What is Blockchain in Energy Market Size?

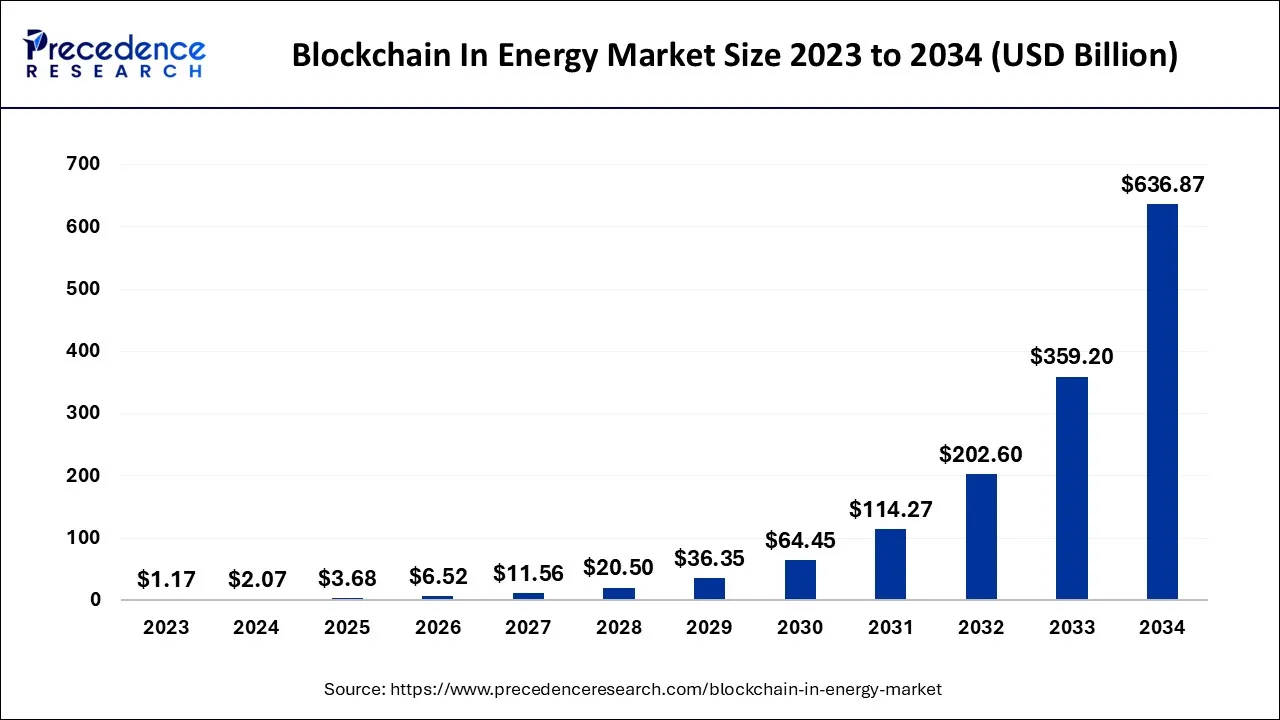

The global blockchain in energy market size is calculated at USD 3.68 billion in 2025 and is projected to surpass around USD 833.82 billion by 2035, growing at a CAGR of 72% from 2026 to 2035.

Market Highlights

- U.S. is expected to expand at a significant CAGR between 2026 and 2035

- By Type, the public segment is predicted to hold the largest market between 2026 and 2035

- By Application, the Peer-to-Peer Transaction segment is projected to dominate the market between 2026 and 2035

- By End-use, the power segment is predicted to dominate the market between 2026 and 2035

Market Overview

Blockchain technology has the potential to revolutionize the energy industry by providing a secure and transparent platform for transactions and data management. The blockchain can be applied in the energy market for peer-to-peer energy trading, renewable energy certificates, grid management, supply chain management, and smart contracts.

Blockchain technology has the potential to enable the development of decentralized energy marketplaces in which individuals and businesses can buy and sell energy directly to one another. This could reduce the need for centralized utilities, resulting in a more efficient and resilient energy system. Renewable energy certificates (RECs) are tradable certificates that represent the environmental characteristics of renewable energy generation. Blockchain technology can provide a safe and transparent platform for tracking REC ownership and transfer, potentially increasing their value and encouraging investment in renewable energy projects.

Blockchain technology can be used to improve grid management by enabling real-time monitoring and control of energy transactions. This could contribute to less energy waste and a more stable and reliable grid. Blockchain technology can be used to track the origin and movement of energy resources like oil, gas, and minerals. This can aid in the prevention of fraud, the increase of transparency, and the improvement of sustainability in the energy supply chain. Smart contracts are self-executing contracts in which the terms of the buyer-seller agreement are directly written into lines of code.

Smart contracts could be used in the energy market to automate billing and payment processes, as well as to facilitate the execution of energy trades. Blockchain technology has the potential to transform the energy market by increasing efficiency, transparency, and security, as well as enabling a more sustainable and decentralized energy system.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.68 Billion |

| Market Size in 2026 | USD 6.52 Billion |

| Market Size by 2035 | USD 833.82 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 72% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Type, By Application, and By End-Use, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Increased renewable energy generation to support sustainable initiatives

The deployment of blockchain technology is expected to accelerate in the energy and utilities sectors, owing to the increased generation of renewable energy to support sustainable initiatives and efforts by oil and gas players to improve operational efficiency and security. Many start-ups are becoming interested in blockchain implementation, both at the enterprise and consumer levels, contributing to blockchain's growth in the energy utilities market. Dropping reliance on fossil fuels, combined with increasing independence of the local grid from external sources of energy in the long term, is expected to boost blockchain demand in the energy utilities industry during the forecast period.

In Europe, for example, various utilities are proposing green purchase programs that would allow customers to purchase renewable energy and bundled energy credits from specific renewable energy projects. Furthermore, blockchain technologies enable power utilities to optimize the generation, distribution, and consumption of electricity. The introduction of specially designed blockchain solutions for electricity grids, as well as new decentralized renewable energy producers, is regularly producing massive data that assists energy companies.

Automation is becoming more popular in energy utilities

The increasing automation in energy utilities is the reason organizations are undergoing infrastructure changes that will assist them in lowering the total cost of ownership and converting to blockchain-powered software. Blockchain-powered infrastructure and solutions can also help energy utilities improve their overall output. New electricity consumers, such as connected homes and electric vehicles, as well as new communicating equipment, such as smart metres, sensors, and remote-control devices, are also generating a large amount of data for energy companies to interpret and make informed decisions about. Blockchain technologies can also help power utilities achieve higher reliability and efficiency while maintaining the balance between consumption and production in an ever-changing energy landscape.

Challenges

Regulatory hurdles

Regulatory barriers to blockchain technology adoption in the energy market can be significant. The energy industry is highly regulated, and new technologies, including blockchain, frequently face legal and regulatory hurdles. Compliance with data privacy laws is one of the most significant regulatory challenges for blockchain in the energy market. Energy markets deal with sensitive and confidential information, such as personal and financial data.

Compliance with regulations such as the general data protection regulation (GDPR) of the European Union or the California Consumer Privacy Act (CCPA) can be a significant challenge for blockchain solutions that involve data storage and transfer. Another regulatory challenge is ensuring compliance with energy market regulations. Blockchain-based energy trading platforms, for example, must adhere to market structure, anti-manipulation, and anti-fraud regulations, among other things.

Furthermore, regulatory requirements for renewable energy certification or the integration of distributed energy resources into the grid may exist. Implementing blockchain-based solutions in the energy market may necessitate regulatory approval, which can be a time-consuming and costly process. Regulators may be hesitant to approve new technologies such as blockchain until they have a better understanding of their impact on the energy market and potential risks.

To overcome these regulatory barriers, blockchain solution providers in the energy sector must engage with regulators and ensure that their solutions comply with relevant regulations. They may also be required to collaborate with industry groups in order to develop standards and best practices for blockchain implementation in the energy market.

Opportunities

The blockchain in the energy market presents several opportunities for growth and expansion in the coming years. Here are some of the key opportunities:

Decentralization of the energy market

One of the key growth opportunities for blockchain technology is the decentralization of the energy market. Historically, the energy market has been centralized, with a few large utility companies controlling electricity generation, distribution, and sale. However, blockchain technology has the potential to decentralize the energy market by enabling peer-to-peer energy trading and the creation of microgrids. Peer-to-peer energy trading is a method for individuals and businesses to buy and sell electricity directly with one another without the use of a centralized utility company.

This is enabled by blockchain-based platforms that allow participants to trade energy and settle payments in a secure and transparent manner. Blockchain can create new revenue streams for energy producers and consumers while also increasing the resilience and reliability of the energy system by enabling peer-to-peer energy trading. Microgrids are small-scale energy systems that can function independently of the larger power grid.

To provide reliable and cost-effective power to local communities or businesses, they typically incorporate renewable energy sources, energy storage, and advanced energy management systems. Blockchain can enable the creation of microgrids by facilitating peer-to-peer energy trading between microgrid participants. This can improve the energy system's resilience and reduce the need for large-scale centralized power plants. Blockchain can enable the creation of virtual power plants in addition to peer-to-peer energy trading and microgrids (VPPs).

A VPP is a network of distributed energy resources that are aggregated and managed as a single entity, such as solar panels, energy storage systems, and electric vehicles. Blockchain can help VPPs manage and operate more efficiently by enabling secure and transparent energy trading and the coordination of energy supply and demand.

Segment Insights

Type Insights

Due to greater usability, the ability to increase platform awareness, and decentralized architecture, the public segment is expected to hold the largest market. Furthermore, this type allows users to enter the network, followed by the encryption of incentive-based transactions. The private sector is expected to expand significantly over the forecast period. Better protection and increased speed, followed by improved regulation to optimize throughput, are the key factors promoting service adoption.

The software primarily focuses on services used during internal business operations. Acceptance of these solutions primarily accounts for less authentication, node activity, and network control to reduce latency.

Application Insights

Over the forecasted period, the Peer-to-Peer Transaction segment is expected to dominate the market. To encourage the production and availability of renewable energy, shifting the emphasis to RES power production, including wind, solar, and ocean, would significantly contribute to the system's development. Aside from the high level of standardization inherent in purchases, pre-trade visibility allows customers to be consumers, thereby reinforcing the industry landscape.

Grid transactions is expected to expand significantly. Grid transactions by power-sharing rely on the energy grid for electricity trade, including current marketplaces, in order to promote low-cost and simple transactions. Increased power demand, regulatory changes toward cheaper energy access, and the implementation of smart grid technologies are the key drivers that improve the market environment. The ability of blockchain platforms to accommodate a large number of small household and business transactions would increase blockchain adoption in the energy market.

End-User Insights

Over the forecasted time frame, the power sector is expected to dominate the market. This is due in part to blockchain technology's ability to control distributed energy sources as well as provide a comprehensive view of energy usage through monitoring. During the forecasted timeframe, the oil and petrol segment is expected to grow rapidly. Blockchain is an innovative platform with significant oil and gas applications. Because most sensor technology is used in the industry, blockchain could directly store payments and financial statements on these sensors, reducing processing time by linking resources to contracts.

Regional Insights

Powering the Future: North America Leads the Blockchain Revolution

North America dominated the market with the largest share in 2025. The dominance of the region can be attributed to the growing demand for transparency in renewable credits and a surge in Distributed Energy Resources (DERs). In addition, the region benefits from the presence of major tech giants such as IBM, with a substantial investment in smart grid tech, fostering advancements.

The blockchain in the energy market in the U.S. is expected to grow at a significant rate. Product installation will be encouraged by the ability to transform the fundamental structure of the energy industry and microgrids to facilitate peer-to-peer energy trading in an immutable and secure manner. For example, the Brooklyn Microgrid was launched in 2016 with the goal of allowing residents to buy and sell power directly amongst themselves by maintaining a secure ledger of energy asset possession.

Germany is expected to grow rapidly as a result of increasing power complexity and a shift in emphasis toward smart grid adoption. According to the European Commission, there are currently 308 smart grid projects with a total investment of USD 2.43 billion. Furthermore, increased investment from energy start-up companies, as well as increased funding activities, will strengthen the industry landscape. Government incentives for renewable energy generation, combined with favorable regulatory policies to promote technology adoption, are expected to boost product installation.

Powering Progress: Notable Blockchain Growth Accelerates Across Asia Pacific

Asia Pacific is expected to grow at a notable CAGR during the forecast period. The growth of the region can be driven by the ongoing integration of smart grids and renewable energy sources, coupled with the increasing focus on achieving net-zero emissions. Moreover, governments across the region are actively supporting blockchain adoption through favourable pilot projects and policies.

China Blockchain in Energy Market Trends

The growth of the market in the country can be linked to its extensive energy consumption and ongoing digital transformation, which prefer blockchain solutions for efficiency and transparency. The Chinese government is actively promoting the integration and development of blockchain in mart city initiatives.

Europe Surges Ahead: Blockchain Ignites Rapid Growth in the Energy Sector

Europe is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the growing demand for security and transparency in energy transactions, along with the supportive government regulations. Also, Blockchain offers efficient tracking and identification of renewable energy generation, leading to regional growth.

Top Companies in the Blockchain in Energy Market & Their Offerings

- Microsoft: Provides the Azure Blockchain Workbench, a cloud-based platform for developing decentralized applications to streamline energy supply chains and enhance transparency.

- SAP: Offers blockchain-as-a-service (BaaS) solutions for green energy tracking and distribution, often in partnership with other companies.

Blockchain in Energy Market Companies

- BigchainDB GmbH

- LO3 Energy, Inc.

- Deloitte Touche Tohmatsu Limited

- IBM Corporation

- WePower UAB

- Accenture plc

- Oracle Corporation

- Infosys Limited

Recent Developments

- November 2020- SAP SE acquired Emarsys eMarketing Systems. With the capabilities of its existing technologies and the convergence of Emarsys, SAP Consumer Service will provide a framework for customized omnichannel interaction, reaching consumers where and when they want to connect, on their preferred platforms, and under their terms.

- October 2020 - Infosys Limited purchased Blue Acorn iCi. This agreement will significantly improve Infosys' end-to-end customer experience and confirm the company's ongoing commitment to assisting consumers on their digitalization journey. Blue Acorn iCi will provide Infosys with critical cross-technology expertise by integrating consumer engagement, digital trading, analysis, and experience-driven commodity trading.

Segments Covered in the Report

By Type

- Private

- Public

By Application

- Sustainability Attribution

- Electric Vehicle

- Energy Financing

- Grid Transactions

- Peer-To-Peer Transaction

- Others

By End-Use

- Power

- Oil & Gas

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting