What is the Thermal Camera Market Size?

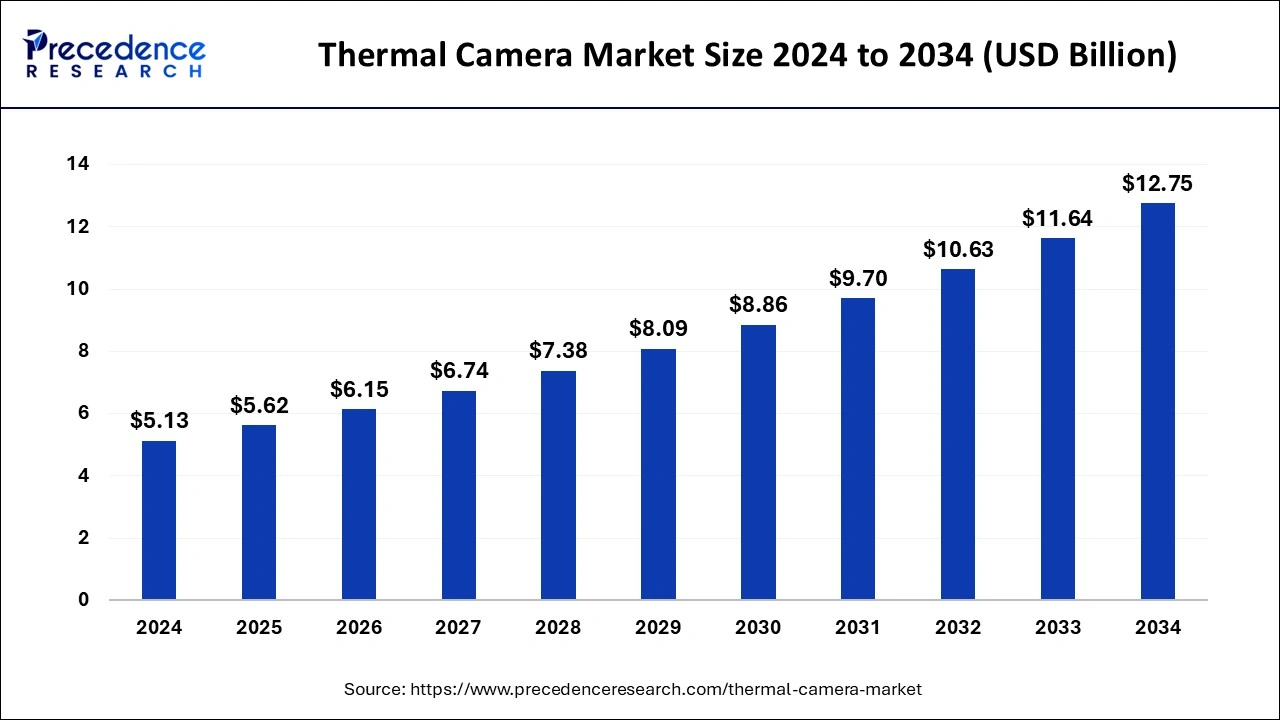

The global thermal camera market size is calculated at USD 5.62 billion in 2025 and is predicted to increase from USD 6.15 billion in 2026 to approximately USD 13.79 billion by 2035, expanding at a CAGR of 9.39% from 2026 to 2035.

Thermal Camera Market Key Takeaways

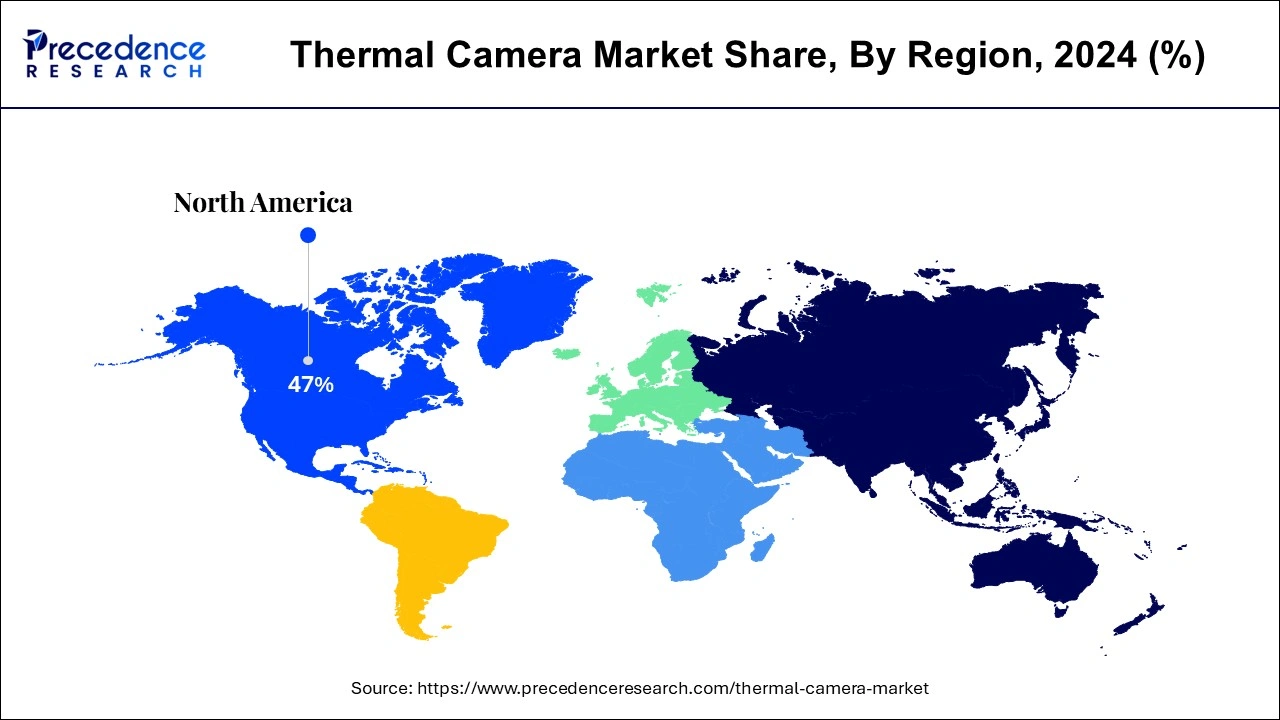

- North America dominated the global thermal camera market with the largest market share of 47% in 2025.

- Asia Pacific is projected to expand at the notable CAGR during the forecast period.

- By technology, the cooled segment contributed the highest market share in 2025.

- By end-user, the military and defense segment has held the largest market share in 2025.

How is AI Revolutionizing the Thermal Camera Market?

AI is revolutionizing the thermal camera market by focusing on digital interpretation of visual data as images and videos. With the integration of deep learning algorithms as convolutional neural networks, the models have become highly efficient and able to extract the most relevant features for each task on their own. The AI algorithms also help to save time along with, help to find relevant information, pattern that can be ignored by human detection. On account of this, many developers have been creating AI solutions that are fed with thermal images. Some of these applications are for material recognition, human detection, automatic guidance for firefighters, fever detection and carpal tunnel syndrome diagnosis.

Thermal Camera Market Growth Factor

- Increasing demand for surveillance across various industries like mining, oil and gas.

- Development of high-speed technology is also propelling the thermal camera market.

- Its ability to efficiently work in adverse conditions.

- Increased use of IR or thermal imaging techniques in military operations that allows high resolution vision even in darkness.

- Thermal cameras can also detect human targets, vehicles which emit enough heat radiation, thus, can be used in rescue operations.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 5.62 Billion |

| Market Size in 2026 | USD 6.15 Billion |

| Market Size by 2035 | USD 13.79 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 9.39% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Largest Market | North America |

| Segments Covered | By Product, By Technology, By End Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Market Dynamics

Key Market Drivers

- Demand for thermal camera in various applications - On the other hand, commercial use of thermal imaging cameras is growing, and over the next few years, the worldwide market is anticipated to grow dramatically. A few applications for thermal cameras and detectors include home automation, security, fire detection, and gas detection. Although they were first created for military applications, thermal cameras are now increasingly utilized in non-military settings. More people are using robust thermal cameras in healthcare, which might result in profitable growth opportunities. Since then, a wider variety of medical applications have used thermal imaging cameras. One of the most popular uses of thermography is the detection of breast pathologies, such as breast cancer, fibrocystic breast disease, and mastitis.

Key Market Challenges

- High cost associated with thermal cameras -Although thermal imaging technology is safe and silent, it has several drawbacks similar to other technologies. The price of these cameras is preventing wider use. Because they are temperature-based, these devices are affected by the weather, and the visual contrast is minimal. The primary barrier to the widespread use of infrared thermal imaging systems is still their high cost, but because to the development of non-cooled infrared plane arrays, they may now offer good resolution and efficiency at reasonable costs. Potential costs of thermal cameras may be significantly decreased by the progress of innovations, breakthroughs in core advancements, and growth in manufacturing performance.

Key Market Opportunities

- Oil & gas companies use thermal imaging to find pipeline leaks -The oil & gas industry faces a variety of maintenance issues, including valves, turbines, generators, and pipe failures that result in harmful emissions and dangerous gas spills into the atmosphere. Detecting invisible oil & gas leaks takes a lot of time and effort when using traditional inspection techniques, especially when there are many components to check. In the oil & gas sector, thermal cameras are frequently employed as tools for preventative maintenance to identify leaks in installations, pipelines, and reservoirs. As a result, they increase protection and pollution levels with a lower risk of disruption as a result of regulatory bodies' actions. The quicker leak detection and immediate source identification made possible by these cameras results in quicker repairs, lower industrial emissions, and greater regulatory compliance. For the oil and gas industry, a number of significant market participants are launching a wide range of these devices. In the upcoming years, these elements are anticipated to propel the thermal camera market.

- Technical advances and R&D activities -Due to increasing R&D investment by key industry participants and a larger emphasis on incorporating cutting-edge technologies, the market for thermal imaging cameras has a bright future. Revenue growth in the thermal camera market is anticipated as surveillance technology develops and the security & surveillance industry expands. As thermal imaging technology is used more often for perimeter security and as the price of thermal imaging equipment drops, the market for thermal imaging cameras will grow. The automobile industry's growing acceptance of thermal imaging as well as favorable government initiatives and regulations are expected to boost the market for thermal cameras.

Segment Insights

Product Insights

Because of its wider range of uses, including thermal imaging, medical imaging, predictive maintenance, and other areas, the portable thermal camera market is anticipated to develop at the greatest rate over the projected period. The demand for these cameras has also increased as a result of the growing need for these devices to detect body temperature and also for other healthcare-related applications. Mount thermal camera devices are essential in smoke detection & protection, early fire warning, and surveillance applications, in addition to being utilized to boost manufacturing productivity or optimize quality assurance.

Technology Insights

The market's largest share will be accounted for by the cooled thermal camera segment. During the forecast period, thermal imaging systems with cooled detectors are anticipated to see rapid acceptance, primarily because of their quick capture rate as well as the broad thermal isolation band. Additionally, because they use shorter infrared wavelengths for sensing, cooled cameras typically have larger magnification capabilities. Since cooled cameras have higher resistance qualities, they can be used with lenses that have more optical elements or thicker components without lowering the signal-to-noise ratio.

End Use Insights

The military and defense segment has held the largest market share in 2024. The industry segment with the highest CAGR will be healthcare as well as life sciences. Thermal cameras are being used by many researchers as well as healthcare organizations all over the world to monitor and capture variations in body temperature for diagnostic reasons. Researchers get information on metabolic and circulatory functioning through the analysis of thermal pictures taken by cameras in order to spot abnormal physical changes.

These tools are also used to look at a wide range of illnesses where the skin's temperature may reveal inflammation or injury to the tissues, or if blood flow is altered due to a clinical deformity. Also most clinicians today use thermal imaging equipment to identify a wide range of medical issues, including circulatory abnormalities, arthritis, recurring strain injuries, and body aches.

Regional Insights

What is the U.S. Thermal Camera Market Size?

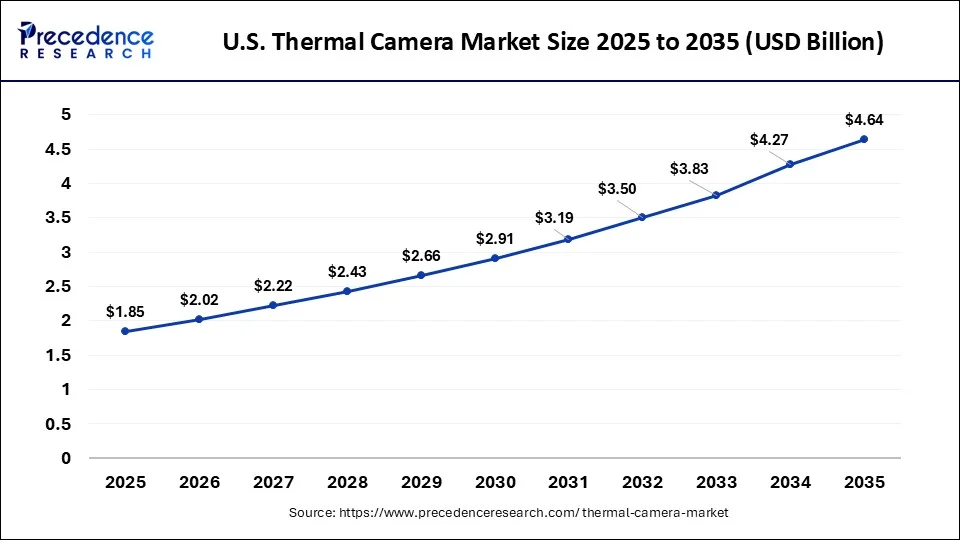

The U.S. thermal camera market size was evaluated at USD 1.85 billion in 2025 and is predicted to be worth around USD 4.64 billion by 2035, rising at a CAGR of 9.63% from 2026 to 2035.

What Made North America the Leading Region in the Thermal Camera Market?

North America is anticipated to lead this market share due to the rising need for thermal imaging technology in the manufacturing as well as commercial sectors. Additionally, the military and defense sector's booming need for these cameras for the purpose of security and surveillance applications is anticipated to have a beneficial influence on the market's expansion in North America. IoT and improved thermal imaging solutions are being implemented more slowly than initially anticipated, with semiconductorbusinesses stepping in to assist advance other new imaging technologies. The technical potential of thermal technology, including its capacity to collect and analyze enormous amounts of industrial data, is the focus of developers and business leaders in the region. This data may be used to manage industrial safety and compliance while enhancing protection, monetary returns, and convenience.

What Makes Europe the Second-Largest Region in the Thermal Camera Market?

The second-largest market share belongs to Europe. This region's market is expected to grow as defense & monitoring need rises. The demand in this area has also been greatly influenced by the progressive fall of thermal cameras in addition to the inexpensive availability of thermal sensors. Additionally, nations like France, the United Kingdom, and Italy are increasing their military spending, making up a significant portion of the market. Due to the escalating border conflicts between nations like India and China, the Asia-Pacific market is predicted to have exceptional growth. Countries are being forced by these wars to increase their military spending and provide their armed forces with cutting-edge monitoring equipment like thermal cameras.

Why is Asia Pacific Considered the Fastest-Growing Region in the Thermal Camera Market?

Asia Pacific is expected to grow at the fastest CAGR over the projection period. This is mainly due to the increasing sales of handheld thermal cameras in several nations, including China, India, New Zealand, Australia, Japan, and South Korea. The rapid investment by the governments for strengthening the capabilities of the defense sector, as well as the surging focus of market players for opening new production centers, is playing a vital role in shaping the market landscape in the region. Moreover, the presence of various market players, such as Wuhan Guide Infrared, Nippon Avionics / NEC Avio, and Tonbo Imaging, is expected to propel the growth of the market in this region.

How is the Opportunistic Rise of Latin America in the Thermal Camera Market?

Latin America is expected to experience an opportunistic rise in the market. The growing demand for advanced thermal cameras from the industrial sector in numerous countries, such as Brazil, Argentina, Colombia, and Venezuela, is driving the market growth. The region's growing focus on public safety, infrastructure monitoring, and early disease detection has accelerated adoption across commercial and government sectors. Additionally, improving economic conditions and supportive regulatory initiatives are encouraging both local and international players to expand their presence and deploy innovative thermal imaging solutions.

What Opportunities Exist in the Middle East & Africa for the Thermal Camera Market?

The Middle East & Africa (MEA) presents immense opportunities for the market, driven by the surging demand for AI-integrated thermal cameras from the automotive sector. Also, the rising investment by oil & gas companies to integrate advanced equipment in drilling rigs and the rapid deployment of fixed thermal cameras in houses to enhance security are expected to boost the growth of the market in this region.

Value Chain Analysis

- Raw Materials Sourcing:This stage involves the sourcing of lenses, sensors, detectors, displays, and batteries required for thermal cameras.

Key Companies: TDK, Bosch, and Infineon. - Testing and Quality Control: This stage involves several processes, such as calibration, assessing accuracy and stability, checking image quality, evaluating functionality, and verifying performance under specific environmental conditions.

Key Companies: TUV, SGS, and Intertek. - Distribution Channel:The distribution channel of thermal cameras comprises online retailers, distributors, and e-commerce platforms.

Key Companies: HikVision Digital Technology Co., Micro-Epsilon, Caterpillar Inc., and Bullit Mobile Ltd.

Thermal Camera Market Companies

- FLIR Systems Inc.

- Seek Thermal

- Axis Communications AB

- Opgal Optronic Industries Ltd.

- Jenoptik AG

- Fluke Corporation

- PCE Instruments

- Mobotix AG

- LumaSense Technologies Inc.

- Spectronic Plc.

- Optris GmbH

- Schneider Electric SE

- DIAS Infrared GmbH

- InfraTec GmbH

- Ulirvision Technology Co. Ltd.

- HikVision Digital Technology Co.

- Micro-Epsilon

- Caterpillar Inc.

- Bullit Mobile Ltd.

- 3M Scott

Latest industrial announcements

- In May 2024, A leading player in defense technology, named as Teledyne FLIR LLC, unveiled the system known as the rouge 1 loitering munition system and showcased its capacities at the Tampa, during special operations forces week.

Recent developments

- In January 2026, Teledyne FLIR OEM launched Tura, a long-wave thermal infrared camera designed for the automotive sector.

(Source: https://www.businesswire.com ) - In November 2025, Fotric launched TK6 handheld thermal imaging camera. This camera is designed for technicians and engineers to operate in tough areas.

(Source: https://www.airbestpractices.com ) - In October 2025, Thermal Master launched the P3 thermal imaging camera. This thermal camera is designed for Android and iPhones.

(Source: https://www.forbes.com ) - In Janurary 2025, TOPDON US announced the launch of TS005, a professional-grade thermal monocular camera for use in covert operations. The camera includes world-class technology with increased heat range and accuracy while using nighttime vision. The camera provides clear vision up to 1200 meters and includes a built-in laser to locate targets up to 600 meters even in extreme weather conditions such as rain, snow, and fog. The camera has applications in law enforcement, emergency medical services, disaster relief, and game wardens.

- In February 2024, center for development of advanced computing (C-DAC), Prama India and ministry of electronics and information technology government of India, have collaborated technologically for thermal cameras. It is considered as a significant step towards supporting innovations and domestic manufacturing. The collaboration was intended to further research and development into innovative thermal technology applications. C-DAC announced the 'Digital India FutureLabs' initiative at IITM, New Delhi with the aim to undertake this research.

Segment Covered in the Report

By Product

- Handheld

- Fixed/Mounted

By Technology

- Uncooled

- Cooled

By End Use

- Military and Defense

- Industrial

- Commercial

- Healthcare and Lifescienes

- Residential

- Automotive

- Oil and Gas

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting