FinTech Blockchain Market Size and Forecast 2025 to 2034

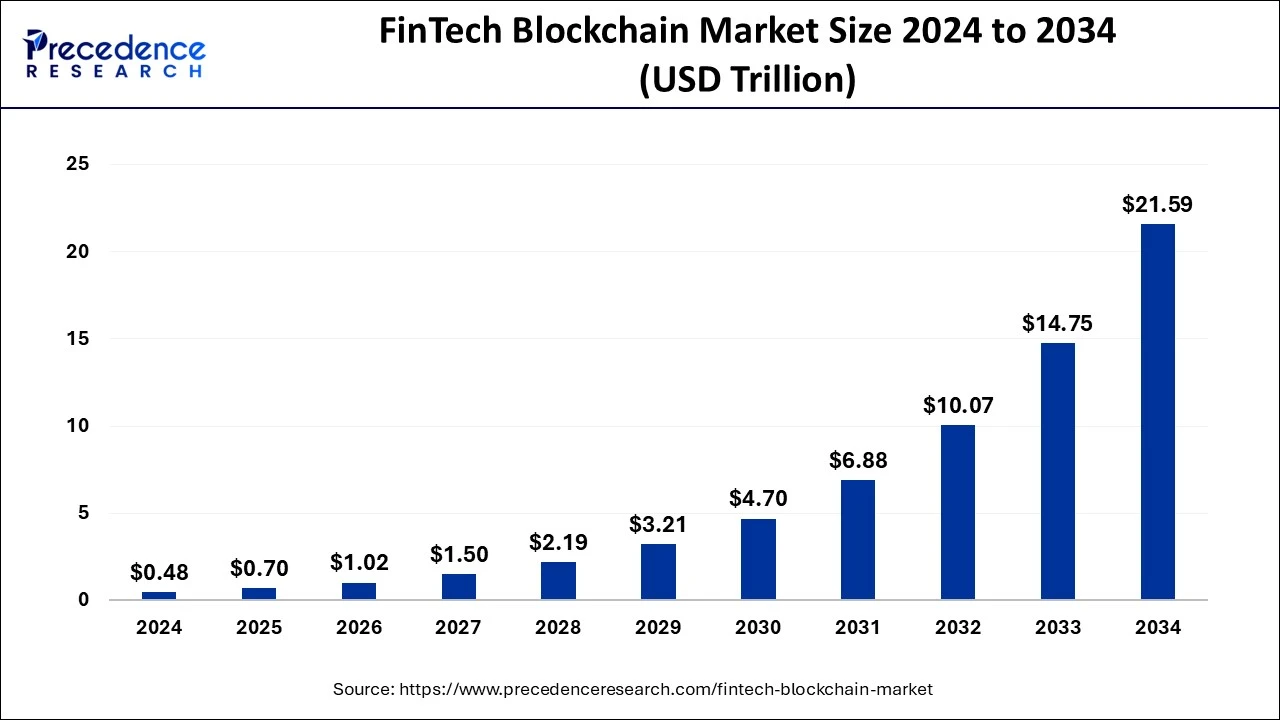

The global FinTech blockchain market size was calculated at USD 0.48 trillion in 2024 and is predicted to hit around USD 21.59 trillion by 2034, expanding at a notable CAGR of 46.31% from 2025 to 2034. The rising penetration of smartphone users and digitization across the payment process for hassle-free person-to-person payments are driving the growth of the FinTech blockchain market.

FinTech Blockchain Market Key Takeaways

- In terms of revenue, the global FinTech blockchain market was valued at USD 0.48 trillion in 2024.

- It is projected to reach USD 21.59 trillion by 2034.

- The market is expected to grow at a CAGR of 46.31% from 2025 to 2034.

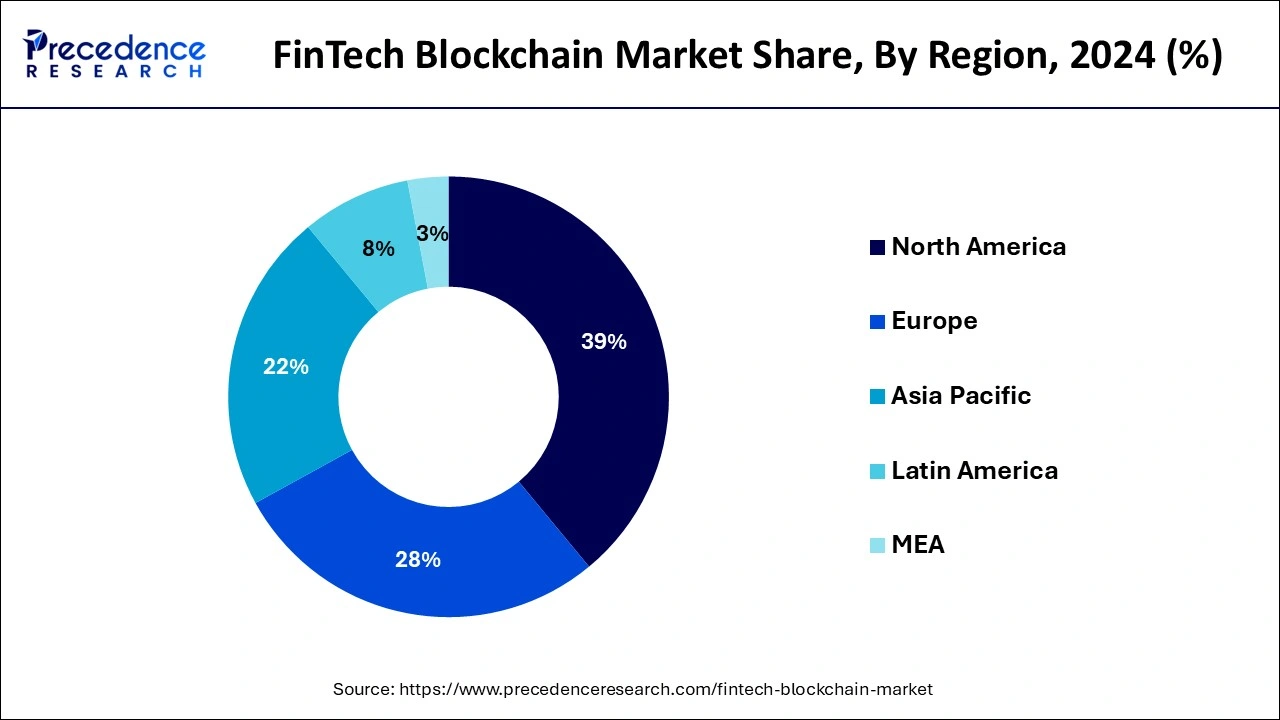

- North America dominated the global market with the largest market share of 39% in 2024.

- Europe will witness significant growth during the forecast period.

- By provider, the infrastructure and protocol segment captured the biggest market share of 43% in 2024.

- By provider, the middleware provider segment is anticipated to hold notable growth during the anticipated period.

- By enterprise size, the large enterprise segment captured the biggest market share in 2024.

- By enterprise size, the small and medium enterprise segments will experience substantial growth during the predicted period.

- By industry vertically, the banking sector segment held the largest market share in 2024.

- By industry vertical, the non-banking financial services segment will show significant growth during the forecast period.

- By application, the payment segment generated the major market share in 2024.

- By application, the clearing and settlement segment will witness significant growth during the forecast period.

How Can Artificial Intelligence (AI) Impact the FinTech Blockchain Market?

The integration of artificial intelligence is revolutionalize the potential future of the FinTech blockchain market. The AI enhanced the customer experience, streamlining the process, and improving the risk management. The integration of AI and blockchain increases the accuracy and reliability of financial services. AI enables personalized services to the customers.

- In October 2024, VanEck, a leading investment management firm, works on multiple investment products and trends transforming the world of finance. The VanEck ventured in crypto with launching a USD 30 million fund for supporting AI, early-stage Crypto, and FinTech start-ups.

U.S. FinTech Blockchain Market Size and Growth 2025 to 2034

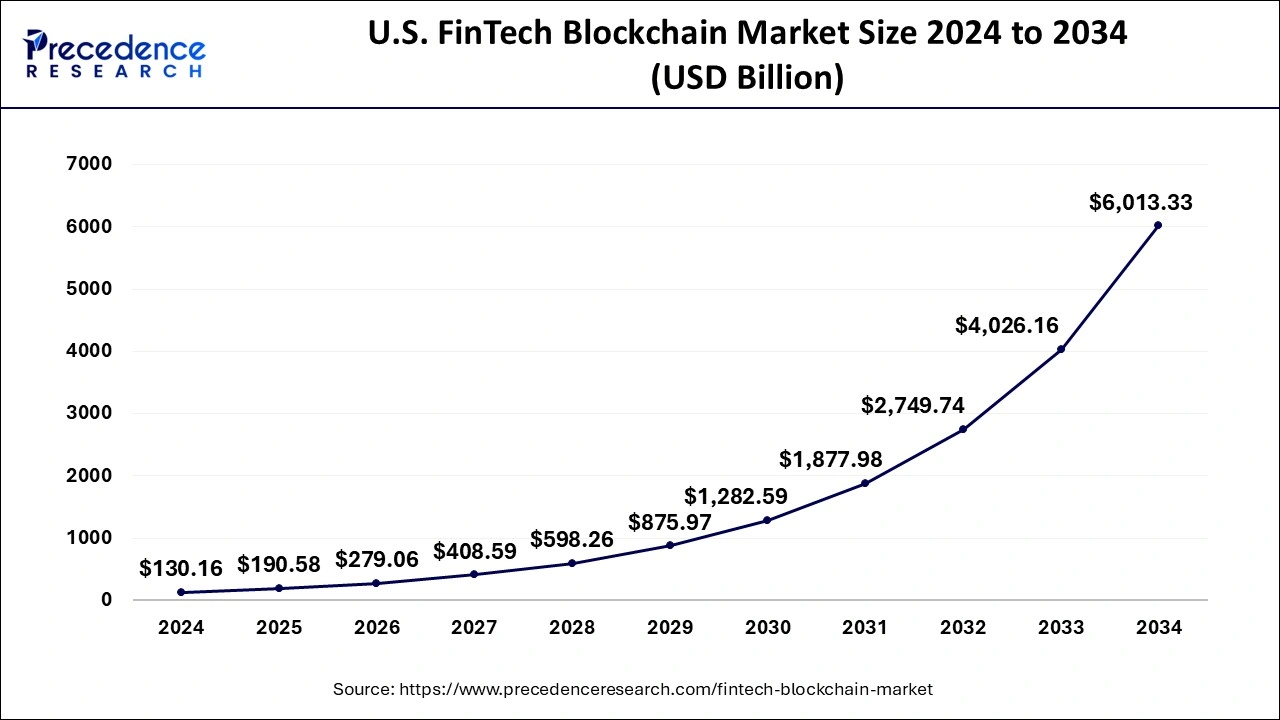

The U.S. FinTech blockchain market size was evaluated at USD 130.16 billion in 2024 and is expected to be worth around USD 6,013.33 billion by 2034, growing at a CAGR of 46.71% from 2025 to 2034.

North America dominated the FinTech blockchain market in 2024. The growth of the market is attributed to the rising presence of the technology leaders in countries like the United States and Canada and the economic stability in the population with the growing per capita income and rise in spending on investment, stocks, and other lifestyles are contributing in the growth of the banking sector.

North America is an early adopter of technologies in every industry, which accelerates the focus of blockchain in the banking and financial sector for payment and streamlining other non-financial operations. Additionally, the adoption of the FinTech blockchain by the different leading industries in the region, such as automotive, healthcare, technology, and others, is rising.

- In the United States, there are nine in ten consumers using digital payment from the last year reaching a new high at 92%. Online shopping is one of the largest platforms, ranging about 70% of digital payment.

Europe will witness significant growth in the FinTech blockchain market during the forecast period. Europe is one of the emerging markets in the technology adoption industry. The robust presence of the banking sector and the evaluation of industrialization across the European countries are driving demand for efficient technology that boosts the expansion and advancements in industries, which boosts the market across the region.

Market Overview

The blockchain technologies are widely accepted by the various industries. The FinTech blockchain is effectively used in making payments from one person to another directly without going to the bank or any financial services. Blockchain technologies are used as distributed ledger technology in the financial industry. There are four different types of blockchain technology: public, private, consortium, and hybrid network.

FinTech Blockchain Market Growth Factors

- The rise in the banking sector: The increasing banking sector across the region due to the rising population, and economic stability in the population is driving the growth of the banking sector and banking operations are driving the demand for efficient technology and the financial and nonfinancial banking operations are contributed in the growth of the FinTech blockchain market.

- Increasing trend of digital payment: The rise in digitization across industries and the financial sector drives the expansion of digital payment. The increasing penetration of smartphones and the busy lifestyles of the population is driving the demand for hassle-free payment transactions, which is driving the growth of the market.

- Government intervention: The rising government interventions in the development of digitization and automation across industries further boost the expansion of the market. Additionally, the rising strategic decisions regarding the blockchain technology and new launches are accelerating the growth of the market.

Market Scope

| Report Coverage | Details |

| Market Size by 2024 | USD 0.48 Trillion |

| Market Size in 2025 | USD 0.70 Trillion |

| Market Size in 2034 | USD 21.59 Trillion |

| Market Growth Rate from 2025 to 2034 | CAGR of 46.31% |

| Dominating Region | North America |

| Fastest Growing Region | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application, Provider, Enterprise Size, Industry Vertical, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Associated benefits

Blockchain is one of the emerging sectors in different industries and benefits several industries with different applications. The FinTech blockchain market provides enhanced transparency, digital identity, enhanced security, auditing, trade, reduced risk of fraud, compliance, instant settlements of payment, scalability, data modification, programmability, cross-border payments, faster transactions, cryptocurrency, and trust building for the stakeholders in the different industries.

Restraint

High cost

The increased implementation and operational cost associated with the FinTech blockchain technology is limiting the adoption from small enterprises and is restraining the growth of the FinTech blockchain market.

Opportunity

Increasing adoption of blockchain in the retail industry

There is a rising demand for the FinTech blockchain market in the retail industry to enhance and streamline operational efficiencies. There are several use cases of blockchain technologies in the retail industry, such as streamlining supply chain management, increasing operational efficiencies, and others. Several leading retail giants have adopted blockchain technologies, such as Carrefour, Amazon, Alibaba, De Beers, and Walmart.

Provider Insights

The infrastructure and protocol segment dominated the FinTech blockchain market in 2024. The rising development of the blockchain infrastructure in a wide range of industries for the payment process is driving the growth of the segment. The increasing digitization across different industries and workplaces and the continuous evaluation of the blockchain infrastructure with the latest advancements and technologies, including immutability, decentralization, and encryption.

The middleware provider segment is anticipated to hold notable growth in the FinTech blockchain market during the anticipated period. The middleware provider enables enhanced applications and functions to elevate the user experience. Additionally, these providers enhance the technological advancements in the existing system that enhance the capabilities of operations and systems.

Enterprise Size Insights

The large enterprise segment dominated the FinTech blockchain market in 2024. The increasing demand for the blockchain payment process for efficiency in high volume payment transactions. There are several leading industries and enterprises that are focusing on the adoption of the FinTech blockchain to cope with the challenges associated with domestic and international payments. The FinTech blockchain enhances the security system with a reduction in risk and associated operational costs.

The small and medium enterprise segments will experience substantial growth in the FinTech blockchain market during the predicted period. The rise in the startup culture and the people inclining towards entrepreneurship is driving the growth of a larger number of small and medium enterprises. The rise in the adoption of digitization and automation in organizations for different operations, including the payment process, reduces the risk of fraud and other challenges associated with the payment process.

Industry Vertical Insights

The banking sector segment held the largest share of the FinTech blockchain market in 2024. The increasing adaptation of blockchain technologies in the banking sector for increasing security, reduction of risk, and maximizing transactional security and transparency. The block is efficiently used in wide applications in the banking sector, including instant settlements, lending platforms, trade, asset management, blockchain trading, smart contracts, enhanced security, identity, stock exchange, and others.

The non-banking financial services segment will show significant growth in the FinTech blockchain market during the forecast period. Blockchain is efficiently used in different non-banking financial services, including helping maintain and streamline the banking and lending services and reducing the issuance and settlement times. The blockchain is used in different banking solutions, including documentation, credit prediction and credit scoring, real-time asset management, tracking and enforcement, and others.

Application Insights

The payment segment led the global FinTech blockchain market in 2024. Blockchain is one of the leading technologies used in the online or digital payment process. The increasing adaptation of digitization and the increasing penetration of smartphones by the population is driving the adoption of blockchain-based payment solutions. The blockchain works in different cases of payments, such as peer-to-peer (P2P) transfers, cross-border payments, digital identity verification, and trade finance. Payment transactions using blockchain technology become very secure and reduce the risk of data manipulation. Leading organizations are focusing on implementing blockchain technology for efficient payment processes.

The clearing and settlement segment will witness significant growth in the FinTech blockchain market during the forecast period. Blockchain technology is the revolutionary technology that is used for revolutionizing financial services. It helps in maintaining and streamlining the clearing and settlement process. The blockchain-based clearing and settlement process enhances efficiency and reduces the risk and cost of operations.

FinTech Blockchain Market Companies

- IBM Corporation

- Microsoft

- AWS

- Bitfury Group Limited

- BitPay

- Coinbase

- Ripple

- Oracle

- Auxesis Group

- Digital Asset Holding

Recent Developments

- In September 2024, the Indian Government's IT Ministry launched the ‘Vishvasya,' the technology developed for enhancing the adoption of blockchain across the country. The Vishvasya offers ‘blockchain-as-a-service' (BaaS)' with geographically distributed infrastructure made to support different permissioned blockchain-based applications.

- In October 2024, Crypto Garage, a leading player working on blockchain financial services in the FinTech field, launched the Mahala, a blockchain backend service used by Amazon Web Services (AWS) for removing the challenges faced by companies while constructing a web3 business.

- In October 2024, a flexible blockchain solutions company ‘Casper Labs' worked with the IBM Corporation to design an artificial intelligence governance tool that uses decentralized ledger technology for launching monitoring, version control, and access controls for AI models.

- In December 2024, SonarX, a Blockchain data infrastructure platform, collaborated with Amazon Web Services (AWS) to bring high-quality, indexed on-chain datasets for AWS's Open Data program.

Segments Covered in the Report

By Application

- Payments

- Clearing and Settlement

- Exchanges and Remittance

- Smart Contracts

- Identity Management

- Compliance Management/Know Your Customer (KYC)

- Others

By Provider

- Application and Solution Providers

- Middleware Providers

- Infrastructure and Protocols Providers

By Enterprise Size

- Large Enterprises

- Small and Medium-Sized Enterprises (SMEs)

By Industry Vertical

- Banking

- Non-Banking Financial Services

- Insurance

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting