Ceramic Coating Market Size and Forecast 2025 to 2034

The global ceramic coating market size was estimated at USD 12.15 billion in 2024 and is predicted to increase from USD 13.10 billion in 2025 to approximately USD 25.60 billion by 2034, expanding at a CAGR of 7.74% from 2025 to 2034. The ceramic coating promotes increased heat resistance coupled with fewer emissions to the atmosphere. This factor is expected to drive the ceramic coating market growth during the forecast period.

Ceramic Coating Market Key Takeaways

- In terms of revenue, the global ceramic coating market was valued at USD 12.15 billion in 2024.

- It is projected to reach USD 25.60 billion by 2034.

- The market is expected to grow at a CAGR of 7.74% from 2025 to 2034.

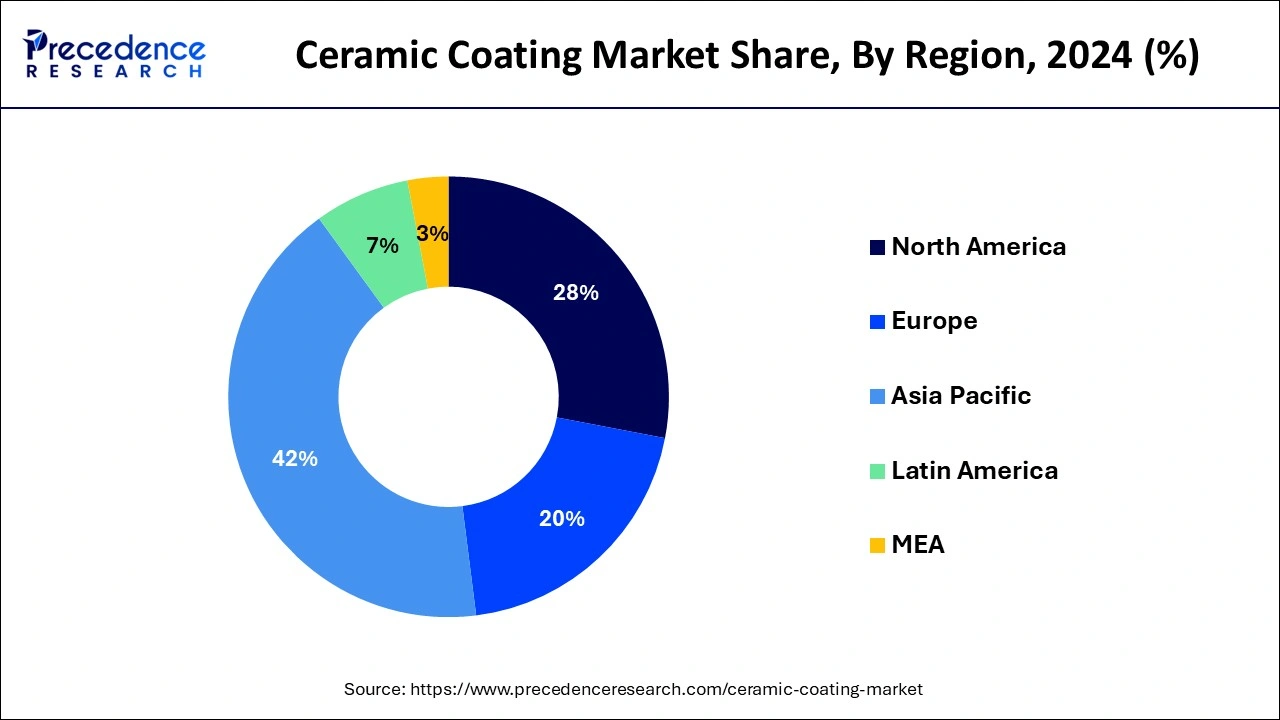

- Asia Pacific dominated the market with the largest revenue share of 42% in 2024.

- North America is expected to grow at the fastest rate throughout the forecast period.

- By product, the oxide segment has held the biggest revenue share of 59% in 2024.

- By product, the carbide segment is expected to grow at the fastest CAGR of 7.71% during the projected period.

- By technology, the thermal spray segment dominated the market in 2024.

- By technology, the PVD segment is the fastest-growing segment of the market.

- By application, the transportation & automotive segment accounted for a significant share of the market.

- By application, the energy segment is expected to create a considerable presence in the market.

Asia PacificCeramic Coating Market Size and Growth 2025 to 2034

The Asia Pacific ceramic coating market size was estimated at USD 5.10 billion in 2024 and is predicted to be worth around USD 10.88 billion by 2034 at a CAGR of 7.87% from 2025 to 2034.

Asia Pacific dominated the ceramic coating market in 2024. Low prices are often associated with lower-quality products rather than reduced operating costs. The significant demand in the region can be likened to consumption in developing countries like China, India, and Japan. The rise in engineering component manufacturing in the area is expected to boost regional demand in the forecasted period. China, a leading manufacturer of ceramic coatings, supplies most of the region's supply. Japan currently makes significant regional consumption and is projected to maintain its dominance throughout the forecast period.

- In April 2024, Toyota Kirloskar Motor Pvt. Ltd. announced the launch of its car care brand. T Gloss services will be available at all authorized Toyota dealerships across India starting. It goes beyond just aesthetics with T Gloss, as it offers a comprehensive range of services. The services offered by the company include ceramic coating, underbody coating, silencer coating, and internal panel protection.

North America is expected to grow at the fastest rate in the global ceramic coating market throughout the forecast period. This is largely due to rapid advancements in the automotive sector. Furthermore, ongoing developments in the aerospace industry are expected to contribute to market growth in the region during the assessment period. The presence of well-established automobile and aerospace industries has facilitated this level of ceramic coating consumption. Future market growth is anticipated to be driven by the automotive and healthcare product sectors.

- In May 2023, Canlak Coatings Inc., a portfolio company of SK Capital Partners and leading formulator and manufacturer of high-quality wood coating systems for commercial and residential flooring, sports flooring, cabinet, furniture, and wood-focused architectural applications, announced the acquisition of Ceram-Traz Corporation d.b.a Ceramic Industrial Coatings.

Market Overview

High-temperature applications use ceramic coatings, which are composed of inorganic materials such as silicon carbide, silicon nitride, titania, hafnia, alumina, and alumina-magnesia. These coatings may find a wider market because of their increased heat resistance, long-term durability, and anti-erosion qualities. Using nanotechnology, a ceramic coating fills in gaps in car bodywork by creating a translucent layer that contains a liquid composite that binds at the molecular level with a paint solution. In comparison to other coatings, this produces a chemical bond with the paint that is imperceptible to the naked sight and produces less pollution.

Over the course of the forecast period, these factors are anticipated to propel the expansion of the ceramic coatings market. Additionally, because of their superior resistance to abrasive wear, corrosion, and heat insulation, ceramic coatings are being employed on metal components in autos on a growing basis. The aerospace and defense sectors are also seeing more applications of oxide and carbide coatings, which are used in space shuttles, insulating tiles, rocket exhaust cones, engine parts, and airplane windscreen panes.

Ceramic Coating Market Growth Factors

- Expansion in the automotive industry is propelling the growth of the ceramic coating market.

- The growing need for performance efficiency will likely boost market growth soon.

- Technological advancements in ceramic coating, along with research and development activities, are fueling the ceramic coating market growth.

- Strict regulations in industries that are searching for compliance solutions can drive the growth of the ceramic coating market.

- Growing disposable income in developing countries can positively impact the ceramic coating market growth during the forecast period.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 7.74% |

| Market Size in 2025 | USD 13.10 Billion |

| Market Size by 2034 | USD 25.60 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product, By Technology, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing demand for ceramic coatings in the aerospace & defense industry

Defense is dependent on a country's requirement for military assets for land, sea, and air operations, whereas the aviation sector is focused on the production, sale, and operation of commercial aircraft. The aerospace and defense industry is largely driven by the United States, but other nations have also recently played a significant role in its success, including China, France, India, Japan, the Middle East, Africa, and the United Kingdom. Turbine engines are frequently utilized for auxiliary power systems, aviation propulsion, and other applications. Ceramic layers called thermal barrier coatings are used to insulate heat engine parts. In gas turbine engines, these low-conductivity coatings can lower component temperatures by up to 1900°F by shielding air-cooled metallic parts from the hot gases produced by the engine.

- In May 2023, AMRC fiber handling expertise aids CMC coating technology. The CICSiC project successfully developed equipment and processing know-how associated with the uniform, continuous coating of SiC-based CMC to bring down the cost and improve performance and reliability for new designs and applications.

Restraint

Fragility and brittleness

Although ceramic coatings offer excellent thermal and chemical resistance, they are relatively brittle compared to other coatings. This brittleness makes them prone to cracking or chipping under mechanical stress or impact by limiting their use in industries that require high mechanical durability. Moreover, the global ceramic coating market has faced significant disruptions due to precautionary lockdowns and other restrictions imposed by governments worldwide. These disruptions have affected supply chains and industries, leading to decreased demand from major sectors like automotive and aerospace, unexpected plant closures, and temporary production halts. The market's year-over-year growth rate has slowed.

Opportunity

Antibacterial coating

Antibacterial coatings have recently become a trend. Vendor companies are keen to cover the latest trends, leading to the launch of antibacterial ceramic coatings that inhibit microorganism growth. These coatings are particularly used in the public transport sector, where surfaces are frequently touched by millions of people. Basic ceramic coatings are hydrophilic, serving as waterproof and non-stick clothing coatings, while non-stick coatings are used in furniture, electrical appliances, and glass. The demand for ceramic coatings is expected to rise due to their improved heat resistance and lower atmospheric emissions, driving the ceramic coating market expansion during the forecast period. Also, the sales of ceramic coating solutions are increasing as they protect metal car parts from abrasion and corrosion and provide an effective thermal barrier.

- In November 2023, global aerospace leader Boeing launched a project to the International Space Station (ISS) on SpaceX's 29th Commercial Resupply Services (CRS) mission. The ISS National Laboratory-sponsored project will test the effectiveness and durability of an innovative antimicrobial coating in long-term space missions.

Product Insights

The oxide segment dominated the ceramic coating market in 2024. The oxide segment held the major market share and is likely to maintain its dominance during the forecast period. Compared to carbides and nitrides, oxides are more affordable. Oxide ceramic coatings protect metals against corrosion and serve as decorative and electrical insulators. These coatings can be applied to steel, cast iron, aluminum, copper, and zinc alloys. In this market, coating services help oil and gas exploration companies reduce exploration costs and increase production.

The ceramic coating market is expected to see rapid growth in the carbide segment. Carbide coatings are costly due to expensive raw materials and manufacturing processes. Carbon fiber coatings are also making their way into the sports industry with applications in horse hooves, golf clubs, and bicycles. XPEL, Inc. has expanded its FUSION PLUS automotive ceramic coating product line to include unique materials designed to protect trim surfaces, plastic, upholstery, glass, and brake calipers.

- In September 2023, Elon Musk's wild Cybertruck tweet suggested offering the stainless-steel-skinned electric pickup truck with an optional tungsten carbide coating for added durability. This would theoretically address concerns of scratches ruining the raw metal's finish, which would be much more difficult to repair than paint.

Technology Insights

The thermal spray segment dominated the ceramic coating market in 2024. Thermal spraying is the most common technique for ceramic coatings, primarily made of metal oxides for wear resistance. Applying thermally sprayed ceramics to metal substrates enhances surface properties, providing thermal or electric insulation and resistance to wear and corrosion.

- In January 2023, Thermal Spray Technologies announced the launch of its new thermal spray coating, T-COAT 910. T-COAT 910 is a high-performance coating designed to provide superior wear resistance and corrosion protection.

The PVD segment is the fastest-growing segment of the ceramic coating market. This growth is driven by the increasing demand for PVD coatings in the medical and electronics industries. PVD coatings enhance the performance of components by improving wear resistance, corrosion resistance, and biocompatibility. However, PVD coatings have limited resistance to high temperatures and surface pressures, making them unsuitable for heavy industries and aerospace applications.

Application Insights

The transportation & automotive segment held a significant share of the ceramic coating market due to its application on vehicle bodies. When applied, the ceramic coating chemically bonds with the factory paint, providing excellent surface protection. This coating shields vehicles from dirt, chemical contaminants, and scratches. Additionally, it makes the vehicle easier to clean and keeps its body panels smooth and free from abrasions.

It is anticipated that the energy segment would establish a significant foothold in the ceramic coating market based on application. Solar panels frequently employ ceramic coatings. They shield the glass from mineral deposits and sea spray, which can corrode and discolor it. The surface of solar panels is also endowed with hydrophobic and self-cleaning qualities by these coatings.

Ceramic Coating Market Companies

- Bodycote

- Praxair Surface Technologies, Inc.

- Aremco Products, Inc.

- APS Materials, Inc.

- Cetek Ceramic Technologies Ltd.

- Keronite Group Ltd.

- Saint-Gobain S.A.

- Element 119

- NanoShine Ltd.

- Ultramet, Inc

Recent Developments

- In June 2023 and June 2023, CeramTec, a manufacturer of ceramic components and systems, announced the opening of a new production facility in China. The new facility will produce ceramic coatings for various automotive, aerospace, and medical applications.

- In March 2023, Cerakote announced the launch of its new ceramic coating, Cerakote Xtreme. This high-performance coating is designed to provide superior protection against wear, corrosion, and heat.

- In February 2023, Nanogate announced the acquisition of Surpass Coatings. Surpass Coatings is a leading provider of ceramic coatings for the aerospace and automotive industries.

Segment Covered in the Report

By Product

- Oxide

- Carbide

- Nitride

- Others

By Technology

- Thermal Spray

- Physical Vapor Deposition

- Chemical Vapor Deposition

- Others

By Application

- Transportation & Automotive

- Energy

- Aerospace & Defense

- Industrial Goods

- Healthcare

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting