What is the Tokenization Market Size?

The global tokenization market size was calculated at USD 4.02 billion in 2025 and is predicted to increase from USD 4.81 billion in 2026 to approximately USD 24.13 billion by 2035, expanding at a CAGR of 19.63% from 2026 to 2035. This market is driven by the increasing demand for secure digital asset management, faster transactions, and wider adoption of blockchain technology across industries.

Market Highlights

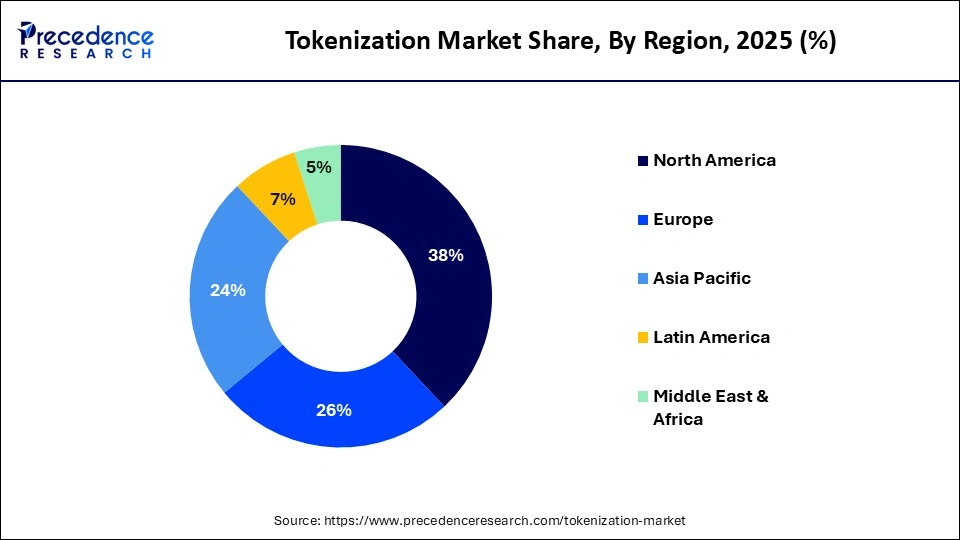

- By region, North America dominated the market with the largest share of 38% in 2025.

- By region, Asia Pacific is expected to grow at the fastest CAGR of 20.0% between 2026 and 2035.

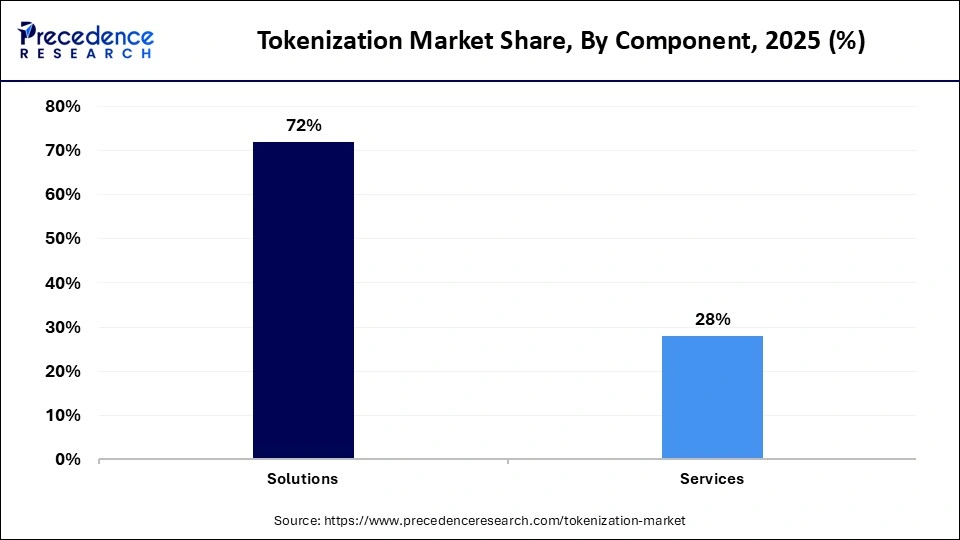

- By component, the solutions segment held the biggest market share of 72% in 2025.

- By component, the services segment is expected to expand at the fastest CAGR of 17.4% between 2026 and 2035.

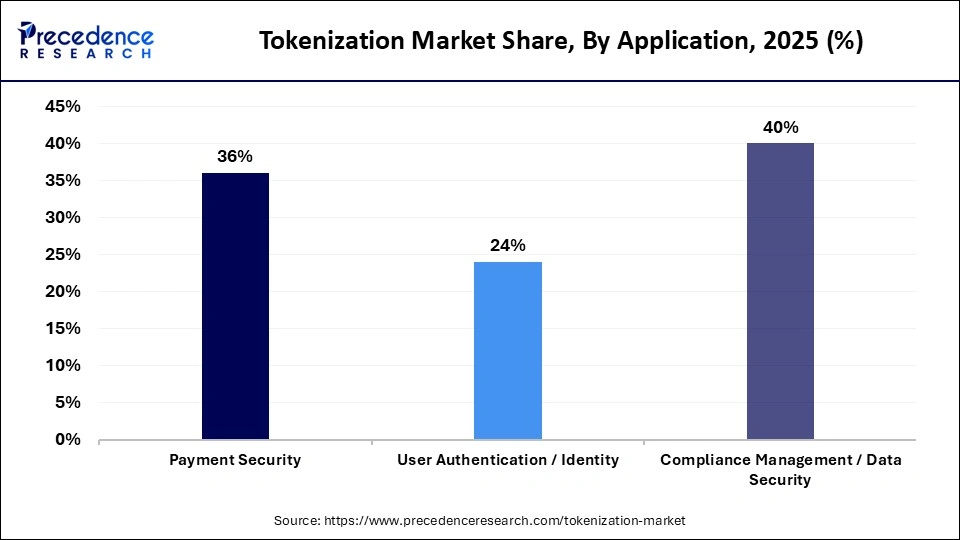

- By application, the payment security segment contributed to the highest market share of 36% in 2025.

- By application, the compliance management / data security segment is expected to grow at the fastest CAGR of 17.6% between 2026 and 2035.

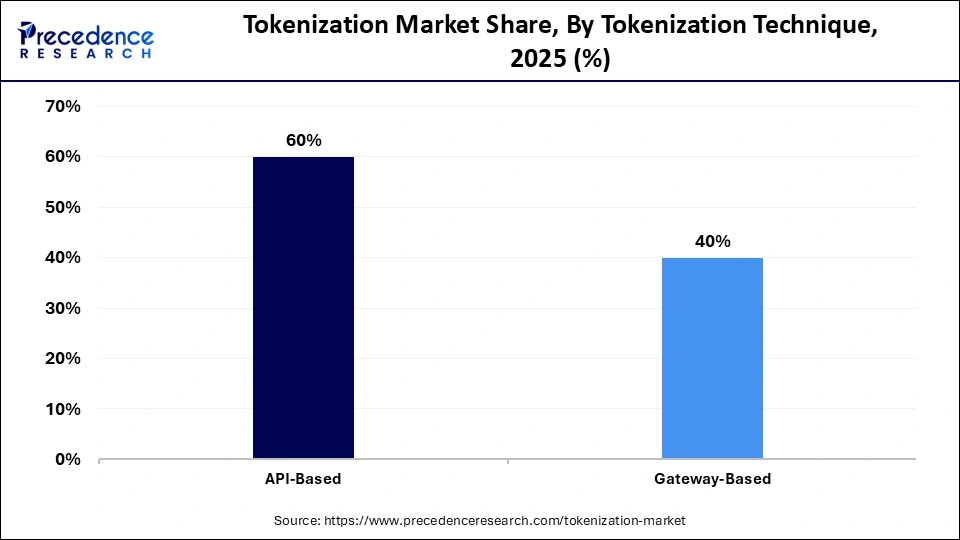

- By tokenization technique, the API-based segment held a major market share of 60% in 2025.

- By tokenization technique, the gateway-based segment is expected to expand at a notable CAGR from 2026 to 2035.

- By deployment mode, the cloud segment captured the highest market share of 61% in 2025.

- By deployment mode, the on-premises segment is poised to grow at a healthy CAGR between 2026 and 2035.

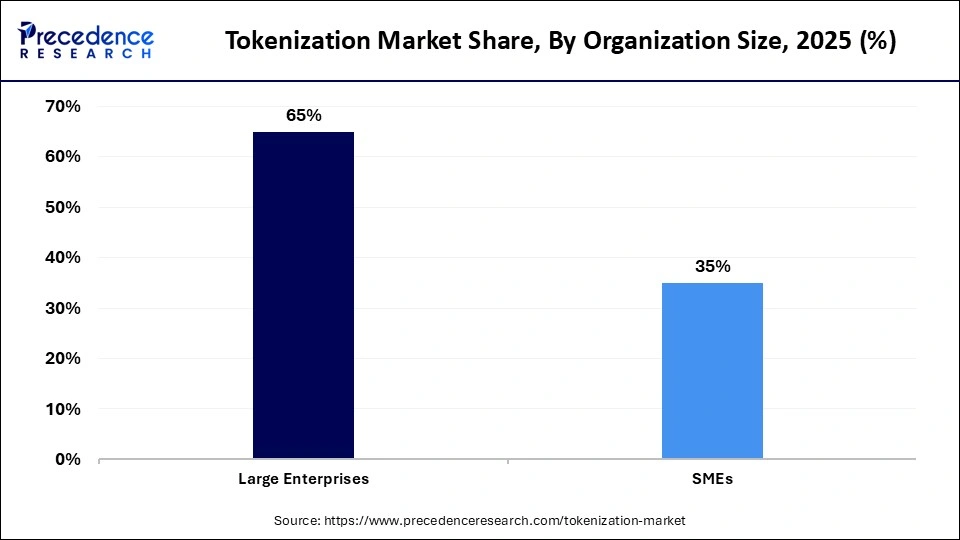

- By organization size, the large enterprises segment contributed the highest market share of 65% in 2025.

- By organization size, the SMEs segment is expected to grow at the highest CAGR of 17.5% between 2026 and 2035.

- By end-user / vertical, the BFSI segment held a major market share of 34% in 2025.

- By end-user / vertical, the & retail segment is expected to expand at a notable CAGR from 2026 to 2035.

Tokenization Market Overview

Why is the Tokenization Market Gaining Momentum?

The tokenization market is gaining strong momentum as companies use blockchain increasingly to turn digital and physical assets into data exchangeable tokens. The market refers to technologies and services that replace sensitive digital information (such as payment data, personal identifiers, or asset records) with secure, non-sensitive tokens to enhance security, privacy, and compliance. Tokenization is widely applied in payment security, data protection, and identity management, reducing risk of breaches and regulatory penalties.

The growing reliance on digital transactions and stringent data-protection regulations are key growth drivers. Adoption in supply chains, real estate finance, and healthcare is accelerating due to growing demand for increased transparency, better liquidity, and quicker transaction processes. Global market expansion is also being supported by favorable regulatory developments and increasing institutional interest.

The Next Phase of Growth in the Tokenization Market

The market is expected to be driven by strong future opportunities across financial services, real estate, and digital assets, as tokenization enables fractional ownership, improved liquidity, and broader investor participation. Increasing regulatory clarity is encouraging institutional adoption, while the integration of decentralized finance (DeFi) platforms is enhancing accessibility and market efficiency. In addition, advances in tokenized payments, AI, and IoT are improving automation, security, and transparency, creating new use cases in cross-border transactions, supply chain management, loyalty programs, and insurance, and unlocking significant business value.

How is AI Transforming the Tokenization Market?

Artificial intelligence plays a pivotal role in transforming the market by improving fraud detection throughout blockchain networks, automating compliance checks, and increasing asset valuation accuracy. Investor confidence is increased by real-time risk assessment and more intelligent tokenized asset decision-making made possible by AI-driven analytics. Additionally, tokenization is becoming more effective, scalable, and secure for businesses and financial institutions thanks to the integration of AI with smart contracts, which simplify transaction execution and portfolio management.

Tokenization Major Market Trends

- Growing adoption of asset-backed and real-world assets (RWA) tokenization across finance, real estate, and commodities.

- Rising use of smart contracts to automate transactions and reduce intermediaries.

- Increasing institutional participation is supported by regulated digital asset platforms.

- Expansion of blockchain infrastructure and interoperability solutions enabling scalable tokenization.

- Strengthening regulatory clarity in key markets, encouraging enterprise-level adoption.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 4.02Billion |

| Market Size in 2026 | USD 4.81 Billion |

| Market Size by 2035 | USD 24.13Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 19.63% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Component, Application,Tokenization Technique,Deployment Mode, Organization Size, End-User / Vertical, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insight

Component Insight

What Made Solutions the Dominant Segment in the Tokenization Market in 2025?

The solutions segment dominated the market while holding the largest share of 72% in 2025, as businesses use tokenization platforms more frequently to safeguard private customer and payment information. These solutions provide real-time token generation, smooth integration, and end-to-end data security. This segment's leadership is further strengthened by high adoption in the retail healthcare and BFSI sectors. The need for sophisticated tokenization solutions is further reinforced by rising digital transactions and worries about cyberthreats.

The services segment is expected to grow at the fastest CAGR of 17.4% during the forecast period. The growth of the segment is driven by the growing need for managed security implementation and consulting services. Many businesses rely more on outside service providers because they lack internal cybersecurity expertise. Services adoption is also being fueled by ongoing system upgrades and compliance management. This tendency is particularly evident in mid-sized businesses that are undergoing digital transformation.

Application Insight

How Does the Payment Security Segment Lead the Tokenization Market in 2025?

The payment security segment led the market with the largest share of 36% in 2025, driven by the quick expansion of mobile wallets, e-commerce sites, and digital payments. Tokenization dramatically lowers the risk of fraud and card data exposure. Secure transaction processing is becoming a top priority for financial institutions and retailers in an effort to increase customer confidence. This segment's dominance is further reinforced by an increase in cross-border and real-time payments.

The compliance management / data security segment is expected to expand at the fastest CAGR of 17.6% in the market over the projection period, as laws like PCI, DSS, GDPR, and HIPAA are tightened. Tokenization is being adopted by organizations to reduce regulatory risks and prevent expensive data breaches. Adoption is accelerating in non-financial sectors due to growing awareness of data privacy. Healthcare and business data management are two areas where compliance management and data security play a critical role.

Tokenization Technique Insight

Why Did the API-based Segment Dominate the Tokenization Market in 2025?

The API-based tokenization segment dominated the market with a major revenue share of 60% in 2025, driven by the need for adaptable and expandable security solutions. APIs make it simple to integrate mobile apps, cloud platforms, and digital ecosystems. The dominance of the segment is further reinforced due to the quick adoption of microservices, SaaS, and fintech architectures because they are customized and deployed more quickly.

The gateway-based tokenization segment is expected to grow at a significant CAGR in the upcoming period, driven by its ease of implementation and compatibility with existing payment gateway infrastructure, which requires minimal system modifications. Strong preference among merchants, widespread acceptance by payment processors, and proven reliability continue to support its dominance. This approach is particularly prevalent across traditional banking and retail environments, where seamless integration and operational continuity are critical.

Deployment Mode Insight

What Made Cloud the Dominant Segment in the Tokenization Market in 2025?

The cloud segment dominated the market with a 61% share in 2025 and is expected to continue its growth trajectory in the coming years. This is mainly due to its scalability, cost efficiency, and ease of deployment, enabling organizations to implement tokenization without heavy upfront infrastructure investments. High transaction volumes and multi-channel payment environments are supported by cloud-based tokenization. Because cloud solutions offer real-time updates and lower infrastructure costs, businesses favor them. Native cloud digital services are becoming increasingly popular, which is contributing to segmental growth.

The on-premise segment is expected to expand at a notable rate in the upcoming period. This is mainly due to the rising adoption among organizations with strict data governance requirements. Sectors such as BFSI and government prefer on-premises solutions for greater control over sensitive data. Increasing concerns around data sovereignty are also driving adoption. Hybrid security strategies are further supporting segmental growth.

Organization Size Insight

Why Did the Large Enterprises Segment Dominate the Tokenization Market in 2025?

The large enterprises segment dominated the market with a 65% share in 2025 due to their high transaction volumes, complex data security requirements, and strong regulatory compliance needs. Large organizations have the financial resources and technical capabilities to deploy advanced tokenization solutions across payments, customer data, and supply chains. Additionally, their early adoption of digital transformation initiatives and cloud-based security technologies reinforced widespread use of tokenization, solidifying their leading market position.

The SMEs segment is expected to expand at the highest CAGR of 17.5% during the projection period, fueled by growing cyber threats and quick digitalization. Wider adoption is being made possible by inexpensive cloud-based tokenization solutions. SMEs are putting data security first to satisfy customers and adhere to legal requirements. Demand is rising due to the expansion of fintech companies and e-commerce.

End-User / VerticalInsight

What Made BFSI the Dominant Segment in the Tokenization Market in 2025?

The BFSI segment dominated the market while holding the largest share of 34% in 2025 due to its strong dependence on safe online transactions and adherence to regulations. Tokenization is used by banks and other financial organizations to safeguard personal information and payment credentials, as digital wallets and online banking support dominance. The prevention of fraud continues to be a major motivator for adoption.

The healthcare segment is expected to grow at the fastest rate over the forecast period, propelled by the rising need to protect sensitive patient data and comply with strict data privacy regulations. Tokenization helps healthcare providers secure electronic health records, payment information, and personal identifiers while enabling safe data sharing across systems. Additionally, the rapid digitization of healthcare services, telemedicine adoption, and integration of cloud platforms is accelerating the use of tokenization to enhance data security and operational efficiency.

Regional Insights

How Big is the North America Tokenization Market Size?

The North America tokenization market size is estimated at USD 1.53 billion in 2025 and is projected to reach approximately USD 9.29 billion by 2035, with a 19.77% CAGR from 2026 to 2035.

What Made North America the Dominant Region in the Tokenization Market in 2025?

North America dominated the market with the highest share of 40% in 2025, backed by early adoption of cybersecurity technologies and sophisticated digital infrastructure. The region is home to a large number of tokenization solution providers. The region benefits from a well-established digital payments ecosystem, widespread cloud adoption, and strict data protection and compliance requirements, which drive the need for tokenization solutions. Additionally, high awareness of data security, rapid digital transformation across industries, and supportive regulatory frameworks further reinforced North America's leadership in the global tokenization market.

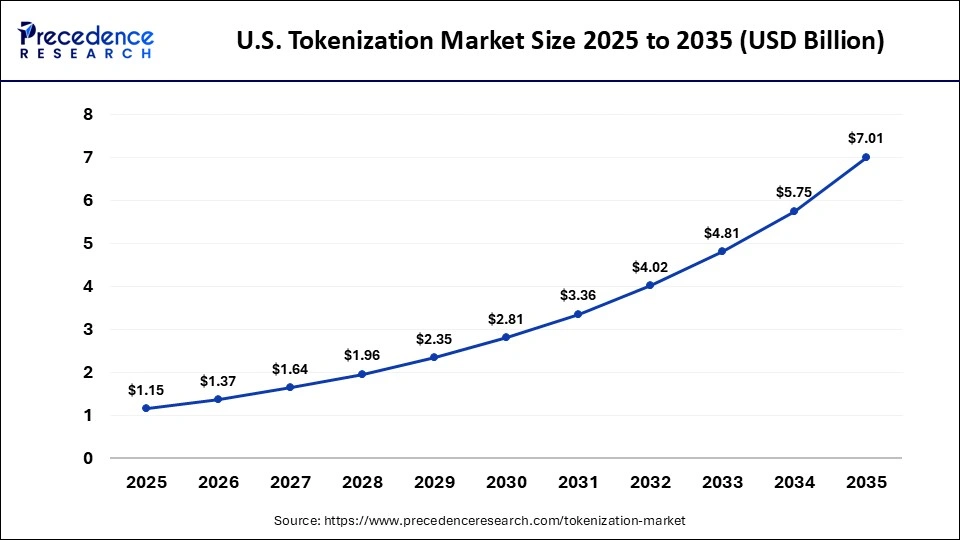

What is the Size of the U.S. Tokenization Market?

The U.S. tokenization market size is calculated at USD 1.15 billion in 2025 and is expected to reach nearly USD 7.04 billion in 2035, accelerating at a strong CAGR of 19.81% between 2026 and 2035.

U.S. Tokenization Market Trends

The market in the U.S. is growing due to its sophisticated digital payment ecosystem, robust BFSI institution presence, and early cybersecurity technology adoption. Tokenization adoption is accelerating across industries due to high online transaction volumes, widespread use of mobile wallets, and expanding fintech innovation. Organizations are further compelled by strict regulatory frameworks like PCI, DSS, HIPAA, and data privacy laws to secure sensitive information through tokenization.

What Makes Asia Pacific the Fastest-Growing Region in the Market?

Asia Pacific is expected to grow at the fastest CAGR of 20.0% in the market, driven by the growing e-commerce industry and the quick adoption of digital payments. Fintech activity is on the rise in nations. Rising concerns over data security and fraud prevention, along with growing investments in cloud infrastructure and fintech innovation, are accelerating the adoption of tokenization solutions. Additionally, supportive government initiatives, increasing smartphone penetration, and a large, digitally active population are creating strong demand for secure and scalable tokenization technologies across the region.

India Tokenization Market Trends

India is emerging as a high-growth market for tokenization, driven by growing e-commerce, quick digitalization, and the increasing use of cashless payment methods. Businesses across the country are adopting tokenization technologies as a result of government initiatives supporting data security and digital payments. Secure data protection solutions are becoming more and more necessary as mobile banking, UPI-based transactions, and fintech startups grow. Additionally, the need for scalable cloud-based tokenization platforms in industries like BFSI, retail, and healthcare is being driven by businesses' growing awareness of data privacy and cyber risks.

Who are the Major Players in the global tokenization Market?

The major players in the tokenization market include Thales Group, Visa Inc., Mastercard Incorporated, Fiserv, Inc., Broadcom Inc., American Express, Micro Focus, TokenEx, CipherCloud, Futurex, Verifone, Bluefin Payment Systems, Marqeta, Helpsystems, MeaWallet

Recent Developments

- In January 2026, BNY announced the extension of its digital cash capabilities for institutional clients. This feature utilizes tokenized deposits, creating on-chain entries representing clients' existing demand deposit claims. The initiative aims to enhance liquidity efficiency and reduce settlement friction in institutional markets, beginning with collateral and margin workflows.

- In May 2025, VanEck announced the launch of its first tokenized fund, the VanEck Treasury Fund (VBILL), providing institutional and qualified investors access to U.S. Treasury-backed assets on-chain. The fund is available across the Avalanche, BNB Chain, Ethereum, and Solana blockchains.

Segments Covered in the Report

By Component

- Solutions

- Services

By Application

- Payment Security

- User Authentication / Identity

- Compliance Management / Data Security

By Tokenization Technique

- API-Based

- Gateway-Based

By Deployment Mode

- Cloud

- On-Premise

By Organization Size

- Large Enterprises

- SMEs

By End-User / Vertical

- BFSI

- Healthcare

- IT & Telecom

- Retail & eCommerce

- Government & Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting