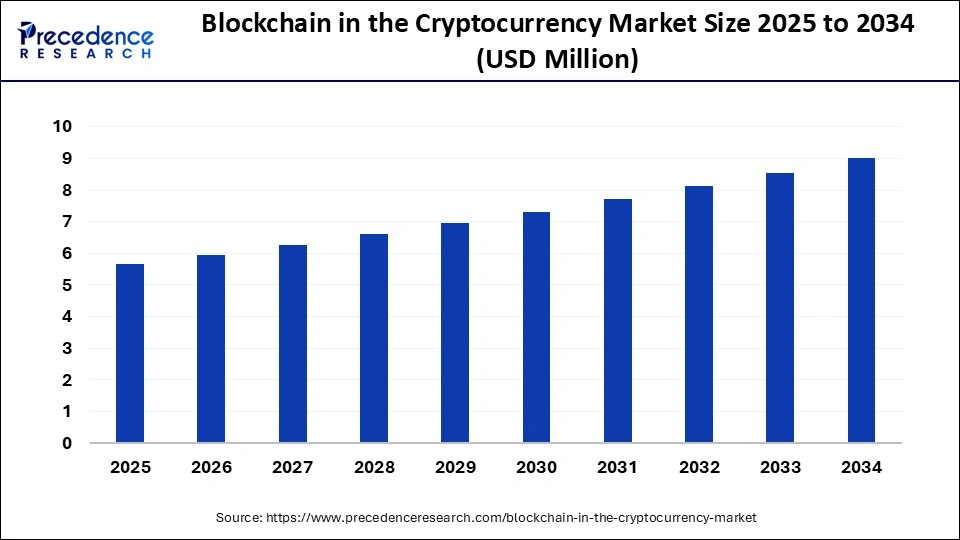

What is the Blockchain in the Cryptocurrency Market Size?

Explore how blockchain powers the cryptocurrency market with secure, transparent transactions, driving DeFi, smart contracts & global adoption. The rising popularity of cryptocurrencies and international transactions are boosting the growth of the market.

Blockchain in the Cryptocurrency Market Key Takeaways

- North America dominated the global blockchain in cryptocurrency market with the largest share in 2024.

- Asia-Pacific is expected to expand at the fastest CAGR between 2025 and 2034.

- By component, the platform segment dominated the market in 2024.

- By component, the services segment is expected to expand at the fastest CAGR in the upcoming period.

- By provider, the infrastructure providers segment dominated the market in 2024.

- By provider, the application providers segment is expected to grow at the fastest CAGR during the forecast period.

- By type, the public blockchain segment held the largest revenue share in 2024.

- By type, the consortium/hybrid blockchain segment is expected to expand at a significant CAGR during the projection period.

- By cryptocurrency type, the bitcoin segment dominated the market with the largest revenue share in 2024.

- By cryptocurrency type, the stablecoins segment is expected to grow at a rapid pace in the coming years.

- By application, the payments segment dominated the global market in 2024.

- By application, the smart contracts segment is expected to expand at the fastest CAGR during the forecast period.

- By end-user, the financial institutions segment held the largest revenue share in 2024.

- By end-user, the retail & e-commerce segment is expected to grow rapidly between 2025 and 2034.

Impact of AI on the Blockchain in Cryptocurrency Market

Artificial intelligence is increasingly integrated into the cryptocurrency and blockchain market, boosting security and efficiency. Blockchain's security and transparency are key drivers. AI enhances operations, reduces fraud through automation, and analyzes vast market data for profitable trading strategies. AI tools monitor transactions and detect and prevent fraudulent activities, improving the security of blockchain networks. AI-powered solutions can optimize transaction processing, increasing the scalability of blockchains. AI also improves KYC processes and is revolutionizing decentralized finance with AI-driven cryptocurrencies emerging.

How Is Blockchain Powering the Cryptocurrency Renaissance?

The backbone of cryptocurrency is blockchain technology, which provides a decentralized, secure, and transparent ledger that records all transactions. The peer-to-peer digital transfer of assets is performed using blockchain technology, eliminating the need for a centralized authority, such as a bank. Blockchain technology underpins cryptocurrency, providing a decentralized, secure, and transparent ledger that records all transactions. It facilitates peer-to-peer digital asset transfers, eliminating the need for a central authority like a bank.

The blockchain functions as a shared ledger, with each transaction stored in a block, linked to the previous one, forming a chain of records. Cryptographic techniques, including encryption, ensure the security and integrity of these transaction records, protecting them from tampering or counterfeiting. The decentralized nature of blockchain networks offers advantages, such as reduced risk of censorship or control by a single entity, distinguishing it from currencies often controlled by centralized bodies.

Blockchain in the Cryptocurrency Market Growth Factors

- Increasing demand for cryptocurrencies on a global level is fueling the growth of the market.

- The expansion of decentralized finance is boosting the market growth.

- Major industry players are investing in crypto, recognizing its potential beyond centralized control, which boost the growth of the market.

- Ethereum Layer 2 solutions are improving transaction speed and reducing costs, supporting the growth of the market.

- Various countries have imposed regulations for cryptocurrencies, influencing the market.

Market Outlook:

- Industry outlook: Scalability & layer-2 innovation advances in rollups, sidechains and other layer-2 solutions reduce transaction costs and latency, enabling mass-market applications micro-payments, gaming, remittances and making on-chain activity economically viable at scale. Clearer regulatory frameworks, institutional-grade custody, and compliant token standards attract capital from banks, asset managers and corporates, transforming liquidity profiles and reducing volatility over the medium term.

- Major investment: institutional venture funds provide growth capital to infrastructure projects, layer-2 protocols, custody platforms, regulated exchanges, accelerating protocol maturity and enterprise adoption. strategic corporate investors, large tech and financial firms invest in blockchain R&D, custody, and tokenization platforms to embed crypto rails into existing services and ensure fiat-on/off ramps.

- Sustainability trend: Sustainability pressures are reshaping blockchain choices: low-energy consensus mechanisms, proof-of-stake networks, carbon-offset initiatives, and layer-2 batching strategies reduce per-transaction environmental impact. Protocols and custodians increasingly disclose energy footprints and pursue greener infrastructure, renewable-powered validators, and energy-efficient data centres. Sustainable token design and transparent reporting become procurement criteria for institutional investors and corporates integrating blockchain into ESG-compliant products.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Authentication, Component,Deployment, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increased Need for Transparency and Security in Transactions

The increasing need for improved transparency and security in transactions is driving the growth of the blockchain in cryptocurrency market. The key feature of blockchain technology is the high security and transparency of transactions, which is the primary driver of this market. This technology is the backbone of cryptocurrency, which is a completely decentralized currency and does not have any single authority control, which simply democratizes the financial processes. This is the primary reason behind the increasing growth of this market. The cryptocurrency is even believed to be the currency of the internet because various internet transactions are done using various cryptocurrencies, and the robustness of blockchain technology provides the trust in this transaction despite the fact that there is no authority backing the transaction.

The cryptocurrency market's expansion is largely driven by the core features of blockchain technology: high security and transparency in transactions. This technology underpins cryptocurrency itself, which is designed as a completely decentralized currency, operating without control from any single authority. This characteristic fundamentally democratizes financial processes, and is the primary catalyst behind the market's continuous growth. Furthermore, cryptocurrency is increasingly viewed as the currency of the internet, facilitating numerous online transactions. The inherent robustness of blockchain technology provides the necessary trust for these transactions, even in the absence of a traditional, central authority backing them.

Restraint

High Cost for Infrastructure and Maintenance

As the number of transactions rises every second, processing a high volume of transactions quickly becomes challenging. Mining a block requires significant computational power, leading to increased transaction fees due to the need for powerful GPUs and high electricity consumption, thus increasing infrastructure and maintenance costs. Complex blockchain algorithms and the network's enormous size create scalability bottlenecks, making it difficult to resolve these issues.

Massive computational power is required in the mining of a block. It requires highly powerful GPU electricity and other resources, which contribute to the increase in transaction fees. The maintenance cost of this infrastructure is continuously rising. A scalability bottleneck is being experienced due to the complex algorithms and protocols used in the blockchain. The network has acquired an enormous size in the current times, which is making it highly complex and difficult to resolve these kinds of issues. Moreover, cryptocurrency prices can fluctuate significantly, making them risky investments.

Opportunity

Rising Transactions of Cryptocurrency

The rising transactions of cryptocurrency worldwide create immense opportunities in the market. More institutions are exploring and investing in cryptocurrencies. Blockchain enables worldwide transactions by facilitating faster and cheaper transactions. Governmental acceptance and the development of regulations provide strong backing for cryptocurrency, fostering trust and normalizing its use among the general public. Several governments, including India and China, have even developed their own cryptocurrencies based on blockchain technology. These combined factors are attracting significant investment in the cryptocurrency and blockchain, propelling the growth of the market.

Component Insights

The platform segment dominated the blockchain in cryptocurrency market with the largest share in 2024. This is mainly due to the increased demand for scalability, highly customizable blockchain solutions. The robustness of blockchain technology empowers cryptocurrencies by providing a strong backbone, which is the key growth factor. Enterprises are leveraging these platforms for diverse operations, with sectors like finance, supply chain, and healthcare finding them essential for daily activities.

The services segment is expected to expand at the fastest rate in the upcoming period. Many businesses are utilizing blockchain in cryptocurrency-related services. Increased demand is evident in audits, smart contracts, and KYC services. The rise of decentralized finance fuels demand for crypto-related consultancy. These trends are the primary drivers of service segment growth within the market.

Provider Insights

The infrastructure providers segment dominated the blockchain in cryptocurrency market. This dominance is primarily attributed to the critical role of infrastructure in blockchain technology. The robust infrastructure of blockchain ensures seamless transactions with high speed. This segment's growth is further reinforced by continuous investments in blockchain and cryptocurrency.

The application providers segment is expected to grow at the fastest CAGR during the forecast period. The growth of the segment is attributed to the increasing demand for blockchain applications, driven by massive investments in cryptocurrencies. Various venture capitalists and other seasoned investors are investing heavily in blockchain applications considering its potential in streamlining transactions.

Type Insights

The public blockchain segment dominated the blockchain in the cryptocurrency market with a major share in 2024. The open, decentralized, and transparent nature of public blockchains drives innovation and provides secure transactions, which are essential for cryptocurrencies and other applications. This segment's dominance also stems from its decentralized nature, supported by blockchain technology. Publicly visible transaction histories enhance transparency in cryptocurrency transactions.

The consortium/hybrid blockchain segment is expected to expand at a significant CAGR during the projection period. The segment growth is driven by its unique features, which is creating an equilibrium between public and private blockchain services. The increasing need for interoperability and flexible solutions further fuels segmental growth. The high efficiency and cost-effectiveness of hybrid blockchain are driving its adoption.

Cryptocurrency Type Insights

The bitcoin segment dominated the blockchain in cryptocurrency market with the biggest share in 2024. This dominance is driven by the robust, established infrastructure for bitcoin. Being the first cryptocurrency, it is highly popular and widespread in the market. Investments from digital investors and financial institutions further solidify Bitcoin's position. Its high security and complex protocols enhance its value, creating a strong environment for continued dominance.

The stablecoins segment is expected to grow at a rapid pace in the coming years. The segment growth is attributed to the unique approach of stablecoins, offering price stability. This mitigates the volatility in cryptocurrencies like Bitcoin or Ethereum. Increased international transactions utilize stablecoins due to their market stability and high credibility.

Application Insights

The payment segment dominated the blockchain in cryptocurrency market with a maximum share in 2024. The segment dominance is driven by improvements in payment system efficiency. This minimizes operational costs and enhances transaction transparency. Blockchain technology's benefits in payment solutions are continuously increasing, driving this segment's dominance in the market.

The smart contracts segment is expected to expand at the fastest rate during the forecast period. These are basically automated programs used to ensure whether the particular conditions are met or not without the requirement of any external authority Like banks or lawyers. This unique feature is driving their popularity in the market.

End User Insights

The financial institutions segment dominated the blockchain in cryptocurrency market with the largest share in 2024. Financial institutions heavily invest in blockchain solutions because of its high transparency. The increased international payments and trust in cryptocurrencies encouraged financial institutions to invest in blockchain solutions to streamline transactions. Government backing and strong regulatory compliance, along with increased need for smart solutions for efficient transaction monitoring, further bolstered the segment growth.

The retail & e-commerce segment is expected to grow at a rapid pace during the forecast period. This growth of the segment is attributed to the increased integration of blockchain in various payment platforms, often with reward-based systems. The growth of the e-commerce sector significantly increased cryptocurrency demand, as it easily integrates into platforms. Bitcoin and other cryptocurrencies facilitate easy national and international transactions, supporting segmental growth.

Regional Insights

North America

Why did North America Dominate the Blockchain in Cryptocurrency Market in 2024?

North America registered dominance in the market by holding the largest revenue share in 2024. This is mainly due to the strong backing from financial institutions like JP Morgan, Goldman Sachs, and Fidelity in North America, where technology and crypto-driven payments are widely adopted. Governments in the U.S. and Canada have shown greater acceptance of cryptocurrencies, establishing regulatory frameworks that foster a safe environment. Key market players and venture capitalists view cryptocurrencies as a high-potential investment. North America's robust tech infrastructure, including tech hubs like Silicon Valley with a strong focus on blockchain R&D, bolstering market growth. The highly crypto-aware consumer base in the U.S., with strong awareness of cryptocurrency benefits and future possibilities, further attracts more investors.

Asia-Pacific Blockchain in Cryptocurrency Market Trends

Asia Pacific is expected to grow at the fastest rate in the coming years. This is mainly due to the rising adoption of cryptocurrencies in various Asian countries like India, China, Indonesia, and Philippines. Key institutions in the region have made significant recent investments in cryptocurrencies, including digital bonds, tokenized gold, and other crypto assets. The government is providing robust licensing and frameworks for crypto management. Corporate-government collaboration and technological innovation are driving cross-border payments using cryptocurrencies, which offer high transparency in tracking payments, enhancing reliability. This creates extensive growth opportunities in the region.

European Blockchain in Cryptocurrency Market Trends

Europe is considered to be a significantly growing area. The growth of the market in the region is primarily driven by the European Union's proactive regulatory framework for cryptocurrency. Financial institutions in Europe are considering cryptocurrency for international payments and asset transfers. Startups and crypto-friendly hubs like Zug, Switzerland, and Berlin are driving innovation and fostering the crypto market's growth. The increased need for transparency in transactions and rising cross-border payments are further driving the growth of the market.

Is Europe Building Regulated, Interoperable Crypto Markets on Top of Blockchain?

Europe emphasizes regulatory frameworks, consumer protection and interoperability as it integrates blockchain into financial markets and public services. EU-level initiatives and national pilots seek to balance innovation with market integrity, encouraging compliant stablecoins, regulated token offerings, and tokenized securities infrastructure. European projects often prioritize privacy-preserving protocols and institutional-grade custody solutions, supporting a more risk-aware adoption path. The continent's strong financial centres and fintech networks make it a prime region for tokenized capital markets and regulated crypto products.

Germany Blockchain in the Cryptocurrency Market Trends

Germany's market is expanding steadily, driven by strong regulatory clarity that positions the country as one of Europe's most crypto-friendly jurisdictions. Growing institutional participation, supported by BaFin-regulated custody services and crypto-enabled financial products, is accelerating adoption across banking and fintech sectors. The rise of tokenization initiatives, especially in real-estate, securities, and supply-chain applications, is broadening blockchain use beyond digital currencies.

Can Middle East Africa Leverage Blockchain to Leapfrog Traditional Finance?

The Middle East & Africa present a mix of sovereign-led innovation and market-driven crypto adoption: wealthy Gulf states fund pilots and attract global crypto firms, while African markets see grassroots adoption for remittances, financial inclusion and P2P value transfer. Infrastructure projects, sovereign funds, and special economic zones create favourable conditions for custody hubs, exchange establishments, and tokenized asset experiments. However, regulatory heterogeneity and infrastructure gaps in payment rails, KYC systems shape uneven growth across the region. Where public sector backing exists, MEA can rapidly pilot CBDCs, cross-border settlement corridors, and asset tokenization platforms.

Saudi Arabia Blockchain in the Cryptocurrency Market Trends

Saudi Arabia is leading the market, its dominance is driven by strong government-backed digital transformation initiatives, including Saudi Vision 2030, which actively promotes blockchain adoption across finance, logistics, and public services. The country also benefits from high cryptocurrency awareness, rising institutional interest, and a rapidly expanding fintech ecosystem supported by the Saudi Central Bank's regulatory sandboxes.

Is Latin America Embracing Crypto as a Hedge and a Financial Tool?

Latin America sees strong retail-driven adoption of cryptocurrencies as both a store of value and a practical remittance mechanism, often influenced by macroeconomic volatility and limited access to traditional financial services. Local entrepreneurs and exchanges build regional liquidity and payment bridges, while stablecoins and P2P trading gain traction for everyday transactions. Regulatory approaches vary, with some governments engaging constructively and others cautiously; this patchwork shapes adoption patterns and business models. Where infrastructure and compliance mature, opportunities emerge for tokenized lending, payroll solutions, and cross-border commerce.

Brazil Blockchain in the Cryptocurrency Market Trends

Brazil's market is expanding rapidly as the country witnesses accelerated adoption of digital assets for payments, remittances, and investment. Regulatory clarity from the Central Bank of Brazil, especially through the Real Digital (CBDC) pilot, has strengthened market confidence and encouraged financial institutions to integrate blockchain solutions. Major Brazilian banks and fintechs are increasingly deploying blockchain for cross-border transfers, fraud reduction, and tokenized asset platforms.

Top Companies in the Blockchain in the Cryptocurrency Market & Their Offerings:

- BitGo, Inc.: BitGo is a crucial provider of digital asset infrastructure, security, and custody services for institutional investors. It pioneered the multi-signature wallet and offers regulated cold storage, staking, and trading solutions, providing the operational backbone for over 1,500 institutional clients and processing about 20% of all Bitcoin transactions by value.

- Bitmain Technologies Holding Company: Bitmain is the world's leading manufacturer of cryptocurrency mining hardware, specifically, ASIC miners like the Antminer series.

- Intel Corporation: As one of the largest semiconductor chip manufacturers globally, Intel has been a pivotal force in shaping the modern computing landscape. It is best known for developing the x86 series of central processing units (CPUs) that power the majority of personal computers and data centres worldwide, as well as being a key developer of memory chips and other related computing devices.

- NVIDIA Corporation: NVIDIA is a leader in accelerated computing, most notably for its invention of the Graphics Processing Unit (GPU), which initially revolutionized PC gaming graphics.

- Ripple: Ripple develops an enterprise blockchain and crypto solution, the primary importance of which lies in its focus on real-time gross settlement systems that enable instant, cross-border financial transactions.

Blockchain in the Cryptocurrency Market Companies

- Advanced Micro Devices, Inc.

- Binance

- Bit fury Group Limited

- Bit Go, Inc.

- Bit Main Technologies Holding Company

- Intel Corporation

- NVIDIA Corporation

- Ripple

- Xapo Holdings Limited

- Xilinx, Inc.

Recent developments

- In June 2025, The United States took the initial steps toward finalization of its major crypto bill as members voted for the bill to establish standards for U.S. stablecoin users. This will be a significant advancement in the crypto market structure bill in the U.S.

(Source: https://www.cnbc.com) - In June 2025, FCA is looking forward to lifting the ban on offering Crypto exchange-traded notes. Particularly for retail investors, as the same kind of products are already available in other countries. Currently, the cETNs can be sold only to professional investors after lifting the ban. They can be sold to individual consumers in the UK.

(Source: https://www.fca.org.uk)

Segments Covered in the Report

By Component

- Platform

- Services

By Provider

- Application Providers

- Middleware Providers

- Infrastructure Providers

By Type

- Public Blockchain

- Private Blockchain

- Consortium/Hybrid Blockchain

By Cryptocurrency Type

- Bitcoin

- Ethereum

- Altcoins (e.g., Ripple, Litecoin, Cardano)

- Stablecoins

By Application

- Payments

- Smart Contracts

- Exchanges

- Supply Chain Management

- Tokenization

- Compliance & Risk Management

By End User

- Financial Institutions

- Retail & E-commerce

- Healthcare

- Government

- Others (e.g., media, travel, energy)

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting