What is the Transaction Monitoring In Fintech Market Size?

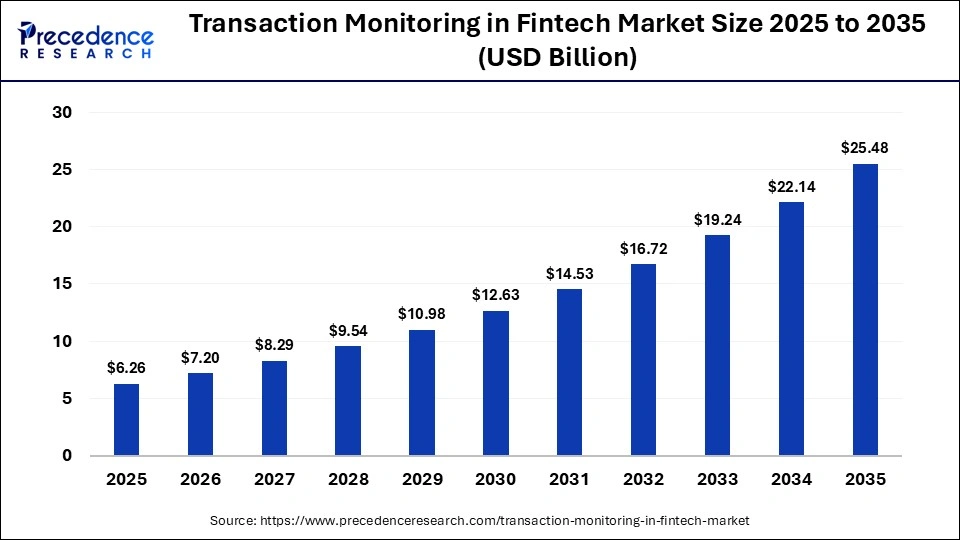

The global transaction monitoring in fintech market size was calculated at USD 6.26 billion in 2025 and is predicted to increase from USD 7.20 billion in 2026 to approximately USD 25.48 billion by 2035, expanding at a CAGR of 15.07% from 2026 to 2035. The market growth is attributed to the rising adoption of real-time AI-driven monitoring and stricter global AML regulations.

Market Highlights

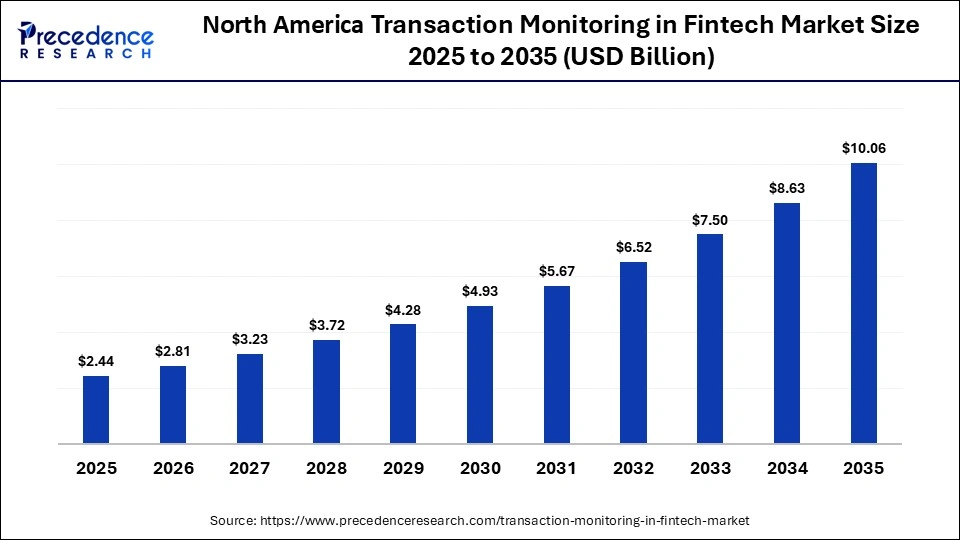

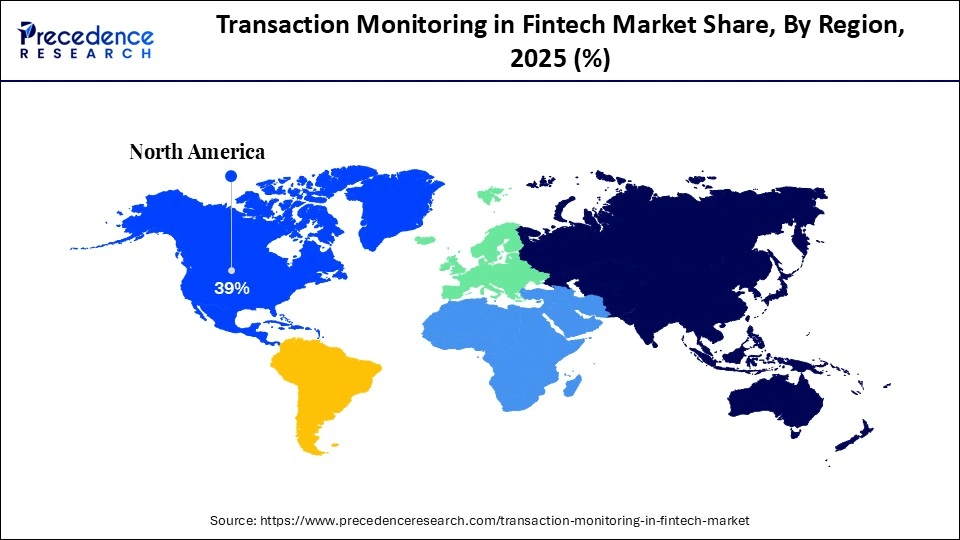

- North America dominated the market with the largest market share of 39% in 2025.

- Asia Pacific is expected to grow at the fastest CAGR between 2026 and 2035.

- By deployment, the cloud segment contributed the highest market share in 2025.

- By deployment, the on-premises segment is expected to grow at a strong CAGR between 2026 and 2035.

- By enterprise type, the large enterprises segment held a major transaction monitoring in fintech market share in 2025.

- By enterprise type, the small & mid-sized enterprises segment is expected to expand at the fastest CAGR from 2026 to 2035.

- By application, the fraud detection and prevention segment held a dominant revenue share in the market in 2025 and is expected to sustain its position in the upcoming period.

Which Factors Drive the Transaction Monitoring in Fintech Market?

The key driver of transaction monitoring in the fintech market is the rise in suspicious activity reporting globally. The rush compels fintechs to implement real-time monitoring of transactions to meet AML/CFT requirements. The UK FIU has reported a record number of SARs, 866,616 in 2024-25, and rejected record sums of suspected criminal proceeds.

Under the Bank Secrecy Act, in FY24, millions of SAR filings were received by FinCEN in the U.S. This spurs demand for automated systems with large alert volumes and intricate risk patterns. Furthermore, with the increasing volume of fintech transactions and the intensifying AML systems across the globe, this force is becoming the market dynamics defining technology monitoring.

Impact of Artificial Intelligence on the Transaction Monitoring in Fintech Market

Artificial intelligence (AI) significantly enhances transaction monitoring for fintech companies by analyzing vast volumes of payment data in real time. Machine learning systems recognize suspicious behaviour on cards, wallets, and digital resources at a faster rate compared to traditional systems. AI minimizes false positives since risk profiles are continuously updated using past and current transaction behavior. Moreover, the AI simplifies regulatory reporting, and thus compliance with AML and CFT regulatory demands is efficient among fintech companies.

Growth Factors

- Increasing Integration of Cryptocurrency Payments: The rising crypto adoption is driving the development of specialized monitoring tools for digital asset transactions.

- Rising Threat of Financial Fraud and Cybercrime: A surge in sophisticated fraud attempts is propelling fintechs to implement robust, real-time monitoring frameworks.

- Growing Demand for Operational Efficiency in Fintech: Automation of transaction monitoring processes is fueling reduced manual workloads and faster compliance reporting.

Transaction Monitoring in Fintech Market Trends

- Adaptive Cross-Border AML Systems Expansion: Real-time cross-border AML platforms help fintechs comply with multiple jurisdictions simultaneously. They boost oversight of foreign payments, online wallets, and crypto transfers. Growing regulatory pressure for global compliance is boosting market demand for advanced solutions.

- Behavioral Biometrics Integration into Compliance: Fintechs use device motion, typing patterns, and touch behavior to feed risk scoring engines. This enhances accuracy in detecting fraud and reducing false-positive alerts in online transactions. The growth and investments in technology in the market are being influenced by the rise in the use of identity-based monitoring.

- AML Risk Scoring Based on ESG and Transaction Attributes: The engines used in monitoring are ESG and transaction based attribute to measure the layered financial risk. Fintech companies can have a better understanding of compliance, minimizing the chances of finance and sustainability-related risks. This new analytic capability is creating market opportunities for smarter, multi-dimensional monitoring solutions.

Intensifying Regulatory Scrutiny and Real-Time Payment Proliferation: Redefining the Transaction Monitoring Landscape

- In 2025, global regulators issued approximately 139 distinct financial penalties for AML/CFT compliance failures, including weaknesses in transaction monitoring, representing a 417% increase in enforcement actions compared to H1 2024.

- Across 2025, the total value of AML/KYC-related fines globally exceeded USD 6 billion, driven by major enforcement actions against banks and fintechs for weak transaction monitoring and reporting frameworks.

- In the Asia-Pacific region, digital real-time payment systems such as India's Unified Payments Interface (UPI) accounted for 49% of all real-time global payment transaction volumes in 2025, signaling a strong foundation for real-time transaction monitoring adoption across banks and fintechs operating on these rails.

- According to data released by the Reserve Bank of India (RBI), 99.8% of all payment transactions in India in the first half of 2025 were digital transactions, reflecting near-complete digital payment adoption and thereby driving requirements for real-time monitoring and compliance across financial entities.

- In June 2025, the Financial Action Task Force (FATF) updated its Recommendation 16 on payment transparency, increasing requirements for information accompanying cross-border payments, a move expected to significantly improve transaction monitoring accuracy and cross-border AML effectiveness.

- In India, fintech-heavy segments (payments banks, PPIs, and wallets) accounted for over 55% of the 4.7 million STRs filed in FY2024–25, according to FIU-IND, reflecting extremely high alert volumes driven by UPI-based real-time transactions.

- According to the Estonian FIU, financial institutions filed 10,366 suspicious transaction reports in 2024, a portion of the 14,185 total reports received relating to unusual activity, reflecting growing reporting activity by fintech-linked services.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 6.26 Billion |

| Market Size in 2026 | USD 7.20 Billion |

| Market Size by 2035 | USD 25.48 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 15.07% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Deployment, Enterprise Type, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Deployment Insights

Which Deployment Segment Dominated the Transaction Monitoring in Fintech Market?

The cloud segment dominated the market in 2025, with rapid fintech transaction growth. Fintech solutions need to have an elastic infrastructure that would be able to handle millions of daily payments. Cloud systems supported real-time analytics across cards, wallets, BNPL, and crypto rails. Furthermore, the fintech firms expanded internationally using cloud regions aligned with local data regulations, which further facilitated the segment growth.

The on-premises segment is expected to grow at the fastest rate in the coming years, owing to the growing focus on data residency and direct system controllability by various organizations. Sensitive transaction datasets are favored in on-premise architectures by high-risk fintechs. These systems enable more customization of monitoring logic and escalation levels. Moreover, the hybrid regulatory expectations further support selective on-premise adoption in the coming years.

Enterprise Type Insights

How the Large Enterprises Segment Dominated the Market?

The large enterprises segment held the largest revenue share in the transaction monitoring in fintech market in 2025, due to their exposure to extremely high transaction volumes and complex multi-rail payment ecosystems. Concurrent card, instant payments, and wire and cross-border flows are processed in these institutions. This greatly amplifies the risks associated with money laundering, fraud, and sanctions. Furthermore, big businesses are adopting monitoring technologies into payment orchestration layers, which decreases detection latency and enhances alert contextualization.

The small and mid-sized enterprises segment is expected to expand rapidly in the market in the coming years, as fintech licensing expansion rapidly brings new entrants under full AML and transaction monitoring obligations in small enterprises. Furthermore, the increasing number of SMEs crossing into the cross-border corridors and digital asset-focused services, which crateing demand for transition monitoring technologies for fintech SMEs.

Application Insights

Why Did the Fraud Detection and Prevention Segment Dominated the Market?

The fraud detection and prevention segment contributed the biggest revenue share of the transaction monitoring in fintech market and is expected to sustain its position during the forecast period, due to the sharply rising fraud losses and expanding regulatory focus on real-time risk mitigation. The significant increase in fraud losses and increased regulatory attention to real-time risk mitigation have dominated the application category of fraud detection and prevention.

According to the EBA and ECB, total fraud in payments in the European Economic Area had increased to €4.2 billion, up from €3.5 billion in 2023, which is 17% points higher than the prior year.

Major banks and controlled fintechs increased the application of automated alert pipes to deal with the volumes of complex card, credit transfer, and remote payment fraud effectively. Additionally, the anticipated increase in cross-border flows and non-traditional payment instruments likely fuel the demand for fraud detection and prevention software in the coming years.

Regional Insights

How Big is the North America Transaction Monitoring in Fintech Market Size?

The North America transaction monitoring in fintech market size is estimated at USD 2.44 billion in 2025 and is projected to reach approximately USD 10.06 billion by 2035, with a 15.22% CAGR from 2026 to 2035.

Why North America Dominated the Transaction Monitoring in Fintech Market?

North America led the market in 2025, due to the highest rates of digital payments and the intensity of regulatory enforcement regarding fintech transaction monitoring. By 2025, FinCEN received more than 4.6 million Suspicious Activity Reports (SARS) in the United States, and fintech institutions are also making an increasing proportion. Additionally, with advanced data infrastructure and heavy investment in AI-driven transaction monitoring platforms, North America is the most mature and heavily monitored fintech environment globally.

What is the Size of the U.S. Transaction Monitoring in Fintech Market?

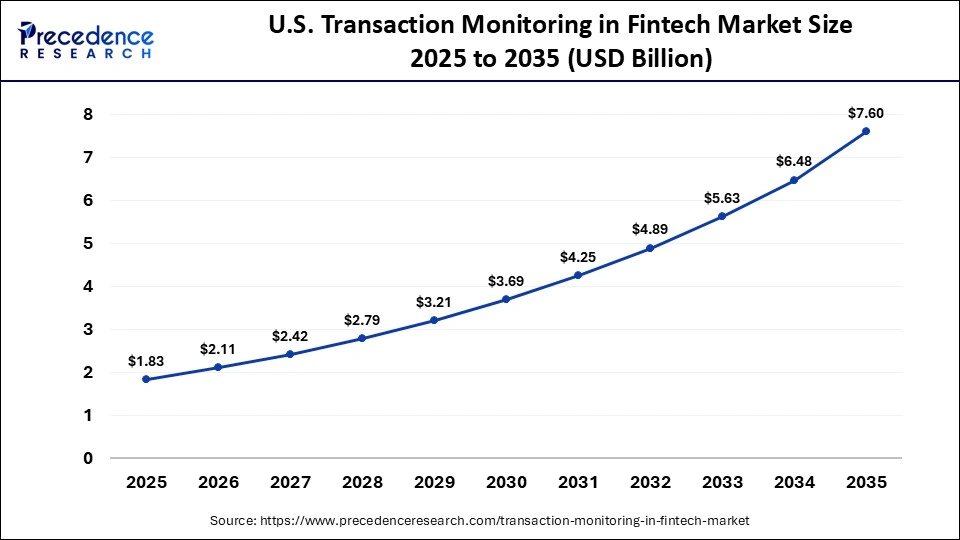

The U.S. transaction monitoring in fintechmarket size is calculated at USD 1.83 billion in 2025 and is expected to reach nearly USD 7.60 billion in 2035, accelerating at a strong CAGR of 15.30% between 2026 and 2035.

U.S. - North America's Core Growth Engine for Transaction Monitoring

The U.S. leads the market in North America, owing to rising fraud and AML surveillance demands. Regulators such as FinCEN, the OCC, and the SEC increased scrutiny of fintechs that process cross-border payments and payments related to cryptocurrency. These regulatory and transaction-scale dynamics continue positioning the United States as the strongest national contributor to monitoring technology demand.

Why Is Asia Pacific Poised for Rapid Growth in Transaction Monitoring?

Asia-Pacific is anticipated to grow at the fastest rate in the transaction monitoring in fintech market during the forecast period, as digital payment adoption accelerates across India, Southeast Asia, and East Asia. Growth of payments in the ASEAN corridors created more exposure to mule networks and layered transactions, which fueled the need to have real-time monitoring tools. Furthermore, the regulatory and operational pressures are expected to keep the Asia Pacific among the fastest-growing regions in the market.

India - Asia Pacific's Fastest-Scaling Transaction Monitoring in Fintech Market

India is leading the charge in Asia-Pacific, due to explosive digital payment growth and expanding regulatory oversight. By 2025, the Reserve Bank of India (RBI) had reported transactions of digital payments of more than 13,000 crore annually, which were mainly driven by UPI and wallets, and merchant platforms. This growth of volume exposed many more frauds in peer-to-peer, merchant, and cross-border corridors, further creating demand for reliable and strong transition monitor solutions in this region.

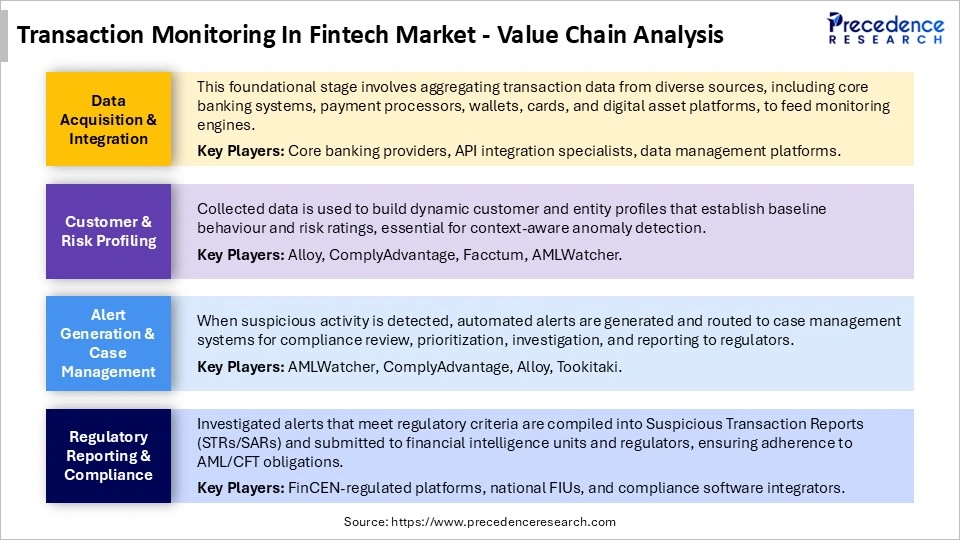

Transaction Monitoring In Fintech Market Value Chain Analysis

Who are the Major Players in the Global Transaction Monitoring in Fintech Market?

The major players in the transaction monitoring in fintech market include Oracle Corporation, Shufti, Sanction Scanner, FICO, SAS Institute Inc., FIS, and Ondato.

Recent Developments

- In September 2025, Hummingbird launched a unified risk and compliance operations platform featuring new capabilities for transaction monitoring, risk monitoring, and customer screening. The platform aims to modernize how financial institutions manage regulatory obligations by consolidating fragmented compliance workflows into a single, integrated system.

- In February 2025, Mastercard officially launched TRACE (Trace Financial Crime) in the Asia-Pacific region, introducing an advanced, network-level financial crime detection solution powered by AI. TRACE leverages large-scale, real-time payments data aggregated from multiple financial institutions to enable tracing and identification of money laundering and complex financial crime patterns.

Latest Announcements by Industry Leaders

- Alloy announced the introduction of its first perpetual Know Your Business (pKYB) and Customer Risk Assessment (CRA) orchestration solution across the UK and Europe, marking a continued expansion of its continuous compliance capabilities in the region. “We incorporated these insights, assessed how the pKYB ecosystem was developing, and extended our pKYC foundation to rapidly move toward a proactive, event-driven model, one that our clients are genuinely enthusiastic about, and that Alloy is uniquely positioned to deliver”, said Grace Liu, Senior Product Director at Alloy.

Segments Covered in the Report

By Deployment

- Cloud

- On-premises

By Enterprise Type

- Small & Mid-sized Enterprises

- Large Enterprises

By Application

- Identity Verification

- Transaction Screening & Ongoing Monitoring

- Anti-Money Laundering

- Fraud Detection and Prevention

- Others (Proxy Detection, etc.)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content