What is the Livestock Monitoring Market Size?

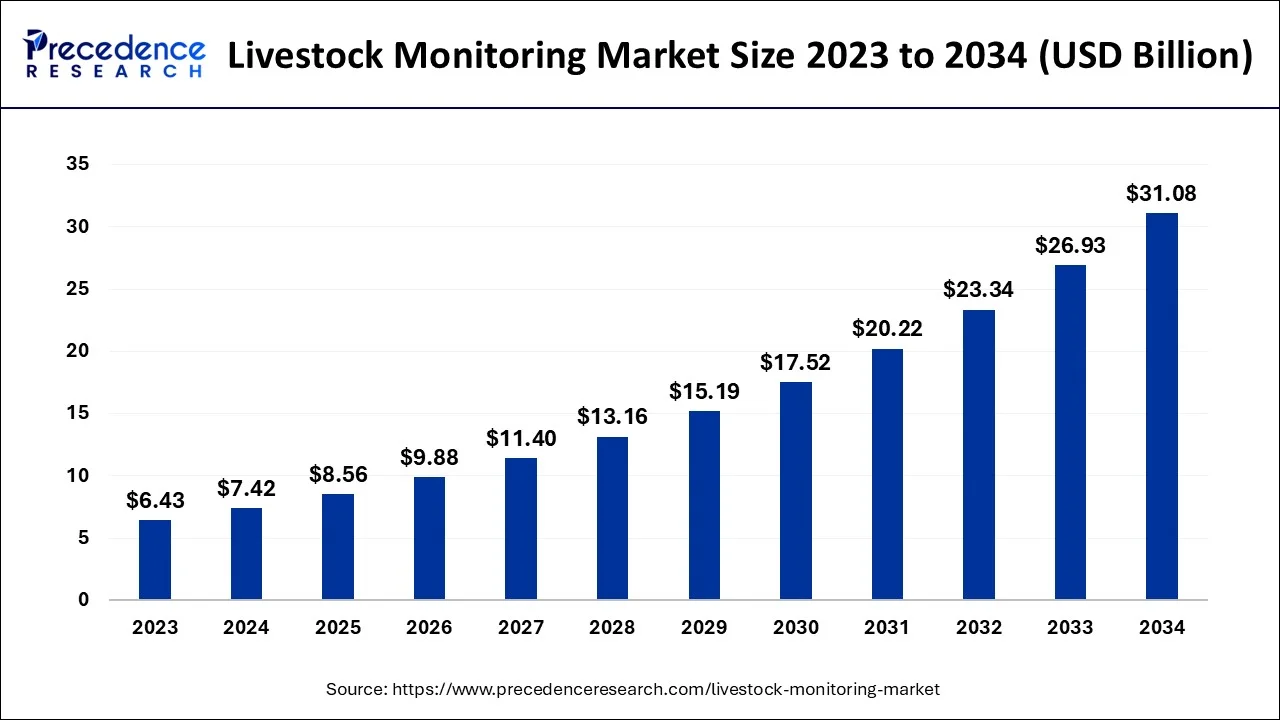

The global livestock monitoring market size is calculated at USD 8.56 billion in 2025 and is predicted to increase from USD 9.88 billion in 2026 to approximately USD 34.86 billion by 2035, expanding at a CAGR of 15.08% from 2026 to 2035.

Livestock Monitoring Market Key Takeaways

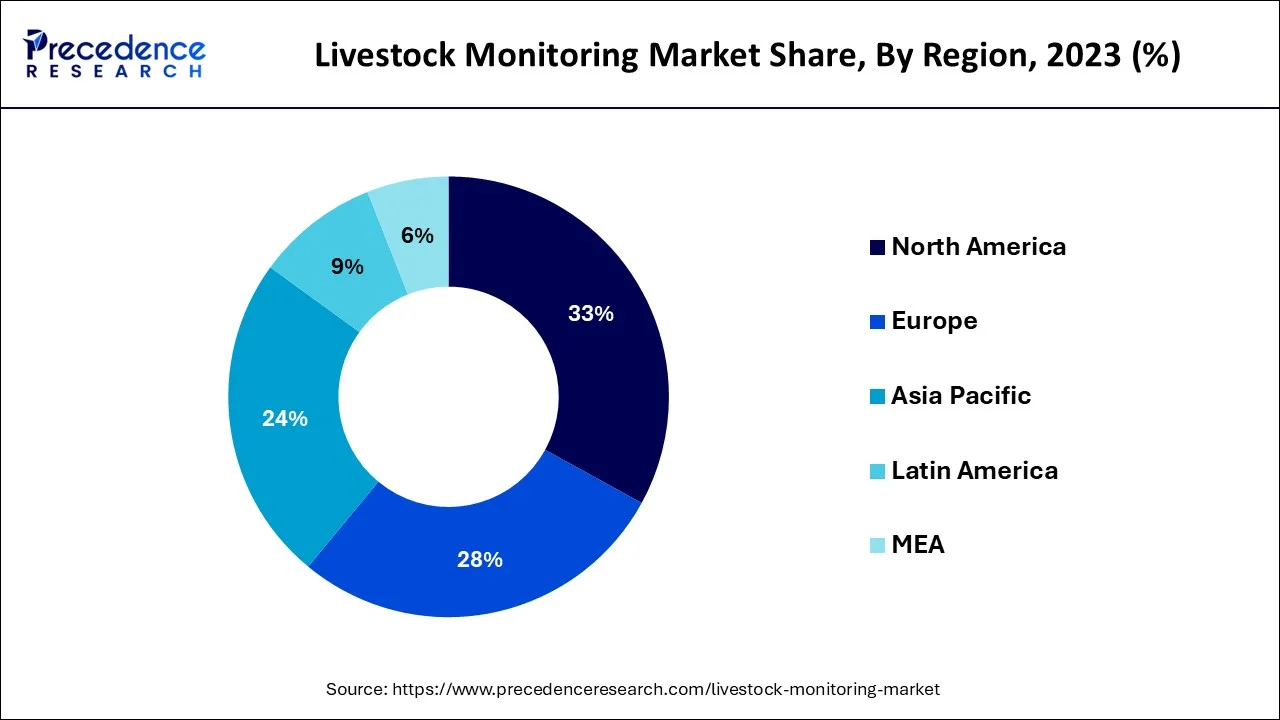

- North America dominated livestock monitoring market in 2025.

- By end user, the dairy farms segment dominated the market in 2025.

- By application, the feeding management segment led the market in 2025.

Market Overview

Livestock management, also called as livestock monitoring or precision livestock farming, utilize IoT-enabled sensors to analyse and check the wellbeing of livestock, most often cattle. Keeping track of farm animals and other livestock is essential due to the expanding scale of the livestock business. A novel solution called a livestock monitoring system uses sensors, GPS, and other tools and techniques, as well as integrating them with a network protocol for information sharing.

On-site tracking devices provide information on the whereabouts and physical condition of the animals rather than solely relying on farmer observation. Farmers may monitor the general health of their animals, including reproduction, feeding routines, and hygiene, with the help of hardware sensors. Farmers can be alerted when an illness is barely starting by monitoring their heart rate, blood pressure, digestion, respiration, temperature, and other bodily functions with the help of connected sensors and wearable technologies. Internet of things IoT technologies would make it easier for animal owners to improve agricultural productivity.

A significant increase in animal disease outbreaks in recent years has increased the need for animal tracking solutions. Farmers will be able to quickly treat and stop the spread of fatal diseases as a result. Furthermore, government initiatives for animal traceability programmes are probably going to be very important in encouraging the adoption of useful hardware options like injectable tags, RIFD tags, and neck/collar tags.

How is AI Influencing the Livestock Monitoring Industry?

Computer vision automates health and welfare monitoring by feeding frequency, tracking bird movements, and environmental interactions. These systems utilize object detection and segmentation to differentiate between healthy and unhealthy behaviors. For reproductive planning, computer vision captures and determines specific behavioral cues that indicate heat periods in animals. This technology can monitor behaviors, like mounting or increased activity levels, to forecast optimal breeding windows.

Livestock Monitoring Market Growth Factors

Demand for meat and livestock feeds will skyrocket as population and income levels continue to climb. With increasing urbanisation and the constantly changing environment, pathogen threats start to change, which causes infectious disease outbreaks in the livestock business. Events like heat stress, flooding, and drought are on the rise, and they have the potential to spread new diseases via developing macroparasites and vector-borne diseases. Therefore, the necessity for livestock monitoring and identification systems has increased due to the incidence of large animal disease outbreaks. Increased farm yields are a result of farmers using livestock and monitoring systems to keep their cattle in better condition. In order to properly maintain animal health, framers and livestock keepers around the world need animal traceability solutions.

The necessity to adopt animal monitoring technology has been influenced by governmental regulations and requirements regarding the quality of food. Customers are becoming more conscious of their food sources and environmental footprints, and the government is promoting the Sustainable Development Goals. New frameworks are being proposed by governments for the use of animal tracking technologies. Government mandates are encouraging the implementation of livestock monitoring technologies worldwide as a result.

Market Outlook

- Industry Growth Overview: The livestock monitoring industry is rapidly evolving due to global meat demand, increased herd sizes, and the increasing need for digital livestock management solutions for real-time health monitoring across the entire farm.

- Sustainability Trends: Precision livestock monitoring contributes to sustainable agriculture through reduced use of antibiotics, decreased carbon footprint, minimized feed waste, improved animal welfare via the early identification of disease, and optimized resource utilization.

- Global Expansion: The government and agribusiness sectors worldwide are investing in smart farming technologies to advance the modernization of livestock production, enhance national and global food security, and increase traceability through global meat and dairy supply chains.

- Startup Ecosystem: Start-up companies involved in agriculture technology offer low-cost IoT-based monitoring devices with mobile monitoring dashboards and artificial intelligence (AI) based analysis to give smallholder producers in developing countries access to modern livestock monitoring systems.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 34.86Billion |

| Market Size in 2025 | USD 8.56 Billion |

| Market Size in 2026 | USD 9.88 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 15.08% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Component, Animal Type, Application, End user, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Segment Insights

Component Insights

Hardware, software, and services are divided into three categories for the livestock monitoring business. The hardware industry is anticipated to dominate the global market. With a revenue share of more than 42% in 2025, the hardware segment dominated the industry. Hardware use is expected to increase agricultural productivity and lessen farmers' difficulties, which will increase output. Hardware technology is safe for both the environment and animals, which appeals to many farmers who raise cattle. Sensors, GPS, and other devices are further divided into sub-segments within the hardware sector.

Over the projected period, the software segment is anticipated to develop at the quickest pace of 18.2%. The software element is made up of a collection of bundled software programmes that can be used to monitor livestock. These programmes' user interfaces, features, and functions are linked. Software is being used by several businesses to make collecting livestock data easier. For instance, Cainthus unveiled its first product, ALUS Nutrition, in February 2020. This individualised technology enables a producer to monitor the accessibility of feed around-the-clock. With the help of this technology, feeding schedules can be adjusted as needed.

Type Insights

Cattle, poultry, swine, horses, and other animals are included in the livestock type segment. Due to the widespread consumption of chicken products around the world, the poultry segment is anticipated to experience the highest growth rate over the projection period. Additionally, it is anticipated that an increasing population would increase demand for poultry products. For example, the U.S. Census Bureau, a key organisation of the U.S. Federal Statistical System, projects that the country's population will rise from 319 million in 2014 to 417 million in 2060.

Due to the advantages of using cattle livestock monitoring systems, the cattle category segment's high-impact rendering driver is the rise in the consumption of dairy and beef products. Additionally, numerous public and commercial organisations constantly monitor the safety, quality, and prevention of disease transmission of cattle and dairy products. These elements are encouraging the use of livestock monitoring systems.

During the projection period, the poultry segment is anticipated to grow at the quickest CAGR of 18.6%. The daily high consumption of poultry products is a significant driver of this market's expansion. The demand for animal health and monitoring has increased due to the strong demand for poultry products and the growing consumer awareness of high-quality products. The demand for chicken products is anticipated to increase even more as a result of this population growth.

Application Insights

The management of milk harvesting, heat detection monitoring, feeding, heat stress, health monitoring, sorting, and weighing are all included in the application segment. During the projection period, the milk harvesting segment is anticipated to increase at the fastest rate. Because manual milking is so sluggish and time-consuming, the use of automatic milking has increased dramatically, lowering expenses and the demand for labour. Additionally, the use of sophisticated cooling tanks to automatically preserve the milk is growing. These elements have fueled the milk harvesting segment's expansion.

In 2025, the category that generated the most revenue more than 27% was feeding management. Animals' living quarters need to be kept clean and they need to have constant access to food and water. In addition to being essential for veterinary health, comfort, and well-being, proper feeding and manure management also helps to prevent illness, disease, and parasites. The aforementioned elements also support the segment's expansion.

Over the projection period, the milk collection segment is anticipated to experience the quickest CAGR of 17.9%. Manual milking takes a long time and is labor-intensive on a dairy farm. So, by introducing auto milking, IoT more successfully addressed this issue, cutting costs and the requirement for people. When the weather is bad, there is a high likelihood that the milk may spoil, but auto milking automatically protects the milk by employing various sophisticated cooling tanks.

End User Insights

The market for livestock monitoring and identification is divided into dairy farms, beef farms, sheep farms, deer farms, goat farms, and pig farms based on the ultimate use. Dairy farms have experienced significant rise in the adoption of livestock monitoring technologies as a result of farmers embracing cutting-edge technology to meet growing demand for milk products. Livestock technologies make it possible for the milk and cow industries to collect information, identify cow health indicators, and detect other variables while minimising costs for both farmers and consumers.

During the projected period, the use of monitoring technologies such RFID and injected tags for cattle farms is anticipated to show the highest CAGR. The use of identification and monitoring systems by beef producers and farmers is the key factor contributing to the segment's growth.

Regional Insights

What is the U.S. Livestock Monitoring Market Size?

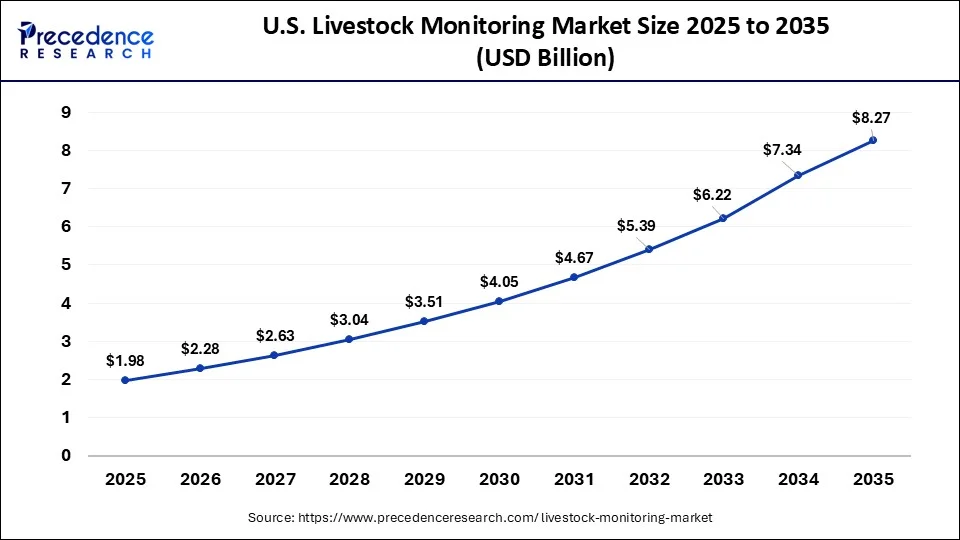

The U.S. livestock monitoring market size is evaluated at USD 1.98 billion in 2025 and is predicted to be worth around USD 8.27 billion by 2035, rising at a CAGR of 15.37% from 2026 to 2035.

North America region hit revenue share of over 33% in 2025. Due to rapid technical advancements and rising adoption costs for agricultural solutions in nations like Canada and the United States, North America held the largest market share. Recent years have seen an increase in the growth rate of animal food and by product consumption in North America, which has forced regional meat and dairy product manufacturers to expand their supply chains. If consumer affluence rises and trade obstacles are removed, there will undoubtedly be an increase in demand for North American animal goods worldwide.

Government and the commercial sector are under pressure to guarantee product quality and safety. The widespread use of cutting-edge technology, including sensors, smart cameras, and global positioning systems, as well as the strong need to lower the price of livestock rearing, are anticipated to fuel market growth in North America. The North American market will be driven by the rising occurrence of zoonotic illnesses and the rising demand for technologies to track sick animals. Government requirements for animal illness surveillance are also anticipated to have a significant impact on market expansion.

Advanced Livestock Monitoring Market of Canada

The cattle and beef industry play a significant role in stimulating economic activity in Canada. The cattle market has displayed robust demand in early 2025, and along with low cow herd inventories, the feeder market is expected to stay strong, as noted in a recent report from Alberta Agriculture. This demand for livestock is driving the market for livestock monitoring. Integration of technology, including AI, robotics, and automation expanding the market.

Automated Livestock Monitoring (ALM) is a state-of-the-art technology that enables Canadian farmers and ranchers to improve their livestock management and promote animal welfare. Utilizing cutting-edge sensors, data analysis, and cloud platforms, ALM delivers immediate insights into the health, behavior, and productivity of animals. Automated Livestock Monitoring is a groundbreaking innovation that is changing the Canadian livestock sector. Through real-time insights and task automation, ALM enables farmers to boost animal welfare, increase productivity, lower expenses, and make informed decisions based on data.

According to the European Union, the EU market would experience increased global demand over the course of 2030, increasing exports from 4.35 million tonnes in 2017 to 4.7 million tonnes in 2030. Thus, it is anticipated that the region will embrace more livestock monitoring solutions.

Over the forecast period, Asia Pacific is anticipated to develop at the greatest CAGR. Most regional livestock monitoring development is anticipated to be driven by governmental mandates and interstate livestock trading rules. The region's milk and cattle farmers have implemented cutting-edge equipment to meet the need for quick-moving dairy and animal goods in the area. Asian livestock farmers choose cutting-edge technologies to increase animal tracking activities in nations like Australia and India. Population expansion has put a lot of pressure on farmers in developing nations like South Korea, India, and other places to be productive and successful. As a result, innovative solutions for better animal and cow products have been presented.

Revolutionizing the Livestock Monitoring Market of China

The output of primary farm animal products in China has risen by 8.85%, with an average yearly growth rate of 2.43% from 2003 to 2022. To satisfy the rising demand for consumption, production growth has largely been driven by the swift expansion of intensive livestock and poultry monitoring methods. Rising focus on animal welfare regulation and technological advancements is growing the market.

Integration of advanced technologies in livestock monitoring is revolutionizing the existingprocesses. The Beijing Dairy Monitoring and Early Warning Platform consists of three sub-systems: "Beijing Dairy Farm Information Collection," "Beijing Dairy Product Price Information Collection," and "China Dairy Damage Early Warning." This platform represents the first software-based research and development of industrial damage early warning theory in agriculture, addressing a significant gap in China.

Digital Livestock Management Solutions Across Latin America

Latin America's market shows notable growth during the forecast period. It is driven by the rising adoption of digital solutions to improve farm productivity, enhance traceability, and meet evolving regulatory standards. Growing investments in agricultural technology, combined with a growing impact on sustainable livestock practices, are fueling the need across diverse segments.

Smart Farming Technologies Transforming Livestock Monitoring in MEA

MEA's market shows rapid growth during the forecast period. In the MEA region, environmental stressors such as extreme heat directly impact livestock. SFT enables for remote, real-time monitoring of animal health along with environmental conditions (temperature, humidity), decreasing mortality rates. Wearable sensors and even AI-powered cameras monitor crucial signs and behavior in real-time to determine diseases, lameness, or distress early, which improves overall animal welfare.

Value Chain Analysis of the Livestock Monitoring Market

- Sensor & Hardware Manufacturing: This part of the process is expected to create smart collars, smart ear tags, biometric sensors, RFID chips, and GPS-enabled devices that will help farmers monitor their livestock's health and location continuously.

Key Players: Allflex, Nedap, and Gallagher Group. - Data Platforms & Analytics Integration: The collected data will be processed via a cloud-based data platform using Artificial Intelligence (AI), Machine Learning (ML), and predictive analytics to monitor health and fertility, feeding behaviour, and disease risk in the cattle.

Key Players: Zoetis, DeLaval, and GEA Group. - Distribution, Farm Deployment & After Sales Service: This stage of the process includes system installation, software customisation, training of farmers, and technical support. For large-scale success, especially in rural and semi-urban environments, particularly in developing markets with low levels of digital literacy, it is important to have a strong distributor network and localised service models.

Key Players: BouMatic, Afimilk, and Lely.

Livestock Monitoring Market Companies

- Sensaphone: Sensaphone provides remote, 24/7 environmental and even equipment monitoring systems to the livestock market, programmed to protect animal welfare and reduce losses. They offer real-time alerts via phone, text, or email for power outages, humidity, temperature, and equipment failure, featuring data logging along with remote access to ensure barn conditions.

- DeLaval, Intervet Inc.: DeLaval and Intervet Inc are major players in the Livestock Monitoring Market, aiming on precision dairy farming, digital animal health, and even automated management systems.

- Dairymaster: Dairymaster provides a comprehensive suite of high-performance, technology-based solutions for the livestock monitoring market, mainly focusing on fertility, dairy cattle health, and efficiency. Their providings integrate IoT (Internet of Things), wearable sensors, and even cloud-based software to offer 24/7 monitoring.

- BouMatic: BouMatic provides comprehensive, technology-based livestock monitoring solutions aimed at dairy herd management, including the RealTime Activity system for tracking health, behavior, feeding, and heat detection. Their solutions utilize neck tags to monitor cow behavior, offering actionable data on activity, rumination, and even walking to maximize profitability.

Other Major Key Players

- GEA Group Aktiengesellschaft

- Nedap N.V

- Afimilk Ltd.

- Sensaphone

- Fancom BV

- Antelliq

- Lely

- Fullwood Packo.

- Allflex Livestock Intelligence.

- ENGS Systems

- CowManager B.V

- HerdInsights

- Zoetis

Recent Developments

- DeLaval introduced DeKaval VMS V310, a fully automated milking management system that can recognise cow heat and pregnancy throughout the harvesting process.

- CowManager unveiled an improved cow monitoring system that is compatible with ear sensor technology. Using smart devices, users may view real-time notifications from the company's new cow monitoring systems.

Segments covered in the report

By Component

- Hardware

- Sensors

- GPS

- Others

- Software

- On Cloud

- On Premise

- Services

- Integration & Deployment

- Maintenance & Support

- Others

By Animal Type

- Cattle

- Poultry

- Swine

- Equine

- Others

By Application

- Milk Harvesting

- Breeding Management

- Feeding Management

- Animal Health Monitoring & Comfort

- Heat Stress

- Behaviour Monitoring

- Other

By End user

- Dairy Farm

- Beef Farm

- Sheep Farm

- Deer Farm

- Goat and Pig Farm

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting