermore, a rapid increase in the worldwide population is increasing crop protection chemicals market demand among the target audience, which is distributed around the globe. The crop protection chemicals market specialists and industry executives have made assumptions about the predicted crop protection chemicals market growth during the forecast period based on all of these factors as well as the obstacles and restrictions that the market faces.

With strong growth and shifting crop mix trends and environmental laws, the crop protection chemicals market has evolved during the forecast period. The food security, growing population, shrinking arable land, and the need for increased agricultural productivity are all driving demand for more agricultural output, enhancing the crop protection industry's expansion internationally. Furthermore, throughout the projected period, rising organic farming across the globe is expected to drive the market for bio-based pesticides.

- Trending for bio-based pesticides administered under eco-friendly conditions is in line with sustainability efforts and, thus, also supports organic farming techniques.

- With the population increasing worldwide and the demand for food increasing, crop protection solutions have become necessary.

- With shrinking arable land and growing food security concerns, more farmers and agriculturists prefer efficient pest, weed, and disease management.

- New farming techniques and increased crop diversification increase the dependence on novel chemicals to provide the highest yield and best crop qualities.

- More stringent food quality standards and possible regulatory frameworks promote safe, effective, and more targeted technologies in crop protection.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 81.25 Billion |

| Market Size in 2026 | USD 85.80 Billion |

| Market Size by 2034 | USD 131.79 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.53% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Crop Type, Source, Form, and Mode of Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How is the rise in food demand driving the growth of the crop protection chemicals market?

The expanding global population requires more food, putting pressure on farmers to produce higher yields. Crop protection chemicals are crucial tools for achieving these higher yields by preventing crop losses because of numerous threats. Crop protection chemicals, including herbicides, insecticides, and fungicides, are important for maximizing crop yields by protecting crops from diseases, pests, and weeds. This permits farmers to meet the escalating food needs and address food security concerns.

Restraint

How are environmental risks restraining the growth of the crop protection chemicals market?

Environmental risks are significantly restraining the growth of the crop protection chemicals market by increasing regulatory pressure, driving demand for safer alternatives, and influencing the marketability of traditional chemical pesticides. Governments and international bodies are implementing stricter regulations on pesticide usage because of growing concerns about human health, along with environmental damage. These regulations include restrictions, bans, and complex approval processes for new products, making it harder for firms to bring products to market.

Opportunity

How do environmentally friendly solutions act as an opportunity for the growth of the crop protection chemicals market?

Environmentally friendly crop protection solutions, like biopesticides and integrated pest management (IPM), are driving growth in the market by providing sustainable alternatives to conventional synthetic chemicals. These solutions reduce environmental impact, lower chemical residues, and address concerns about pest resistance, contributing to increased acceptance and investment in research and development for these products. Many governments are incorporating regulations that restrict or ban the usage of certain synthetic pesticides, creating a market opportunity for safer alternatives.

Products Insights

In 2024, the herbicides segment dominated the market. This is attributed to increased use, notably of non-selective herbicides in a variety of agricultural applications. The recent advances in the production of non-selective herbicides have increased their demand for weed management in industrial and constriction fields.

The insecticides segment, on the other hand, is predicted to develop at the quickest rate in the future years. The insecticides are widely used during the growth of staple crops, which are heavily attacked by insects. Farmers are less reliant on insecticides to protect production as integrated pest management has progressed over time.

Source insights

The biologicals segment is the fastest growing in the crop protection chemicals market during the forecast period. This growth is mainly driven by the increasing need for sustainable and eco-friendly agricultural practices. The growth in organic farming and the rising need for organic food products are directly fueling the requirement for biopesticides. Many governments are incorporating stricter regulations on synthetic pesticide use, thus encouraging the adoption of biologicals.

Crop Type Insights

The cereals and grains segment has accounted highest market share in 2024. The crop protection chemicals are high in demand in the cultivation of cereals and grains. The demand has been raised by diminishing cropland and a greater emphasis on the growth of food crops.

The fruits and vegetables segment is fastest growing segment of the crop protection chemicals market in 2023. On a global scale, fruits and vegetables, account for the highest market share, with considerable demand for these products to meet the high demands of the farming community.

Form insights

The liquid segment dominated the crop protection chemicals market in 2024. Liquid formulations can be easily applied utilizing various equipment, such as sprayers and irrigation systems, permitting for broad and efficient coverage. Liquid formulations are absorbed quickly by plants, contributing to faster pest and disease control. They are usually more compatible with other agricultural inputs such as fertilizers and pesticides, simplifying the application process.

The dry segment is the fastest growing in the crop protection chemicals market during the forecast period. This is primarily due to the various advantages solid formulations provide over liquid options, such as easier storage, better stability, and decreased risk of spillage. Solid formulations are usually more stable than liquids, meaning they are less prone to degradation or unwanted reactions, contributing to a longer shelf life and easier storage. Ongoing advancements in formulation technologies are enhancing the performance and versatility of solid crop protection goods, making them increasingly attractive to farmers.

Mode of application insights

The foliar spray segment dominated the crop protection chemicals market in 2024. Foliar sprays permit direct along with targeted application of chemicals to plant leaves, by ensuring effective delivery to the site of pest as well as disease activity. This method provides flexibility in timing and dosage, permitting farmers to adjust treatments derived on specific pest or disease outbreaks. Foliar sprays can be absorbed by leaves as well as translocated via the plant, protecting areas not directly sprayed.

The seed treatment segment is the fastest growing in the crop protection chemicals market during the forecast period. This growth is driven by the increasing need for efficient and sustainable crop protection solutions, mainly in the early stages of plant development. By considering healthy seedlings, seed treatment led to better crop establishment, leading to increased outputs. Innovations in seed coating technologies as well as the rise of precision agriculture have thus boosted the acceptance of seed treatments.

Regional Insights

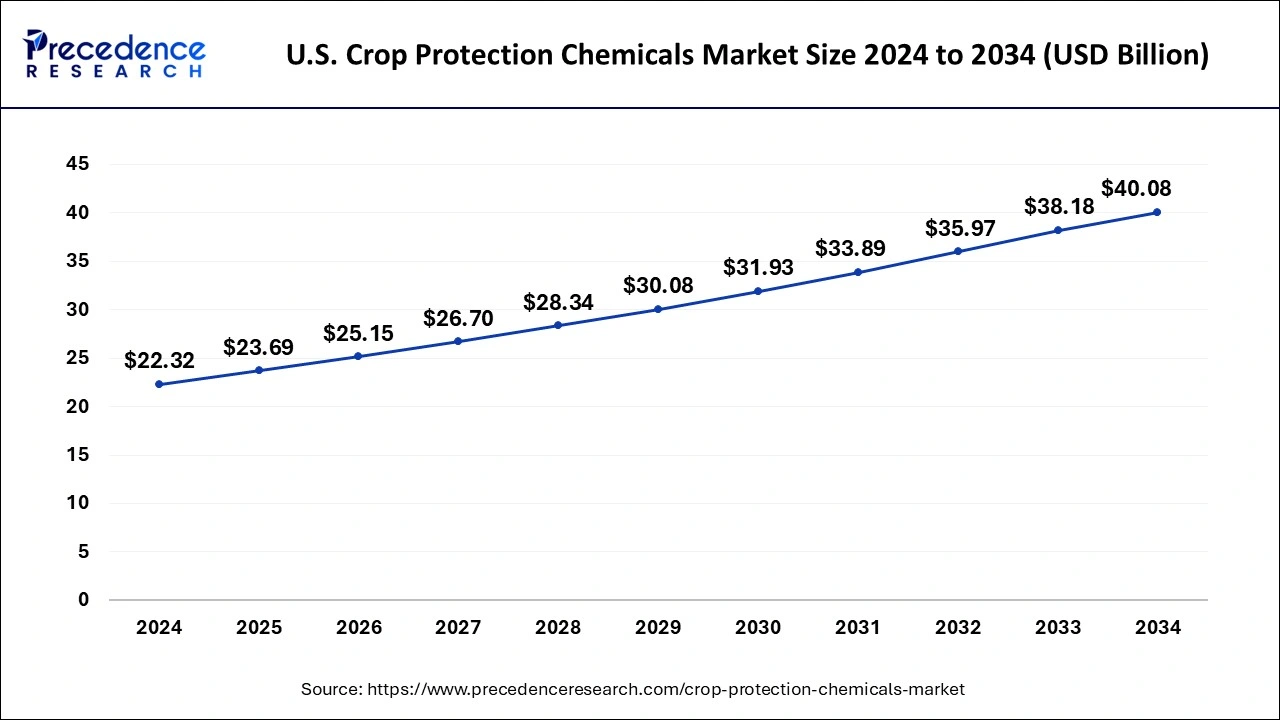

U.S. Crop Protection Chemicals Market Size and Growth 2025 to 2034

The U.S. crop protection chemicals market size is evaluated at USD 23.69 billion in 2024 and is projected to be worth around USD 40.08 billion by 2034, growing at a CAGR of 6.03% from 2025 to 2034.

North America dominated the market with highest revenue share in 2024. As the world's population grows, so does demand for agricultural productivity, which is propelling the crop protection chemicals market expansion in the region. The growing concern about green farming methods and the loss of many traditional goods due to excessive use of synthetic pesticides is also driving the market for bio-based crop protection agents.

North America's leading agricultural chemical market, the United States is at the forefront of crop protection chemicals, with large-scale commercial farming capabilities and advanced agricultural history. Some of the largest mass crop producers (corn, soybeans, and cotton) rely on large amounts of herbicides, insecticides, and fungicides to adequately protect and ensure productivity. Multiple agrochemical companies, based in the U.S., invest millions into research and development to provide solutions to their customers in terms of responsible and available crop protection products. In addition, regulatory support and the development of farm technologies such as precision farming provide ongoing business stability to the demand for crop protection products across the diversity of agricultural ranges throughout the country.

Asia-Pacific, on the other hand, is expected to develop at the fastest rate during the forecast period. The number of bio-pesticides particularly microbial pesticides, that have been registered is continuously increasing. The region's demand for bio-insecticides is expected to increase in the upcoming years as the government focuses more on environmental sustainability while maintaining agricultural output.

With the largest and most diverse agricultural industry in Asia Pacific, India is number one in the region for crop protection chemicals. With a large population supporting farming activity, the demand for protection by planting and growing the major crops of rice, wheat, and pulses to mitigate pests and disease is critical. The government is encouraging modern farming practices and offered various subsidies that decreased the price of agrochemical products to reach small and medium farmers. Increased awareness of the damage that pests and diseases can cause to the economy, and improvement to distribution networks sees the crop protection industry continue to multiply, with increasing concerns over crop losses due to climate impact factors making it a top priority in India.

Latin America Crop Protection Chemicals Market: The Future of Farm Protection

Latin America plays a key role in the global crop protection chemicals market, mainly because of its large and diverse agricultural landscape and its status as a major producer of key crops like soybeans, sugarcane, corn, and coffee. The region's warm, humid, and subtropical climates create perfect conditions for pests and diseases, leading to high demand for effective protection methods to achieve good yields for both local use and exports. Countries are adopting modern farming inputs and practices, and the market is mainly driven by synthetic chemicals, with a growing focus on biopesticides and sustainable solutions.

Brazil Crop Protection Chemicals Market Trends

Brazil stands out as the key consumer of crop protection chemicals in Latin America, with market growth driven by the expansion of cultivated land and rising agricultural commodity exports. The country utilizes a diverse range of chemicals, including herbicides, fungicides, and insecticides, to protect its primary crops. While synthetic pesticides remain dominant, there's an increasing focus on adopting modern, IPM techniques and exploring bio-based alternatives and attract continued private investment and technological advancements in the sector.

Middle East and Africa (MEA) Crop Protection Chemicals Market: A Roadmap for Sustainable Growth

The Middle East and Africa (MEA) region is a growing market for crop protection chemicals, marked by high demand for grain crops and extensive field cultivation. The market is fueled by the need to boost agricultural productivity and secure food supply in response to a rising population and difficult climate conditions. The affordability of chemical pesticides and the vast cultivated areas are key factors encouraging product use. Countries are increasingly adopting modern farming inputs and technologies to improve yields, along with a rising awareness of environmental safety.

Saudi Arabia Crop Protection Chemicals Market Trends

There is a strong focus on addressing specific agricultural challenges, including water scarcity and unique pest pressures. The country relies on a mix of traditional and modern crop protection solutions to safeguard its domestic production of various crops, including vegetables and fruits. The emphasis is on adopting efficient and targeted solutions, with potential future exploration of advanced technologies.

The Continental Shift: Europe's AI-Driven Leap in Precision Crop Protection

The European crop protection chemicals market is mature, highly regulated, and serves as a hub for innovation, with a notable shift toward sustainability and biopesticides. Strict EU regulations on pesticide use, driven by environmental and health concerns, are guiding the industry toward safer, residue-free products and integrated pest management (IPM) strategies. Major multinational companies such as Bayer and BASF are heavily investing in R&D for new, environmentally friendly active ingredients and advanced application technologies like drones and AI for targeted spraying. Europe, especially Spain, France, and Germany, consumes large amounts of fungicides and herbicides to protect high-value crops such as fruits, vegetables, grains, and cereals.

Germany Crop Protection Chemicals Market Trends

Germany is a cornerstone of the European crop protection industry, holding the largest market share by value. The country has a large agricultural sector, mainly focusing on grains and cereals, which drives strong demand for herbicides and fungicides. Germany is home to global agrochemical leaders like Bayer AG and BASF SE, making it a key center for research and development as well as production of crop protection solutions. The market is heavily shaped by the German government's commitment to sustainable agriculture, which promotes the adoption of biopesticides and precision farming techniques.

| Country | Governing Bodies | Key Legislation/Frameworks |

| U.S. | Environmental Protection Agency (EPA) | FIFRA (Federal Insecticide, Fungicide, and Rodenticide Act), FFDCA (Federal Food, Drug, and Cosmetic Act), FQPA (Food Quality Protection Act) |

| EU | European Food Safety Authority (EFSA) Member State authorities | Regulation (EC) No 1107/2009 (concerning the placing of plant protection products on the market), REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) |

| India | Central Insecticides Board & Registration Committee (CIBRC) | The Insecticides Act, 1968 and Insecticides Rules, 1971, FSSAI Regulations for MRLs |

| Brazil | ANVISA (health), MAPA (agriculture), IBAMA (environment) | Strict registration process involving joint approval from the three agencies |

Value Chain Analysis

- Feedstock procurement: It involves the sourcing of petrochemical and natural raw materials needed for the manufacture of active ingredients in crop protection chemicals.

Key Players: Bayer AG, BASF SE, Syngenta Group - Chemical Synthesis and Processing: Transform feedstocks into active chemical compounds through the controlled course of chemical reactions involving purification and processing methods.

Key Players: Corteva Agriscience, Sumitomo Chemical Co., Ltd., Jiangsu Yangnong Chemical Co., Ltd. - Formulation and blending of compounds: Combines the active ingredients with additives that provide the final product with stability, safety, and efficiency in application in agricultural use.

Key Players: Syngenta Group, Bayer AG, BASF SE - Quality Testing and certification: In the laboratories, very stringent testing should be done on all products to confirm safety and performance standards that comply with agricultural and regulatory standards.

Key Players: Bayer AG, Corteva Agriscience, FMC Corporation - Packaging and Labelling: Package the product in the safest container available with a label that clearly states composition, dosage, safety instructions, and regulations applicable to this product.

Key Players: Corteva Agriscience, UPL Limited, BASF SE - Distribution of Industrial Uses: Distribution through distributors and cooperatives, and retail channels to purchasers consisting of farmers and agricultural service providers.

Key Players: UPL Limited, Albaugh LLC, Bayer AG - Waste Management and Recycling: Eco-friendly disposal, recycling, or reuse of by-products are carried out to reduce risks to the environment and human health.

Key Players: Syngenta Group, Corteva Agriscience, FMC Corporation

Crop Protection Chemicals Market Companies

- Bayer CropScience AG: Offers a broad portfolio of synthetic and biological herbicides, fungicides, and insecticides; focuses on digital farming tools (e.g., Climate FieldView).

- BASF SE: Provides an extensive range of fungicides, insecticides, and herbicides; provides digital farming solutions via the xarvio platform.

- Sumitomo Chemical Co. Ltd: Facilitates a variety of proprietary insecticides, herbicides, fungicides, fertilizers, and plant growth regulators (e.g., Sumi Max herbicide).

- The Dow Chemical: Primarily provides chemical intermediates, surfactants, and solvents used in the formulation of agrochemicals; the specific crop protection brands are now managed by Corteva Agriscience.

- ADAMA Agricultural Solutions Ltd.: Specializes in cost-effective, off-patent herbicides, fungicides, and insecticides with global distribution (e.g., Agas insecticide, Bumper fungicide).

- Nufarm Limited: Develops and supplies herbicides, insecticides, and fungicides for global agricultural applications.

- Arysta Lifesciences Corporation: Provides innovative crop protection solutions, including pesticides and biocontrol products for sustainable farming.

- America Vanguard Corporation: Manufactures and distributes herbicides, fungicides, and insecticides to enhance crop yield and protection.

- JiangsuYangnong Chemical Group Co. Ltd: Produces a wide range of agrochemicals, including insecticides and fungicides, serving domestic and international markets.

Recent Developments

- In August 2024, Crystal Crop Protection Limited, a leading agrochemical organization, has launched Proclaim XTRA, its latest insecticide specifically formulated for maize and soybean. Proclaim XTRA is designed to provide effective protection against all kinds of caterpillar especially Spodoptera spp. like Fall Army worm. This innovative solution promises to enhance crop health and productivity, contributing to the success and sustainability of farmers' produce.

(Source: https://agrospectrumindia.com) - In April 2025, Dhanuka Agritech launches integrated crop protection portfolio for apple farmers in India. This portfolio features precise interventions for pest management, crop development, and enhanced pollination support. Thus, farmers can guard their crops and deliver top-class apple quality.

(Source: https://www.en.krishakjagat.org) - UPL has undertaken significant acquisitions to boost its position in the global crop protection chemicals market. In February 2019, the corporation finalized the USD 4.2 billion acquisition of ArystaLiveScience Inc. from platform specialty products.

- Sinochem and ChemChina were reformed and amalgamated in May 2021 to form a conglomerate. Both companies are situated in Beijing and each has a number of subsidiaries in other industries.

- Corteva Agriscience will introduce a new mobile application in December 2020 to assist growers in protecting their crops and ensuring a more resilient and sustainable agriculture system.

- BASF SE acquired unique L-glufosinate ammonium technology from AgroMet is in September 2020. The company was bought for its expertise in generating extremely concentrated weed control solutions.

The keycrop protection chemicals market players conduct substantial research and development to develop insecticides with greater requirements. These compounds are subjected to lot of restrictions, including chemical registration, codes of practice, environmental health impact assessments, product laboratory evaluations, and limitations on storage, use, and transportation.

Segments Covered in the Report

By Products

- Herbicides

- Selective

- Non-Selective

- Glyphosate

- Atrazine

- 2,4-D

- Others

- Fungicides

- Chlorathalonil

- Sulfur

- PCNB

- Maneb

- Others

- Insecticides

- Malathion

- Carbaryl

- Chlorpyrifos

- Others

- Biopesticides

- Others

By Crop Type

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Others

By Source

- Synthetic Chemicals

- Biologicals

By Form

- Dry

- Liquid

By Mode of Application

- Foliar Spray

- Seed Treatment

- Soil Treatment

- Others (chemigation and fumigation)

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content