Cathodic Protection Market Size and Forecast 2025 to 2034

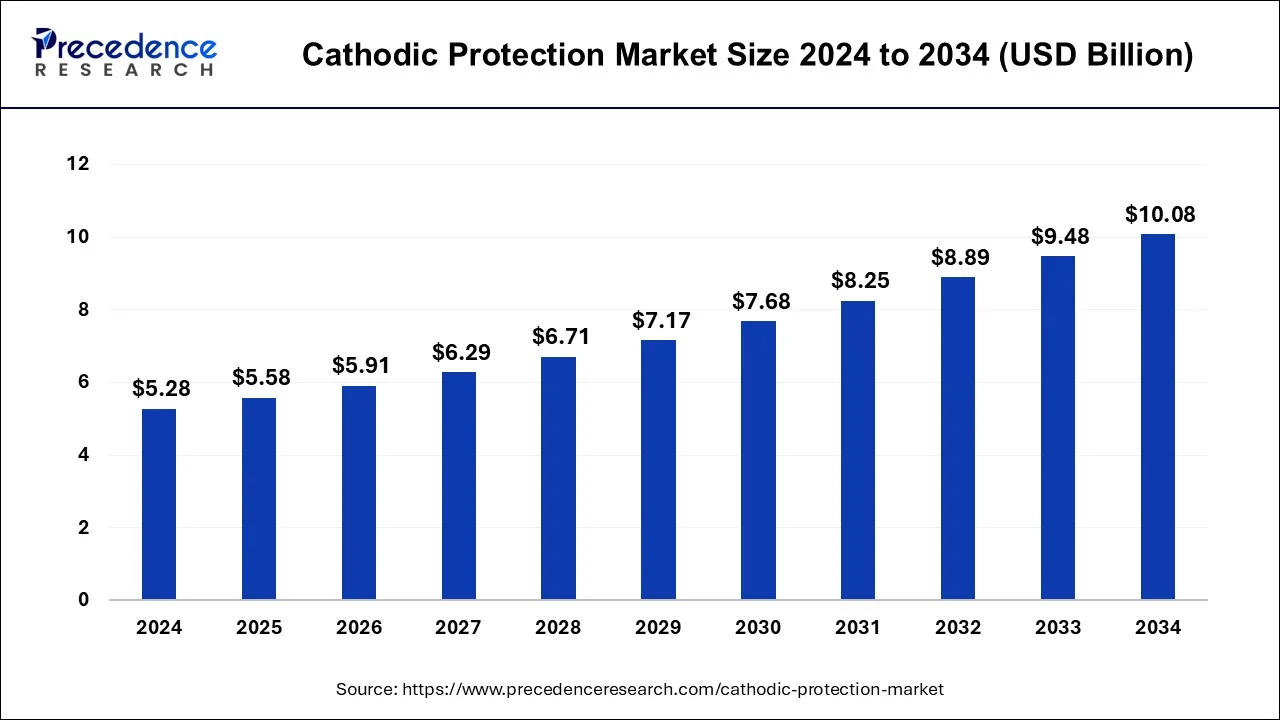

The global cathodic protection market size was USD 5.28 billion in 2024, grew to USD 5.58 billion in 2025, and is projected to surpass around USD 10.08 billion by 2034, representing a healthy CAGR of 6.79% between 2025 and 2034.

Cathodic Protection Market Key Takeaways

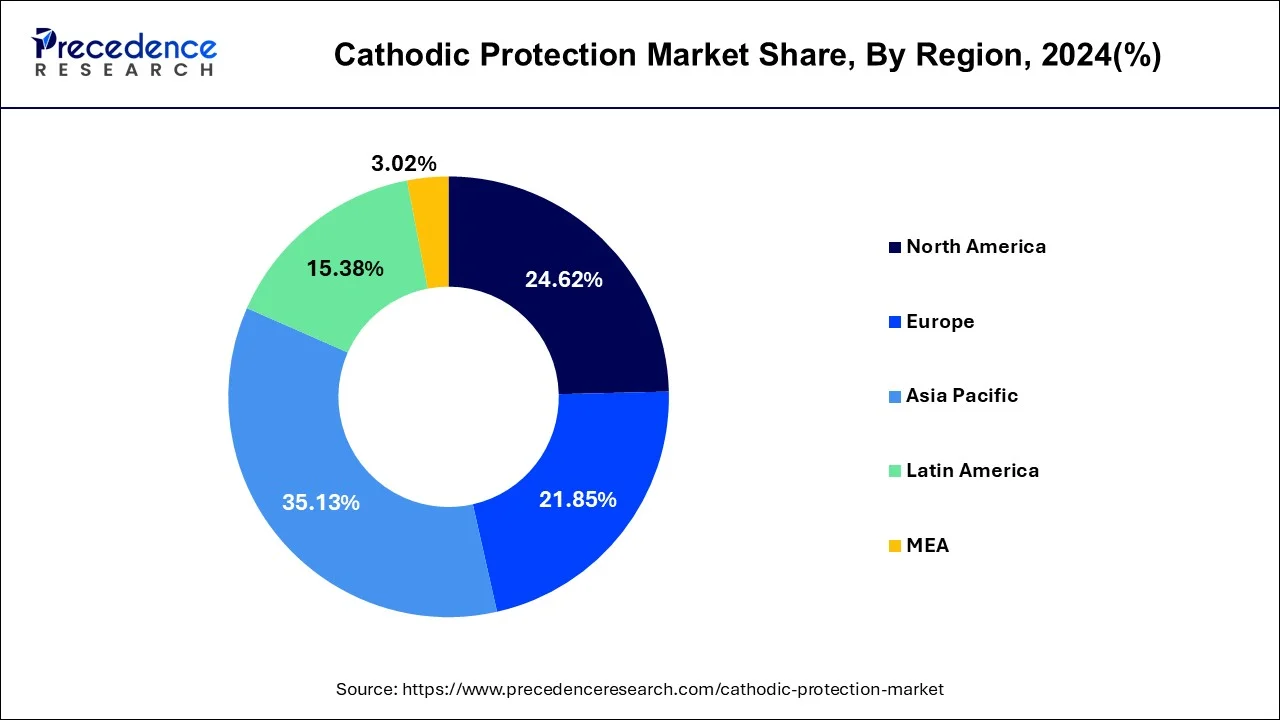

- Asia Pacific has generated highest revenue share of around 35.13% in 2024.

- By solution, the instrumentation segment is projected to experience the highest growth rate in the market between 2025 and 2034.

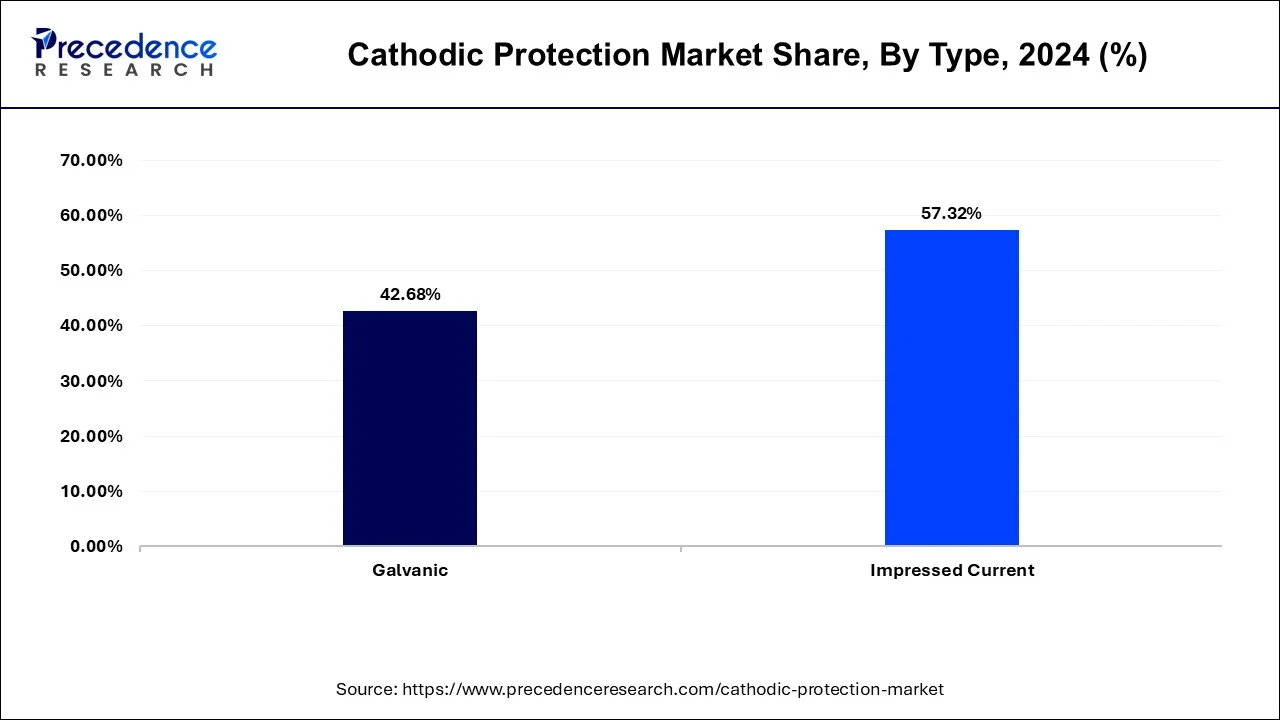

- By type, the impressed current segment is anticipated to grow with the highest CAGR in the market during the forecast period of 2025 to 2034.

- By application, the offshore structures segment is expected to grow at the fastest rate in the market during the forecast period.

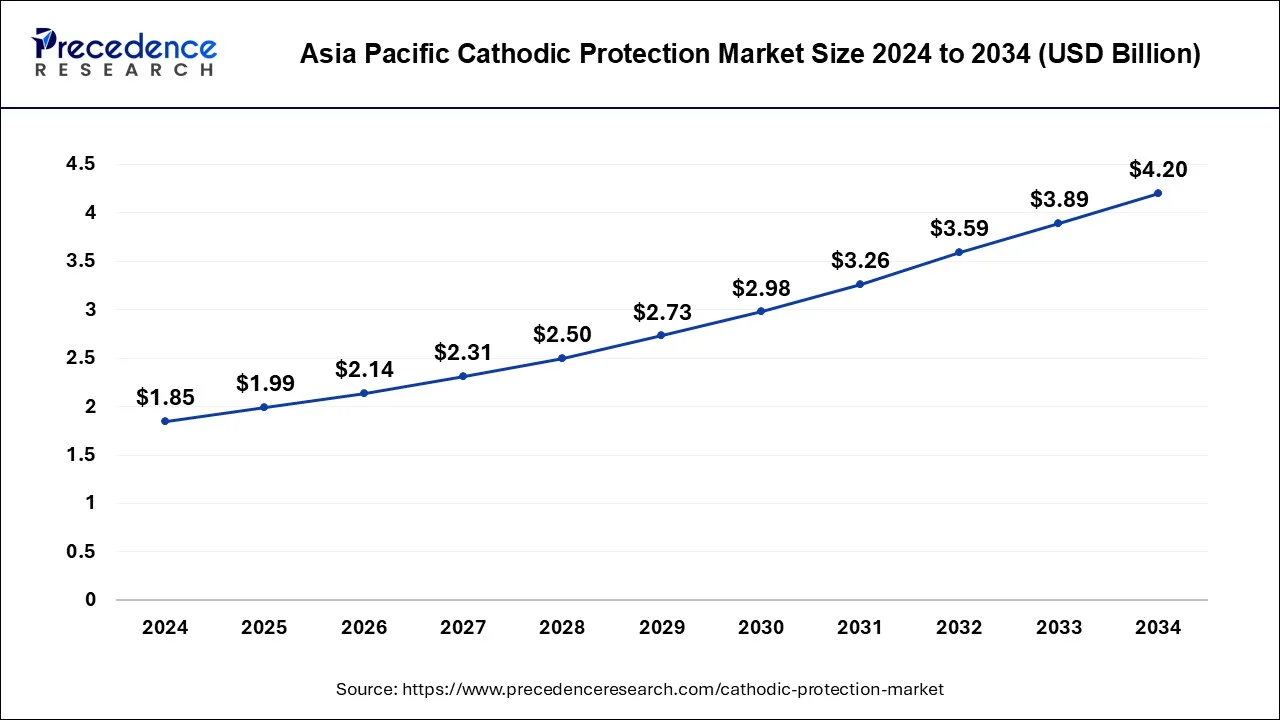

Asia Pacific Cathodic Protection Market Size and Growth 2025 to 2034

The Asia Pacific cathodic protection market size accounted for USD 1.85 billion in 2024 and is expected to be worth around USD 4.20 billion by 2034, growing at a CAGR of 8.68% from 2025 to 2034.

Asia Pacific is expected to hold the largest share of the market during the forecast period. The rising demand for the autonomous industry will boost the market demand in countries like India, China, Japan, etc. the major market competitors in the autonomous industries like TATA, Mahindra & Mahindra Ltd, and Bajaj Auto Limited are investing in the research and development program in the region will result in the growth in the market demand.

According to the various survey, India is becoming the global economy in the upcoming era. The growing infrastructure and industrial investments in developing areas are expected to expand the end-users during the forecast period.

China has emerged as one of the fastest-growing global economies in the last decade. With the ever-going increase in the heavy industrial sector, the nation is expected to be the significant end-user of the cathodic prevention methods.

North America shows significant market growth in terms of global share revenue during the forecast period.Due to higher investment and technological advancement, North America becomes the dominating market in the cathodic prevention market. In North America, the U.S. took the highest share of the market due to the higher demand for oil and gas. Also the demand for zinc cathodic for the deterioration of the water pipes in the U.S. region boosts the demand of the market.

- North America cathodic protection market size was accounted for USD 1300.3 million in 2024 and it is growing at a CAGR of 5.21% from 2025 to 2034.

- Europe cathodic protection market size was exhibited at USD 1153.9 million in 2024 and it is growing at a CAGR of 5.86% from 2025 to 2034.

- China cathodic protection market was valued at USD 743.3 million in 2024 and it is growing at a CAGR of 5.68% from 2025 to 2034.

- Germany cathodic protection market size was estimated at USD 223.5 million in 2024 and it is growing at a CAGR of 6.30% from 2025 to 2034.

- India cathodic protection market size was reached at USD 377 million in 2024 and it is growing at a CAGR of 15.17% from 2025 to 2034.

Market Overview

Corrosion is a naturally formed thing that can occur when some metal and the environment come in contact. It is derived from the reaction between water, air, and metal. In steel and iron-based metal, these reaction form corrosions also known as rust. Cathodic protection is used for the prevention form rust or corrosion in steel or iron metal which can be useful in industrial as well as domestic use. Hence the demand increase in the end-use industries including heavy and small industries.

- Aegion is a multinational company that deals with several types of industries subject to rehabilitation, protection, and design of infrastructure projects. It also provides corrosion engineering services and technologies to cathodically protect infrastructure.

- Aegion's highest annual revenue was $807.8Mn in 2022.

- Cathodic Protection co ltd is preferably dealing with all cathodic protection and marine anti-fouling solutions.

- James Fishers and Sons mentioned that at the year-end of 2022, the group is expecting the revenue report approximately 475 Mn pounds as compared to the previous year's 442.4 Mn pounds.

Cathodic Protection Market Growth Factors

Corrosion is a slow process that disrupts the properties of metal and breaks down the strength of metal. It is the byproduct of the environmental reaction between specific metals, water, and air. Corrosion occurs when the metal comes in a chemical reaction with oxygen in nature that has moisture or water in it. Corrosion can be primarily prevented by choosing a quality and long-lasting surface covering which create the prevention wall between rusting or corrosion cycle and sacrificed metal. There are various forms of corrosion prevention techniques used for the prevention of corrosion. The cathodic protection system is one of the methods for preventing the destruction of metals from corrosion.

Cathodic protection is the layers between these reactions which prevent the metal from corrosion protection. A cathodic prevention system is the secondary form of defense from preventing the structure of starting point to the aging of the infrastructure and maintaining the cycle. Cathodic protection is used in water, automobile, oil and gas, building, and construction industries. The rising demand for cathodic prevention systems in these industries results in the growth in the demand for the market.

Cathodic prevention is used for extending the life cycle of the service of the structural infrastructure. Cathodic prevention can be found in the galvanic design or impressed current system as per the design requirement and applications. Cathodic prevention system is widely accepted by various industries for preventing their infrastructure from corrosion and increasing the life expectancy of the services. Due to their durability and effectiveness the demand for cathodic protection systems in the global anticorrosion market.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 5.28 Billion |

| Market Size by 2034 | USD 10.08 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 6.79% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Solutions, By Type, and By Applications |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

One key recent driver in the cathodic protection industry is the emergence of AI powered and IoT integrated monitoring systems, particularly in sectors like oil and gas and infrastructure. Leading providers including MATCOR, Aegion Corporation, Corrosion Protection specialist, and BAC Corrosion Control Ltd. Are now rolling out advanced solutions that combine real time data capture isn't just about upgrading hardware it's a transforming in how corrosion is managed. Instead of periodic manual checks, operators are embracing continuous, automated monitoring that flags performance anomalies, predicts maintenance needs, and enhances decision making with actionable insights. The ability to detect subtle trends before they escalate into major failures boosts operational uptime, reduces risk, and significantly cuts maintenance costs. In effect, these smart systems are evolving cathodic protection from a reactive service into a proactive, precision driven capability a that's unleashing a wave of adoption across industries where asset integrity matters most.

Restraint

One noteworthy restraint stemming from contemporary developments is the challenge of electrical interference impacting cathodic protection effectiveness. Modern infrastructures often run cathodic protection systems in close proximity to electrified installations such as railway tracks, overhead power lines, or high voltage communication cables. These adjacent electrical systems can introduce stray electrical currents and electromagnetic fields that disrupt how protective current is distributed across metal structures. The consequence is uneven corrosion coverage certain areas may be overprotected while others remain vulnerable ultimately reducing the system's reliability. Addressing these interferences demands meticulous CP systems design, incorporating robust grounding strategies, conductive shielding, and physical separation of conflicting systems. Yet, such mitigations dramatically amplify design complexity, construction expenses, and maintenance burdens, particularly in retrofitting or environmentally constrained sites. This makes electrical interference a formidable and persistent barrier hindering the broader adoption of advanced cathodic protection technologies.

Opportunities

The advancement of switch mode technology

The Advancement in the cathodic protection systems from the recent innovation of switch mode technology. The Second generation rectifier system had several filtrations. The brand new switch mode-specific component is introduced to the market to increase the efficiency and effectiveness of the product. The system includes a control system and a remote monitoring system for communication technologies. The switch mode technology was also useful for the environmental protection strategies. The system was designed to integrate analog and digital control loops, to allow exact cathodic protection. Similarly, the single-module cathodic protection system was launched. Which can be integrated with the digital control loop technology as well as component technologies. These technologies are integrated with the broadband connectivity from satellite to fiber optic and internet connectivity as well.

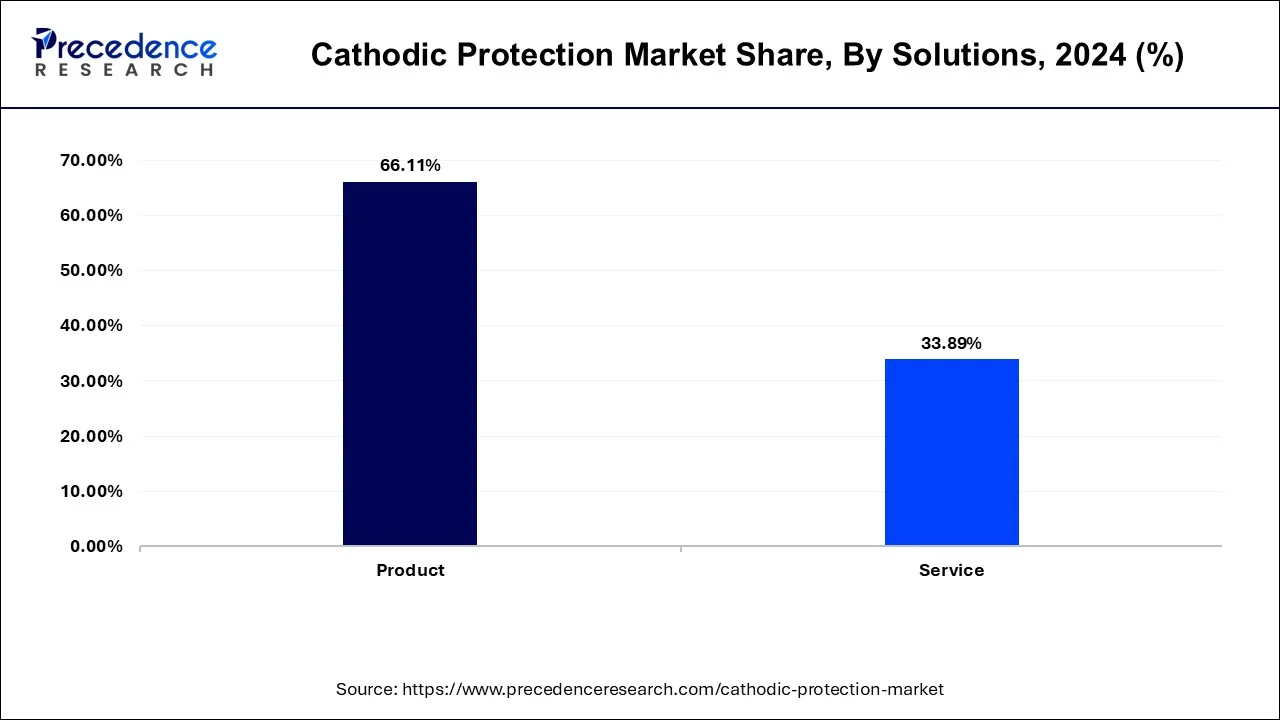

Solutions Insights

Within the solution category, the instrumentation segment emerging as the fastest growing area, and its importance in the market continues to expand as industries embrace digital transformation. Modern infrastructure operators increasingly recognize that corrosion is not just a maintenance issue but a critical risk factor that can impact safety, reliability, and overall operational costs. As a result, they are shifting toward more advanced tools that allow for precise monitoring, automation, and predictive analysis. Instrumentation plays a pivotal role in this shift, offering technologies that can continuously assess the effectiveness of cathodic protection systems and provide real time data on performance.

Worth the rise of smart infrastructure and industrial internet of Things (IIoT) adoption, the integration of sensors, remote monitoring devices, and automated control systems is becoming a standard expectation in corrosion management. These capabilities empower asset owners to move from reactive to proactive strategies, reducing downtime and avoiding costly failures. This transformation is fuelling the strong growth trajectory of the most dynamic areas within the cathodic protection landscape.

Global Cathodic Protection Market Revenue, By Solution, 2022-2024 (USD Million)

| By Solution | 2022 | 2023 | 2024 |

| Product | 3,129.9 | 3,307.2 | 3,491.1 |

| Service | 1,622.9 | 1,705.0 | 1,789.7 |

Type Insights

Among the types of cathodic protection systems, the impressed current segment is anticipated to expand at the fastest rate in the coming years due to its superior versatility and adaptability. Unlike traditional sacrificial systems, impressed current solutions can be tailored to handle large, complex, and critical infrastructure where more advanced corrosion control is required. This makes them particularly attractive for industries such as oil and gas, maritime transport, power generation, and infrastructure development, all of which rely heavily on long lasting protection in demanding environment.

Impressed current systems are specially valued for their ability to deliver uniform and controlled protection across vast surfaces, assuring consistency even under challenging conditions. The ability to adjust and scale these systems based on project requirements makes them an attractive option for both existing assets and new installations. Furthermore, as environmental and safety regulations become stricter, industries are prioritizing solutions that offer long term durability and reduce the frequency of replacements or repairs. These factors collectively highlight why the impressed current segment is becoming the fastest growing type, as organizations increasingly invest in reliable and high performance cathodic protection technologies.

Global Cathodic Protection Market Revenue, By Type, 2022-2024 (USD Million)

| By Type | 2022 | 2023 | 2024 |

| Galvanic | 2061.4 | 2158.4 | 2253.7 |

| Impressed Current | 2691.4 | 2853.8 | 3027.1 |

Applications Insights

In terms of application, offshore structures are projected to be the fastest growing segment of the cathodic protection market, largely due to the global expansion of offshore energy projects. Both traditional oil and gas exploration and the rapidly growing offshore renewable energy sector rely heavily on the integrity of subsea and surface structures. These assets operate in some of the harshest environments on earth, where content exposure to saltwater, pressure, and temperature fluctuations accelerates corrosion at a rapid pace. Cathodic protection is indispensable for maintaining the functionality and safety or platforms, pipelines, subsea cables, and wind turbine foundations. With the world placing increasing emphasis one energy security and renewable energy investments, offshore projects are expanding in both scale and complexity.

Global Cathodic Protection Market Revenue, By Applications, 2022-2024 (USD Million)

| By Applications | 2022 | 2023 | 2024 |

| Pipeline | 869.3 | 910.2 | 951.6 |

| Storage facilities | 937.8 | 1,001.6 | 1,068.5 |

| Processing plants | 1,069.4 | 1,133.5 | 1,200.3 |

| Water & Wastewater | 529.0 | 554.3 | 580.3 |

| Transportation | 480.1 | 500.2 | 520.7 |

| Transportation | 507.2 | 531.5 | 556.6 |

| Others | 359.9 | 381.0 | 402.8 |

This expansion is driving is the demand for advanced cathodic protection solutions that can safeguard high value infrastructure for decades of operation. The offshore segment's rapid growth also reflects a broader recognition that preventing corrosion in these environments is not only about protecting assets but also about assuring environmental safety and avoiding costly accidents or energy disruptions. As a result, offshore structures are set to remain at the forefront of cathodic protection adoption, fuelling the segment's accelerated rise in the market.

Cathodic Protection Market Companies

- Aegion Corporation

- BAC Corrosion Control Ltd

- Cathodic Protection Co Ltd

- CMP Europe

- Farwest Corrosion Control Company

- Imenco AS

- James Fisher

- MATCOR, Inc

- Nakabohtec Corrosion Protecting Co

- The Nippon Corrosion Engineering Co

Recent Development

- Force Technology has introduced a novel non-contact tool known as the Field Gradient Sensor (FiGS) for assessing cathodic protection systems on subsea infrastructure. This innovation allows for contactless inspections by measuring both the magnitude and direction of electric field gradient, offering more accurate diagnostics than conventional methods. It enables detection of coating defects, evaluation of anode performance, and prediction of system lifespan without needing physical contact or extensive calibration. FiGS can be deployed via ROVs or AUVs and is being expanded for offshore wind, deeper water environments, and digital twin integration to streamline maintenance and predictive monitoring.

(Source: Non-contact inspection tool assists with cathodic protection surveys of subsea infrastructure | Offshore ) - The institute of Corrosion's India branch recently hosted a webinar that highlighted a forward looking shift in CP monitoring: the implementation of digital twin technology for offshore structures. These digital replicas integrate real time inspection data with electrochemical simulation models, enabling operators to virtually monitor, simulate, and optimize CP system performance by identifying potential discrepancies before they escalate, thereby improving accuracy in spotting corrosion related issues and ultimately supporting more effective resource planning.

(Source: ICorr India Updates - Institute of Corrosion)

Segments Covered in the Report

By Solutions

- Products

- Services

By Type

- Galvanic

- Impressed current

By Applications

- Pipeline

- Storage facilities

- Processing plants

- Water & Wastewater

- Transportation

- Buildings

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting